You won’t recognize the new world of financial services without this report

|

Business Insider, 1/1/0001 12:00 AM PST

We’ve entered the most profound era of change for financial services companies since the 1970s brought us index mutual funds, discount brokers and ATMs. No firm is immune from the coming disruption and every company must have a strategy to harness the powerful advantages of the new financial technology (“fintech”) revolution. The battle already underway will create surprising winners and stunned losers among some of the most powerful names in the financial world: The most contentious conflicts (and partnerships) will be between startups that are completely reengineering decades-old practices, traditional power players who are furiously trying to adapt with their own innovations, and total disruption of established technology & processes:

As you can see, this very fluid environment is creating winners and losers before your eyes…and it’s also creating the potential for new cost savings or growth opportunities for both you and your company. After months of researching and reporting this important trend, Business Insider Intelligence has put together an essential briefing that explains the new landscape, identifies the ripest areas for disruption, and highlights the some of the most exciting new companies. These new players have the potential to become the next Visa, Paypal or Charles Schwab because they have the potential to transform important areas of the financial services industry like:

If you work in any of these sectors, it’s important for you to understand how the fintech revolution will change your business and possibly even your career. And if you’re employed in any part of the digital economy, you’ll want to know how you can exploit these new technologies to make your employer more efficient, flexible and profitable.

Among the big picture insights you’ll get from this new report, titled The Fintech Ecosystem Report: Measuring the effects of technology on the entire financial services industry:

This exclusive report also:

The Fintech Ecosystem Report: Measuring the effects of technology on the entire financial services industry is how you get the full story on the fintech revolution. To get your copy of this invaluable guide to the fintech revolution, choose one of these options:

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of the fast-moving world of financial technology. |

Is 2016 the Year Russia Legalizes Bitcoin?

|

CryptoCoins News, 1/1/0001 12:00 AM PST The Deputy Chairman of the Russian State Duma Committee — the lower house of the Russian legislature — spoke about cryptocurrencies today. The deputy had a few interesting things to say about Russia’s hardline stance on cryptocurrencies in the past and possible future of the legality of Bitcoin in Russia, particularly for settlement with individuals […] The post Is 2016 the Year Russia Legalizes Bitcoin? appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Lightning’s Balancing Act: Challenges Face Bitcoin’s Scalability Savior

|

CoinDesk, 1/1/0001 12:00 AM PST Jameson Lopp is a software engineer at BitGo, creator of Statoshi.info and founder of bitcoinsig.com. He enjoys building web services and is intrigued by problems of scale. In this feature, Lopp examines the Lightning Network, a proposed solution for scaling the bitcoin network while enabling low-cost microtransactions. The bitcoin community has been discussing the concept […] |

