BTC Inc. and Genesis Mining Launch Genesis Engineering and See Opportunity in Eurasia

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST BTC Inc., parent group of BTC Studios, BTC Labs and BTC Media, and Genesis Mining, a cloud mining service provider, recently announced a partnership to launch Genesis Engineering, a Hong Kong–based joint venture focused on promoting and developing the cryptocurrency mining industry worldwide, with a special focus on emerging and underserved markets. “We see opportunities in terms of excess capacity worldwide in such regions as the Americas and Eurasia, said David Bailey, CEO of BTC Media. “Centers of mining are often places with excess capacity and relatively cheap electricity rates. As a result, mining operations bring benefits to those areas in terms of both employment and resource allocation.” “The excess energy supply in certain regions is a big opportunity for mining worldwide,” added Genesis Mining CEO and Co-Founder Marco Streng. “We see the positives of mining ranging from individuals to large organizations. Whether it is a hobby, someone’s way to accumulate a certain cryptocurrency or a business with a profit motive, mining has been a positive endeavor for people all over the world. We look forward to growing the base of miners worldwide through promotion, education and new initiatives.” “The formation of a partnership between BTC Inc. and Genesis Mining to create Genesis Engineering is important because it combines the leaders in the cryptocurrency information space and the cloud mining space to grow the industry in underserved markets at a time when crypto is in a position to be embraced by and benefit new markets,” John Riggins, Head of Development for Eurasia at Genesis Engineering, told Bitcoin Magazine. “Genesis Engineering will be positioned as a mining information leader, promoting the industry through workshops and consulting in developing regions. We see an energy landscape that includes excess and unused electricity in markets that could benefit from the introduction of a crypto mining industry in their economy as China has benefited over the last few years. “The crypto industry is in a growth stage and mining is a cornerstone of the industry that must grow in lock-step,” added Riggins. “Markets with excess energy capacity are in a good position to benefit as the mining industry develops, benefiting local economies through job creation and energy utilization.” Riggins noted that the market of the post–Soviet Union is especially ripe for this sort of growth; therefore, Genesis Engineering will have a special focus in these countries. According to the company, these countries have the hallmarks of key regions for the development of cryptocurrency mining, including huge excess energy capacity, developed infrastructure and favorable climate conditions. For instance, oil producers in the region face an ecological tax on excess gases produced in oil excavation that is not put to use and is burned; this is gas that can be used to power mining facilities, create local jobs and make these countries regional leaders in the crypto industry. “On the information and promotion side, we will be opening the first of multiple showrooms and co-working spaces in November,” Riggins said. “This facility will house a mining museum and will be used as a venue to promote the industry through workshops and a speaker series. On the consulting and mining business side, we are in negotiations with the largest electro energy production companies in the region, consulting on the positives of mining and the opportunity to use their spare capacity in these territories.” Genesis Engineering will support the crypto mining industry broadly, including not only bitcoin but additional coins. It considers mining to be an important feature of the cryptocurrency sector, ensuring security and decentralization through incentives. The target market of Genesis Engineering ranges from hobbyists and small businesses reached by the company’s showrooms, co-working spaces and speaker series, to multinational energy companies and large-scale miners reached by the company’s consultancy and mining projects. Besides promotion of cryptocurrency mining and related consulting work, Genesis Engineering will offer cloud mining services through Genesis Mining, with an initial focus on markets that have been underserved in Eurasia. The pricing structure will be similar to Genesis Mining’s current offering, but with a focus on making the service and mining equipment attractive in emerging markets, as well as to organizations that are interested in large-scale mining but have not yet entered the industry and will need to be led through that process. Persuaded that cryptocurrency mining can be a boon to energy suppliers and populations in these regions, “Genesis Engineering will consider partnerships with energy providers and analyze how crypto mining could add value to different markets,” concluded Riggins. The post BTC Inc. and Genesis Mining Launch Genesis Engineering and See Opportunity in Eurasia appeared first on Bitcoin Magazine. |

BILL ACKMAN ON ADP: I lost the vote, but I also won (ADP)

|

Business Insider, 1/1/0001 12:00 AM PST

Bill Ackman's Pershing Square lost its bid Tuesday to appoint three nominees to the board of Automatic Data Processing, the human-resources company. But according to Ackman, he also won. Pershing Square in August disclosed an 8% stake in the company that handles many Americans' paychecks. Tuesday's vote capped a testy three months that included, among other things, insults slung from ADP's CEO, Carlos Rodriguez, and rival hedge fund managers alike. Ackman has contended that ADP, though it has performed well, could perform better, and deliver gains to his fund and other shareholders alike. Overall, he's optimistic about ADP, despite the proxy loss. ADP's stock price has improved since Pershing Square made its presence known, to the tune of some $300 million in gains, he said. And he's confident ADP will act to make changes that his firm suggested, bringing on more gains. A win-win, so to speak. Regardless, times have been tough for Pershing Square. An infamous long-term bet against Herbalife failed to produce gains, for instance, and assets at Pershing Square have dropped by $1.6 billion in the past five months, Business Insider earlier reported. A proxy fund for the firm is down about 3.3% after fees for the year through October, meanwhile. We caught up with Ackman after the vote Tuesday to get his take on his strategy on ADP and activism going forward. Rachael Levy: I wanted to know what happens to your strategy on ADP going forward? How does this change your strategy, if at all? Bill Ackman: It doesn't change our strategy at all. The company has tried to characterize this as a major win for the company. It's actually a major win for the shareholders. The company has tried to characterize this as a major win for the company. It's actually a major win for the shareholders. So I got 31% support from shareholders out of the votes cast for my seat on the board, not including another 14% that were withheld from the guy I ran against. Because ISS, the proxy advisory firm, said, "Support Bill by withholding votes from Eric Fast." So looked at correctly, I got 45% support from shareholders for my candidacy in the board. It's not a win, but it's a major minority, or just shy of majority vote, for the board. Shareholders throughout the contest totally supported our view that this company should be operating much more efficiently and should address the problems it has in its enterprise segment. In order to win this contest, the company had to come out publicly and make statements about improving their margins, improving their competitiveness, about accelerating growth on the back half of next year. We're going to monitor the company very carefully. And now the ball is in management's court. Will they deliver on the promises they made to shareholders? And if not, nine months from now we nominate another slate of directors. Levy: What happens to the $500 million you raised for this position? Ackman: That capital is committed for four-and-a-half years. We're a long term investor in the company and we have no plans to meaningfully change our position. Levy: What did you learn from this experience? Would you have done anything differently? Ackman: The thing that hurt us a lot is that ISS did not support all three of our candidates like Glass Lewis and Egan Jones did. They recommended a very unusual way for shareholders to support my election to the board, which was to withhold votes for Eric Fast. That's ultimately what cost us the election. Had I had known that was a possibility, I probably would have just run one candidate myself. It was a very simple decision – do they want to vote in favor? It almost becomes a referendum on our idea and there's no need to go through the gymnastics of withholding for one director to support me on the board. That, I would say, is the biggest takeaway from this experience. Levy: Let me make sure I understand this. So instead of proposing three board members, you'd have proposed only one? Ackman: Well, had I known that ISS would, I was confident that we'd get support from the proxy advisor firms and we did. Except in the case of ISS, they said, support Bill for the board, but do it in a backhanded way. Do it by withholding support from one of management's nominees. Those 14% of shareholders that voted that way, that withheld votes, were 14% of votes that I didn't get. That's what hurt our candidacy here.

