Brave Publishers Can Now Have Their Identities Verified with Civic

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Civic, a digital identity firm, has collaborated with Brave, the privacy-based browser with a blockchain-based digital advertising platform, to provide identity verification services to Brave’s content creators. Verified content creators on Brave now have the option of verifying their identities using Civic’s identity verification service in order to get paid Basic Attention Tokens (BAT) via their Ethereum wallets. Brave’s blockchain-based digital advertising platform is built on the strength of the Brave browser, which uses user attention as a metric for rewarding publishers with BAT ERC20 tokens. BATs are derived from user attention and can be used to “obtain a variety of advertising and attention-based services on the BAT platform.” Brave users can opt to anonymously reward publishers for content they find interesting by donating BATs through Brave’s integrated payment system. Civic is an identity verification platform that allows consumers to authorize the use of their identities in real time. Leveraging Civic’s Reusable KYC, Brave’s publishers will be able to verify their identities and ensure authenticity through the Civic App, which also provides customers with control over the use of their personal information. In an interview with Bitcoin Magazine, Civic CEO and Co-Founder Vinny Lingham said the partnership provides another “important use case for digital identity” as it allows Brave publishers to enjoy the convenience and simplicity of decentralized identity verification. “With rising awareness of consumer protection and data privacy issues, it’s great to see two privacy-focused organizations coming together and leveraging blockchain technology to find better, more secure alternatives for the future,” he concluded. Brendan Eich, the CEO and co-founder of Brave, also hailed the partnership with Civic, which he says would afford Brave’s publishers and creators the opportunity to “safely collect their tokens and get rewarded for their content.” According to Civic, its Reusable KYC allows users to “safely and securely verify their identities” on the BAT platform in order to receive payments without sharing unnecessary data. Having a digital identity that you can reuse eliminates the “day-to-day hassles of proving who you are,” said Lingham. “Civic’s identity platform is all tied to the idea of a decentralized reusable identity. Just imagine a secure, trusted digital identity that would be accessible from your mobile device, never stored in a centralized database, and accepted anywhere you go, from applying for a bank account to entering a bar to boarding a flight.” In the case of Brave, publishers who are Civic users can swiftly connect to the Civic App — which guarantees privacy and authenticity — to verify their identities on the Brave platform. This article originally appeared on Bitcoin Magazine. |

Study Reveals Growing Sophistication in Malicious Mining of Cryptocurrency

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Several Chinese researchers from Fudan University, Tsinghua University and the University of California Riverside have produced the first systematic study of the malicious mining of cryptocurrencies, known as cryptojacking, unveiling increasing complexity over time. And it doesn't seem as if this trend will die down anytime soon. What Is Cryptojacking?Cryptojacking has asserted itself in the cybersphere as the valuation of the cryptocurrency sector soared over the past 18 months and refers to where a hacker hijacks the processing power of a computer to mine cryptocurrency on the hacker’s behalf. AdGuard reported in November 2017 that over 220 cryptojacking websites were found among the top 100,000 websites according to Alexa. And this trend is not likely to die down anytime soon. As reported by Bitcoin Magazine in March 2018, the U.K.’s National Cyber Security Centre stated that “... it is likely in 2018-19 that one of the main threats will be a newer technique of mining cryptocurrency which exploits visitors to a website.” The phrase “cryptojacking” burst onto the scene when it was found out that The Pirate Bay was experimenting with Coinhive in September 2017 to see if the non-profit could generate more revenue through its website. Coinhive allows you to add a script to a webpage and mine the cryptocurrency Monero (XMR) by utilizing a visitor’s processing power. But the admins of The Pirate Bay mistakenly configured the settings to use a visitor’s entire processing power without their consent, which led to an explosion of abuse of the Coinhive service. Even though altruistic goals can be achieved using in-browser mining, as evidenced by UNICEF’s “Hope Page,” it has been increasingly utilized for nefarious purposes, with pressure mounting on services such as Coinhive to make it less attractive to cybercriminals. Hackers can also capitalize off of a website’s weak security measures by dropping scripts into web pages to mine cryptocurrency, like what happened with the website of U.S. television program Showtime in September 2017. A recent research paper has highlighted that, even though many cases have popped up, cryptojacking may be even more prevalent than we think. Existing Identification Techniques Only Scratch the SurfaceFirst, the study examines the extent of cryptojacking, which has never been fully measured due to the arbitrary nature of surveying the cybersphere for this type of malicious attack. The research notes that existing approaches make assumptions that cryptojacking web pages exhausts the user’s CPU resources or contains keywords as malicious payload signatures, and it was noted that many counterexamples were discovered. By targeting regular, repeated, hash-based computations with a cryptojacking detector called CMTracker for over 850,000 websites, the study was able to provide a more complete picture of what is really happening and noted that 53.9 percent of the identified samples would not have been uncovered by existing cryptojacking surveying approaches based on blacklists, which are both incomplete and inaccurate. Additionally, the results from CMTracker were vetted manually. But how does CMTracker work and how did it manage to find nearly three times as many cryptojacking domains as the most recent reports? Two behavior-based profilers are used, one to detect automated mining scripts, known as the hash-based profiler, and one to monitor the calling stack of a website, known as the stack-structure based profiler. For the hash-based profiler, if a website uses more than 10 percent of its execution time on hashing, it is reported as a cryptocurrency miner. The idea for the stack-structure profiler goes something like this: Mining tasks will not take place as the user is loading the page; rather, one or more dedicated threads are created since mining cryptocurrency comes with a heavy workload. If hackers use code obfuscation techniques to evade hash-based profiling, then the repeated behavioral patterns of the miner’s execution stack can be used to identify cryptocurrency miners. The stack depth and call chain of mining scripts are repeated and regular. By observing whether a dedicated thread repeats its call chain periodically and whether the call chain occupies more than 30 percent of the whole execution time in this thread, a cryptocurrency miner is reported to be present. Along with the condition for a hash-based profiler, these two thresholds are the lower bounds from cryptojacking in the real world. The final check is made manually, looking at the terms of service of each website to see if there is any user agreement that makes it clear to the user or implicit in their agreement that their processing power is being used for cryptocurrency mining while visiting the website. The study found that only 35 websites were “benign,” with implicit agreement being sought from users. When evaluating the performance of CMTracker, the researchers chose a subset of 200 websites from the sample to manually check if cryptocurrency mining scripts were indeed running on the website in question and found no false positives. While the paper acknowledges that some cryptojacking websites may have evaded CMTracker, “... neither we nor other publicly available reports showed any evidence of real cases that can escape CMTracker’s two behavior-based detector.” How Rampant Is the Cryptojacking Problem?Among all the top 100,000 sites according to the Alexa rankings, the CMTracker found 868 unique domains that contain cryptojacking and on a further evaluation of external links, including 548,264 distinct domains from the top 100,000 Alexa ranked websites, found a total of 2,700 cryptojacking sites. As compared with previous reports, the situation is getting worse over time, illustrated by the table from the study below. Observed cryptojacking activities have increased 260 percent in just five months from November 2017 to April 2018.

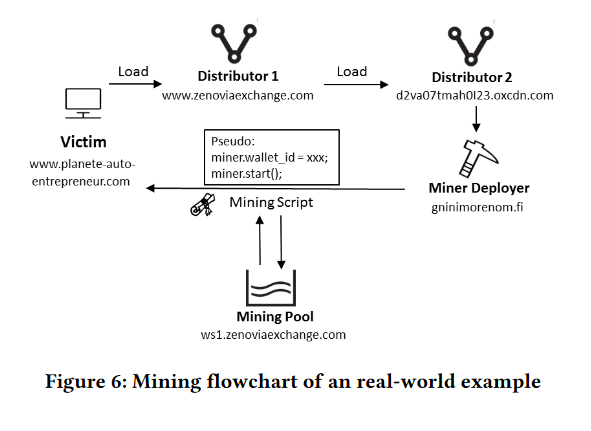

A 260% increase in observed cryptojacking from Nov. 2017 to Apr. 2018 The websites most affected are those related to adult content, art and entertainment; this makes sense, as most websites in these categories provide pirated sources, so users spend an extended amount of time searching for a particular movie, episode or video, which translates into higher profits for attackers. As more time is spent on the site, more processing power is committed to mine cryptocurrency. Using a basic approximation technique based on the difficulty of mining Monero, as well as its block reward and price, the study estimated that hackers could gain $1.7 million from more than 10 million users per month. In terms of global energy consumption, since the victims of cryptojacking are forced to consume more electricity, it costs more than 278,000 kWh extra units of power daily, enough energy to power a small American town with around 9,000 people. Using that annexed power, attackers are thought to make, collectively, around $59,000 per day. The Main Players in the Cryptojacking GameWho is responsible for cryptojacking? The study also investigates the players, and the figure below shows a real-world example of the interaction between each of these players. By using the distribution of different mining participants from a random subsection of their sample, some answers are provided.

