Florida Bill Seeks to Define Bitcoin as a Monetary Instrument

|

CryptoCoins News, 1/1/0001 12:00 AM PST […] The post Florida Bill Seeks to Define Bitcoin as a Monetary Instrument appeared first on CryptoCoinsNews. |

Lightning Network Retools for Litecoin

|

CryptoCoins News, 1/1/0001 12:00 AM PST […] The post Lightning Network Retools for Litecoin appeared first on CryptoCoinsNews. |

Vermont Law Adds Bitcoin as 'Permissible Investment' for MSBs

|

CoinDesk, 1/1/0001 12:00 AM PST Vermont has passed a new bill that tweaks state law to account for digital currencies. |

Ripple Shoots Past Ethereum For No. 2 In Crypto Capitalization

|

CryptoCoins News, 1/1/0001 12:00 AM PST […] The post Ripple Shoots Past Ethereum For No. 2 In Crypto Capitalization appeared first on CryptoCoinsNews. |

Litecoin Mining Pool Disappears, Stoking Fears of Fraud

|

CoinDesk, 1/1/0001 12:00 AM PST A litecoin mining pool seemingly pulled the plug over the weekend, stoking accusations of theft and fraud. |

Lending Club may have hit a dead end

|

Business Insider, 1/1/0001 12:00 AM PST

This story was delivered to BI Intelligence "Fintech Briefing" subscribers. To learn more and subscribe, please click here. Despite the aftermath of a governance scandal in early 2016, US alt lending giant Lending Club seemed to be on track for a slow but steady recovery at the end of the year. Its results for Q1 2017, published on Thursday, however, indicate its improvement has stalled, and reveal few significant changes within the organization. Overall performance is generally down, despite some minor bright spots. Origination volume slipped 1% quarter-over-quarter (QoQ) from $1.99 billion to $1.96 billion in Q1, marking a 29% year-over-year (YoY) decline from $2.75 billion in Q1 2016. This is likely why net revenue also fell QoQ, by 5% from $130.5 million to $124.5 million in the period. Admittedly, losses narrowed from $32.3 million in Q4 2016 to $29.8 million in Q1, but only by 8%. Banks also apparently continued to regain their confidence in the company, now accounting for 40% of investment in the platform, up by 7% QoQ, and 6% YoY. While the declines in originations and net revenue were mild, so was the narrowing of losses; meaning that overall, performance was relatively stagnant. Lending Club again stated that it's pursuing growth, but gave little evidence of how it's doing this. In the results call, CEO Scott Samborn pointed to continued investment in growth areas, including Lending Club's technology platform and its underwriting capabilities — but these are the most basic elements of its business, rather than new initiatives. This suggests that the company doesn't have a clear growth strategy or measurable goals. And while it's possible that it wants to return to the growth rates it saw in 2014, this would require more dramatic changes than we have so far seen. It's also worth noting that several of its peers have stopped chasing outsized growth, having decided it's unsustainable in the long run, which should give Lending Club food for thought. John Heggestuen, director of research at BI Intelligence, Business Insider’s premium research service, has compiled a detailed report on the payments ecosystem that drills into the industry to explain how a broad range of transactions are processed, including prepaid and store cards, as well as revealing which types of companies are in the best and worst position to capitalize on the latest industry trends. Here are some key takeaways from the report:

In full, the report:

To get your copy of this invaluable guide, choose one of these options:

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of the payments ecosystem. |

The Newly President Elect of France, Emmanuel Macron, Might be a Bitcoiner

|

CryptoCoins News, 1/1/0001 12:00 AM PST […] The post The Newly President Elect of France, Emmanuel Macron, Might be a Bitcoiner appeared first on CryptoCoinsNews. |