Levy: What other options do you have now? You mentioned the proxy vote in nine months. Is there anything else you can do as an activist? Ackman: The ball, as I said, is back in management's court. They've committed to address the issues that we've identified. They already have plans underway to address these issues. So the question is are they going to address these issues or not? If they don't deliver for shareholders, next year we'll get the support we need to get on the board of the company. If they're successful, and we hope they're successful, the stock should go up a lot. So either way, we win. Levy: And how are you going to approach activist positions going forward? Ackman: The same way we always do. Again, we run very few proxy contests. The last proxy contest we ran was for board seats at Canadian Pacific. If we have to run another proxy contest, we will in the future. One of the things that hurt us in this contest is the stock has done well. I don't think anyone's ever run a proxy contest with a stock as up as much as ADP before. And I think we've shown with the amount of minority support we got here that shareholders will support an activist in a case even where the stock has done well if there is a significant chance of improvement. ADP stock has done well over the years, therefore it's not a natural target for an activist. But over the last three months, we've explained why this is a target, because the company has huge potential for improvement. What our investors want us to do is make them money. We've made them money so far in our investment in ADP. Levy: Going forward, are there any new positions you can announce today? Ackman: No. Levy: More broadly, this is more of a philosophical question about the nature of activism, do you get the sense that activism has changed? Is it any different today in this raging bull market? Ackman: I don't know that it has. Look, I'll point out the following which I think is something that isn't well understood. Activism isn't about winning proxy contests. It's about making money for investors by getting companies that aren't achieving their potential to achieve their potential. Activism isn't about winning proxy contests. It's about making money for investors by getting companies that aren't achieving their potential to achieve their potential. Proxy contests are one of the tools in the activist tool kit to motivate a company. We used that tool here, we were forced to, it wasn't our first choice. But we were forced to. It has had the intended effect, OK? The ADP management team and board are going to be very motivated over the next nine months to deliver for shareholders. They know they have a major owner of the company who is watching everything they're doing and they have a much more educated shareholder base. So it's a completely different company today and that's what creates an interesting opportunity. Levy: With stock market highs as they are, does that make it harder to win support from investors? Ackman: No. I think the facts are specific to every company. We were always viewed as underdogs here because ADP stock has done well. The fact that we got 31% support of shareholders, not including the 14%, shareholders that voted against Eric Fast to support me, is a very powerful indication. By the way, we also got the support of the second largest shareholder of the company. Levy: Was that BlackRock or Vanguard? Ackman: BlackRock. Levy: More generally, back to this broader question, do you think activists wield the same power when the market is this high? Ackman: If activists have good ideas, they will get one of two things, they will get support from shareholders or companies will be pushed to address the issues that an activist identifies. Levy So essentially, yes, they should have the same power they had previously. Ackman: Bear in mind, ADP is the second biggest company ever for an activist to take a position in. Levy: Right. What is the significance of that? Ackman: The bigger the company, the more difficult the target, typically. Levy: One other thought I had on this, this was an interesting campaign in that ADP was fairly active in speaking out. The CEO went on major news networks often, as well. If companies that activists target have advisors talking them through activist defense, counter communications campaigns, that kind of thing, does that make it so the lower hanging fruit of investments have been picked off? Does that make your job harder, essentially? Ackman: Look, if every company in America is run efficiently, that's not good for activists. That's good for Americans, but not for activists. Look, if every company in America is run efficiently, that's not good for activists. That's good for Americans, but not for activists. We do very few of these, maybe one a year, and they're not usually proxy contests. I think we can find one or two interesting ideas a year. That's all we need to make a living. Levy: Could you speak about overall stock market valuations? Ackman: I'm not an overall stock market prognosticator. I'm the wrong guy for that question. Levy: Back to ADP specifically, why go after a company that has been doing well over a company that could use a bigger boost? Ackman: The gap where they could be and where they are is extremely wide. Because the company is in a good industry, there are good tailwinds, so that we do well, even if we are to fail as an activist, we'd still make money as an investor. Levy: Bill, thank you so much for taking the time. Is there anything else that you think we should add, or that I didn't get to ask you that you think we should consider? Ackman: The press is very focused on, they think of an election like a presidential election. This is very different. In a presidential election, the person who loses has no influence going forward. In an activist campaign, even if the shareholder activist loses if you will, I continue to be a shareholder of the company. The company has committed to make a significant number of changes and improvements on the business. And we get to monitor their progress and in nine months from now, we can put another slate of directors if we choose to. Levy: So the fight continues on. Ackman: It's the end of the beginning, OK? We're still in the very early innings but we're off to a good start. The stock is up, call it almost 15%, from the unaffected price. SEE ALSO: 'The train has left the station': Al Gore isn't worried about Trump's environmental rollbacks Join the conversation about this story » NOW WATCH: I spent a day trying to pay for things with bitcoin and a bar of gold |

STOCKS DIP: Here's what you need to know

|

Business Insider, 1/1/0001 12:00 AM PST

The Nasdaq edged lower on Tuesday, while the Dow and the S&P 500 were little changed.

1. Bill Ackman suffers a big blow in his effort to shake up ADP. Ackman's bid to add three directors including himself to ADP's board was rejected by the company's shareholders on Tuesday. He started a bitter proxy battle with the HR-software provider in August, calling for sweeping changes including the replacement of CEO Carlos Rodriguez. 2. Oil climbed to highs not seen in two years amid increased political tensions in Saudi Arabia. Brent crude oil, the international benchmark, poked above $64 per barrel earlier on Tuesday, before retracing some of those gains later in the day. 3. Republicans dropped a slew of changes to their tax bill on Monday. The amendment, which passed late in the evening on a party line vote, contains seven new adjustments to the tax plan. While Democrats decried the timing and sudden changes in the bill during the Ways and Means Committee markup, the package still was able to pass due to the GOP's overwhelming advantage in the committee. 4. An influential conservative group slammed a key piece of the GOP tax plan as "class warfare." David McIntosh, the president of Club for Growth, said in a statement that the bill contained several provisions that would attack wealthy Americans unfairly. 5. Traders are making big bets on the largest takeover attempt in tech history. Qualcomm may be willing to do whatever it takes to repel Broadcom's $103 billion hostile takeover, but stock investors remain bullish on a deal getting done. ADDITIONALLY: We just witnessed the fall of a Wall Street god, writes Linette Lopez. Salesforce kicked off its party for 170,000 people with a surprise revenue forecast. This could be the biggest looming fight over the Republican tax plan. We just got a glimpse of how bitcoin futures will work. Here's what happens with your stuff after you die. SEE ALSO: All the countries Trump will visit in Asia — and what he'll encounter when he gets there Join the conversation about this story » NOW WATCH: How the iPhone X could make Apple a $1 trillion company |

