Bitcoin Ponzi Scheme Operator Pleads Guilty to Securities Fraud

|

CoinDesk, 1/1/0001 12:00 AM PST Bitcoin ponzi scheme perpetrator Trendon Shavers has plead guilty to securities fraud and is now awaiting sentencing. |

Bitcoin Price Declines On Greece Market Positive News

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin price had been trailing just below its 1-hour 200-period moving average for days. The overlap between the Sunday evening US session and the early Monday Asia-Pacific session saw a sharp sell-off - to support - where the market is now eyeing $200. This analysis is provided by xbt.social with a 3 hour delay. Read the full analysis here. Not a member? Join now and receive a $29 discount using the code CCN29. Bitcoin Price Analysis Time of analysis: 15h00 UTC Bitfinex 1-Hour Chart From the analysis pages of xbt.social, earlier today: The Greek elections have had a market positive […] The post Bitcoin Price Declines On Greece Market Positive News appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

21 Inc Announces 'Bitcoin Computer' for Developers

|

CoinDesk, 1/1/0001 12:00 AM PST 21 Inc has announced it will begin accepting pre-orders for the 21 Bitcoin Computer, its first consumer product, on Monday. |

SatoshiPay Gets €160,000 Investment from Jim Mellon Fund

|

CoinDesk, 1/1/0001 12:00 AM PST Jim Mellon, executive director of Kuala Innovations, told CoinDesk the group now owned 10% of SatoshiPay, a bitcoin micropayment processor. |

What Bitcoin Is Now And What It Could Become

|

TechCrunch, 1/1/0001 12:00 AM PST

|

New Art Installation Makes Music Out of Bitcoin Trades

|

Gizmodo, 1/1/0001 12:00 AM PST

Cryptocurrencies like Bitcoin and Litecoin enjoy a brisk pace of trading activity. But what does all that cyber wheeling and dealing look like? Better yet, what does it sound like? A new art installation in Moscow takes all that raw data and transforms it into musical notes, making melody out of global finance. |

New Art Installation Makes Music Out of Bitcoin Trades

|

Gizmodo, 1/1/0001 12:00 AM PST

Cryptocurrencies like Bitcoin and Litecoin enjoy a brisk pace of trading activity. But what does all that cyber wheeling and dealing look like? Better yet, what does it sound like? A new art installation in Moscow takes all that raw data and transforms it into musical notes, making melody out of global finance. |

Storj Network Passes 1 Petabyte Storage Space

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Decentralized cloud storage provider Storj Labs Inc. has announced that its second round of network testing called “Test Group B” has reached the 1 petabyte milestone of managed storage space. Test Group B is an in-depth test of the platform’s storage client DriveShare , a software that enables users to earn money by sharing extra hard drive space. The Storj Test Group B has reached 1,173 terabytes in storage space and currently supports 293 users online. “We’re extremely pleased by the support and validation we’ve received from our community,” said CEO Shawn Wilkinson in a statement. “We’re excited to release the world’s first crowdsourced cloud storage platform.” The Test Group B network test is set to run until late October, with increased rewards and test group participants. In recognition of the 1 petabyte milestone, Storj Labs has increased the testing rewards pool from 100,000 Storjcoin X (SJCX) to 1 million SJCX, which is currently worth around $16,000. DriveShare is an open-source software powered by the Storj network that is a part of the startup’s successful crowdsale campaign. The DriveShare client allows users to rent out unused hard drive or cloud storage space at the rates of Dropbox, Mega, Box and many other cloud platforms. Photo Ludovic.ferre / Wikimedia (CC) The post Storj Network Passes 1 Petabyte Storage Space appeared first on Bitcoin Magazine. |

