Decentral to Sell Bitcoin in Retail Stores Across Canada

|

CryptoCoins News, 1/1/0001 12:00 AM PST Canadian decentralized technologies hub Decentral will soon enable citizens across Canada to easily purchase bitcoin, the innovation hub revealed in an announcement today. Toronto-based innovation and disruption hub Decentral has announced a new series of ‘bitcoin cards’ that can be purchased at local retail stores nationwide. The Decentral Bitcoin Cards will be available for buyers […] The post Decentral to Sell Bitcoin in Retail Stores Across Canada appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

We've Found Gravitational Waves. Now What?

|

Gizmodo, 1/1/0001 12:00 AM PST

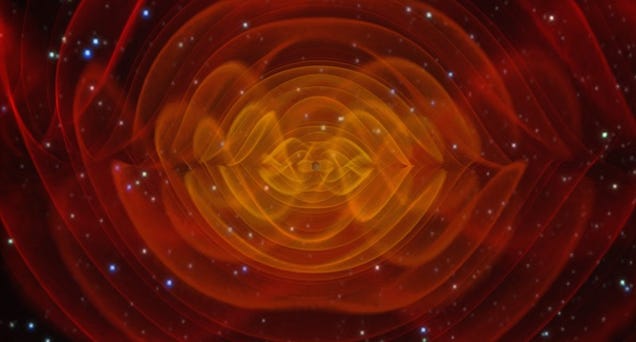

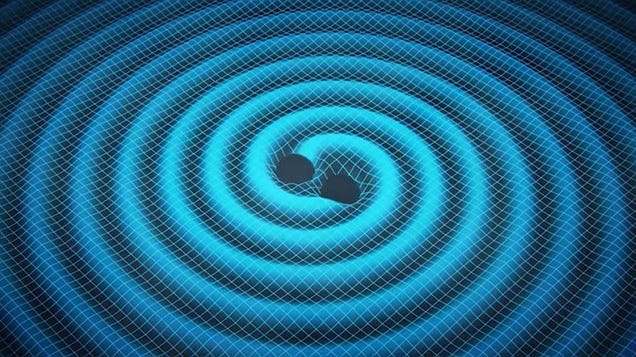

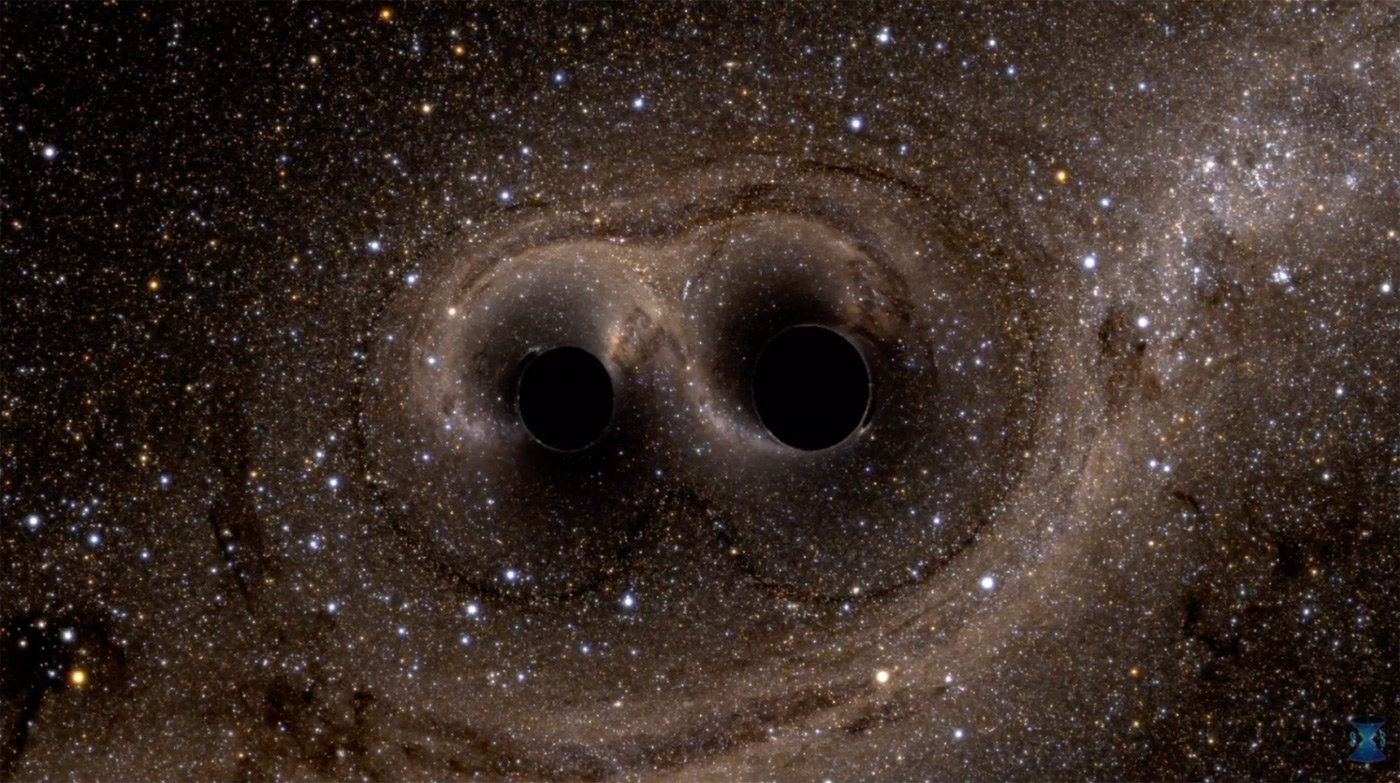

David Reitze, executive director of the LIGO Laboratory, took the podium at the National Press Building in Washington, DC, this morning, and said the words we’ve all been waiting on tenterhooks to hear: “We have discovered gravitational waves.” And a packed auditorium in Caltech’s Cahill building in Pasadena—where people had gathered to watch the live feed—erupted into wild applause. |

EXCLUSIVE: Physicists Have Literally Woven The Fabric of Spacetime

|

Gizmodo, 1/1/0001 12:00 AM PST

Ripples in the fabric of spacetime, you say? Gabriela González, a professor of physics and astronomy at Louisiana State University and spokesperson for the Laser Interferometer Gravitational Wave Observatory (LIGO), was wearing a very interesting garment at the National Press Center today, where gleeful physicists gathered to announce the first direct detection of gravitational waves. |

Industry Businesses Pledge to Avoid Bitcoin Network Split

|

CoinDesk, 1/1/0001 12:00 AM PST A group of bitcoin miners, exchanges and service providers have issued a letter stating that they would not back hard forks of the network. |

BitPay's Stephen Pair: Community Needs to Become Proficient at Managing Bitcoin Forks

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST As opposing sides in Bitcoin's long-lasting scaling dispute seem to be inching closer, one of the remaining sources of contention is not whether, but how to achieve a small block size bump. TheBitcoin Core development team wants to increase the maximum block capacity through aSegregatedWitnesssoft fork, which has since been embraced by a large part of Bitcoin’s development community and a significant segment of the Bitcoin industry. Others, like CEO of major payment processorBitPay Stephen Pair, believe the perceived benefits of soft forks over hard forks are being overstated. Speaking to Bitcoin Magazine, Pair explained:

A centerpiece of Bitcoin Core’s scalability “road map,” Segregated Witness is set to increase the effective block size to some 1.6 megabytes to 2 megabytes by moving signature data into a new data structure. Pair is skeptical, however, that Segregated Witness should be considered a short-term scaling solution.

On Hard Forks Pair himself initiallysigned an industry letter in support ofBIP 101, the proposal by former Bitcoin Core lead developer Gavin Andresen intended to increase the block size limit to 8 megabytes, then doubling every other year for the next 20 years. He latersaid he preferredBlockstream president Adam Back's “BIP 248,” an informal proposal to raise the limit to 8 megabytes over four years. And more recently, Pairpitched his own solution: a dynamic block size cap to automatically re-adjust based on recent transaction volume. Additionally, the BitPay CEO is willing to accept a one-time block size increase, such as a hard fork block size limit increase as proposed by Bitcoin Classic. Pair did add, however, that a hard fork shouldn't be thought of too lightly:

On Firm Forks An alternative proposal to increase the block size limit is sometimes referred to as a “firm fork” or a “soft hardfork.” This could allow a majority of miners to change any consensus rules, including those that would typically require a hard fork. But as opposed to both hard forks and soft forks, it would render non-upgraded nodes completely unable to detect any new transactions. “While the additional complexity of implementing it may not be worth the effort, you could perform a hard fork where miners effectively DOS old nodes by merge mining empty blocks under the old consensus rules,” Pair explained. “I think that would make hard forks a lot safer. People will still have to upgrade, but for those that neglect to upgrade, it will be immediately apparent as it will seem that no transactions are being included in their chain.” This proposal has itself sparked some controversy, to the point where some dubbed it an “evil soft fork.” Since users would no longer be able to opt-out of a change, they'd have to follow the rules as decided on by miners – or create a new chain. Pair is not too worried about these consequences, however:

The post BitPay's Stephen Pair: Community Needs to Become Proficient at Managing Bitcoin Forks appeared first on Bitcoin Magazine. |

THE PAYMENTS ECOSYSTEM: Everything you need to know about the key players and trends in the payments industry

|

Business Insider, 1/1/0001 12:00 AM PST

The way we pay is changing dramatically. For example, people are beginning to use their smartphones for every kind of formal and informal transaction — to shop at stores, buy songs online, and even split their rent. At the heart of these changes in how we pay are thousands of companies competing and collaborating to facilitate transactions. To understand why the payments industry has faced so much disruption in such a short time, there's just one key thing to understand: Payments is about transferring information from one party to another, and nearly every stakeholder in the industry benefits when that process runs on digital rails. But payments is also an extremely complex industry that few fully understand. In BI Intelligence's 2016 Payments Ecosystem report, we make it simple, explaining how it works, who the key players are, and where it's headed. In this latest edition of the report, BI Intelligence drills even further into the industry to explain how a broad range of transactions are processed — including prepaid and store cards — and we reveal which types of companies are in the best and worst position to capitalize on the latest industry trends. Here are some key takeaways from the report:

In full, the report:

Companies mentioned in the report include: Visa, PayPal, American Express, Western Union, Gemalto, Oberthur Technologies, Bank of America, Wells Fargo, MasterCard, Discover, Chase, First Data, Stripe, Klarna, Braintree, Venmo, Moneris, Synchrony Financial, Green Dot, NCR, MICROS, Square, ShopKeep, Verifone, Ingenico, Starbucks, Apple, Samsung, Google, MoneyGram, Ria, Azimo, TransferWise, Xoom, Bango, Boku, Microsoft, R3 CEV, Jawbone. Interested in getting the full report? Here are two ways to access it:

Our BI Intelligence INSIDER Newsletters are currently read by thousands of business professionals first thing every morning. Fortune 1000 companies, startups, digital agencies, investment firms, and media conglomerates rely on these newsletters to keep atop the key trends shaping their digital landscape — whether it is mobile, digital media, e-commerce, payments, or the Internet of Things. Our subscribers consider the INSIDER Newsletters a "daily must-read industry snapshot" and "the edge needed to succeed personally and professionally" — just to pick a few highlights from our recent customer survey. With our full money-back guarantee, we make it easy to find out for yourself how valuable the daily insights are for your business and career. Click this link to learn all about the INSIDER Newsletters today. |