Bitcoin Price Analysis: Bitcoin’s All-Time High Tests a Historic Reversal Point

|

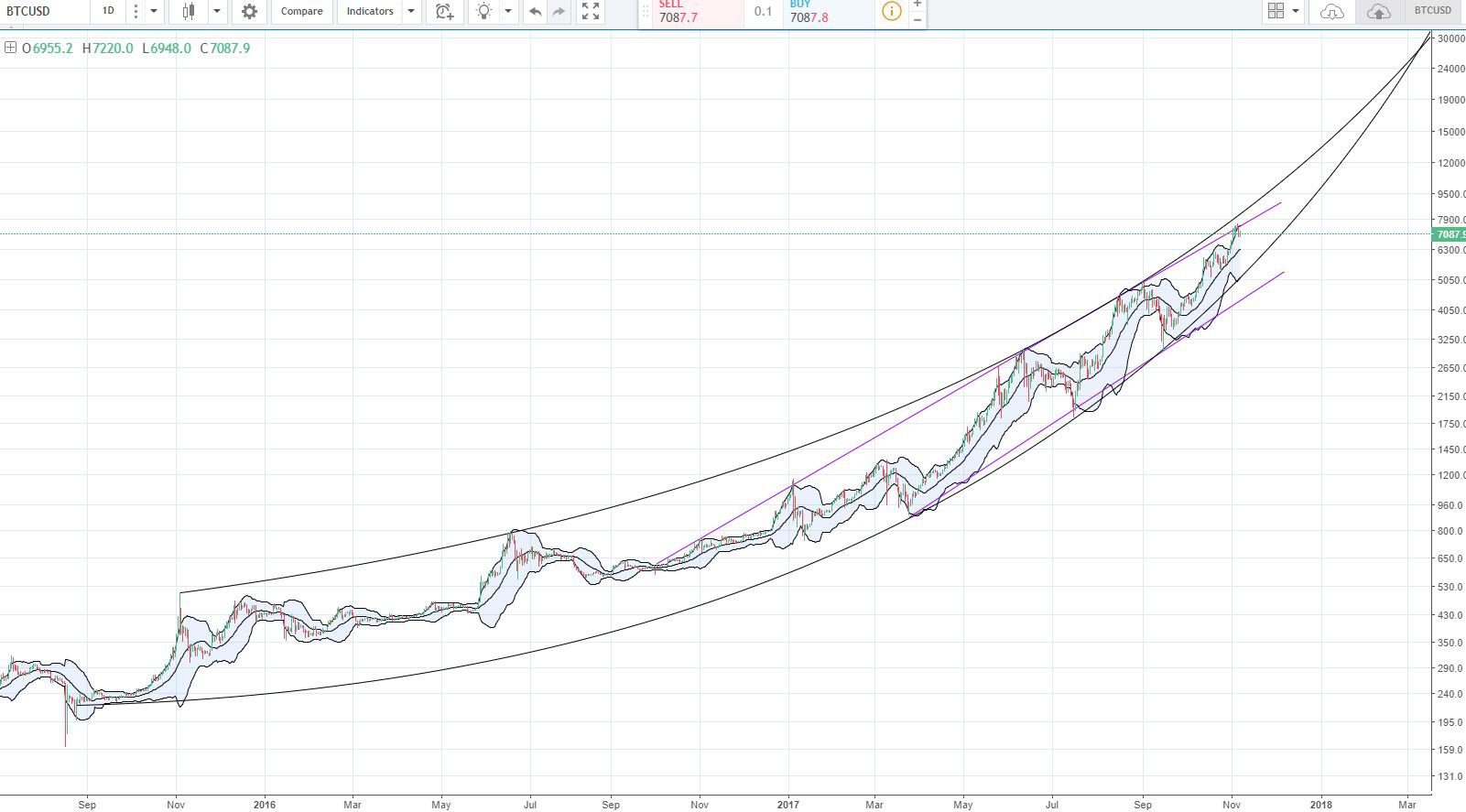

Bitcoin Magazine, 1/1/0001 12:00 AM PST For months on end, BTC-USD had a strong bullish rally that has been well confined between both a linear ascending channel and (on a macro scale) a parabolic curve:

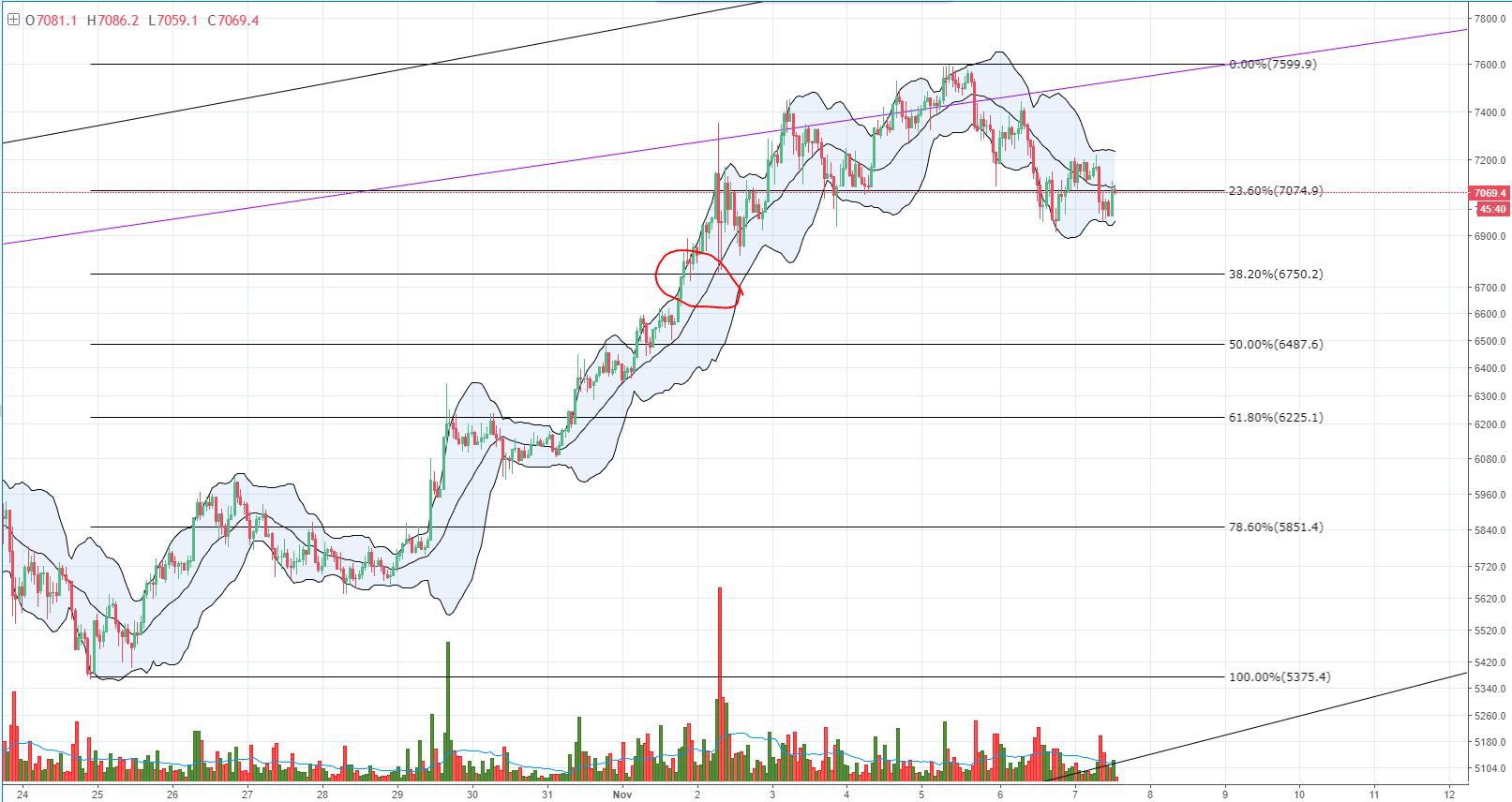

After a very strong, bullish rally, bitcoin managed to settle on a new all-time high in the $7,500s. This price peak bounced right off the upper linear ascending trendline shown in Figure 1. Historically, every time bitcoin has touched the upper ascending trendline, the market has gone through a corrective phase and entered into a relatively strong bearish reversal. At the time of this article, bitcoin is currently testing key, macro support of the lower $7,000 price range:

The 23% Fibonacci support has been a point of interest in the market’s history and will prove to be strong support. BTC-USD has attempted to break this support level a couple of times already and we are currently making a third test. A break below this level of support could send the price down to the 38% retracement values and test the $6,700 prices. However, if we look at the previous price action (the red circle) that brought the price upward, we don’t see any consolidation or support in the market’s history. This tells us that the 38% price level most likely won’t prove to be significant support during a potential move downward and we can expect to find stronger support in lower values around the $6,400–$6,500 prices. Historically, during correction periods, bitcoin has retraced 50–61% of the initial bull run:

The 50–61% retracement trend has formed a very nice, consistent ascending trendline for the lower support values. Unfortunately in this case, a retracement to the lower trendline would shove us outside the parabolic envelope described in the last bitcoin market analysis. On a macro level, if we do continue on a macro retracement to the 50–61% retracement values, we will likely find support on the lower parabolic curve in the $5,300s. Overall, bitcoin appears to be experiencing a slow bleed and will likely continue until some buying pressure picks up on the market. In general, the bullish pressure is somewhat exhausted, and if there is a resumption of an uptrend, we will likely see support and bullish continuation off the 23% retracement and $6,500 values outlined in Figure 3. Right now, bitcoin is in a precarious situation because it’s sitting just above support at the $7,000 level and doesn’t appear to have any interest in climbing back up just yet. Keep an eye on this support level and watch for a rise in volume on the next test of support. If we break this support level, it’s likely to continue downward for several hundred dollars before finding support once again. Summary:

Trading and investing in digital assets like bitcoin and ether is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTC Media related sites do not necessarily reflect the opinion of BTC Media and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results. The post Bitcoin Price Analysis: Bitcoin’s All-Time High Tests a Historic Reversal Point appeared first on Bitcoin Magazine. |

Shopping center stock GGP is rising on reports that Brookfield is interested in a takeover (GGP)

|

Business Insider, 1/1/0001 12:00 AM PST

Join the conversation about this story » NOW WATCH: THE BOTTOM LINE: A market warning, the big bitcoin debate and a deep dive on tech heavyweights |

Oprah Winfrey has now raked in $300 million from her Weight Watchers investment (WTW)

|

Business Insider, 1/1/0001 12:00 AM PST

Weight Watchers shareholders rejoiced on Tuesday as the company's stock surged as much as 22%. But no one had more to celebrate than Oprah Winfrey. The TV superstar and media mogul owns roughly 10% of the company's stock after making a huge investment back in late 2015, and it's paid off handsomely. Including the most recent share spike, Winfrey's total profit from the Weight Watchers bet now sits at a whopping $300 million, according to data compiled by Craig Giamonna of Bloomberg News. At the root of the most recent stock increase was a stellar third-quarter earnings report, which saw the company beat analyst profit estimates and boost its full-year earnings forecast. On the heels of Weight Watchers' success, it's clear that the massive profits reaped by Winfrey are fully deserved, considering how much her presence in ad campaigns has boosted sales and brand visibility. And she'll appear in more ads during the ever-important winter season, CEO Mindy Grossman said on the earnings call. Keep in mind that it was Winfrey's initial investment in the company that kickstarted a resurgence in stock strength. When she first bought into Weight Watchers, it was trading below $7 per share, but then doubled in a single trading session. Its stock has since climbed 674%, including almost 400% in 2017 alone. And since Winfrey also owns options that could increase her stake in the company to 15%, she could see an even bigger windfall of profits if she elects to exercise them. Including the initial investment of $43 million, her full stake is now worth more than $500 million. Not bad at all for a side investment.

SEE ALSO: Traders are making big bets on the largest takeover attempt in tech history Join the conversation about this story » NOW WATCH: THE BOTTOM LINE: A market warning, the big bitcoin debate and a deep dive on tech heavyweights |

A few weeks after a cryptocurrency startup raised $32 million, two of its founders have left the company amid a swirl of questions

|

Business Insider, 1/1/0001 12:00 AM PST

Two of the founders of a flashy crypto currency startup that raised $32 million last month amid a storm of skepticism about its business and leadership have abruptly left the company. Sam Sharma and Raymond Trapani, who reportedly had no previous experience running an crypto currency business before founding Centra, but whose love of luxury cars and piles of cash are well documented on both social media and in court documents, "are stepping aside," the company announced Oct. 31 in a blog post. Sharma most recently served as Centra's president and Trapani as its chief operating officer, though both held various titles in the three-month whirlwind that's marked the early days of the startup. The co-founders made the decision to leave Centra on their own following an unflattering profile in The New York Times, said Allan Shutt, Centra's general counsel, adding that it's not unusual for founders to leave a company once it's outgrown them. The Times article highlighted the pair's relative inexperience in business and revealed that they have both been indicted for perjury in Manhattan.

