An investing legend who's nailed the bull market at every turn sees no end in sight for the 269% rally

|

Business Insider, 1/1/0001 12:00 AM PST

When Laszlo Birinyi talks about the stock market, it's in your best interest to listen. The legendary investor and president of Birinyi Associates has repeatedly nailed his predictions since the start of the bull market. He was one of the first analysts to recommend buying after markets bottomed in March 2009 and has remained a stock enthusiast as the S&P 500 has nearly quadrupled. Most recently, he said in the middle of the year that the benchmark would hit 2,500 by the end of September. Right on cue, the S&P 500 is sitting within 5 points of that target after hitting a series of new highs this week. Perhaps even more impressive than Birinyi nailing the start and subsequent gyrations of the eight-year bull market has been his continued willingness to make bold forecasts in the face of pessimism. In December 2008, in the throes of the financial crisis, he wrote that stocks were near a bottom. Need more evidence of his prescience? No problem:

In an interview with Business Insider, Birinyi laid out his arguments for the continuation of the bull market. He also poked holes in many of the most popular bearish stock arguments — from high valuations to record-low volatility to breadth. He doesn't buy any of it. Nor is he a fan of exchange-traded funds, one of the world's fastest-growing investment vehicles. Birinyi is instead focused on something he thinks is going widely unappreciated: the massive amount of cash sloshing around in the market. This interview has been edited for clarity and length. Joe Ciolli: What specific elements do you think are pushing the market higher? We hear a lot about earnings growth and relatively subdued geopolitical tensions. What is shaping your fundamental picture? Laszlo Birinyi: I don't think people appreciate how much cash there is in today's market. It seems like everything is just an excuse to put that cash to work, whether it's a tax bill or economics or [President Donald Trump's chief economic adviser Gary] Cohn not leaving the White House — those are all just excuses. The bond market is unsettled, and you've removed some of the stock-market concerns of the last couple years, most notably earnings. People are feeling a little more confident and willing to invest, and they have the cash to do it. The other issue is that while the averages are lackluster, there's a lot of trading money focused on individual stocks. The S&P may not have moved 1% or 2% in however many days, but the reality is that stocks are having really good days. You have a lot of individual stock volatility, which reflects the fact that people have the funds and they're looking for vehicles in which to manifest those funds. They're using single stocks as the vehicles, not broad asset classes such as emerging markets or gold or commodities. The critical ingredient in the market is cash. We also focus on the fact that many of the negative arguments really don't hold water. Valuations: Yes, they're high, but since 2009 we've become enchanted by what everyone calls Shiller's Cape. We went back to the 1980s and found that in an entire 10-year span, there was only one mention. This isn't a law that's been in existence ever since the New York Stock Exchange has been around. We weren't even aware of it in the last cycle. My argument against the whole thing is: It's never gotten you in the market. We can catalog a bunch of articles that show no one's ever said to buy. It's always been "The market's overpriced," "The market's expensive," "The market's high," but no one's ever said buy. In July 2009, there were some articles saying that according to some valuation measures, the market was fully valued. In July 2009! To me, something that's never told me to buy is not something I'm going to listen to when deciding when to sell. Stock market breadth (a measure of how widely distributed gains are): There are 10-12 different versions of breadth. There are all kinds of ways to look at it, and the bears find the one that looks least compelling. One of the problems I've always had with technicians is that they come up with a viewpoint and then they come up with data to support it. To me, a lot of these concerns have been with us a long time. Fundamentals/earnings: The interesting thing about earnings this quarter is that while they've maybe not been quite up to expectations, what's making things difficult is that people are now looking at earnings as just the first cut. And then they say, "Well, what about revenue?" And after earnings and revenue, they look at some other factor. You have a stock like Netflix where the earnings were so-so but the subscription rate was really good. You have this volatility because there's money sloshing around, waiting to do something. All of a sudden you look at Netflix and it's up 10%. With a stock like Priceline that has a so-so report but the outlook isn't that exciting, so everyone jumps on the downside. You have this tremendous individual stock volatility. The fact that overall earnings are good has made people a little more confident about the market, but it's also made things more difficult because earnings are now just the first cut. But net-net, it's a positive. Ciolli: In the past, you've expressed caution around what you describe as "irrational exuberance." Are we seeing that right now, and how has that view shaped your firm's forecasts? Birinyi: We're really not seeing it. As for what we've done, we reached our objectives for the first six months at the end of June. So we wrote at the end of June that we would be buying the September 29 S&P $250 call — in other words, we were looking for 2,500 by the end of September. And this was not just a comment; we actually put money on the table. We're now at that level. [Note: The index closed at a record high of 2,498.37 on Wednesday, the day before this interview.] There's absolutely no change in our view that the market will