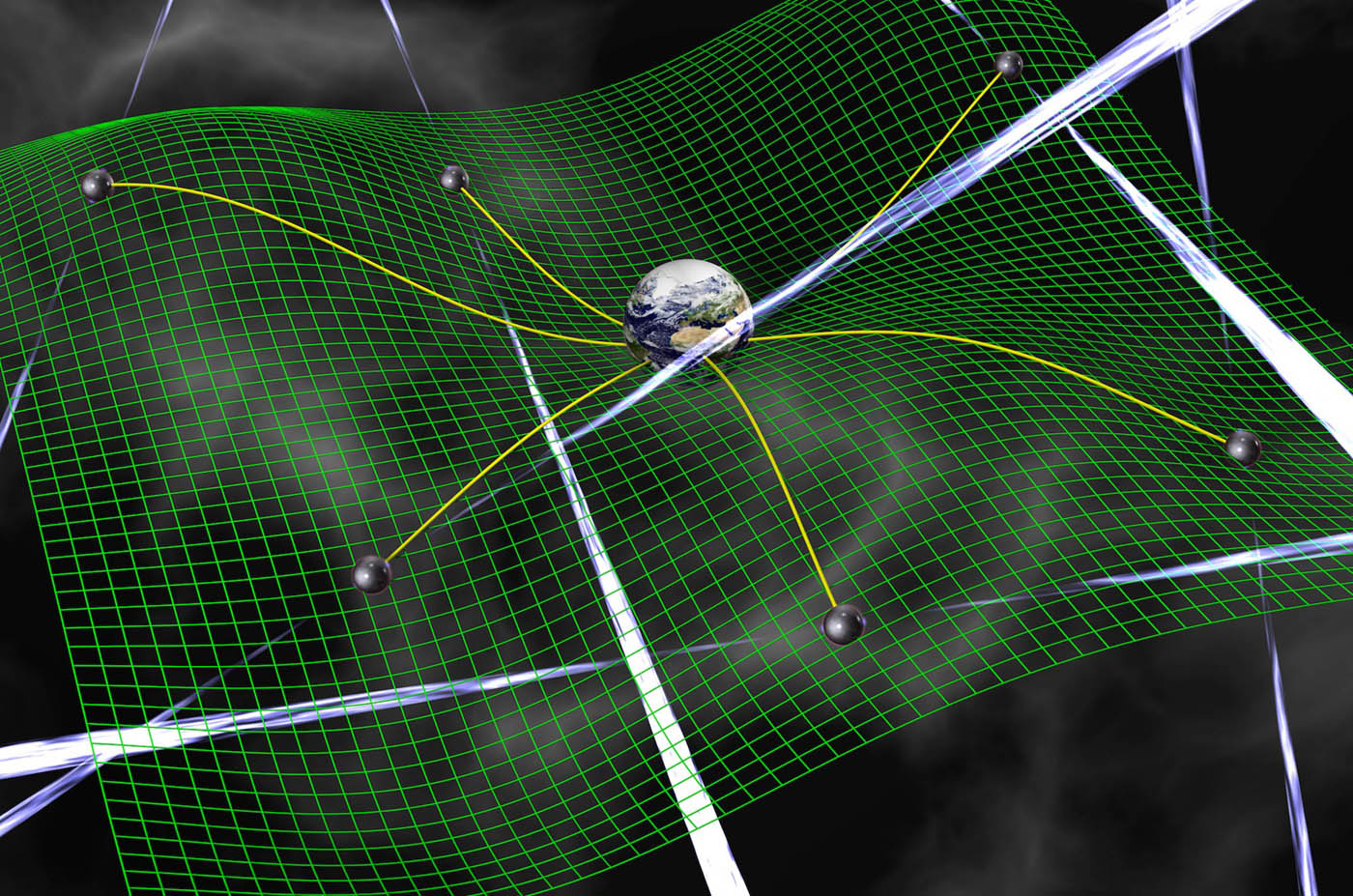

Astronomers are using pulsars to spot gravitational waves

|

Engadget, 1/1/0001 12:00 AM PST

|

Larry Summers slams the Wall Street Journal's 'illogical' take on his call to kill the $100 bill (USD, DXY)

|

Business Insider, 1/1/0001 12:00 AM PST

Larry Summers is defending his call to get rid of the $100 bill. In a Washington Post op-ed written with the Harvard Kennedy School's Peter Sands, the Harvard professor focused on a Wall Street Journal editorial that took on his original call to ban the denomination. Summers is not alone in calling for the end of larger denominations. Last week, European Central Bank president Mario Draghi said the bank is considering a ban of the 500 euro note because it's a convenience for criminal activity as well as savers. (The ECB, we'd note, has taken interest rates into negative territory in an effort to kickstart the eurozone economy and move inflation closer to its 2% goal.) And while the Journal wrote, "Beware politicians trying to limit the way you can conduct private economic business. It never turns out well," Summers contended that this claims contains, "two levels of illogic." The first is that even a staunch libertarian recognizes that there must be some antifraud efforts in an economy that won't impact business activity. But Summers seems to take slightly larger issue with the Journal's contention that — through monetary policy — politicians are working to curtail the economic freedom of ordinary people. Here's Summers (emphasis ours): [It] is surely a stretch to assert that ceasing government’s active effort to circulate and print 500 euro notes or $100 bills constitutes a government infringement on the conduct of private economic business. Do the Journal editors believe that liberty was constrained by the U.S. decision in the 1960s to stop printing $1,000 dollar bills or to stop issuing bearer bonds? Surely it is not a government’s obligation to provide every means of payment or store of value that someone might choose to use. Nor, it should be emphasized, did the abolition of the $1,000 put us on any kind of slippery slope to monetary perdition. Our advocacy for the elimination of high denomination notes is based on a judgment that any losses in commercial convenience are dwarfed by the gains in combatting criminal activity, not any desire to alter monetary policy or to create a cashless society ... And we believe that for the foreseeable future there will be a role for cash in modern economies, though we would not be surprised if in many contexts its transactions costs come to exceed those of various electronic payment schemes. Summers' bottom line is that removing the $100 note would only have a muted effect on a very wealthy minority, as most people would not mind the inconvenience of carrying a few extra notes in lower denominations. He also noted that governments already routinely intervene in private commercial affairs (think tax laws), and people have the freedom to pick whichever legal tender they like (think Bitcoin). And so while removing the $100 bill may be seen as some vague infringement of liberties, to Summers it is simply the logical step in our ever-more-financialized economy. You can read his full piece in The Washington Post here » SEE ALSO: LARRY SUMMERS: It's time to kill the $100 bill Join the conversation about this story » NOW WATCH: We did a blind taste test of Pizza Hut, Domino's, and Papa John's pizza — here's the verdict |

MIT Hosts Annual Bitcoin Expo March 5 and 6 to Explore Challenges Facing Bitcoin

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST On March 5th and 6th, the MIT Bitcoin Club is hosting its annual Bitcoin Expo in the Samberg Conference Center on the MIT campus. It is the... The post MIT Hosts Annual Bitcoin Expo March 5 and 6 to Explore Challenges Facing Bitcoin appeared first on Bitcoin Magazine. |