The cryptojacking process visualized and the players involved Most participant domains occur in no more than three malicious samples, and only a small percentage of mining pools, mining distributors or miner deployers are found in more than 10 web pages. The results suggest that blacklists may be ineffective as malicious miners are not centrally controlled. Another key result is that advertisers and mining services are mostly linked to cryptojacking websites. For instance, it notes a trend of advertisers turning to malicious mining, citing zenoviaexchange.com, a service similar to Coinhive, as an example of a former advertising service provider that’s now a miner. Also, by studying the distribution of wallet IDs associated with mining scripts and finding that a given wallet ID is commonly associated with less than three malicious web pages, the data leads to the conclusion that many different actors benefit from abusing cryptocurrency mining services. To better understand the dynamics of cryptojacking, the research also sheds some light on the life cycle of malicious miners. Around 20 percent of the miner deployer’s domains that are cryptojacking pages in the sample disappear in under nine days, but distributors migrate to newer domains at a lower rate. the study points out that “Interestingly, blacklists do not target distributor domains even though they rarely change.”

Life cycles of cryptojacking domains; miner deployers, distributors and mining pools Evasion can also mean something more than simply migrating to a new domain. The study finds that, out of 100 cryptojacking sites in the sample, there were 56 instances limiting CPU usage, 43 instances of payload hiding and 26 instances of code obfuscation. For instance, a pirate streaming site can take 30 percent CPU for the video and only 10 percent of CPU for mining, making it difficult for the user to notice. Two examples highlighted in the study illustrate the increasing sophistication of cryptojacking activities. Firstly, cryptojacking may occur through code obfuscation, where the malicious mining code is hidden or buried in the code. Another notable technique used by some cryptojacking domains involves utilizing two different mining services, for example Coinhive and Crypto-Loot. In case either of the mining deployers are blocked by Ad Blockers or are shut down, the cryptojacking domain is resistant to any failure in either Coinhive or Crypto-Loot, in case either are blacklisted. Protection and Mitigation Measures for CryptojackingGiven that cryptojacking participants can use more sophisticated means to evade detection, it begs the question of whether browser extensions or anti-virus programs can protect users from this sort of cyber theft. The researchers suggest that most protective measures are based on blacklists and then go on to evaluate the effectiveness of two of the most widely used blacklists in a 15-day experiment: NoCoin and MinerBlock. The results show that less than 51 percent of malicious attacks are detected, and — due to the fact that blacklists are updated every 10 to 20 days, as compared to nine or less for mining deployers — this divergence means that the malicious actors are always one step ahead, as cryptojacking domains migrate or vanish at a higher rate. As a result, the detection rate does not increase, even though coverage does. To effectively combat cryptojacking, the researchers propose a behavior-based approach to detection, which can then be implemented by browser extensions and anti-virus engines. As indicated by the experiments, it takes three seconds for the CMTracker to analyze a web page for cryptojacking and, when combined with a whitelist for those websites having explicit reference to the donation of processing power in the user terms of service, could effectively reduce malicious mining. These researchers also point to cryptocurrency mining services as having paid inadequate attention to the abuse of their services; mining scripts are run without user notification and users cannot turn off these scripts. Consequently, they propose that the mining services like Coinhive, which powers half of all cryptojacking domains, should shoulder some of the responsibility. Mining services could do this by implementing a pop-up window or something similar to notify the user, allow them to deny the request and disable the mining process. At present, there is an implementation of Coinhive called AuthedMine that is an opt-in version. As highlighted by Krebs on Security in March 2018, it is hardly used, which Coinhive has blamed on anti-malware companies. “They identify our opt-in version as a threat and block it,” Coinhive told Krebs on Security. “Why would anyone use AuthedMine if it’s blocked just as our original implementation?” Bitcoin Magazine contacted Coinhive via email with regards to the research paper and whether their service will be modified but, at the time of writing, no response has been received. To facilitate further research of cryptojacking, the research team plans to release the source code of CMTracker on GitHub, as well as on the cryptojacking websites list. The full paper “How You Get Shot in the Back: A Systematical Study of Cryptojacking in the Real World” can be found here. The paper will be presented at the 2018 ACM SIGSAC Conference on Computer and Communications Security in Toronto, Canada, taking place October 15-19, 2018. This article originally appeared on Bitcoin Magazine. |

Bitmain Rival Ebang Launches New Line of Uber-Efficient Bitcoin Miners

|

CryptoCoins News, 1/1/0001 12:00 AM PST One of Bitmain’s biggest rivals is ready to give the bitcoin mining giant a run for its money as both firms prepare to go public in Hong Kong. Upstart Bitcoin Mining Firm Unveils New 10nm Chip, Miner Series The China-based Ebang Communication, one of the world’s largest manufacturers of application-specific integrated circuit (ASIC) chips for The post Bitmain Rival Ebang Launches New Line of Uber-Efficient Bitcoin Miners appeared first on CCN |

Green Energy Bitcoin Mining Will Have ‘Insignificant Environmental Impact’

|

CryptoCoins News, 1/1/0001 12:00 AM PST As the Bitcoin network grows, so too does the concern around its environmental impact, and with good reason. Bitcoin consumes more electricity than the entire island of Ireland, and that power consumption is set to steadily rise in the coming years. Beyond the electricity required to run the network, there are the materials required to The post Green Energy Bitcoin Mining Will Have ‘Insignificant Environmental Impact’ appeared first on CCN |

Regulation News Moves Bitcoin Prices, BIS Report Says

|

CoinDesk, 1/1/0001 12:00 AM PST A new report from the Bank of International Settlements (BIS) contends that bitcoin markets are swayed by news events related to regulation. |

Winklevoss-Led Cryptocurrency Exchange Gemini Eyes UK Expansion: Report

|

CryptoCoins News, 1/1/0001 12:00 AM PST Gemini, the U.S. cryptocurrency exchange founded by bitcoin billionaires Cameron and Tyler Winklevoss, is rumored to be eyeing an expansion into the United Kingdom. Gemini Plots Transatlantic Expansion Citing two sources close to the process, the Financial Times reports that the New York-based exchange operator has hired advisors regarding a move into Britain and may The post Winklevoss-Led Cryptocurrency Exchange Gemini Eyes UK Expansion: Report appeared first on CCN |

Bitcoin Price Analysis: Potential Reaccumulation Could Test Bear Trend

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Last week, after a devastating move that shook the market violently up and down for a 7% move in just a few short minutes, bitcoin saw a major sign of strength as it proceeded to have a slow, but steady markup where it managed to establish a local high in the $6,800s:

This shakeout forced the market to temporarily establish a new monthly low in what could be argued to be a stop-hunt prior to the move to the $6,800s. Sitting atop its most recent rally is what appears to be a reaccumulation trading range shown below: While it’s still early to tell, the current consolidation has some of the hallmarks of a classic reaccumulation trading range that, if realized, will likely lead to a continuation to the upside. Currently, the market is rebounding from what appears to be a “spring” or a “shakeout” — an effort to create liquidity for large players. Part of the alleged shakeout includes testing prior resistance to see if it can properly hold as support. And, as you can see below, the spring tested the previous high and is currently holding support — a good sign for the bulls:

So where does that leave us? While it is pure speculation at this point, if we see a strong round of buying, the first immediate test would take us to the top of the current trading range to test the $6,800s again. If the reaccumulation trading range proves to properly consolidate, a break to the upside is expected that will surely have us testing our macro descending trendline:

If we manage to make it to the descending trendline, this will mark our fifth test of supply along that boundary. This is a potentially trend-changing signal that could pave the way through the woods and lead us out of the bear market. While several major coins are seeing massive gains, bitcoin is still playing possum; it will continue to do so until this descending trendline is broken. The macro trend is slightly leaning bullish as the total volume is consolidating and, as we have seen in the past, several large coins (see previous ETH-USD Market Analysis) have begun to set records in volume in what could potentially be a macro bottom. As always, this is pure speculation, but it is a scenario that I feel is entirely possible. We will have to play it day by day and see how the trend interacts with the descending trendline. If we see a definitive break of that trendline, I fully expect to see a large swell of buying interest hit the market as the larger investors regain confidence in a potential bull market. Summary:

Trading and investing in digital assets like bitcoin and ether is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTC Media related sites do not necessarily reflect the opinion of BTC Media and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results. This article originally appeared on Bitcoin Magazine. |