continue higher. Once the market goes above 2,500 — which hasn't happened yet — we will be coming up with a new target, because we think this is a market that's ideal for taking small steps rather than looking out 12-18 months. There are too many moving parts, such as North Korea, which we're not going to try to factor into our process. Ciolli: What is your take on the current low-volatility environment? It often gets characterized as a ticking time bomb. Does it worry you or signal anything in particular? Birinyi: Like so many things, that is a characteristic of a market. When people say to me that the market hasn't had a 1% run in a certain number of days, that tells me just that. It doesn't tell me anything about tomorrow or what's going to happen. The VIX isn't the fear index — it's a measure of potential volatility in either direction. Yet for some reason, people have glommed onto the idea that if the VIX spikes, the market's going to go down. No, when the VIX spikes, it means the market could go either up or down a lot. If you go back to the bottom in 2009, the VIX was telling you that there were going to be another two years of a bear market. It tells you about volatility, not direction. To me, it's just another vehicle. It's totally meaningless with regard to the future of the market. In an uninteresting market, people have found that this is something you can play. It seems like VIX ETFs and [exchange-traded notes] are a quick way to lose money. Ciolli: What about ETFs, which have seen a huge increase in popularity and are often blamed for sapping the market of volatility? Birinyi: We looked at ETFs. I don't think people really appreciate or understand a lot of the ETFs. Do you know what the fifth-biggest stock in the technology ETF is? A telephone company. When you say you want to buy tech, are you OK buying telephones? We looked, and if you took the eight biggest ETFs and bought them in January, you were up approximately 10% end of year. If you bought the biggest stock in those ETFs, you're up 25%. That should be the story instead of all these new ideas. If you go back in time, there's always been three guys from MIT that could come up with a better mousetrap. They were doing the same thing 10-12 years ago. Today we have bigger computers, and the algorithms are more complicated, but it's not new. You go out, you buy individual stocks where you understand that business and you understand what you're doing. If you bought some sort of VIX vehicle, I'm not sure you could understand if it did what you thought it would. Are you really getting paid for being correct? I'm not sure. It's fine for people with the background to do it, but not for 99% of the population. To me, all these shortcuts and easy ways to get into the market are very, very expensive. Without a way to quantify it, I'd almost be willing to bet you a very large amount of money that the dealers have made more money on the VIX than the customers. To me, this is all noise that floats because there's nothing else going on. People want to have something to talk about. Ciolli: What's your view on how political developments are affecting the market now? Immediately after the election, a lot of the stock-market gains were attributed to policy optimism, but that correlation seems to have lessened. What's the current dynamic? Birinyi: It's having some influence in the sense that it's given people a reason to reassess their circumstances and what they're doing. But I don't think it's having a direct influence in terms of what you buy and sell. If you look at the stocks that responded immediately after the election, they've not held up. While I'm willing to concede that there was a Trump bump, there aren't Trump stocks. The market, in so many ways, has suggested that the alleged direct beneficiaries of the new administration really aren't benefiting. Investors, including myself, jumped on these ideas, and many lost some money doing so. All politics are local. When you have developments that aren't likely to directly affect most individuals, they're really not going to be that concerned. Healthcare did affect most individuals, and the town meetings were pretty raucous. But when you talk about the wall and things like that, it won't affect 99% of people, so they're not focused on it. Bank regulation isn't going to affect most people, so they're not going to try and do anything about it. Trump has gotten people out of their chairs and doing something, but I don't think it's been in the stocks that you'd most closely associate with his politics. Ciolli: Overall, what's the best piece of advice you can give to investors right now? Birinyi: We have a cliche here that we say to our customers, and it's from a Wendy's commercial: Where's the beef? We see so many articles about how there's going to be a correction, but out of all the forecasts, I've never seen one that outright says to sell. No one comes out and says, "There's going to be a correction — short the S&P." It's all "The market is scary" or "We could have a downdraft," but at the end of the day, the question remains: Has there been a transaction? Having sat on a trading desk on Wall Street, where you live and die by what you do, to me this is just noise. In the last eight years, there was only one instance that I recall where a strategist came out and said, "There's going to be a correction, and you should sell the S&P." And we did! It didn't work out — we lost a little bit of money. And that was OK. We like situations where someone gives something tangible, where someone is accountable. That's why, when we put up our forecast in June, we said we were buying those September 29 S&P $250 calls. We had skin in the game, and I think customers appreciate that. We may be wrong, but we're not going to sit there and give people a forecast we're not following ourselves. As somebody once said, don't tell me it's going to rain — tell me to buy an umbrella. SEE ALSO: A pioneer of the VIX says the market is looking at volatility all wrong |