Storj Network Passes 1 Petabyte Storage Space

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Decentralized cloud storage provider Storj Labs Inc. has announced that its second round of network testing called “Test Group B” has reached the 1 petabyte milestone of managed storage space. Test Group B is an in-depth test of the platform’s storage client DriveShare, a software that enables users to earn money by sharing extra hard drive space. The Storj Test Group B has reached 1,173 terabytes in storage space and currently supports 293 users online. “We’re extremely pleased by the support and validation we’ve received from our community,” said CEO Shawn Wilkinson in a statement. “We’re excited to release the world’s first crowdsourced cloud storage platform.” The Test Group B network test is set to run until late October, with […] The post Storj Network Passes 1 Petabyte Storage Space appeared first on Bitcoin Magazine. |

Press Release: Bitcoin Lottery YABTCL Offers Over 1 BTC In Free Draws, Introduces Unprecedented Variable House Edge Feature

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Bitcoin Press Release: Provably fair online Bitcoin lottery platform YABTCL has implemented an unprecedented variable house edge feature, giving the lottery less advantage over the player than in traditional draws. YABTCL recently celebrated its 2nd year of smooth operations. Provably fair online Bitcoin lottery YABTCL just released their variable house edge system in their instant lottery this week, where users can play with a house edge varying from 1% to 0% depending on the conditions they meet. Variable house edge Bitcoin lottery gaming is so far unprecedented, and offers more favorable conditions to players. To give back to the Bitcoin community, YABTCL is pleased to offer a free entry lottery with jackpots greater than 1 BTC. They have a wide […] The post Press Release: Bitcoin Lottery YABTCL Offers Over 1 BTC In Free Draws, Introduces Unprecedented Variable House Edge Feature appeared first on Bitcoin Magazine. |

Press Release: DNotes Live on Cryptsy For Bitcoin Trading, Growth of Ecosystem With World’s First Cryptocurrency Savings Accounts Continues Unabated

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Stable Bitcoin alternative DNotes has just been added to reputable Bitcoin and cryptocurrency exchange Cryptsy. DNotes offers a complete digital currency infrastructure; including the world’s first Cryptocurrency Investment Savings Plans. Chicago, Illinois – DNotes is pleased to announce it has recently been added to reputable digital currency exchange Cryptsy. Operating for over 2 years, Cryptsy has more than 270 000 registered users with over 300 000 trades taking place on the platform every day. Cryptsy accepting DNotes helps solidify DNotes’ extensive ecosystem; which includes the world’s first long term cryptocurrency savings plans (CRISPs), DCEBrief.com which offers the latest digital currency news for busy executives, DNotesVault guaranteed safe coin storage, and women oriented cryptocurrency neutral platform CryptoMoms.com. Now that DNotes is […] The post Press Release: DNotes Live on Cryptsy For Bitcoin Trading, Growth of Ecosystem With World’s First Cryptocurrency Savings Accounts Continues Unabated appeared first on Bitcoin Magazine. |

Australian Banks to Close Bitcoin Companies’ Accounts

|

CryptoCoins News, 1/1/0001 12:00 AM PST Australian banks have advised Australian bitcoin companies they are closing their accounts, according to The Australian Financial Review. The publication has seen the letters from Westpac Banking Corporation and Commonwealth Bank of Australia. Ron Tucker, chairman of The Australian Digital Currency Commerce Association, said all large Australian banks were shutting the door on bitcoin companies. The banks sent letters to Australian bitcoin exchanges, including Bit Trade and Buyabitcoin. The letters said the banks will close the exchanges’ accounts and did not give any explanation. At least 17 Australian bitcoin companies have received letters and 13 already have had their accounts […] The post Australian Banks to Close Bitcoin Companies’ Accounts appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Bitcoin and Gold Exchange Vaultoro Reaches $1 Million in Gold Trading Volume