Kraken: An Overview of One of Europe's Top Bitcoin Exchanges

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST In this overview, we explore Kraken and its journey from a Mt. Gox alternative to soften the blow of bitcoin’s dependence on just one exchange to becoming one of the most respected cryptocurrency exchanges in the world. We’ll also look at the various features of its platform, chiefly trading and acquiring cryptocurrency. SnapshotOperating since: May 2013 (beta) / September 2013 Location: Canada, EU, Japan, U.S. Fiat pairs supported: USD, EUR, CAD, JPY Notable cryptocurrencies supported: BTC, ETH, LTC, BCH, XRP, XMR, DASH, XLM, DOGE, EOS, ICN, GNO, MLN, REP, USDT, ZEC Countries served: Worldwide, with restrictions in New York and some other areas. Account verification: Full name, date of birth, mobile number, country of residence (Tier 1), + physical address (Tier 2), + proof of identity and proof of address (Tier 3), + know-your-customer (KYC) documents and application form (Tier 4) Funding options: SEPA bank transfer, SWIFT, U.S. domestic wire transfers, Japanese domestic wire transfers, Canadian domestic wire transfers, cryptocurrency Withdrawal options: SEPA bank transfer, cryptocurrency, electronic funds transfer (EFT) for CAD, SWIFT, U.S. domestic wire transfers, Japanese domestic wire transfers, Canadian domestic wire transfers Fee structure: 0.36 percent sliding down to 0 percent depending on 30-day volume, asset traded, trade size and whether your order is “maker” or “taker” A Brief History of the World’s Largest Euro-to-Bitcoin ExchangeWhile Kraken was founded in July 2011, it eventually emerged as a platform to reduce the bitcoin market’s dependency on a single exchange. Kraken’s founder and CEO, Jesse Powell, offered assistance to Mt. Gox, which accounted for around 70 percent of all bitcoin trades over the period of April 2013 until early 2014, following two hacks in 2013. After surveying the poor management of Mt. Gox during May 2013, Powell launched the beta version of Kraken and the startup began to thrive in one of the technological centers of the world, San Francisco’s Bay Area. Powell is quoted as saying in 2014, “I wanted there to be another [exchange] to take its place, if Mt. Gox failed.” And indeed, Kraken delivered. In the same year, Payward, Kraken’s parent company, raised $5 million in a Series A funding round that was led by Hummingbird Ventures and included Digital Currency Group and Blockchain Capital. These funds were secured for the exchange’s security and legal compliance. In February 2016, SBI Ventures led a multimillion-dollar Series B funding round to widen the exchange’s reach; that round also included support from Money Partners Group, a leading foreign exchange broker in Japan. The company started by offering bitcoin and litecoin, and gradually expanded to include dogecoin in April 2014 and Ethereum’s ether in August 2015. The exchange now offers nine out of ten of the top cryptocurrencies by market capitalization. A Rocky Relationship with the U.S.Kraken has also been a strong supporter of sensible regulation. Along with Bitfinex, Kraken pulled out of New York following the BitLicense proposals in 2015, which were seen as stifling innovation. Due to troubles with U.S. regulators, Kraken shifted focus to other markets, such as Canada in July 2015. More recently, Powell came out against regulatory measures from New York, which for some has added more credibility among crypto enthusiasts to the exchange as one business at the forefront of the crypto revolution, striving for sensible regulation. When asked about details on operations, internal controls and measures for market manipulation and fraud in early 2018, Kraken declined to participate. In 2017, the exchange explained that while its competitors may have some sort of insurance schemes in place, they looked into different insurance policies and determined that none offered significant protection for their clients. They also mentioned FDIC insurance does not cover losses due to hacks or the loss of bitcoin or other cryptocurrencies. Instead, they think having world-class security in pace is the best protection, adding, “But if some form of insurance becomes available that really offers a significant level of protection without being prohibitively expensive, we will certainly consider adopting it.” The exchange claimed to have pulled out of New York in August 2015 but it has come under fire in September 2018, with New York’s legal chief accusing Kraken of operating illegally in the state, referring the supposed violation to the New York Department for Financial Services (NYFDS). The uncertainty as to what will happen going forward could turn into a regulatory risk for Kraken and its US customers. Kraken is one of the longest-, continuously running Bitcoin exchanges and one of the most respected due to its security practices, ethics and “agnostic support” for the cryptocurrency sector. Powell has previously stated, “We are an agnostic exchange which means that we do not prefer a certain digital asset over another,” when judging the investment case study competition in conjunction with The Economist. Kraken never delayed the introduction of contentious forks, like Bitcoin Cash or Ethereum Classic, or sided with a particular cryptocurrency project. At the same time, Kraken has not hastily added new cryptocurrencies, like Bitfinex has done in the past (e.g., Bitcoin Interest), suggesting their restraint is down to the company wanting the cryptocurrency space as a whole to succeed rather than risk promoting scams. One comical tweet from Kraken pokes fun at Coinbase for its announcement of potential additions to its platform in July 2018. Compared to how Coinbase handled Bitcoin Cash, with accusations of market manipulation and insider trading when BCH-USD soared above $3,500 in January 2018, Kraken added BCH with no controversy, shortly after the fork took place. Moreover, Powell has never publicly stated what his cryptocurrency holdings are, which again contrasts to Coinbase CEO Brian Armstrong, who has stated previously that he holds more ether than bitcoin. Security FirstKraken undergoes a regular audit to prove that it has the full reserves of cryptocurrency to back up its operations and was the first to provide a cryptographically verified proof of reserves following the Mt. Gox implosion. The auditor checks the balances of Kraken’s holdings, with the exchange providing the addresses by signing them. The addresses’ public signatures are then summed to check the total bitcoin balance at a certain point in time. Then the exchange provides the balances of each customer’s account, and the auditor ensures that this figure matches up with the balance held. A Merkle tree is used, where the auditor publishes the root node hash so it is publicly available to confirm that the balances held are approximately the same as the sum of customer balances, using the Bitcoin blockchain. Finally, users can independently verify that their data was used in the audit, enabling customers to conform to the motto “Don’t trust, verify.” As usual, two-factor authentication is suggested so that individuals’ personal data cannot be leaked. Kraken also recommends setting up a Master Key so that you can still recover your account if you lose access to your login details or if a hacker gains access to your account. By using the Master Key, you can prevent a password reset. If you are planning on holding your cryptoassets on the Kraken exchange for a long period of time (for example, if you are performing a margin trade that you expect to last around a month), then enabling the Global Setting Lock (GSL) is also advised. This security feature ensures that no changes can be made to your account setting and hides sensitive information. If a hacker gains access to your account while GSL is enabled, they will be unable to add new withdrawal addresses or change the email address associated with the account. Finally, you can set up PGP within your email to ensure that all communications from Kraken are genuine and are not phishing links or tampered emails. Having your emails coming from Kraken to you encrypted adds an extra layer of security as, from time to time, you may have sensitive information contained within correspondences from the exchange. All correspondence is done via email, and the business does not have a phone number for support. The platform itself has never been hacked, but its users have due to poor OpSec, so it is best to take advantage of all the features outlined above. Another key point to make is to use a fresh email address, one that is not publicly known, for each exchange to thwart potential hacking attempts. To encourage white hat hackers to disclose and help patch vulnerabilities in the site, Kraken offers a bug bounty with a discretionary reward based on the severity of the issue. LiquidityAt the time of writing, the majority of the volume on the Kraken exchange is geared toward Ethereum’s ether (ETH), followed by bitcoin (BTC), ripple (XRP), EOS, Tether (USDT) and monero (XMR). While Kraken offers both USD and EUR pairs for all cryptocurrencies, the EUR pairs are generally more liquid, and if you are margin trading, you may want to take advantage of this.

If you are using an arbitrage strategy, it may be worth considering including Kraken’s XBT-USD pair, as it often deviates significantly from other exchange’s prices due to the difference in liquidity. The chart below shows that Kraken’s XBT-USD pair can differ significantly from Bitstamp’s BTC-USD pair, with an arbitrage trader making a risk-free return from buying on the exchange with the lower price and selling on the exchange with the higher price.