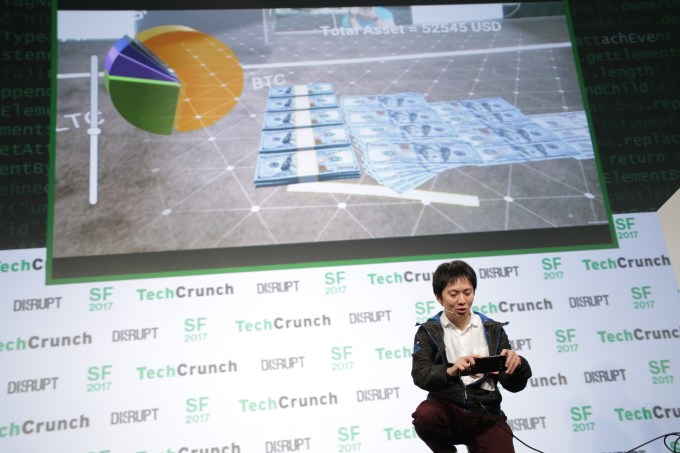

Crypto Asset Visualizer turns your bitcoin into a AR pile of cash

|

TechCrunch, 1/1/0001 12:00 AM PST

|

Trump is set to have an unusual level of influence over the Fed — and that's needed right now

|

Business Insider, 1/1/0001 12:00 AM PST With four key vacancies on the Federal Reserve's Board of Governors, President Donald Trump is set to reshape the central bank. A fifth spot could open by February, when Chair Janet Yellen's four-year term ends. Trump said Thursday that he likes and respects Yellen, but hasn't made a decision on whether to renominate her yet. Trump, who values loyalty, might well appoint yes-men and women to lead the central bank. "Investors I talk to in the US, Europe, and Asia are in my view too complacent about the risk that we going forward will get a politicized Federal Reserve," according to Torsten Slok, Deutsche Bank's chief international economist, in a recent note. That's the extreme scenario that could increase the market's uncertainty about how much inflation the Fed would tolerate. But a tighter relationship between the White House and the central bank is desirable right now, according to Paul Sheard, the chief economist at S&P Global. The post-crisis economy has been marked by low inflation, which is the opposite of what central banks have been trying to achieve by keeping interest rates low to encourage spending. To address this, Sheard said, we need to have a different mindset about the Fed's independence. "You can still have independence, but coordination and closer communication is probably not a bad idea," he told Business Insider. It's "quite beneficial in the sort of circumstances that the world has been in since the financial crisis." The idea of independent central banks, Sheard said, dates back to the 20th century, when the threat was not deflation, but hyperinflation. The lesson learned? "If you don't make the central bank independent, then the government would have the tendency to spend too much, run up its budget deficit, and rely on the central bank to finance those deficits, and that would end up being inflationary," Sheard said. But now that central banks are fighting deflation, it might be more desirable to have governments run bigger deficits to stimulate growth, with central banks on board to assist. "It's a way of getting economies back to full employment and getting inflation back to target much quicker than has been the case," Sheard said. And so, it's really a question of whether the relationship between the Fed and the White House can be updated for present-day needs. That's different from a situation where the central bank is seen more as a lackey of the government, Sheard said. Whether that relationship helps the economy is a big question mark. As Sheard noted, Trump is new to politics, and hasn't necessarily bought into the Fed's super-academic approach, as another president might have. "What the market would probably react rather badly to was a sense that the Fed was being politicized and people who really didn't have the necessary expertise were being appointed," Sheard said. "In other words, if it was not just the independence, but the integrity of the institution" that was in jeopardy. SEE ALSO: Janet Yellen's right-hand man is hanging up his boots |