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Real-time bitcoin-to-gold exchange and banking 2.0 Vaultoro has reached a significant $1 million milestone in gold trading volume, recording an average monthly trading growth rate of 91 percent. The exchange has seen a rapid increase of its user-base, especially in developing countries such as India, which are severely underbanked or unbanked. “The developing world skipped the landline and went direct to mobile phones. They are now doing the same with traditional branch banking because it’s just too uneconomical to set up,” said Vaultoro CEO and cofounder Joshua Scigala in a statement. “Vaultoro enables anyone to easily enter the global economy securely and privately by utilizing the native Internet currency bitcoin and removing the extreme volatility by combining the security of […] The post Bitcoin and Gold Exchange Vaultoro Reaches $1 Million in Gold Trading Volume appeared first on Bitcoin Magazine. |

Bitcoin and Gold Exchange Vaultoro Reaches $1 Million in Gold Trading Volume

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Real-time bitcoin-to-gold exchange and banking 2.0 Vaultoro has reached a significant $1 million milestone in gold trading volume, recording an average monthly trading growth rate of 91 percent. The exchange has seen a rapid increase of its user-base, especially in developing countries such as India, which are severely underbanked or unbanked. “The developing world skipped the landline and went direct to mobile phones. They are now doing the same with traditional branch banking because it’s just too uneconomical to set up,” said Vaultoro CEO and cofounder Joshua Scigala in a statement. “Vaultoro enables anyone to easily enter the global economy securely and privately by utilizing the native Internet currency bitcoin and removing the extreme volatility by combining the security of assigned gold bullion. This will go a long way towards ending poverty by including a potential 5 billion people who have been left behind by traditional banking,” Scigala added. Crowdfunding Campaign In conjunction with the announcement, Vaultoro has launched an equity crowdfunding campaign on BNK TO THE FUTURE, to maintain its growth and to expand its services throughout underbanked regions in Asia and Latin America. The startup has offered 25 percent equity for $785,000 , enabling anyone to fund the project and profit from the platform. Currently, Vaultoro has raised $236,000 from 149 international backers. With the new financing, the startup plans to redevelop its mobile application, and offer a multi-lingual platform for its users. The post Bitcoin and Gold Exchange Vaultoro Reaches $1 Million in Gold Trading Volume appeared first on Bitcoin Magazine. |

A Solution To Bitcoin’s Governance Problem

|

TechCrunch, 1/1/0001 12:00 AM PST

|

Bitcoin According to Regulators: Money, Currency, Property, and Now a Commodity

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Bitcoin is now officially a commodity according to U.S. regulators, Bloomberg Business reports. The Commodity Futures Trading Commission (CFTC) announced on Thursday that it had filed and settled charges against a Bitcoin exchange for facilitating the trading of option contracts on its platform. “In this order, the CFTC for the first time finds that Bitcoin and other virtual currencies are properly defined as commodities,” notes the CFTC press release. The U.S. Commodity Futures Trading Commission is an independent agency of the U.S. government created in 1974, which regulates futures and option markets that are subject to the Commodity Exchange Act. By this action, the CFTC asserts its authority to provide oversight of the trading of cryptocurrency futures and options, which will now be subject […] The post Bitcoin According to Regulators: Money, Currency, Property, and Now a Commodity appeared first on Bitcoin Magazine. |