Slush Pool Introduces Provably Fair Bitcoin Mining

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Bitcoin mining today is dominated by mining pools. These mining pools arguably have a strong hold on the Bitcoin network, but also on their own participants. Since mining pools typically operate with little transparency, participants must issue a lot of trust in pool operators not to cheat them out of Bitcoin. Czech Republic-basedSlush Pool – accounting for some4 percent of total hash power on the Bitcoin network – now believes it has solved this problem. Its “provably fair” mining should take away any mistrust – plus introduce some added benefits. A Quick Recap on Mining Miners are the entities on the Bitcoin network that confirm transactions and secure the network with hash power by finding Bitcoin blocks. These blocks include several types of data, most importantly transactions, but also the previous block header (linking blocks together), a timestamp and a random number called a “nonce.” Using a mathematical trick called hashing, miners combine and scramble all of this data into an unpredictable random number called a hash, which is the “block header,” identifying the block. The same data will always result in the exact same block header, but if even a tiny alteration is made to any of the data, it will result into a completely new hash. If a miner hashes data ten times, odds are that one of these hashes starts with a zero. If a miner does it a hundred times, odds are one of them starts with two zeros. The Bitcoin network requires a valid block header to start with a certain amount of zeros: the difficulty factor. Miners essentially keep hashing potential blocks until they find a valid block, or one that meets the required difficulty. A Quick Recap on Pools Mining pools – the first of which was Slush Pool back in 2010 – divide the work required to find blocks among all participants. A pool operator constructs a block, minus the nonce, and sends this block to all participants, called “hashers.” (“Hashers” are sometimes simply referred to as “miners” – but they don't do everything typical [solo] miners do.) Hashers take the block as provided by the pool operator, and simply add a nonce to hash the bundle together. If any of the hashers finds a valid block, it sends this block to the pool operator, after which the pool redistributes the block reward among all connected hashers. (A hasher cannot keep the profit of the block for himself, as the coinbase transaction in the block is already attributed to the Bitcoin address controlled by the pool operator.) The part of the block reward attributed to each hasher is based on his or her share of hash power contributed to the pool. This share, in turn, is calculated using “almost valid” blocks. If Bitcoin's difficulty requires valid blocks to start with 10 zeros, an “almost valid” block might start with nine zeros, or eight, or seven. Since hashers find these “almost valid” blocks more often, pool operators have a good idea of how much hash power each hasher contributes. (There is always a slight element of variance – luck – involved, as some hashers might randomly find a bit more almost-valid blocks than others. But as more almost-valid blocks are taken into account, this variance increasingly cancels out.) The Problem: Pool Operator Control The problem is that no one but the pool operator knows what percentage of hash power each hasher contributes. While hashers provide the pool operator with a certain amount of almost-valid blocks, they have no way of knowing how many “of the blocks all other hashers found. They have to trust the mining pool to tell them what their share is. Well, almost. Hashers do know how much hash power they contributed to a pool, they can see how many blocks a pool found, and they can estimate how much total hash power is connected to the Bitcoin network based on how often blocks are found. As such, they can also estimate how much their mining pool contributes to the network, and therefore whether the pool is being honest. But since pools – and smaller pools in particular – find only a certain number of blocks, it can take a long time to gather enough data to reliably draw a conclusion. This uncertainty can be abused by dishonest pool operators. A pool operator could claim the total hash power is a bit higher than it really is, and that the pool is on an unlucky streak. He could then issue hashers too little share and skim some profit of the top for himself. Likewise, if an honest pool operator really does have an unlucky streak, hashers might falsely conclude the total hash power of their mining pool is lower than it really is -- and falsely conclude their share is bigger than the pool operator claims it is. The Solution: Publish the Blocks The solution as introduced by Slush Pool is straightforward. Rather than keeping the almost- valid blocks for themselves, Slush Pool will publish them for anyone to see. Since it's easy to check whether these almost-valid blocks are indeed almost valid (meaning they did require hash power to produce), and due to the much lower impact of variance, it's impossible to fake the public list. And it becomes impossible for a pool operator to pretend the total hash power is more than it really is. (If hashers keep track of the almost-valid blocks they submit, they could also check whether these are included in the public list – though this shouldn't even be necessary.) As an added benefit, this solution also offers more transparency, perhaps most interestingly regarding miner votes. With the introduction of Bitcoin XT, soon to be followed by Bitcoin Classic, Slush Pool was the only mining pool to allow individual hashers to vote on their preferred block size limit. But while hashers – and any other interested party – had to trust Slush Pool to actually attribute the right amount of hash power to the preference hashers desired, Slush Pool can now prove that it does. The post Slush Pool Introduces Provably Fair Bitcoin Mining appeared first on Bitcoin Magazine. |

Video: PayPal Shuts down Bitcoin Parody of Its Super Bowl Commercial

|

CryptoCoins News, 1/1/0001 12:00 AM PST PayPal has put the brakes on a bitcoin-based parody of its Super Bowl commercial that surfaced on YouTube not long after the original advert’s primetime bow. A reimagined version of PayPal’s Super Bowl advert that was published on YouTube has been pulled from the video-sharing platform at the behest of PayPal. PayPal’s commercial proclaims the […] The post Video: PayPal Shuts down Bitcoin Parody of Its Super Bowl Commercial appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Watch Live as Physicists Discuss Today's Gravitational Wave Announcement

|

Gizmodo, 1/1/0001 12:00 AM PST

The rumors were true! This morning leaders of the Laser Interferometer Gravitational Wave Observatory (LIGO) announced the first direct detection of gravitational waves. In honor of this momentous discovery, the Perimeter Institute in Waterloo, Ontario, is hosting a live webcast today at 1pm EST: “Ripple Effects: A Forum on Gravitational Waves.” |

Einstein’s Gravitational Waves Have Been Detected For The First Time

|

TechCrunch, 1/1/0001 12:00 AM PST

|

Why Bitcoin’s Scaling Debate is An Opportunity Not a Flaw

|

CoinDesk, 1/1/0001 12:00 AM PST Writer Nozomi Hayase looks at how bitcoin's scalability debate should be seen as just another phase in the growth of the digital currency. |