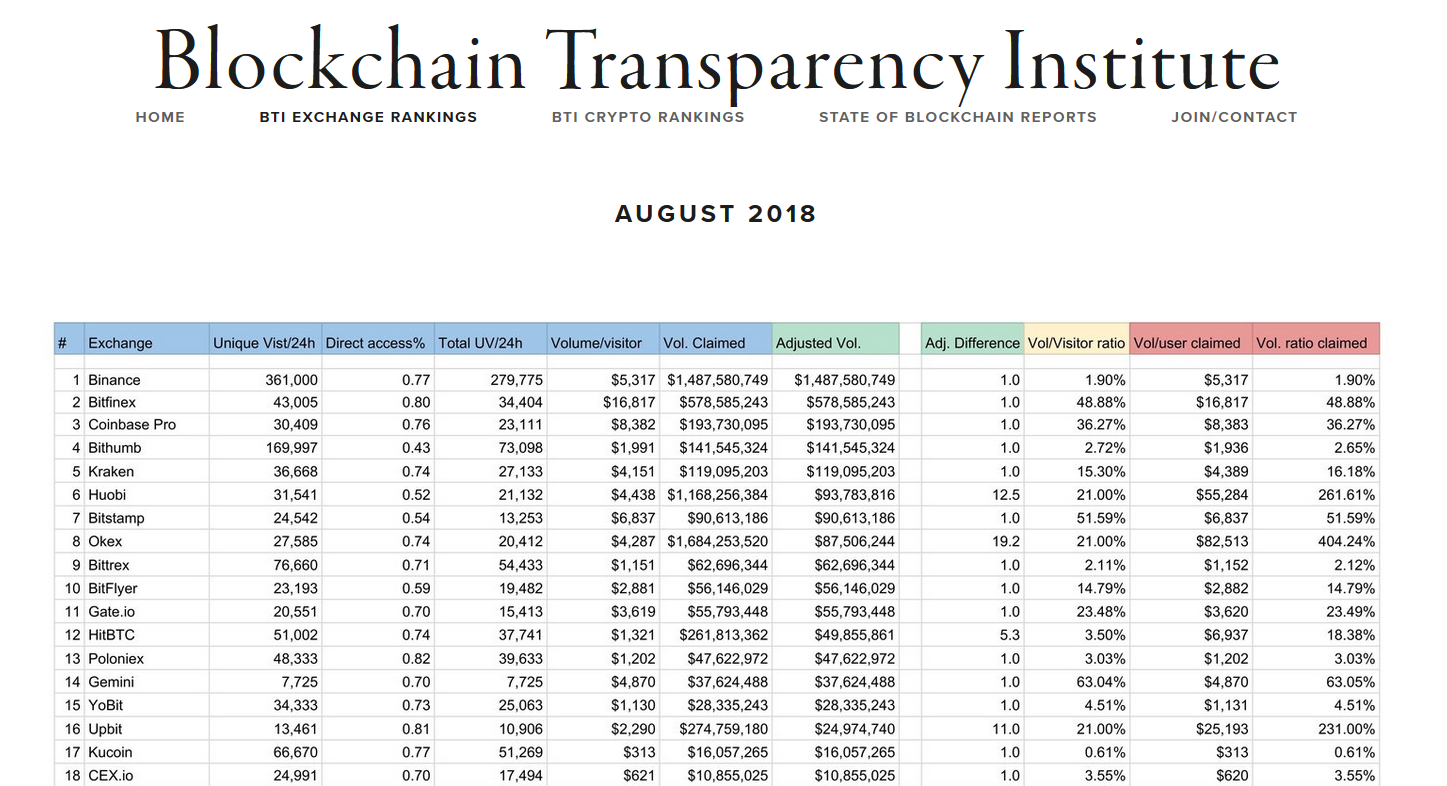

Kraken also offers dark pools, which allow you to make an order that is hidden from public view. Dark pools are offered for both bitcoin and ether, allowing traders to place large order sizes that may otherwise move the market and be matched with similar orders at potentially better prices; it is important to note, however, that dark pools incur an additional fee. You can execute these orders in the intermediate and advanced tabs in the trading subsection. You can select orders using the dark pool in the intermediate or advanced tabs on the new order page. As with Bitstamp, wash trading and the faking of volume are not suggested to be problems for Kraken, highlighted in a report from the Blockchain Transparency Institute. The researchers found no evidence of wash trading, as reported volumes closely matched the volumes uncovered by the report. However, this ranking is subject to change, and updated figures will be released sometime in September 2018.

ReputationKraken made its mark in the cryptocurrency scene early on, with the discovery of a flaw in the Namecoin protocol in October 2013, leading to the developers fixing the fault. While the altcoin was listed on the platform after the vulnerability was addressed, namecoin (NMC) was removed later on due to a downward spiral in trading volumes. Kraken’s reputation has also benefited from its foresight and commitment to the long term, as highlighted by the 2014 scare around transaction malleability, where users could change the transaction ID (TXID) within a short window of opportunity and under certain conditions. Fortunately for Kraken customers, the exchange was unaffected by this “bug” as it had foreseen the troubles that would come with relying solely on transaction IDs to track bitcoin transfers, and had developed a more robust accounting system. Around the same time, Mt. Gox was dealing with this issue of mutated TXIDs and had no other way of tracking its customers’ incoming bitcoin transactions. By tracking bitcoin transfers with a variety of information, such as transaction size, time and recipient data, Kraken solidified its reputation among Bitcoiners by demonstrating an intimate understanding of the Bitcoin protocol. Moreover, the exchange was also enlisted to help recover the stolen bitcoins from Mt. Gox, and claims can still be made through Kraken’s platform. The trustee in charge of Mt. Gox’s case chose Kraken because of its proven operating history and resistance to hacks. Kraken was also instrumental in forming the Japan Authority of Digital Assets (JADA), the first Bitcoin regulatory body with government backing. Similarly, in the U.S., Kraken was an important player in the formation of the Digital Asset Transfer Authority (DATA), a self-regulatory authority for the cryptocurrency industry. Furthermore, as a testament to its position as an industry-leading exchange, Kraken was one of the first exchanges to be added to the Bloomberg terminal to track the price of bitcoin. Over the years, Kraken has also been active in the area of mergers and acquisitions, with the exchange acquiring four crypto-focused businesses in 2016 and 2017. In 2016, Kraken took over American exchanges Coinsetter and Glidera, Canadian exchange Cavirtex, as well as Dutch exchange CleverCoin. Following this, during March 2017, the charting site Cryptowatch also fell under the ownership of the exchange. The exchange’s reputation is boosted by recognition from leading business journals. The exchange was nominated as one of the 10 most promising blockchain startups by Great Wall of Numbers author Tim Swanson in 2014, appearing in Business Insider. Also, before its launch, Kraken was named as one of the most important Bitcoin companies by Upstart Business Journal. Fiat-to-CryptoFidor Bank, a financial institution regulated by the German financial regulator BaFin, is Kraken’s partner bank; the cooperation started in October 2013. Kraken can be thought of as a eurocentric exchange, but the platform has gradually widened its reach, later adding USD, CAD and JPY as supported fiat currencies. U.S. customers have not always had it easy using Kraken. The exchange withdrew from the American market in 2014 but later returned by partnering with PayCash to offer USD deposits. GBP deposits and withdrawals were available previously, but this feature has been withdrawn and may be added again at a later date. Kraken is one of the biggest exchanges that list Tether, and you can trade this U.S. dollar–pegged cryptocurrency using the exchange, which could prove useful if the fears surrounding the stablecoin ever boil to the surface. In the event of a Tether breakdown, you could margin short USDT-USD as its peg breaks. Alternatively, if you believe that Tether is bona fide, you could provide market liquidity by buying below the peg when Tether’s value drifts below $1.00. However, in the case that Tether does implode, Kraken might be affected severely in the short term, but since it is not dependant on Tether entirely, it should be well placed to survive any “cryptopocalypse” related to the stablecoin. Trading InterfaceKraken’s interface is quite basic but does show the spread between bids and asks as well as the order depth. You cannot trade directly from the charts page on Kraken, though, and you cannot apply technical analysis within the site’s interface. Unlike some other exchanges, there is no SMS functionality for price alerts.

The spread and order book depth can be shown within Kraken’s trading interface, but no technical analysis. You can also link your Kraken account with Cryptowatch to trade directly from the charting website and apply technical indicators such as MACD and the Parabolic SAR.