Bitcoin According to Regulators: Money, Currency, Property, and Now a Commodity

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Bitcoin is now officially a commodity according to U.S. regulators, Bloomberg Business reports . The Commodity Futures Trading Commission (CFTC) announced on Thursday that it had filed and settled charges against a Bitcoin exchange for facilitating the trading of option contracts on its platform. “In this order, the CFTC for the first time finds that Bitcoin and other virtual currencies are properly defined as commodities,” notes the CFTC press release . The U.S. Commodity Futures Trading Commission is an independent agency of the U.S. government created in 1974, which regulates futures and option markets that are subject to the Commodity Exchange Act . By this action, the CFTC asserts its authority to provide oversight of the trading of cryptocurrency futures and options, which will now be subject to the agency’s regulations. “While there is a lot of excitement surrounding bitcoin and other virtual currencies, innovation does not excuse those acting in this space from following the same rules applicable to all participants in the commodity derivatives markets,” said CFTC’s Director of Enforcement Aitan Goelman. The CFTC action targets Bitcoin exchange Coinflip, which operated the Bitcoin financial derivatives market Derivabit, and its chief executive officer Francisco Riordan, for “conducting activity related to commodity options transactions without complying with the Commodity Exchange Act (CEA) and CFTC Regulations, specifically, by operating a facility for the trading or processing of commodity options without complying with the CEA or CFTC Regulations otherwise applicable to swaps or conducting the activity pursuant to the CFTC’s exemption for trade options.” The website derivabit.com hasn’t been active since mid-2014. A September 2014site snapshot on Internet Archive advertised Derivabit services as “Financial derivatives to manage exposure to Bitcoin volatility – Buy & sell option contracts to control your Bitcoin risk” and listed ongoing trades. Later snapshots just said “Not Currently Accepting Customers,” and the domain was announced for sale on Bitcointalk with the source code in January 2015. More information on Derivabit services is available in this discussion thread on Hacker News . The CFTC press release notes that Coinflip and Riordan cooperated with the Division of Enforcement’s investigation. “The cease and desist was a fair settlement,” said Riordan to Bloomberg Business , and added that customer funds had been refunded in July 2014, before the CFTC made contact with the company: “There wasn’t enough trade volume for the site to sustain itself.” A follow-up Bloomberg Business article lists reactions and comments to the CFTC claim from notable members of the Bitcoin community. “There are so many regulators in the U.S., and they all want more jurisdiction, which leads to a constant stream of bizarre rulings,” said Bitcoin developer Mike Hearn. “None of them has much work to do because there’s not a whole lot of financial innovation happening in the States. So when they find a small one-man startup they can’t resist giving themselves work to do – so they go in and whack it, especially in California.” Heard added that he is not terribly surprised and not terribly worried. “I think the CFTC has a very weak case here and it’s a very creative reinterpretation of what the word commodity means,” he said. “The ruling will be challenged, and judges will apply common sense and decide it to be a currency.” Some commentators said that compliance with the Commodity Exchange Act and applicable CFTC regulations would be too costly for many Bitcoin startups, with the predictable result that many innovative U.S. companies will be forced to move offshore. Others, in agreement with Hearn, noted that the CFTC claim is inconsistent with related decisions by regulatory agencies in the United States and other countries. Journalist David Seaman summarized the situation in a tweet : “To commodities regulators, Bitcoin is a commodity. To bank regulators, it’s a bank. To stock regulators, it’s a stock. Everyone wants ‘in.’” The post Bitcoin According to Regulators: Money, Currency, Property, and Now a Commodity appeared first on Bitcoin Magazine. |

Verizon Ventures: Blockchain's Future is Brighter Than Bitcoin's

|

CoinDesk, 1/1/0001 12:00 AM PST CoinDesk speaks with Verizon Ventures, the venture capital arm of US teleco giant Verizon, to learn more about its blockchain strategy. |

Skype is Unavailable Across the World

|

CryptoCoins News, 1/1/0001 12:00 AM PST The popular video-calling service Skype is currently unavailable. Users around the world are unable to make calls. A spokesperson from Skype says the problem is with the status settings of the service. The post Skype is Unavailable Across the World appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Wall Street is trying to tap into the 'enormous' potential of the technology behind bitcoin (GS, CS, MS, BAC, WFC, c)