Coinbase Integrates Bitcoin Classic

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin exchange Coinbase will now include Bitcoin Classic as a means to block confirmation by running Bitcoin Classic nodes. The news was revealed by CEO Brian Armstrong following the fork’s announcement of a new code that pushes for doubling the blocksize to 2MB. In a Twitter post today, Coinbase CEO Brian Armstrong revealed that the bitcoin […] The post Coinbase Integrates Bitcoin Classic appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Scientists Spot the Gravity Waves that Flex the Universe

Wired, 1/1/0001 12:00 AM PST Direct evidence at last for gravitational waves, ripples in spacetime that Einstein predicted 100 years ago, comes from a years-long Big Physics project. The post Scientists Spot the Gravity Waves that Flex the Universe appeared first on WIRED. |

Science confirms that gravitational waves exist

|

Engadget, 1/1/0001 12:00 AM PST

|

Bitcoin Price In A Downdraft

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin price topped out its advance with a whimper, yesterday, and has resumed decline at the time of writing. Meanwhile, gold is shooting to the moon. This analysis is provided by xbt.social with a 3-hour delay. Read the full analysis here. Not a member? Join now and receive a $29 discount using the code CCN29. […] The post Bitcoin Price In A Downdraft appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Holy Shit! Scientists Have Confirmed the Existence of Gravitational Waves

|

Gizmodo, 1/1/0001 12:00 AM PST

Since Albert Einstein first predicted their existence a century ago, physicists have been on the hunt for gravitational waves |

PayPal Blocks Bitcoin Parody of Super Bowl Commercial

|

CoinDesk, 1/1/0001 12:00 AM PST A parody of a PayPal Super Bowl commercial that was posted on YouTube has been blocked by the Internet payments company. |

Jeff Garzik Launches Bloq, Offering Code-For-Hire Blockchain Service

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin entreprenuer Jeff Garzik has started Bloq, a code-for-hire service to develop features for blockchain software and provide access to blockchain support, according to Bloomberg. The company charges $3,000 to $5,000 per month. PriceWaterhouseCoopers has agreed to sell the service to its customers. “That opens up a lot of doors for us early in the company’s […] The post Jeff Garzik Launches Bloq, Offering Code-For-Hire Blockchain Service appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Bitcoin Mining Pools Reject Bitcoin Classic

|

CryptoCoins News, 1/1/0001 12:00 AM PST Mining pools that represent at least 70% of the total hashing power of the bitcoin network have announced that they would not be supporting Bitcoin Classic or, for that matter – any “contentious hard-fork.” The mining pools are joined by some of the world’s largest bitcoin exchanges in revealing the decision. In a letter via […] The post Bitcoin Mining Pools Reject Bitcoin Classic appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

The Schism Over Bitcoin Is How Bitcoin Is Supposed to Work

Wired, 1/1/0001 12:00 AM PST The bitcoin community can't even agree on whether or not it's breaking up. But the disagreements won't kill bitcoin. The post The Schism Over Bitcoin Is How Bitcoin Is Supposed to Work appeared first on WIRED. |

Bitcoin Classic Releases New Code That Could Double the Block Size in Bitcoin

|

CryptoCoins News, 1/1/0001 12:00 AM PST Today, Bitcoin Classic released code that could double the block size. The concept is crucial, the timing is interesting, the repercussions massive. At CCN, we have covered block size conversations and opinions. Bitfury’s Vavilov has an opinion. Dash has addressed the limitations. But now the debate is in full swing and the intensity is increasing. […] The post Bitcoin Classic Releases New Code That Could Double the Block Size in Bitcoin appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

PS. Did you know...

PS. Did you know...

“We have detected gravitational waves.” David Reitze, LIGO Laboratory Executive Director Today, scientists announced that, for the first time in history, gravitational waves have been detected. Gravitational waves are ripples in spacetime throughout the universe. What’s truly remarkable about this discovery is that Albert Einstein predicted the existence of gravitational…

“We have detected gravitational waves.” David Reitze, LIGO Laboratory Executive Director Today, scientists announced that, for the first time in history, gravitational waves have been detected. Gravitational waves are ripples in spacetime throughout the universe. What’s truly remarkable about this discovery is that Albert Einstein predicted the existence of gravitational…  At last, scientists have validated a key part of Einstein's general theory of relativity. The National Science Foundation, Caltech and MIT have confirmed the existence of gravitational waves, or ripples in spacetime. Their two LIGO (Laser Interfero...

At last, scientists have validated a key part of Einstein's general theory of relativity. The National Science Foundation, Caltech and MIT have confirmed the existence of gravitational waves, or ripples in spacetime. Their two LIGO (Laser Interfero...