The creator of Wall Street's 'fear gauge' says people don't understand it as well as they should

|

Business Insider, 1/1/0001 12:00 AM PST

One of Wall Street's most popular positions is betting that nothing will happen in the markets. Every day, traders across the US place bets that volatility will continue to decrease as stocks continue to climb higher and higher. And for the most part, they've profited from those bets. Since the CBOE's volatility index, or VIX, otherwise known as Wall Street's fear gauge, was launched in January 1993, more than 30 trading products have been created to let investors bet on its levels. And since the financial crisis in 2008 — when it reached an intraday record high of 89 — those levels have only gone down. This summer, the VIX reached a historic low of 9. Today, it's hovering at about 12. Business Insider recently spoke with Bob Whaley, the Vanderbilt University finance professor who created the wildly popular index. Whaley, 64, said he had been pleasantly surprised by the attention his index had received since its launch almost three decades ago. Here's what he had to say: This interview has been lightly edited for length and clarity. Graham Rapier: Tell me about your involvement in the creation of VIX. Bob Whaley: The idea of a volatility index comes from Gary Gastineau in the late '70s, and at that point there were no index options. What he proposed and created was this volatility index based upon the volatilities of high-market-value stocks, and so the idea had been around for a while. In the early '90s I had done some work for the CBOE around market volatilities. They were associated with the market crash of October 1987, when implied market volatilities went well over 170% — well over today's level of about 11. It was a pretty intense time. The CBOE enjoyed the work that I did for them and asked me to develop a volatility index for them, and that's what I did. I took all of their data, took a sabbatical from Duke, and headed off to France — so the VIX was actually created by a Canadian in France using American data. They needed a company identifier, and they were so pleased with my work that they wanted to choose REW, my initials. But the American Exchange had the ticker symbol REW, and they refused to trade. So the guy I was working with at CBOE faxed me a list of potential symbols to be used for this volatility index, and I chose VIX. After the fact, it would make more sense — but I had an opportunity for fame and it went by the wayside. Rapier: How do you explain VIX, and the trading products that are based on it, to an everyday person? Whaley: Technically speaking, it is the expected volatility of the S&P 500 over the next 30 days. But the way I explain it is the price of insurance. If you were to own a house on the North Carolina coast or Florida coast and you hear the news of this hurricane coming, would you be willing to pay more for insurance? And the answer to that is presumably so. In normal times, you may not be willing to pay as much. But when you know an event like that has a strong probability of occurring, what you'll do is pay more for insurance. What happens is people want to buy more insurance, and the insurers are willing to sell it, but not at the same price. What they'll do is escalate their price because they have to be hedged in terms of their exposure. So during these times, like the hurricanes, people are willing to pay extremely more for insurance. The analogy is institutions or people may have a pension fund largely consisting of stocks, now what happens when they become frightened of a stock market crash? They can exit their position, but they can also buy index put options. Essentially those are the insurance policy. These put options provide you with insurance on your stock portfolio, so if the market dives, the value of these put options will go way up and you won't lose any money. The reason it's called the investor fear gauge is simply because it's driven by the demand for S&P 500 index put options. If institutions become frightened by certain geopolitical risks, what they'll do is rush in and buy a bunch of index puts. When they buy those, the VIX level will go up because it's nothing more than a weighted average of the prices of those puts. Rapier: How should people interpret current VIX levels? Whaley: When you see VIX go up, you can know there are a bunch of people out there that are buying insurance on the stock market because they're anxious about something. When VIX goes down, it's just recognition that people aren't too worried. The average closing level is 19. If it's 11 now, that means people aren't particularly concerned. At the same time, its level was 9 a couple weeks ago, so there's clearly more anxiety now than there was a few weeks ago, but relative to its entire history it's just not that big a deal. Rapier: What do you make of all this attention it's getting lately? Whaley: I don't think people understand it as well as they should. The VIX doesn't trade. It's just a number produced from these 250 S&P 500 option prices. But what does trade are the VIX futures and the VIX options, which are related to VIX but in a strange way. Where VIX is the volatility over the next 30 days, VIX futures is the expectation of the volatility 30 days from now. Those two series don't behave like one another, in fact quite differently. VXX is incredibly actively traded. Would I have thought it would be this actively traded? No, but it is. I think the VIX futures index is particularly staggering. It probably trades more shares in a day than Microsoft. If you look at the turnover ratio, you'll find that it's a huge number. If people were just buying and holding, that number would be much lower. Rapier: What kinds of investors are trading these instruments? Are they doing it in a smart way? Whaley: If you look at VXX and go to 13F filings, you'll see it's largely an instrument used by retail customers, not institutions. If you go over to the ownership of XIV, it's largely institutions that know that this thing will go downward through time. It only goes down a few cents a day, but if you get a volatility spike, you'll lose money, but you're not going to get that many spikes if you have a long-term investment. In fact, if you go to the prospectus of these things, it explicitly states that if you buy and hold these things, you're assured to lose most if not all of your investment. But people do still buy and hold, and it's largely retail customers. Because how many retail customers look at a prospectus? Those things are 300 pages long. They don't do that. The issue I have is if you're a sophisticated investor, like an institution, they know exactly what's going on. Retail customers don't. Rapier: Do you trade any VIX-linked products yourself? Whaley: Yes I do. I buy long-term put options on VXX, because I know VXX is going to go down through time. There may be days where there's a spike in volatility, but I don't care because these options have three years to maturity, so I just let their prices go up as VXX goes down. It's worked pretty well. |