Those trading with bots can take advantage of Kraken’s APIs, with Thrasher as one example of a trading bot that you can utilize in conjunction with Kraken. Fee StructureThe fees on Kraken depend on a variety of factors, including the total cost of your order, the currency pair you are trading, your 30-day trading volume and whether your order is maker or taker. Moreover, if you are margin trading, two further fees are applicable — opening fee and rollover fee. If you want to place a maker order, which provides liquidity, you can use the Post Limit Order checkbox on the New Order page, and the fees range from 0 to 0.16 percent. On the other hand, taker orders take liquidity from the market as your order will be matched immediately with another in the order book. The fees for taker orders range from as low as 0.10 percent to 0.26 percent. It is important to note that Tether trades do no count toward your 30-day trading volume. The home screen indicates what fee you will pay and what fee you can expect if your trading volume rises to a specific amount. Unlike Bitstamp, withdrawing cryptocurrency comes with a fee that is dependant on which cryptocurrency you want to withdraw; for instance, the fee is 0.0005 BTC for bitcoin, 0.005 ETH for ether and 0.001 LTC for litecoin. Altcoin SupportKraken has regularly added new coins to its platform, with the most recent being bitcoin cash in August 2017. The platform supports many ERC20 tokens, like REP, ICN and MLN, along with privacy-focused coins like monero and zcash. Favorites of seasoned crypto-traders, like dogecoin, bitcoin and Stellar, are also available. Two coins that were traded on Kraken but are no longer available are Namecoin and VEN, a centralized digital currency founded in 2007 and backed by a basket of currencies, commodities and carbon futures. Newer altcoins like Cardano, Nano and Tron are not yet supported by Kraken, and bitcoin cash was the last Bitcoin fork that was added; it is not surprising that this established exchange is not trying to cash in off of the fork mania over the past year. Customers and developer teams can request new additions to Kraken’s platform on the support subpage and then click on Request a Feature; its team has stated many times that it will not announce new additions before they are listed in order to prevent market manipulation. Powell recently highlighted that the exchange does not have any listing fees, which helps to reduce the problems of moral hazard frequently associated with the cryptocurrency exchange market, and also suggests the company adds coins based on merit, not on the depth of their founders’ pockets. Kraken is somewhere in the middle of the scale of coverage of the crypto market amongst the largest exchanges; while more altcoins are on offer as compared to platforms like Bitstamp and Coinbase, it does not offer as many altcoins as Bittrex, Binance, Poloniex or Huobi. KYC Verification ProcessesThere are five tiers of verification on the Kraken platform, named Tier 0 to 4 respectively. Tier 0 permits you to only get a feel for the platform and does not allow any trades, deposits or withdrawals. It is only necessary to submit an email address for Tier 0 accounts. Next, Tier 1 permits you to trade solely in digital currencies, restricting the use of fiat currencies for deposits or withdrawals, but you can withdraw up to $2,500 per day and $20,000 per month. For Tier 1, you have to submit your full name, date of birth, country and telephone number. Tier 2 eases the restrictions on fiat currencies, allowing you to withdraw $2,000 per day and $10,000 per month, depending on which country you are located in. You must provide your address to be accepted at this tier. Both Tier 1 and 2 can be verified within an hour, with the latter increasing the daily withdrawal limit for cryptocurrencies ($5,000) but halving the monthly withdrawal limit for cryptocurrencies ($10,000) to account for the introduction of fiat currencies. Tier 3 is the same as Tier 2, except that funding limits are much higher and you must provide proof of identification and proof of your address. Finally, Tier 4 is probably only useful to you if you are a high-net-worth individual, as the funding limits for Tier 3 are already pretty high (withdrawals allowed up to $25,000 per day and $200,000 per month, for instance). In this case, you must complete and sign an application form as well as KYC documents, which will enable you to raise your deposit/withdrawal limits to an even higher level. Verification for Tiers 3 and 4 may take anywhere between one to five days, as it is not automated like for the lower tiers. TradingPowell has previously indicated that the exchange exists to “first and foremost … provide a market for spot, deliverable bitcoin” and that “advanced features for traders, like margin, are secondary” and could be removed if the market becomes too volatile. Nevertheless, Kraken is one of the best places to margin trade and has offered this feature since May 2015. Margin trading allows you to amplify your gains (as well as losses), with Kraken offering 5:1 leverage for pairs like BTC-EUR and ETH-XBT, while other pairs such as XMR-EUR and USDT-USD offer a lower leverage of 2:1. The margin feature is useful for advanced traders, who can borrow funds to open a position bigger than their account balance and potentially increase their profits if the market moves in their favor. The table below displays the pairs that support margin trading and the leverages you can use with these tickers. EUR margin pairs are not available to residents of the U.S. states of NH, TX, and WA.  While Kraken does not offer extremely high leveraged trades, like BitMEX, which allows you to use a margin of 100:1, it serves as an ideal place to start margin trading if you haven’t done so before, providing an opportunity to get to grips with leveraged trading. A variety of orders is available, allowing you to be flexible with your trades and how much attention you place on the crypto market. For instance, advanced orders such as stop losses and take profits are available. The more-vanilla orders like market and limit orders are also present for the novice trader. These various order types can be used to adjust to the market, allowing you to be more productive with your trading.

We cannot talk about Kraken and its history without talking about the trading engine. There was a time when getting an order filled while margin trading on Kraken was a very frustrating exercise. Many have complained about the lack of effectiveness of the trading engine and how, in its worst performing times, it has caused traders to lose money through no fault of their own, where orders were not executed when they were supposed to be. Some customers were refunded partially with Kraken Fee Credits, so traders can be assured somewhat that if such losses are made due to the fault of the trading engine, they will get some compensation; however, the easier choice many sought was to switch to a platform with a better trading engine. The problem became exacerbated during the crypto mania toward the end of 2017. Kraken had to revamp its trading engine to keep up with demand. In a post from January 2018, the company announced that a new, more scalable trading engine had been put into place. The engine does work much better now, and a recent blog post explained that the trading engine will be updated and maintained frequently. VerdictKraken is an all-rounder: it has margin trading, a variety of security features and fairly wide support for different cryptocurrencies, providing most traders with enough markets to keep them entertained. Furthermore, its reputation is excellent, emerging initially as an alternative to Mt. Gox to assuming the role of a leader in the cryptocurrency exchange sector. Kraken’s hand in discovering and correcting a fault in Namecoin’s protocol and its reluctance to add the myriad of Bitcoin forks mean that customers can be confident the exchange will do their due diligence before adding more cryptocurrencies. The platform has a few minor drawbacks. U.S. customers may not be served well by a company that gives the middle finger to certain regulatory bodies in the States, such as the NYFDS, which could prompt further action by American regulators in the near future. The trading interface is quite bland, but the integration with Cryptowatch more than makes up for this. SMS price alerts would also be a welcome addition. Providing a higher leverage for margin trading could also be beneficial for the platform to take a bite out of BitMEX’s market share. Also, for beginner traders, the site may be a bit complicated to use to its full extent. Luckily, when making a new order, you can choose from beginner, intermediate or advanced setups and put in a relevant order. For intermediate or advanced traders, you won’t get much better than Kraken, and if so, it will only be a marginal improvement, i.e., higher margins (BitMEX) or lower withdrawal fees for bitcoin (Bitstamp). This article originally appeared on Bitcoin Magazine. |