|

Business Insider, 1/1/0001 12:00 AM PST

But Wall Street doesn't care about the cryptocurrency. It is the technology behind it - the so-called blockchain - which gets finance executives really excited. Bitcoin is a digital currency, the value of which fluctuates wildly. It has caught the eye of regulators, with New York Department of Financial Services publishing this summer publishing a framework for regulating digital currency firms. Blockchain is technology that underpins bitcoin, and it could have a huge impact on how Wall Street will operate in coming years. Blockchain is a distributed ledger through which each transaction is tracked and recorded, eliminating ambiguity on pricing and ownership. “None of our products are dependent on bitcoin as a cryptocurrency,” Blythe Masters, CEO of Digital Asset Holdings, told Business Insider. “We build solutions on top of any distributed ledger whether it's the Bitcoin blockchain or a private network." Masters previously spent decades at JPMorgan, and her new company is one of several that is seeking to use blockchain technology to help build secure settlement systems for assets. The company's looking to make use of blockchain technology extends from small, startups such to big banks: Masters' former employer JPMorgan for example is working internally to develop blockchain technology, according to a person familiar with the matter. Attendee lists at recent industry events serve as a testament to how seriously big banks take the technology. Executives from Morgan Stanley, Goldman Sachs, Bank of America, Wells Fargo, Citigroup and Fidelity have been present. Exchanges are interested too. At the Coindesk consensus conference September 10 in New York, Nasdaq chief information officer Brad Peterson told attendees he expects the exchange to start implementing technology to clear trades, among other functions. Venture capital executives and bankers said they believe a big influx of capital is coming for blockchain, which has the potential to disrupt various elements of finance and transaction execution. Lately, industry cheerleaders have pointed to businesses including loan syndication, land titles and property records, and clearing trades as potential uses of the technology.

Speakers at the event September 10, including Masters, said they believed blockchain technology might catch on faster in other countries where regulators are quicker to adapt to new technologies. "Regulators don't know how to deal with it," said Erik Gordon, clinical assistant professor at the University of Michigan's Ross School of Business. "We've got to get regulatory consistency to get into the mainstream." Even this early into blockchain’s introduction to Wall Street, budding industry experts are bullish on the technology’s potential. "The upside is enormous,” Nasdaq’s Peterson told event attendees during the discussion. Join the conversation about this story » NOW WATCH: We got our hands on Donald Trump's failed 1989 board game and it's bizarre |

5 Ways to Be Completely Anonymous Online

|

CryptoCoins News, 1/1/0001 12:00 AM PST Anonymity while surfing on the internet is not easy to maintain. Attackers and government agencies alike keep a track of your web activity and identity, with the former trying to infiltrate your system and violate your privacy. A lot has been going on recently to ring people’s minds with the fact that nobody is safe on the internet these days. Recently, the Ashley Madison Hack compromised over 37 million users. Now that is a staggering amount. It only goes to show how little people do to protect their identity and be anonymous while surfing on the internet. The post 5 Ways to Be Completely Anonymous Online appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Bitcoin Lottery YABTCL Offers Over 1 BTC In Free Draws, Introduces Unprecedented Variable House Edge Feature

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin Press Release: Provably fair online Bitcoin lottery platform YABTCL has implemented an unprecedented variable house edge feature, giving the lottery less advantage over the player than in traditional draws. Provably fair online Bitcoin lottery YABTCL just released their variable house edge system in their instant lottery this week, where users can play with a house edge varying from 1% to 0% depending on the conditions they meet. Variable house edge Bitcoin lottery gaming is so far unprecedented, and offers more favorable conditions to players. To give back to the Bitcoin community, YABTCL is pleased to offer a free entry […] The post Bitcoin Lottery YABTCL Offers Over 1 BTC In Free Draws, Introduces Unprecedented Variable House Edge Feature appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Bitcoin as a Commodity: What the CFTC’s Ruling Means

|

CoinDesk, 1/1/0001 12:00 AM PST Attorney Jared Marx discusses a recent ruling by the United States Commodities Futures Trading Commission, which saw it label bitcoin as a commodity. |