'Crazy' ICOs are driven by Bitcoin millionaires who need to diversify but don't want to pay tax

Business Insider, 1/1/0001 12:00 AM PST

LONDON — Where is all this ICO money coming from? That was the question I wanted to ask when Business Insider was invited to lunch last week with Lightspeed Venture Partners investor Jeremy Liew and Blockchain founder/CEO Peter Smith at The Hoxton, a trendy hotel much favoured by tech startups in Shoreditch, London. More than $1.8 billion has been raised in "initial coin offerings" this year, much of it by companies you have never heard of. There's an ICO to build the largest aquarium in the world, for instance. And one for prostitution. It's not clear where this $1.8 billion originated, however. The traditional funders of venture capital are so-called "limited partners," like banks and pension funds. They aren't the ones throwing money at imaginary currencies with imaginary values. A $2 billion firehose of risk-loving money.ICOs are largely unregulated offerings of digital coins, a bit like Bitcoin, that dozens of small tech companies are selling to raise funding. They operate like IPOs, but instead of offering equity they offer cryptocurrency tokens of their own design. The coins can then be exchanged at a later date, either traded to other buyers or for assets produced by the company itself. ICOs are as exciting, and risky, and crazy, as they sound. So who is providing this firehose of risk-loving money? In Liew and Smith's opinion, a lot of it is coming from Bitcoin millionaires who want to diversify their exposure. Many people who bought Bitcoin years ago are now staggeringly wealthy. In 2012, Bitcoin traded for $10 a coin. If you bought $3,000 of Bitcoin that year and held it, you'd now be a millionaire. It's hard to say how many secret Bitcoin millionaires there are in the world, but it's a lot. There are 17 million Bitcoin wallets on Blockchain's system alone. Not all of them are millionaires, obviously. But enough of them are. When you're a Bitcoin millionaire and the Chinese government can wipe away 25% of your assets in an afternoon, you need to act.Their problem is that Bitcoin remains enormously volatile. A year ago it traded below $1,000. It peaked at $4,950 this month but has since fallen back again to $3,222 at the time of writing, largely due to the news that China would ban ICOs and severely tighten regulations around Bitcoin.