Kraken: An Overview of One of Europe's Top Bitcoin Exchanges

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST In this overview, we explore Kraken and its journey from a Mt. Gox alternative to soften the blow of bitcoin’s dependence on just one exchange to becoming one of the most respected cryptocurrency exchanges in the world. We’ll also look at the various features of its platform, chiefly trading and acquiring cryptocurrency. SnapshotOperating since: May 2013 (beta) / September 2013 Location: Canada, EU, Japan, U.S. Fiat pairs supported: USD, EUR, CAD, JPY Notable cryptocurrencies supported: BTC, ETH, LTC, BCH, XRP, XMR, DASH, XLM, DOGE, EOS, ICN, GNO, MLN, REP, USDT, ZEC Countries served: Worldwide, with restrictions in New York and some other areas. Account verification: Full name, date of birth, mobile number, country of residence (Tier 1), + physical address (Tier 2), + proof of identity and proof of address (Tier 3), + know-your-customer (KYC) documents and application form (Tier 4) Funding options: SEPA bank transfer, SWIFT, U.S. domestic wire transfers, Japanese domestic wire transfers, Canadian domestic wire transfers, cryptocurrency Withdrawal options: SEPA bank transfer, cryptocurrency, electronic funds transfer (EFT) for CAD, SWIFT, U.S. domestic wire transfers, Japanese domestic wire transfers, Canadian domestic wire transfers Fee structure: 0.36 percent sliding down to 0 percent depending on 30-day volume, asset traded, trade size and whether your order is “maker” or “taker” A Brief History of the World’s Largest Euro-to-Bitcoin ExchangeWhile Kraken was founded in July 2011, it eventually emerged as a platform to reduce the bitcoin market’s dependency on a single exchange. Kraken’s founder and CEO, Jesse Powell, offered assistance to Mt. Gox, which accounted for around 70 percent of all bitcoin trades over the period of April 2013 until early 2014, following two hacks in 2013. After surveying the poor management of Mt. Gox during May 2013, Powell launched the beta version of Kraken and the startup began to thrive in one of the technological centers of the world, San Francisco’s Bay Area. Powell is quoted as saying in 2014, “I wanted there to be another [exchange] to take its place, if Mt. Gox failed.” And indeed, Kraken delivered. In the same year, Payward, Kraken’s parent company, raised $5 million in a Series A funding round that was led by Hummingbird Ventures and included Digital Currency Group and Blockchain Capital. These funds were secured for the exchange’s security and legal compliance. In February 2016, SBI Ventures led a multimillion-dollar Series B funding round to widen the exchange’s reach; that round also included support from Money Partners Group, a leading foreign exchange broker in Japan. The company started by offering bitcoin and litecoin, and gradually expanded to include dogecoin in April 2014 and Ethereum’s ether in August 2015. The exchange now offers nine out of ten of the top cryptocurrencies by market capitalization. A Rocky Relationship with the U.S.Kraken has also been a strong supporter of sensible regulation. Along with Bitfinex, Kraken pulled out of New York following the BitLicense proposals in 2015, which were seen as stifling innovation. Due to troubles with U.S. regulators, Kraken shifted focus to other markets, such as Canada in July 2015. More recently, Powell came out against regulatory measures from New York, which for some has added more credibility among crypto enthusiasts to the exchange as one business at the forefront of the crypto revolution, striving for sensible regulation. When asked about details on operations, internal controls and measures for market manipulation and fraud in early 2018, Kraken declined to participate. In 2017, the exchange explained that while its competitors may have some sort of insurance schemes in place, they looked into different insurance policies and determined that none offered significant protection for their clients. They also mentioned FDIC insurance does not cover losses due to hacks or the loss of bitcoin or other cryptocurrencies. Instead, they think having world-class security in pace is the best protection, adding, “But if some form of insurance becomes available that really offers a significant level of protection without being prohibitively expensive, we will certainly consider adopting it.” The exchange claimed to have pulled out of New York in August 2015 but it has come under fire in September 2018, with New York’s legal chief accusing Kraken of operating illegally in the state, referring the supposed violation to the New York Department for Financial Services (NYFDS). The uncertainty as to what will happen going forward could turn into a regulatory risk for Kraken and its US customers. Kraken is one of the longest-, continuously running Bitcoin exchanges and one of the most respected due to its security practices, ethics and “agnostic support” for the cryptocurrency sector. Powell has previously stated, “We are an agnostic exchange which means that we do not prefer a certain digital asset over another,” when judging the investment case study competition in conjunction with The Economist. Kraken never delayed the introduction of contentious forks, like Bitcoin Cash or Ethereum Classic, or sided with a particular cryptocurrency project. At the same time, Kraken has not hastily added new cryptocurrencies, like Bitfinex has done in the past (e.g., Bitcoin Interest), suggesting their restraint is down to the company wanting the cryptocurrency space as a whole to succeed rather than risk promoting scams. One comical tweet from Kraken pokes fun at Coinbase for its announcement of potential additions to its platform in July 2018. Compared to how Coinbase handled Bitcoin Cash, with accusations of market manipulation and insider trading when BCH-USD soared above $3,500 in January 2018, Kraken added BCH with no controversy, shortly after the fork took place. Moreover, Powell has never publicly stated what his cryptocurrency holdings are, which again contrasts to Coinbase CEO Brian Armstrong, who has stated previously that he holds more ether than bitcoin. Security FirstKraken undergoes a regular audit to prove that it has the full reserves of cryptocurrency to back up its operations and was the first to provide a cryptographically verified proof of reserves following the Mt. Gox implosion. The auditor checks the balances of Kraken’s holdings, with the exchange providing the addresses by signing them. The addresses’ public signatures are then summed to check the total bitcoin balance at a certain point in time. Then the exchange provides the balances of each customer’s account, and the auditor ensures that this figure matches up with the balance held. A Merkle tree is used, where the auditor publishes the root node hash so it is publicly available to confirm that the balances held are approximately the same as the sum of customer balances, using the Bitcoin blockchain. Finally, users can independently verify that their data was used in the audit, enabling customers to conform to the motto “Don’t trust, verify.” As usual, two-factor authentication is suggested so that individuals’ personal data cannot be leaked. Kraken also recommends setting up a Master Key so that you can still recover your account if you lose access to your login details or if a hacker gains access to your account. By using the Master Key, you can prevent a password reset. If you are planning on holding your cryptoassets on the Kraken exchange for a long period of time (for example, if you are performing a margin trade that you expect to last around a month), then enabling the Global Setting Lock (GSL) is also advised. This security feature ensures that no changes can be made to your account setting and hides sensitive information. If a hacker gains access to your account while GSL is enabled, they will be unable to add new withdrawal addresses or change the email address associated with the account. Finally, you can set up PGP within your email to ensure that all communications from Kraken are genuine and are not phishing links or tampered emails. Having your emails coming from Kraken to you encrypted adds an extra layer of security as, from time to time, you may have sensitive information contained within correspondences from the exchange. All correspondence is done via email, and the business does not have a phone number for support. The platform itself has never been hacked, but its users have due to poor OpSec, so it is best to take advantage of all the features outlined above. Another key point to make is to use a fresh email address, one that is not publicly known, for each exchange to thwart potential hacking attempts. To encourage white hat hackers to disclose and help patch vulnerabilities in the site, Kraken offers a bug bounty with a discretionary reward based on the severity of the issue. LiquidityAt the time of writing, the majority of the volume on the Kraken exchange is geared toward Ethereum’s ether (ETH), followed by bitcoin (BTC), ripple (XRP), EOS, Tether (USDT) and monero (XMR). While Kraken offers both USD and EUR pairs for all cryptocurrencies, the EUR pairs are generally more liquid, and if you are margin trading, you may want to take advantage of this.

If you are using an arbitrage strategy, it may be worth considering including Kraken’s XBT-USD pair, as it often deviates significantly from other exchange’s prices due to the difference in liquidity. The chart below shows that Kraken’s XBT-USD pair can differ significantly from Bitstamp’s BTC-USD pair, with an arbitrage trader making a risk-free return from buying on the exchange with the lower price and selling on the exchange with the higher price.

Kraken also offers dark pools, which allow you to make an order that is hidden from public view. Dark pools are offered for both bitcoin and ether, allowing traders to place large order sizes that may otherwise move the market and be matched with similar orders at potentially better prices; it is important to note, however, that dark pools incur an additional fee. You can execute these orders in the intermediate and advanced tabs in the trading subsection. You can select orders using the dark pool in the intermediate or advanced tabs on the new order page. As with Bitstamp, wash trading and the faking of volume are not suggested to be problems for Kraken, highlighted in a report from the Blockchain Transparency Institute. The researchers found no evidence of wash trading, as reported volumes closely matched the volumes uncovered by the report. However, this ranking is subject to change, and updated figures will be released sometime in September 2018.