Bitt Launches the Blockchain Barbadian Digital Dollar

|

CryptoCoins News, 1/1/0001 12:00 AM PST Barbados-based fintech firm Bitt Inc. has launched the Barbadian Digital Dollar, the Caribbean’s first blockchain-based digital money this week as a means to bring solutions to the unbanked in the region. In a marked effort to provide financial and banking solutions to its home country, Barbadian fintech company Bitt launched the Barbadian Digital Dollar earlier […] The post Bitt Launches the Blockchain Barbadian Digital Dollar appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Bitcoin Mining Company Butterfly Labs Settles Case With Federal Trade Commission for $38.6M

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST This article is by Rebecca Campbell. Butterfly Labs has agreed to settle the Federal Trade Commission's charges of making misleading claims... The post Bitcoin Mining Company Butterfly Labs Settles Case With Federal Trade Commission for $38.6M appeared first on Bitcoin Magazine. |

Exchange Acquisition Consolidates Finland's Bitcoin Market

|

CoinDesk, 1/1/0001 12:00 AM PST Finland-based bitcoin broker Prasos has acquired a local bitcoin exchange to add to its range of services. |

Gavin Andresen: Bitcoin Core Is Not Listening to Its Customers

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST In a recent interview with Let's Talk Bitcoin, Bitcoin Foundation Chief Scientist Gavin Andresen explained his issues with Bitcoin Core and... The post Gavin Andresen: Bitcoin Core Is Not Listening to Its Customers appeared first on Bitcoin Magazine. |

Bitcoin Price Shows Market Caution

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin price has lost direction. Ordinarily, this kind of price action can be described as merely corrective, but the chart shows several months of lower lows and, now again, a lower high. This analysis is provided by xbt.social with a 3-hour delay. Read the full analysis here. Not a member? Join now and receive a […] The post Bitcoin Price Shows Market Caution appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Japan considers treating Bitcoin like real money

|

Engadget, 1/1/0001 12:00 AM PST

|

21 Bitcoin Computer Now Shipping to 32 European Countries

|

CoinDesk, 1/1/0001 12:00 AM PST 21 Inc has announced that its Bitcoin Computer device is now shipping to European countries including the UK, France, Germany and Italy. |

Bitcoin Exchange Gemini Announces New Fees And Rebate Schedule

|

CryptoCoins News, 1/1/0001 12:00 AM PST Gemini has adjusted its flat fee schedule to a dynamic, real-time, “maker-taker” schedule after collecting enough data to know how to encourage a stable, efficient and active marketplace, according to a blog on the Gemini website by Cameron Winklevoss, president and co-founder. To launch the program, every customer will get the most favorable fee and […] The post Bitcoin Exchange Gemini Announces New Fees And Rebate Schedule appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

‘Moralists’, the Latest Extortionists to Begin Using Bitcoin

|

CryptoCoins News, 1/1/0001 12:00 AM PST Visitors and patrons of Switzerland’s largest strip club have received blackmail letters from self-anointed ‘moralists’, demanding $2,000 in bitcoin (approx 4.72 BTC) or face ‘exposure’ with pictures of them visiting the strip club sent to their families. Bitcoin ransoms aren’t going away anytime soon. Patrons of a Swiss strip club near Zurich have been sent […] The post ‘Moralists’, the Latest Extortionists to Begin Using Bitcoin appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

US CFTC Advisor Chou Calls Blockchain Without Bitcoin Efforts Misguided

|

CryptoCoins News, 1/1/0001 12:00 AM PST Paul Chou, CEO of LedgerX and the bitcoin advisor to the U.S. Commodities and Future Trading Commission (CFTC), says companies trying to use the blockchain without bitcoin are seriously misguided, and so far the concept is unproven, according to New York Business Journal. Chou says bitcoin and blockchain are inextricably linked and must remain as […] The post US CFTC Advisor Chou Calls Blockchain Without Bitcoin Efforts Misguided appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Blockchain Project Bitnation Marches Pangea Beta Forward

|

CryptoCoins News, 1/1/0001 12:00 AM PST One of the earliest blockchain projects, Bitnation, wants to aggregate all of the values of government into a distributed software platform, from identity and contracts to resolution services. Bitnation seeks to promote the idea that government can be a service, “geographically unbound, decentralized and voluntary.” Bitnation founder Susanne Tarkowski Tempelhof aims high when it comes […] The post Blockchain Project Bitnation Marches Pangea Beta Forward appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Earlier this month scientists detected gravitational waves, but it wasn't easy. Because of the tiny forces involved, it took us nearly 100 years to confirm Einstein's original prediction that ultra-massive objects like black holes could send ripples...

Earlier this month scientists detected gravitational waves, but it wasn't easy. Because of the tiny forces involved, it took us nearly 100 years to confirm Einstein's original prediction that ultra-massive objects like black holes could send ripples...

Japan's financial services regulator is considering recognizing Bitcoin and other virtual currencies as equal to their real-world counterparts. The news comes via Nikkei's Asian Review, which claims that authorities want to improve customer protectio...

Japan's financial services regulator is considering recognizing Bitcoin and other virtual currencies as equal to their real-world counterparts. The news comes via Nikkei's Asian Review, which claims that authorities want to improve customer protectio...