When you're a Bitcoin millionaire and a single press release from the Chinese government can wipe away 25% of your assets in an afternoon, you need to take action. (Of course, the prices of most digital coins rise and fall in rough tandem with Bitcoin so there is a question about how "diversified" you'd be with the bulk of your wealth in the crypto markets. But still.) ICOs are where that action is going. I started by asking Liew — Snapchat's first investor — what he thought of the ICO arena, which to outsiders just looks crazy. It looks crazy to us too. — Jeremy Liew "It looks crazy to us too," Liew joked over guacamole and chips. But there are diamonds inside that craziness, he believes, and the key is to ignore the noise in favour of the really solid ideas that offer buyers assets that have a real underlying value. One example is Filecoin, he says, which lets users buy computer storage space on a decentralised server network. On one level, Filecoin is simply a credit that lets you buy a place to store your stuff. But Filecoin can be traded like Bitcoin, so unspent Filecoin might — or might not — appreciate in value like an investment. And it can be cashed out for Bitcoin or regular fiat "real world" currency if you don't want it anymore. It's a digital credit that entitles you to a purchasable asset, but its value fluctuates like a currency. In other words, it could, therefore, pay off as an investment. "It's kind of like anybody in the world being able to get a seed investment in a Google or a Facebook or an Amazon or something like that," according to Fred Wilson, a partner at Union Square Ventures (he's an investor). A good way to diversify out of Bitcoin without alerting the government is to trade into an ICO.There's an added wrinkle: Tax. So far, governments have not been very good at taxing Bitcoin. They disagree on whether it's property or currency, for instance. And because you can hold Bitcoin almost anonymously, it's hard for governments to find it and tax it. Bitcoin generally becomes taxable at the moment you convert it into cash. But it's no fun being a Bitcoin millionaire if, as soon as you buy a Ferrari, the government says, "Hey, nice Ferrari! Where did you get the money for it?" Most ICO currencies are tradeable with Bitcoin. So a good way to diversify out of Bitcoin without alerting the IRS and HMRC is to trade into an ICO. if you've got $1 million in Bitcoin lying around, then throwing $100,000 into an ICO isn't too painful, especially if you believe that ICO is going through the roof. There will be a shakeout. — Peter Smith That's the promise. Prices fall, too, of course. "There will be a shakeout" Blockchain's Smith says. The dumb, non-transparent, risky companies will get washed away just like they did in the dot-com bubble of 2000. Eventually, the ICO market will settle in as a funding device for prosaic but valuable small-cap businesses that large banks usually ignore. But until then, it's the Wild West out there. |

The 27 scariest moments of the financial crisis

|

Business Insider, 1/1/0001 12:00 AM PST

Nine years ago, the US economy sank into a recession, the housing market crashed, and credit markets seized, bringing the banking industry to its knees. Businesses were going down. Workers were losing jobs. Americans were losing hope. For many, the psychologically critical low moment was the Lehman Brothers bankruptcy on September 15, 2008. But the memory of events before and after that day is slowly fading. Business Insider outlined the 27 major moments, from 2007 to 2009, and added some context. From the initial reports of subprime defaults to AIG's second bailout, here are the scariest moments of the financial crisis. Steven Perlberg contributed reporting. |

The Fed is getting ready for its ‘biggest meeting of the year’