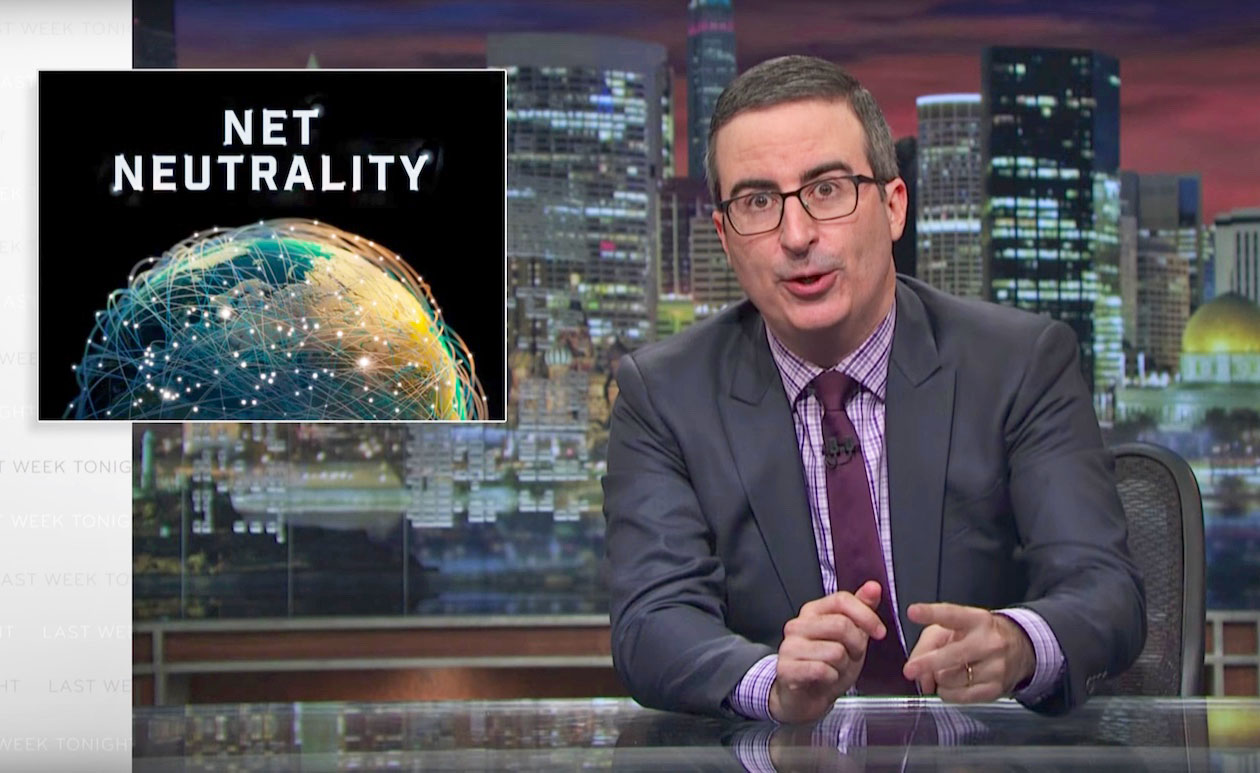

Net-neutrality supporters cripple the FCC website again

|

Engadget, 1/1/0001 12:00 AM PST

|

One Wall Street analyst says Tesla's an 'extreme growth story' and it's not too late to buy (TSLA)

|

Business Insider, 1/1/0001 12:00 AM PST

Last week, a team of UBS equity analysts tore up the investment thesis behind Tesla, sending the stock down 5%. The team, led by Colin Langan, wrote, "The absolute downside for the TSLA stock is material as we believe any significant problems with the current or future products would likely cripple the company in the early stages of its growth." They gave Tesla a $160 price target and said in a worst-case scenario shares could fall as low as $43. However, the stock has bounced back, and in a note to clients circulated on May 8, Evercore ISI analyst George Galliers defended the stock and urged Evercore clients to buy it. Galliers reiterated his "Outperform" rating and $330 price target for Tesla, implying 7% of upside. Here's Galliers:

Galliers said that while Tesla's growth is rapid it does come at a cost. Tesla's spending grew 38% last year, way above the industry average of 6%. Evercore said that a stabilization in spending is unlikely to happen until Tesla has exhausted global demand and filled out their product offerings to include a more traditional line up of sedans, SUVs, and trucks. Evercore does not belive Tesla will hit their 2018 target of delivering 500,000 units. The bank predicted 369,000 units in 2018 and 500,000 on a twelve month rolling basis by 2019. Evercore said such a performance would still be good enough to send the stock higher. Gaillers made it clear that going forward, the Model 3 will be the key to Tesla's near-term success or failure. "Tesla’s top-line developments over coming quarters will ultimately be determined by the launch cadence of the Model 3," Gaillers wrote. He believes that the risks surrounding the Model 3 have diminished and that orders for the Model 3 "are without precedent." Galliers said that the Model 3 represents the largest preorder event in automotive history with hundreds of thousands preorders in place, and expects it to be a hit.

Click here for a real-time Tesla chart.

Join the conversation about this story » NOW WATCH: These are the small, agile new aircraft carriers meant to take F-35s into battle |

Litecoin is Giving New Life to Bitcoin's Most Experimental Tech

|

CoinDesk, 1/1/0001 12:00 AM PST An upgrade to the litecoin codebase is inspiring new strategies from blockchain developers seeking eventually to build on bitcoin. |

Litecoin is Giving New Life to Bitcoin's Most Experimental Tech

|

CoinDesk, 1/1/0001 12:00 AM PST An upgrade to the litecoin codebase is inspiring new strategies from blockchain developers seeking eventually to build on bitcoin. |

Bitcoin-Based Korean Foreign Money Transfer FinTechs See Regulatory Respite

|

CryptoCoins News, 1/1/0001 12:00 AM PST […] The post Bitcoin-Based Korean Foreign Money Transfer FinTechs See Regulatory Respite appeared first on CryptoCoinsNews. |

Australia Commits to Kill Bitcoin Double Tax Despite Delay

|

CryptoCoins News, 1/1/0001 12:00 AM PST […] The post Australia Commits to Kill Bitcoin Double Tax Despite Delay appeared first on CryptoCoinsNews. |

Indian IT Giant Wipro Sees $80 Million Bitcoin Demand in Bio Attack Threat

|

CryptoCoins News, 1/1/0001 12:00 AM PST […] The post Indian IT Giant Wipro Sees $80 Million Bitcoin Demand in Bio Attack Threat appeared first on CryptoCoinsNews. |

Sunday night, John Oliver merely pointed out a problem (again), and the results were pretty predictable if you're familiar with the last time he did similar. The most recent episode of HBO's Last Week Tonight's main segment concerns net neutrality an...

Sunday night, John Oliver merely pointed out a problem (again), and the results were pretty predictable if you're familiar with the last time he did similar. The most recent episode of HBO's Last Week Tonight's main segment concerns net neutrality an...

Tesla

Tesla