Shutt claimed to speak on behalf of Sharma and Trapani. The pair didn't respond to attempts to reach them via Facebook and LinkedIn. Email sent to Trapani's work address was rejected by Centra's server. Centra has said it's developing a debit card that users will be able to link to the digital wallets they use to store cyber currencies including bitcoin and ether. Users would be able to use the debit card to make purchases with their cyber currencies of items being sold for dollars or other traditional currencies. After announcing its product in August, the company brought on board celebrity endorsers including boxer Floyd Mayweather and musician DJ Khaled to promote its fundraising effort. In September, Centra raised its $32 million via an initial coin offering, or ICO. In an ICO, a company creates and exchanges a new cyber currency for an established one, such as bitcoin or ether. Unlike initial public offerings, where companies raise money by selling their stock to the public, ICOs are basically unregulated. A number of eyebrow-raising events have led some to question Centra as a business.The executive shakeup comes as questions are being raised about Centra and follow a string of eyebrow-raising events at the company and among its employees. Just weeks before their departure — and immediately after Centra completed its fundraising — Sharma and Trapani were indicted by a Manhattan grand jury for perjury. The indictments were a result of their testimony in July during a trial over charges that Sharma had driven under the influence last year, according to Times. Sharma and Trapani both testified that Sharma had had only had one drink before getting in his car, according to The Times. Despite that, Sharma ended up cutting the trial short and pleading guilty to a misdemeanor DUI charge. The perjury charges accuse Sharma and Trapani of knowing that Sharma had more to drink than they testified at trial, The Times reported.

According to Florida state records, William Hagner, who is Trapani's grandfather and is replacing Sharma as Centra's president, served as president of a Miami Exotics based in Boca Raton, Florida. Trapani, who is being replaced as Centra's COO by Robert Farkas, another co-founder who previously served as the company's chief marketing officer, served as vice president of Miami Exotics. Meanwhile, in a blog post in August, a web developer named Harry Denley raised numerous concerns about Centra's then-impending ICO. Most notably he questioned whether Michael Edwards, who Centra at the time listed as its CEO, was a real person. Denley noted that Centra had posted two different photos of Edwards on its site over the course of just a few days. One of the pictures appeared to be of a professor in Canada whose actual name appeared to be Andrew Halayko. He also linked to a questionable LinkedIn profiles of Edwards. Denley reported that at least one other person listed as a member of Centra's team also appeared to be a fake. After threatening to sue Denley, Centra later attributed the apparently fake profiles to mistakes by freelancers. Edwards' name and that of the other person Denley identified were removed from the company's website and Edwards' LinkedIn profile was deleted. The company then named Sharma its president. The co-founders are out, but Centra still has to build its core product.Sharma still retains a stake in Centra after leaving the company, said Shutt, the general counsel. He wouldn't say whether Trapani does also. Centra's digital wallet app is available for download, but the company hasn't yet distributed its debit card to customers. On its website, Centra says it plans to distribute them by the end of this year. Despite the questions raised about the company and the executive upheaval, customers and investors have no cause to worry, Shutt said. "I truly believe that the product will be developed in the near future," he said. "The money is not in jeopardy. It's certainly not a scam." |

Millennial investors are 'losing confidence' in Snap ahead of earnings (SNAP)

|

Business Insider, 1/1/0001 12:00 AM PST

Millennials aren't too bullish ahead of Snap's third-quarter earnings report, due out after the bell on Tuesday. Investors on the Robinhood platform, which is popular among millennial investors, are buying shares of Snap 2% more than they are selling shares in the week ahead of earnings. That's a big drop from last quarter's report, ahead of which Robinhood investors were buying shares 20% more than they were selling. Snap is the ninth most popular stock on Robinhood's platform. "Retail investors on Robinhood are losing confidence in Snap ahead of their earnings report today," Sahill Poddar, a data scientist at Robinhood, told Markets Insider. Wall Street is just as mixed as retail investors. Only nine of the 34 analysts surveyed by Bloomberg rate the company a "buy" while 20 are neutral and five a "sell." Wall Street is expecting an adjusted loss of $0.15 on revenue of $235.5 million. Snap shares are up about 2.43% at $15.19 a piece ahead of the results. Snap is still trading about 10% below its initial public offering price of $17. Read about what happened to Twitter after one of its biggest investors was thrown in jail.Join the conversation about this story » NOW WATCH: THE BOTTOM LINE: A market warning, the big bitcoin debate and a deep dive on tech heavyweights |

We just got a glimpse of how bitcoin futures will work

|

Business Insider, 1/1/0001 12:00 AM PST

CME Group, one of the largest exchange groups in the world, announced last week it will roll out a bitcoin futures contract in the fourth quarter. The announcement has generated a lot of buzz on Wall Street, and sparked a big rally in the cryptocurrency. Bitcoin climbed from $6,100 on October 30 (the day before the announcement) to more than $7,000 on November 7. Futures, which allow two parties to exchange an asset at a specified price at an agreed upon date in the future, have been around since the late 19th century. In some cases, when a futures contract settles the buyer of the contract can receive their payment in the product itself (a barrel of oil, say), or in cash. The latter are referred to as cash settled futures. CME's bitcoin futures will settle in cash. (You can read a full explainer on bitcoin futures here.) As futures get ready for trading, CME this week sent out a note setting out how the bitcoin futures will work. Here's what you need to know:

SEE ALSO: GOLDMAN SACHS: Bitcoin could get close to $8,000 Join the conversation about this story » NOW WATCH: Watch billionaire Jack Ma sing his heart out during a surprise performance at a music festival |

$800 MILLION FEEDING FRENZY: Wall Street banks stand to make a fortune from a tech deal spree (AVGO, QCOM)