Thousands of Bitcoins Have Been Lost Over Time

|

CryptoCoins News, 1/1/0001 12:00 AM PST James Howells threw a hard drive with 7,500 bitcoins away. He had mined the coins back when they were worth very little. He has yet to find his hard drive at the dump. Dump workers say he never will. Howell is not the first person - nor the last - to lose bitcoins. According to the website btcburns.cf, 397 bitcoin addresses have burned 2,673.4075 bitcoins. There have been 15,617,100 bitcoins mined, meaning 0.018289588948355% of bitcoins created have been burned. Approximately 0.0002 are burned for each bitcoin mined. If this rate remains constant, 4,200 bitcoins will have been burned by the […] The post Thousands of Bitcoins Have Been Lost Over Time appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Will Bitcoin Be a Primary Currency for Islamic State?

|

CryptoCoins News, 1/1/0001 12:00 AM PST Will bitcoin be a primary currency of Islamic State as it seeks to establish an actual nation? Islamic State (IS) has used bitcoin to raise funds, according to Deutsch Welle, a German-based satellite TV station. An IS bitcoin account received around $23 million in the past month, according to the report. As the militant group seeks to establish an actual nation, IS is building state-like institutions and services, including schools, hospitals and now a treasury. Bitcoin And The 'Gold Dinar' In addition to using bitcoin, IS has also minted and released its own currency called the "gold dinar." The group's use […] The post Will Bitcoin Be a Primary Currency for Islamic State? appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

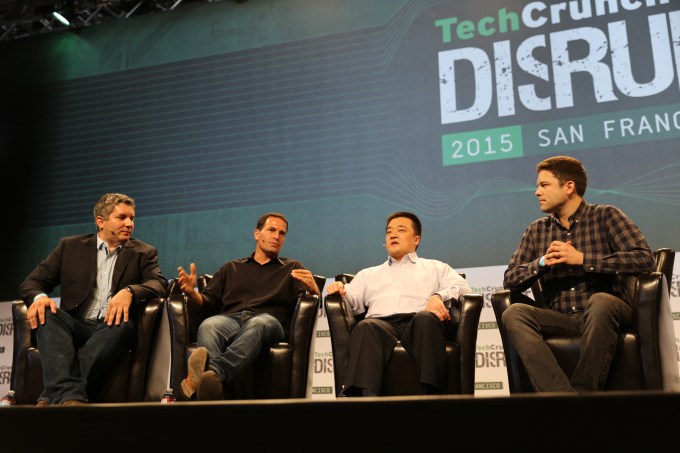

Is it time to stick a fork in bitcoin? The digital currency has been making the news for a couple of years now. Yet, many are taking a step back and wondering whether bitcoin as we know it will still be around in the future. Wences Casares from Xapo, Nathaniel Popper (author of Digital Gold), and Bobby Lee from BTCC (formerly BTC China) took the stage with our own John Biggs at Disrupt SF to…

Is it time to stick a fork in bitcoin? The digital currency has been making the news for a couple of years now. Yet, many are taking a step back and wondering whether bitcoin as we know it will still be around in the future. Wences Casares from Xapo, Nathaniel Popper (author of Digital Gold), and Bobby Lee from BTCC (formerly BTC China) took the stage with our own John Biggs at Disrupt SF to…

The software that runs the Bitcoin network is managed by a group of volunteer developers. In theory, the developers answer to Bitcoin users who choose whether or not to run a particular version of the Bitcoin software. In reality, majority mining power is what drives adoption of new versions of the Bitcoin software, taking the approval mechanism out of the hands of Bitcoin users.

The software that runs the Bitcoin network is managed by a group of volunteer developers. In theory, the developers answer to Bitcoin users who choose whether or not to run a particular version of the Bitcoin software. In reality, majority mining power is what drives adoption of new versions of the Bitcoin software, taking the approval mechanism out of the hands of Bitcoin users.  Bitcoin has gone from a hacker plaything to a mainstream financial instrument accepted in coffee shops.

Bitcoin has gone from a hacker plaything to a mainstream financial instrument accepted in coffee shops.