ReputationKraken made its mark in the cryptocurrency scene early on, with the discovery of a flaw in the Namecoin protocol in October 2013, leading to the developers fixing the fault. While the altcoin was listed on the platform after the vulnerability was addressed, namecoin (NMC) was removed later on due to a downward spiral in trading volumes. Kraken’s reputation has also benefited from its foresight and commitment to the long term, as highlighted by the 2014 scare around transaction malleability, where users could change the transaction ID (TXID) within a short window of opportunity and under certain conditions. Fortunately for Kraken customers, the exchange was unaffected by this “bug” as it had foreseen the troubles that would come with relying solely on transaction IDs to track bitcoin transfers, and had developed a more robust accounting system. Around the same time, Mt. Gox was dealing with this issue of mutated TXIDs and had no other way of tracking its customers’ incoming bitcoin transactions. By tracking bitcoin transfers with a variety of information, such as transaction size, time and recipient data, Kraken solidified its reputation among Bitcoiners by demonstrating an intimate understanding of the Bitcoin protocol. Moreover, the exchange was also enlisted to help recover the stolen bitcoins from Mt. Gox, and claims can still be made through Kraken’s platform. The trustee in charge of Mt. Gox’s case chose Kraken because of its proven operating history and resistance to hacks. Kraken was also instrumental in forming the Japan Authority of Digital Assets (JADA), the first Bitcoin regulatory body with government backing. Similarly, in the U.S., Kraken was an important player in the formation of the Digital Asset Transfer Authority (DATA), a self-regulatory authority for the cryptocurrency industry. Furthermore, as a testament to its position as an industry-leading exchange, Kraken was one of the first exchanges to be added to the Bloomberg terminal to track the price of bitcoin. Over the years, Kraken has also been active in the area of mergers and acquisitions, with the exchange acquiring four crypto-focused businesses in 2016 and 2017. In 2016, Kraken took over American exchanges Coinsetter and Glidera, Canadian exchange Cavirtex, as well as Dutch exchange CleverCoin. Following this, during March 2017, the charting site Cryptowatch also fell under the ownership of the exchange. The exchange’s reputation is boosted by recognition from leading business journals. The exchange was nominated as one of the 10 most promising blockchain startups by Great Wall of Numbers author Tim Swanson in 2014, appearing in Business Insider. Also, before its launch, Kraken was named as one of the most important Bitcoin companies by Upstart Business Journal. Fiat-to-CryptoFidor Bank, a financial institution regulated by the German financial regulator BaFin, is Kraken’s partner bank; the cooperation started in October 2013. Kraken can be thought of as a eurocentric exchange, but the platform has gradually widened its reach, later adding USD, CAD and JPY as supported fiat currencies. U.S. customers have not always had it easy using Kraken. The exchange withdrew from the American market in 2014 but later returned by partnering with PayCash to offer USD deposits. GBP deposits and withdrawals were available previously, but this feature has been withdrawn and may be added again at a later date. Kraken is one of the biggest exchanges that list Tether, and you can trade this U.S. dollar–pegged cryptocurrency using the exchange, which could prove useful if the fears surrounding the stablecoin ever boil to the surface. In the event of a Tether breakdown, you could margin short USDT-USD as its peg breaks. Alternatively, if you believe that Tether is bona fide, you could provide market liquidity by buying below the peg when Tether’s value drifts below $1.00. However, in the case that Tether does implode, Kraken might be affected severely in the short term, but since it is not dependant on Tether entirely, it should be well placed to survive any “cryptopocalypse” related to the stablecoin. Trading InterfaceKraken’s interface is quite basic but does show the spread between bids and asks as well as the order depth. You cannot trade directly from the charts page on Kraken, though, and you cannot apply technical analysis within the site’s interface. Unlike some other exchanges, there is no SMS functionality for price alerts.

The spread and order book depth can be shown within Kraken’s trading interface, but no technical analysis. You can also link your Kraken account with Cryptowatch to trade directly from the charting website and apply technical indicators such as MACD and the Parabolic SAR.

Those trading with bots can take advantage of Kraken’s APIs, with Thrasher as one example of a trading bot that you can utilize in conjunction with Kraken. Fee StructureThe fees on Kraken depend on a variety of factors, including the total cost of your order, the currency pair you are trading, your 30-day trading volume and whether your order is maker or taker. Moreover, if you are margin trading, two further fees are applicable — opening fee and rollover fee. If you want to place a maker order, which provides liquidity, you can use the Post Limit Order checkbox on the New Order page, and the fees range from 0 to 0.16 percent. On the other hand, taker orders take liquidity from the market as your order will be matched immediately with another in the order book. The fees for taker orders range from as low as 0.10 percent to 0.26 percent. It is important to note that Tether trades do no count toward your 30-day trading volume. The home screen indicates what fee you will pay and what fee you can expect if your trading volume rises to a specific amount. Unlike Bitstamp, withdrawing cryptocurrency comes with a fee that is dependant on which cryptocurrency you want to withdraw; for instance, the fee is 0.0005 BTC for bitcoin, 0.005 ETH for ether and 0.001 LTC for litecoin. Altcoin SupportKraken has regularly added new coins to its platform, with the most recent being bitcoin cash in August 2017. The platform supports many ERC20 tokens, like REP, ICN and MLN, along with privacy-focused coins like monero and zcash. Favorites of seasoned crypto-traders, like dogecoin, bitcoin and Stellar, are also available. Two coins that were traded on Kraken but are no longer available are Namecoin and VEN, a centralized digital currency founded in 2007 and backed by a basket of currencies, commodities and carbon futures. Newer altcoins like Cardano, Nano and Tron are not yet supported by Kraken, and bitcoin cash was the last Bitcoin fork that was added; it is not surprising that this established exchange is not trying to cash in off of the fork mania over the past year. Customers and developer teams can request new additions to Kraken’s platform on the support subpage and then click on Request a Feature; its team has stated many times that it will not announce new additions before they are listed in order to prevent market manipulation. Powell recently highlighted that the exchange does not have any listing fees, which helps to reduce the problems of moral hazard frequently associated with the cryptocurrency exchange market, and also suggests the company adds coins based on merit, not on the depth of their founders’ pockets. Kraken is somewhere in the middle of the scale of coverage of the crypto market amongst the largest exchanges; while more altcoins are on offer as compared to platforms like Bitstamp and Coinbase, it does not offer as many altcoins as Bittrex, Binance, Poloniex or Huobi. KYC Verification ProcessesThere are five tiers of verification on the Kraken platform, named Tier 0 to 4 respectively. Tier 0 permits you to only get a feel for the platform and does not allow any trades, deposits or withdrawals. It is only necessary to submit an email address for Tier 0 accounts. Next, Tier 1 permits you to trade solely in digital currencies, restricting the use of fiat currencies for deposits or withdrawals, but you can withdraw up to $2,500 per day and $20,000 per month. For Tier 1, you have to submit your full name, date of birth, country and telephone number. Tier 2 eases the restrictions on fiat currencies, allowing you to withdraw $2,000 per day and $10,000 per month, depending on which country you are located in. You must provide your address to be accepted at this tier. Both Tier 1 and 2 can be verified within an hour, with the latter increasing the daily withdrawal limit for cryptocurrencies ($5,000) but halving the monthly withdrawal limit for cryptocurrencies ($10,000) to account for the introduction of fiat currencies. Tier 3 is the same as Tier 2, except that funding limits are much higher and you must provide proof of identification and proof of your address. Finally, Tier 4 is probably only useful to you if you are a high-net-worth individual, as the funding limits for Tier 3 are already pretty high (withdrawals allowed up to $25,000 per day and $200,000 per month, for instance). In this case, you must complete and sign an application form as well as KYC documents, which will enable you to raise your deposit/withdrawal limits to an even higher level. Verification for Tiers 3 and 4 may take anywhere between one to five days, as it is not automated like for the lower tiers. TradingPowell has previously indicated that the exchange exists to “first and foremost … provide a market for spot, deliverable bitcoin” and that “advanced features for traders, like margin, are secondary” and could be removed if the market becomes too volatile. Nevertheless, Kraken is one of the best places to margin trade and has offered this feature since May 2015. Margin trading allows you to amplify your gains (as well as losses), with Kraken offering 5:1 leverage for pairs like BTC-EUR and ETH-XBT, while other pairs such as XMR-EUR and USDT-USD offer a lower leverage of 2:1. The margin feature is useful for advanced traders, who can borrow funds to open a position bigger than their account balance and potentially increase their profits if the market moves in their favor. The table below displays the pairs that support margin trading and the leverages you can use with these tickers. EUR margin pairs are not available to residents of the U.S. states of NH, TX, and WA.  While Kraken does not offer extremely high leveraged trades, like BitMEX, which allows you to use a margin of 100:1, it serves as an ideal place to start margin trading if you haven’t done so before, providing an opportunity to get to grips with leveraged trading. A variety of orders is available, allowing you to be flexible with your trades and how much attention you place on the crypto market. For instance, advanced orders such as stop losses and take profits are available. The more-vanilla orders like market and limit orders are also present for the novice trader. These various order types can be used to adjust to the market, allowing you to be more productive with your trading.