|

Business Insider, 1/1/0001 12:00 AM PST

Broadcom just unloaded a record-breaking $130 billion bid for fellow semiconductor giant Qualcomm. If completed, it would be the largest tech takeover of all time — and could net the companies' investment bankers a massive payday of as much as $280 million in advisory fees. Qualcomm is reportedly planning to reject the offer. This isn't the first mammoth transaction Wall Street bankers have orchestrated involving these two firms. Qualcomm was in the middle of trying to buy NXP Semiconductor's for $47 billion — which also would be one of the largest deals of all time — before Broadcom crashed the party and said it would buy Qualcomm, with or without NXP. In fact, bankers have been bingeing on lucrative M&A deals involving Broadcom, Qualcomm, and NXP over the past three years. The feeding frenzy so far, including the pending transactions, involves four deals since 2015 worth $230 billion. The deals could trigger as much as $790 million in fees for the Wall Street firms running the deals, according to according to Jeffrey Nassof, director of consulting firm Freeman & Co. That figure includes financing fees — except for the just-announced Broadcom for Qualcomm deal — which adds $210 million to the tally. Broadcom could reportedly require as much as $90 billion in debt to close the deal, which means the total amount of advisory and financing fees paid out to banks could surpass $1 billion. In many cases, the same banks have advised on multiple transactions. JPMorgan advised Broadcom on its deal with Avago, signed on to help finance Qualcomm's deal for NXP Semiconductors, and is part of the financing team for Broadcom's bid for Qualcomm. Here's a breakdown of the transactions, as well as how much bankers earned in advisory fees: March 2015: NXP buys Freescale Semiconductor — $16.7 billionAnnounced in March of 2015 and completed later that year in December. Dutch chipmaker NXP was advised exclusively by Credit Suisse, which also provided financing for the transaction along with several other banks. Credit Suisse earned $25 million in fees for advising on the deal, and a share of the $35 million fee for arranging $5.3 billion in debt financing, according to according to Jeffrey Nassof, director of consulting firm Freeman & Co. Morgan Stanley was the exclusive advisor to Freescale, which paid the bank $42 million in fees. Fees: $102 million May 2015: Avago Technologies buys Broadcom — $37 billionAvago announced it would pay $17 billion in cash and $20 billion in stock to acquire Broadcom, adopting the latter company's name and creating the behemoth that's now pursuing Qualcomm. The deal closed at the beginning of 2016. Avago hired Deutsche Bank as its financial adviser for the deal, paying $22.5 million in fees, according to fillings with the Securities and Exchange Commission. Broadcom hired JPMorgan as its adviser, agreeing to pay a fee of 0.14% of the total deal value, which comes to nearly $52 million. Wall Street banks also earned $100 million in fees for arranging $16.1 billion in debt financing, according to Nassof. Fees: $174.5 million October 2016: Qualcomm to buy NXP Semiconductor — $47 billion offerLast year, Qualcomm ponied up an all-cash offer of $47 billion to buy NXP. The deal is still in limbo, as NXP shareholders — including feared activist Elliott Management — had been hoping to extract a sweeter offer. The boutique bank Qatalyst Partners was the lead adviser to NXP, along with Barclays and Credit Suisse. On the buy side, Goldman Sachs and Evercore advised Qualcomm. The boutique firm Centerview Partners advised Qualcomm's board. And Goldman Sachs and JPMorgan signed on to provide debt financing. The banks would share a pot of between $140 million and $160 million, according to Nassof. Banks would also earn a $75 million fee for arranging $24.6 billion in debt to finance the deal. Fees: As much as $235 million November 2017: Broadcom to buy Qualcomm — $130 billion offerMoelis & Co., Citi, Deutsche Bank, JPMorgan, Bank of America Merrill Lynch, and Morgan Stanley are each advising Broadcom on the potential merger. Those banks could share between $110 million and $135 million in advisory fees, according to Nassof. Qualcomm has retained Goldman Sachs and Evercore to mount its defense in the deal; the banks could earn between $120 million and $145 million in fees, according to Nassof. Bank of America, Citi, Deutsche Bank, JPMorgan, and Morgan Stanley are also helping arrange debt financing, and Silver Lake Partners has agreed to supply $5 billion in convertible debt financing. Broadcom could reportedly require as much as $90 billion in debt to close the deal, but it's too early to say how much banks would net from arranging the financing. If they financed the majority of the transaction through the bond markets, however, the fees could top $500 million, according to Nassof. Fees: As much as $280 million Join the conversation about this story » NOW WATCH: We just got a super smart and simple explanation of what a bitcoin fork actually is |

Nearly 2 million veterans would benefit from raising the federal minimum wage

|

Business Insider, 1/1/0001 12:00 AM PST

Nearly 2 million US veterans would benefit from raising the federal minimum wage to $15 per hour. Approximately 1.8 million of the 9 million veterans in payroll jobs across the US would get a raise if Congress raised the federal minimum wage to $15 per hour by 2024, the liberal-leaning Economic Policy Institute determined in an analysis on the Raise the Wage Act of 2017 in honor of Veterans Day. Nearly two-thirds of the veterans who would get the raise are age 40 or older, over 60% have some college experience, and nearly 70% work full time, the EPI found. "This means that despite their service to the country, the intensive training that they have received, and the access to additional education provided to veterans through the GI Bill, 1 out of every 5 veterans is still being paid so little that they stand to benefit from raising the minimum wage," the Economic Policy Institute's David Cooper and Dan Essrow wrote. The debate over raising the federal minimum wage has heated up over the past few years. Those against raising it argue that a higher minimum wage could lead businesses to raise their prices or to cut jobs and benefits in an attempt to offset the cost. Those in favor of raising it, on the other hand, argue that raising the minimum wage above the current $7.25 per hour federal standard would improve living standards, and would enable consumers to spend more. That increased spending would then give a nice, healthy boost to an economy that still shows some slack several years after the Great Recession. The current federal minimum wage is at $7.25 per hour. Parts of the country have raised their minimum wages above that, including a number of states and major cities like Seattle, Washington and Los Angeles, California. The Raise the Wage Act of 2017 was introduced by Sens. Bernie Sanders (I-VT) and Patty Murray (D-A), and Reps. Bobby Scott (D-VA) and Keith Ellison (D-MN) back in April. It would incrementally raise the minimum wage to $15 per hour by 2024, and starting in 2025 it would be "indexed" to median wages so that each year the minimum wage would be adjusted based on the growth in median earnings. It would also increase the subminimum wage for tipped workers (which has been at $2.31 per hour since 1991) and phase out the youth minimum wage and the subminimum wage for workers with disabilities. The real federal minimum wage peaked back in 1968 at $8.54 in 2014 dollars, according to an analysis by the Pew Research Center. The chart below from Pew compares the real (adjusted for inflation to 2014 dollars) federal minimum wage to the nominal (non-inflation adjusted) federal minimum wage since 1939. A study from The Economist in 2015 found that "one would expect America... to pay a minimum wage around $12 an hour" based on how rich the country is and the pattern among other developed economies in the Organization for Economic Cooperation and Development (OECD).