|

Business Insider, 1/1/0001 12:00 AM PST

The central bank is widely expected to announce the start of a reduction in its $4.4 trillion balance sheet at the conclusion of its meeting on September 20. It's a move the Fed hopes will go smoothly, but which has the potential to rattle financial markets long accustomed to the Fed’s monetary largesse. The Fed bought large quantities of Treasury and mortgage bonds during the Great Recession and financial crisis of 2007 to 2009, in an effort to push down long-term borrowing costs and to stimulate an economy and credit markets that had ground to a halt. The policy, controversial in some quarters, was widely known as quantitative easing (QE). So the beginning of the reversal of QE is a big deal, even if Fed officials, leery of jittery bond investors, continue to reassure Wall Street that the gradual pace of reduction in the Fed’s reserve base will mean there is little market impact. Scott Anderson, chief economist at Bank of the West, says the upcoming gathering of the rate-setting Federal Open Market Committee is "the biggest meeting of the year" for the central bank. That’s because what Janet Yellen has to say in her quarterly press conference will lay the groundwork for expectations of a possible interest hike in December and inform the outlook for the next year, Anderson wrote in an email to reporters. He thinks the Fed is being too sanguine about the potential impact of unwinding QE, which it intends to accomplish by gradually reducing and eventually eliminating reinvestments of maturing bond returns back into the central bank’s portfolio. "Ongoing balance sheet reduction at the same time fed funds rate hikes continue at the same pace as this year might be too much tightening too soon for the expansion to bear without adverse consequences," Anderson said. Anderson says he’s "increasingly uncomfortable" with Fed policymakers’ own projections that the central bank would raise interest rates three more times next year and in 2019. Uncertainty about the path of interest rate policy is heightened by a extensive round of looming top-level turnover at the Fed, including a possible replacement of Fed Chair Janet Yellen, when her term expires early next year, and the appointment of a new vice chairman following the early resignation of Stanley Fischer. "We still expect one more quarter-point hike from the FOMC in December, but no longer align with the Fed median for 2018 and 2019. We forecast only two quarter-point hikes now for 2018 and 2019." The main reason? Inflation continues to chronically undershoot the Fed’s target, suggesting the labor market is not as firm as the official 4.4% jobless rate suggests. In addition, "bond market inflation expectations remain well below historical norms, and the two- to 10-year Treasury spread has narrowed since the beginning of the year," Anderson said. "This is a sign that the Fed could be pushing too hard to normalize monetary conditions, and the growth and inflation outlooks are at risk. Both bond market signals counsel a go-slow approach from the FOMC going forward."

SEE ALSO: Trump could force a repeat of the Federal Reserve’s worst modern-day policy blunder |

Don’t dismiss Dimon’s predictions of a bitcoin bubble – after all, he should know

|

The Guardian, 1/1/0001 12:00 AM PST The virtual currency’s soaring value has set off alarm bells: but its success reflects the continuing lack of trust in traditional banking following the credit crunch When the boss of Wall Street’s biggest bank calls a bubble, the world inevitably sits up and listens, albeit with a sense of historically weighted irony: of course an investment bank boss would spot disaster after his industry presided over the last one. Jamie Dimon, the chief executive of JP Morgan, said last week that the ascendancy of the virtual currency bitcoin – which has risen in price from just over $2 in 2011 to more than $4,000 at points this year – reminded him of tulip fever in 17th-century Holland. “It is worse than tulip bulbs,” he said. “It could be at $20,000 before this happens, but it will eventually blow up. I am just shocked that anyone can’t see it for what it is.” Dimon’s comments are an open invitation for derision from those who, rightly, point out that although JP Morgan may be top of the Wall Street heap, that heap is far from being the moral high ground. Under Dimon’s leadership, it has agreed a $13bn settlement with US regulators over selling dodgy mortgage securities – the instruments behind the credit crunch – and its run-ins with watchdogs include a $264m fine last year for hiring the children of Chinese officials in order to win lucrative business in return. Continue reading... |

Built in less than 24 hours at TC Disrupt SF 2017’s hackathon, CAV, or Crypto Asset Visualizer, does exactly what it sounds like – it makes it easier to visualize your cryptocurrency holdings.

Using augmented reality, CAV calculates the USD value of your crypto holdings, then displays a virtual pile of cash on the ground in front of you. Right now it’s a demo – and…

Built in less than 24 hours at TC Disrupt SF 2017’s hackathon, CAV, or Crypto Asset Visualizer, does exactly what it sounds like – it makes it easier to visualize your cryptocurrency holdings.

Using augmented reality, CAV calculates the USD value of your crypto holdings, then displays a virtual pile of cash on the ground in front of you. Right now it’s a demo – and…

The Federal Reserve is about to make a momentous decision that should not be taken lightly.

The Federal Reserve is about to make a momentous decision that should not be taken lightly.