We cannot talk about Kraken and its history without talking about the trading engine. There was a time when getting an order filled while margin trading on Kraken was a very frustrating exercise. Many have complained about the lack of effectiveness of the trading engine and how, in its worst performing times, it has caused traders to lose money through no fault of their own, where orders were not executed when they were supposed to be. Some customers were refunded partially with Kraken Fee Credits, so traders can be assured somewhat that if such losses are made due to the fault of the trading engine, they will get some compensation; however, the easier choice many sought was to switch to a platform with a better trading engine. The problem became exacerbated during the crypto mania toward the end of 2017. Kraken had to revamp its trading engine to keep up with demand. In a post from January 2018, the company announced that a new, more scalable trading engine had been put into place. The engine does work much better now, and a recent blog post explained that the trading engine will be updated and maintained frequently. VerdictKraken is an all-rounder: it has margin trading, a variety of security features and fairly wide support for different cryptocurrencies, providing most traders with enough markets to keep them entertained. Furthermore, its reputation is excellent, emerging initially as an alternative to Mt. Gox to assuming the role of a leader in the cryptocurrency exchange sector. Kraken’s hand in discovering and correcting a fault in Namecoin’s protocol and its reluctance to add the myriad of Bitcoin forks mean that customers can be confident the exchange will do their due diligence before adding more cryptocurrencies. The platform has a few minor drawbacks. U.S. customers may not be served well by a company that gives the middle finger to certain regulatory bodies in the States, such as the NYFDS, which could prompt further action by American regulators in the near future. The trading interface is quite bland, but the integration with Cryptowatch more than makes up for this. SMS price alerts would also be a welcome addition. Providing a higher leverage for margin trading could also be beneficial for the platform to take a bite out of BitMEX’s market share. Also, for beginner traders, the site may be a bit complicated to use to its full extent. Luckily, when making a new order, you can choose from beginner, intermediate or advanced setups and put in a relevant order. For intermediate or advanced traders, you won’t get much better than Kraken, and if so, it will only be a marginal improvement, i.e., higher margins (BitMEX) or lower withdrawal fees for bitcoin (Bitstamp). This article originally appeared on Bitcoin Magazine. |

Kraken: An Overview of One of Europe's Top Bitcoin Exchanges

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST In this overview, we explore Kraken and its journey from a Mt. Gox alternative to soften the blow of bitcoin’s dependence on just one exchange to becoming one of the most respected cryptocurrency exchanges in the world. We’ll also look at the various features of its platform, chiefly trading and acquiring cryptocurrency. SnapshotOperating since: May 2013 (beta) / September 2013 Location: Canada, EU, Japan, U.S. Fiat pairs supported: USD, EUR, CAD, JPY Notable cryptocurrencies supported: BTC, ETH, LTC, BCH, XRP, XMR, DASH, XLM, DOGE, EOS, ICN, GNO, MLN, REP, USDT, ZEC Countries served: Worldwide, with restrictions in New York and some other areas. Account verification: Full name, date of birth, mobile number, country of residence (Tier 1), + physical address (Tier 2), + proof of identity and proof of address (Tier 3), + know-your-customer (KYC) documents and application form (Tier 4) Funding options: SEPA bank transfer, SWIFT, U.S. domestic wire transfers, Japanese domestic wire transfers, Canadian domestic wire transfers, cryptocurrency Withdrawal options: SEPA bank transfer, cryptocurrency, electronic funds transfer (EFT) for CAD, SWIFT, U.S. domestic wire transfers, Japanese domestic wire transfers, Canadian domestic wire transfers Fee structure: 0.36 percent sliding down to 0 percent depending on 30-day volume, asset traded, trade size and whether your order is “maker” or “taker” A Brief History of the World’s Largest Euro-to-Bitcoin ExchangeWhile Kraken was founded in July 2011, it eventually emerged as a platform to reduce the bitcoin market’s dependency on a single exchange. Kraken’s founder and CEO, Jesse Powell, offered assistance to Mt. Gox, which accounted for around 70 percent of all bitcoin trades over the period of April 2013 until early 2014, following two hacks in 2013. After surveying the poor management of Mt. Gox during May 2013, Powell launched the beta version of Kraken and the startup began to thrive in one of the technological centers of the world, San Francisco’s Bay Area. Powell is quoted as saying in 2014, “I wanted there to be another [exchange] to take its place, if Mt. Gox failed.” And indeed, Kraken delivered. In the same year, Payward, Kraken’s parent company, raised $5 million in a Series A funding round that was led by Hummingbird Ventures and included Digital Currency Group and Blockchain Capital. These funds were secured for the exchange’s security and legal compliance. In February 2016, SBI Ventures led a multimillion-dollar Series B funding round to widen the exchange’s reach; that round also included support from Money Partners Group, a leading foreign exchange broker in Japan. The company started by offering bitcoin and litecoin, and gradually expanded to include dogecoin in April 2014 and Ethereum’s ether in August 2015. The exchange now offers nine out of ten of the top cryptocurrencies by market capitalization. A Rocky Relationship with the U.S.Kraken has also been a strong supporter of sensible regulation. Along with Bitfinex, Kraken pulled out of New York following the BitLicense proposals in 2015, which were seen as stifling innovation. Due to troubles with U.S. regulators, Kraken shifted focus to other markets, such as Canada in July 2015. More recently, Powell came out against regulatory measures from New York, which for some has added more credibility among crypto enthusiasts to the exchange as one business at the forefront of the crypto revolution, striving for sensible regulation. When asked about details on operations, internal controls and measures for market manipulation and fraud in early 2018, Kraken declined to participate. In 2017, the exchange explained that while its competitors may have some sort of insurance schemes in place, they looked into different insurance policies and determined that none offered significant protection for their clients. They also mentioned FDIC insurance does not cover losses due to hacks or the loss of bitcoin or other cryptocurrencies. Instead, they think having world-class security in pace is the best protection, adding, “But if some form of insurance becomes available that really offers a significant level of protection without being prohibitively expensive, we will certainly consider adopting it.” The exchange claimed to have pulled out of New York in August 2015 but it has come under fire in September 2018, with New York’s legal chief accusing Kraken of operating illegally in the state, referring the supposed violation to the New York Department for Financial Services (NYFDS). The uncertainty as to what will happen going forward could turn into a regulatory risk for Kraken and its US customers. Kraken is one of the longest-, continuously running Bitcoin exchanges and one of the most respected due to its security practices, ethics and “agnostic support” for the cryptocurrency sector. Powell has previously stated, “We are an agnostic exchange which means that we do not prefer a certain digital asset over another,” when judging the investment case study competition in conjunction with The Economist. Kraken never delayed the introduction of contentious forks, like Bitcoin Cash or Ethereum Classic, or sided with a particular cryptocurrency project. At the same time, Kraken has not hastily added new cryptocurrencies, like Bitfinex has done in the past (e.g., Bitcoin Interest), suggesting their restraint is down to the company wanting the cryptocurrency space as a whole to succeed rather than risk promoting scams. One comical tweet from Kraken pokes fun at Coinbase for its announcement of potential additions to its platform in July 2018. Compared to how Coinbase handled Bitcoin Cash, with accusations of market manipulation and insider trading when BCH-USD soared above $3,500 in January 2018, Kraken added BCH with no controversy, shortly after the fork took place. Moreover, Powell has never publicly stated what his cryptocurrency holdings are, which again contrasts to Coinbase CEO Brian Armstrong, who has stated previously that he holds more ether than bitcoin. Security FirstKraken undergoes a regular audit to prove that it has the full reserves of cryptocurrency to back up its operations and was the first to provide a cryptographically verified proof of reserves following the Mt. Gox implosion. The auditor checks the balances of Kraken’s holdings, with the exchange providing the addresses by signing them. The addresses’ public signatures are then summed to check the total bitcoin balance at a certain point in time. Then the exchange provides the balances of each customer’s account, and the auditor ensures that this figure matches up with the balance held. A Merkle tree is used, where the auditor publishes the root node hash so it is publicly available to confirm that the balances held are approximately the same as the sum of customer balances, using the Bitcoin blockchain. Finally, users can independently verify that their data was used in the audit, enabling customers to conform to the motto “Don’t trust, verify.” As usual, two-factor authentication is suggested so that individuals’ personal data cannot be leaked. Kraken also recommends setting up a Master Key so that you can still recover your account if you lose access to your login details or if a hacker gains access to your account. By using the Master Key, you can prevent a password reset. If you are planning on holding your cryptoassets on the Kraken exchange for a long period of time (for example, if you are performing a margin trade that you expect to last around a month), then enabling the Global Setting Lock (GSL) is also advised. This security feature ensures that no changes can be made to your account setting and hides sensitive information. If a hacker gains access to your account while GSL is enabled, they will be unable to add new withdrawal addresses or change the email address associated with the account. Finally, you can set up PGP within your email to ensure that all communications from Kraken are genuine and are not phishing links or tampered emails. Having your emails coming from Kraken to you encrypted adds an extra layer of security as, from time to time, you may have sensitive information contained within correspondences from the exchange. All correspondence is done via email, and the business does not have a phone number for support. The platform itself has never been hacked, but its users have due to poor OpSec, so it is best to take advantage of all the features outlined above. Another key point to make is to use a fresh email address, one that is not publicly known, for each exchange to thwart potential hacking attempts. To encourage white hat hackers to disclose and help patch vulnerabilities in the site, Kraken offers a bug bounty with a discretionary reward based on the severity of the issue. LiquidityAt the time of writing, the majority of the volume on the Kraken exchange is geared toward Ethereum’s ether (ETH), followed by bitcoin (BTC), ripple (XRP), EOS, Tether (USDT) and monero (XMR). While Kraken offers both USD and EUR pairs for all cryptocurrencies, the EUR pairs are generally more liquid, and if you are margin trading, you may want to take advantage of this.