SEE ALSO: Millions of American adults are not allowed to vote — and they could change history Join the conversation about this story » NOW WATCH: $6 TRILLION INVESTMENT CHIEF: Bitcoin is a bubble |

‘Buy Bitcoin’ Overtakes “Buy Gold” as Private Gold Trading Declines in October

|

CryptoCoins News, 1/1/0001 12:00 AM PST […] The post ‘Buy Bitcoin’ Overtakes “Buy Gold” as Private Gold Trading Declines in October appeared first on CryptoCoinsNews. |

CME Group's Leo Melamed: We'll 'Tame' Bitcoin

|

CoinDesk, 1/1/0001 12:00 AM PST CME Group Chairman Emeritus Leo Melamed said he believes in the future of bitcoin and expects major investment in his company's futures contracts. |

What you need to know on Wall Street today

|

Business Insider, 1/1/0001 12:00 AM PST

Bill Ackman's bid to add three directors, including himself, to ADP's board was rejected by the company's shareholders on Tuesday. The billionaire founder of the hedge fund Pershing Square started a bitter proxy battle with the HR-software provider in August, calling for sweeping changes which included the replacement of CEO Carlos Rodriguez. Ackman's nominees were supported by less than 20% of ADP's shareholders, the company said. With that defeat, we witnessed the fall of a Wall Street god, according to Business Insider's Linette Lopez. Elsewhere in investing news, one of the hottest hedge fund launches of the year has doubled its assets in about six months. Bridgewater reportedly paid a $1 million settlement to an employee pushed out after a relationship with a top exec. Leucadia has doubled down on an investment in hedge fund Folger Hill. And one of the world's hottest investment strategies is slowing — and that could shift the whole landscape. In deal news, Disney has reportedly been in talks to buy most of 21st Century Fox. The deal could cost Disney $40 billion, according to Jefferies. Disney and Fox need a deal to take on the tech giants, according to Business Insider's Mike Shields. Just not this deal. Elsewhere in deal news, Tesla is pushing forward with robot manufacturing, and traders are betting that Broadcom's record-setting hostile takeover of Qualcomm will get done. The Tax Policy Center released an analysis on Monday of the Tax Cuts and Jobs Act, saying the bulk of the benefits from the GOP tax bill would go toward wealthier Americans. A couple of hours later, it retracted its analysis of the bill, following the discovery of an error with their analysis. Here are the rest of the headlines:

In related news, Forbes says Commerce Secretary Wilbur Ross inflated his net worth. Join the conversation about this story » NOW WATCH: TOP STRATEGIST: Bitcoin will soar to $25,000 in 5 years |

Snap is gaining ahead of earnings (SNAP)

|

Business Insider, 1/1/0001 12:00 AM PST

Snap is trading up 2.56% at $15.21 a share ahead of the company's third-quarter earnings report, which is scheduled to be released after markets close on Tuesday. Wall Street is expecting an adjusted loss of $0.15 per share on revenue of $235.5 million. Nine of the 34 Wall Street analysts tracked by Bloomberg rate the company a "buy", while 20 rate it a "neutral" and five rate it a "sell". Snap has been facing issues with its platform ahead of the report. The company acknowledged that "some" users were experiencing issues with the app and said it's working on a fix. A lot of users tweeted their frustrations about the outage. The company was hit by layoffs, and executives have said they will slow hiring next year. Recently, 18 people were laid off from the recruiting division and about 12 were cut from the company's hardware division. Snap is still trading 10.4% below its initial public offering price of $17. Read more about the company's platform issues here.

SEE ALSO: Snapchat isn't working for a lot of people Join the conversation about this story » NOW WATCH: $6 TRILLION INVESTMENT CHIEF: Bitcoin is a bubble |

$8,000: Goldman Sachs’ Analyst Predicts Bitcoin Price Gains

|

CryptoCoins News, 1/1/0001 12:00 AM PST […] The post $8,000: Goldman Sachs’ Analyst Predicts Bitcoin Price Gains appeared first on CryptoCoinsNews. |

Qchain’s Forward Advancement Amid the Changing World of ICOs

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Alongside Bitcoin’s meteoric rise in global interest and price has been a frenzy of activity around initial coin offerings (ICO). According to the online coin offering tracker Coinschedule, in 2017 alone there have been nearly 250 ICOs collectively raising over $3 billion. This heightened interest combined with the potential for lucrative returns has prompted fears in some investment circles that we are facing a bubble. Indeed, the bubble seems to have already popped to some extent, with far fewer ICOs hitting their target raises than they were a few months ago. Today’s ICOs are being initiated by funding-hungry startups, often with a blind eye toward any sort of regulatory due diligence. As a result, this wild and reckless approach has raised the eyebrows of the U.S. Securities and Exchange Commission (SEC) among other regulatory bodies worldwide. The SEC, in fact, has opened a new cyber unit for cryptocurrency violations to address the proliferation of these campaigns. What’s problematic here is the lack of compliance guidance with respect to ICOs relative to crowdfunding regulations or federal securities law. This prevailing environment has ignited calls for stricter oversights addressing scams and “pump and dump” schemes that are now infiltrating this space. Startups have an enormous amounts of wiggle room when forming an ICO token. Unfortunately, many of these campaigns are launched with little more than a hastily constructed website and white paper with the company’s core product rarely battle-tested by real users. This heightens the notion that reaching cash rich startup status does not ensure product success. Once acquired by investors, ICO tokens can then be exchanged in a secondary market for liquid value. In the meantime, shareholders (mostly founding members and lead developers) often lay claim to 10 or 20 percent of the initial tokens tied to a vesting schedule. It’s the outside token investors that are often at risk as they, at times, find themselves subjected to “pump and dump” and other nefarious schemes, harming the overall integrity of the crypto landscape. Navigating the Ever-Evolving ICO Landscape Wally Xie, CEO of Qchain, an emerging digital marketing, advertising and analytics platform seeking to leverage the strengths of both NEM and Ethereum blockchain protocol, said that that while know-your-customer (KYC) compliance really hurt his company’s recent ICO, he felt that it was a necessary sacrifice to make in terms of long-term legitimacy and the safe development of Qchain in the U.S.

“We are finding that we perhaps made the wrong move by targeting the cryptocurrency community at large, rather than negotiating with ‘whales’ from the outset,” Xie said. “We've also faced lots of legal challenges, such as having to do stringent KYC to comply with U.S. regulations, since lots of money laundering is also happening in the space.”

Xie noted that similar issues involving integrity and credibility are plaguing the industry his company is taking aim at, namely, native advertising. He said that as that industry’s expansion leads to improved conversion rates compared to traditional web display ads, that has come at the cost of trust found in traditional media outlets. This erosion of trust, he added, has helped drive a flood of people toward "fake news" websites that make their money in confirmation biases.

Xie is worried that a similar scenario may be emerging in the high stakes game of ICO funding.

“The ICO space is definitely changing as it is becoming more of a pay-to-play environment,” Xie said. “Successful ICOs now typically already receive massive pre-ICO investment from folks like Draper, so the feasibility of an ICO for all parties involved has definitely changed. In some ways, it's become a less democratic process. ICOs are becoming less accessible and stratification is starting to happen in a manner similar to what occurs in any maturing space.”

Jordan Valentine, an expert specializing in emerging technologies at Spitzberg Partners — a boutique corporate advisory and investment firm headquartered in New York — believes that we are fast approaching the end of the frontier days in the ICO space, if we haven’t gotten there already. He noted that in 2017, we had seen four nine-digit coin offerings and billions raised through ICOs. That, he said, is simply too much money changing hands for regulators to allow this bubble to grow unfettered.

“Going forward, government agencies will certainly look to be more present in the crypto world as they develop an institutional understanding of the issues at hand,” Valentine said. “My personal hope is for a regulatory framework that reins in some of the more reckless activity in crypto without unduly burdening legitimate innovation.”

Valentine believes that this reaction is already in motion in the U.S. In July 2017, the SEC clarified its stance on ICOs, warning that coin offerings would be subject to U.S. securities laws. This means that coin offerings will be judged by the Howey Test — a legal precedent for determining whether a financial instrument is an investment contract. For U.S. investors, this distinction connotes strict income or net worth requirements, restricting the pool in the U.S.

“Digital coins can be used to confer a wide range of rights in addition to value, so their application under securities law isn’t exactly straightforward,” said Valentine. “Interest in coin offerings will likely be tempered a bit in the short term, as would-be investors wait for further regulatory clarity and watch as the first penalties are doled out. However, the allure of finding a big win will be enough to keep this fundraising mechanism relevant, barring a serious clampdown from Washington.”

When asked about the prevailing trend toward launching an ICO campaign without a demonstrated product or service, Valentine is skeptical.

“An ICO backed only by a white paper and a webpage is, in the best case, an incredibly questionable gamble; in the worst cases, these raises are outright predatory, with the organizers bailing as soon as possible,” he said. “Even in the case of a ‘good’ white paper ICO, buyers are taking on huge risk, as they generally do not acquire any right to information or managerial discretion.”

But Valentine offers this reminder:

“While most coin offerings are very much a long shot bet to the buyer, they’re not all scams. There are a number of potentially paradigm-changing ideas supported by a token that merit the attention of the savvy and adventurous.”

“In terms of our product, we didn’t want to espouse a ‘break first/fix later’ ethos that has come to dominate Silicon Valley, made infamous by such companies as Uber and Zenefits,” he said. “Funding is critical, but the quality of what we are delivering will always come first.” The post Qchain’s Forward Advancement Amid the Changing World of ICOs appeared first on Bitcoin Magazine. |

Traders are betting that Broadcom's record-setting hostile takeover of Qualcomm will get done (BRCM, QCOM)

|

Business Insider, 1/1/0001 12:00 AM PST

Qualcomm may be willing to do whatever it takes to repel Broadcom's $103 billion hostile takeover, but stock investors remain bullish on a deal getting done. Despite a 16% spike in Qualcomm shares since initial reports of the proposed deal, traders are still paying the highest premium in more than two years to bet on a further increase, relative to hedges against stock losses.

And while the company's stock still sits roughly 10% below the $70 per share offered by Broadcom, that's to be expected at this point. Even though acquisition targets generally spike on the initial news, they tend to trade at a discount to the offer price until a deal is set in stone on both sides and proper regulatory approval is received. With that in mind, investor positioning can be a valuable indicator when handicapping the likelihood a deal gets completed. While Qualcomm is very much trading in this middle ground now, the unabashed bullishness being signaled by the options market suggests that they're confident in further share gains that would likely accompany a done deal. It's possible that traders are being encouraged by Broadcom's aggressive approach to the takeover. According to a Bloomberg report, the company is getting ready for a proxy battle and may make its pitch directly to Qualcomm shareholders if their board rejects the offer. Another tactic Broadcom could use is to nominate directors for Qualcomm’s board ahead of the company’s annual general meeting in 2018. Investor confidence — and an accompanying lack of downside worry — can be seen through another measure, which looks at the portion of Qualcomm shares being shorted. The indicator, known as short interest, is close to its lowest level in more than six months, according to data compiled by IHS Markit. So while the ultimate outcome is still very much unknown, those looking to get a read on investor expectations would be well-served to watch both metrics outlined above.

Join the conversation about this story » NOW WATCH: $6 TRILLION INVESTMENT CHIEF: Bitcoin is a bubble |

JEFFERIES: Disney's potential Fox deal could cost $40 billion (DIS, FOX, FOXA)

|

Business Insider, 1/1/0001 12:00 AM PST

Disney reportedly held discussions with 21st Century Fox to buy a portion of its assets. According to Jefferies, those assets could be worth $40 billion. The media and entertainment company is reportedly eyeing Fox's international cable networks, its Star film studio, and it's non-sports/non-news cable networks, such as FX and National Geographic. In the event of a deal, John Janedis of Jefferies believes Fox and its properties could be worth 40% above current levels, or $39 per share. There's value in the "sum of the parts," Janedis notes, which could give Fox considerable upside. He estimates that the international cable networks are worth $14 billion at a multiple of 10x EBITDA, the film studio is worth $560 million at 9X EBITDA, the non-sports or news cable networks is worth $1.2 billion in 8.5X EBITDA, and stakes in SKY and other assets could be valued at $8.6 billion and $5 billion, in addition to Fox's 30% stake in Hulu. Fox's shares have risen 10% since news of the discussions between the media conglomerates were revealed. Disney's shares have gone up 1.58%. Rupert Murdoch, the media mogul behind Fox, has reportedly rejected Disney's offer as it currently stands. "Given the potential structure, we do not think the remaining assets are appealing enough to FOXA as a standalone to complete a deal in the proposed form," Janedis wrote in a note. Disney would have to offer the company at least $37 billion to make the deal worth it. Disney has recently made a series of investments to boost its direct-to-consumer video streaming services. Fox's shares are trading at $28.27 though it has been lagging down 4.39% year over year. Disney stock is trading at $101.63 and is down 5.07% for the year. To read more about the upside of Disney's streaming services bet, click here.

SEE ALSO: CREDIT SUISSE: Disney needs to be rewarded for going after Netflix Join the conversation about this story » NOW WATCH: $6 TRILLION INVESTMENT CHIEF: Bitcoin is a bubble |

Blue Apron plunges more than 13% to an all-time low (APRN)

|

Business Insider, 1/1/0001 12:00 AM PST

Blue Apron is down 13.66% on Tuesday at $3.35 a share, a new all-time low. On Tuesday, there were no new downgrades from Wall Street and no announcements from the company. But still, the company plunged to new lows. Blue Apron posted its third-quarter earnings earlier this month, reporting $210.6 million of revenue, which was higher than Wall Street's expectations. The company, however, still saw a bigger than expected loss per share of $0.47. Blue Apron said it reduced its marketing costs by 31% in the quarter, which was the reason for its 6% decline in total customers. The numbers continued to work against Blue Apron, as the cost of goods sold increased 13% year-over-year, accounting for 71% of its revenue in the most recent quarter. The company's largest competitor, Hello Fresh, went public in Germany last week. Hello Fresh reported revenue growth in its most recent quarter, and a net loss much smaller than Blue Apron's. Blue Apron is down 66.13% since its initial public offering of $10 a share. Read more about Blue Apron's competitors here.SEE ALSO: Blue Apron costs surge despite layoffs and reduced marketing spend Join the conversation about this story » NOW WATCH: THE BOTTOM LINE: A market warning, the big bitcoin debate and a deep dive on tech heavyweights |

Bittrex on SegWit2x: Bitcoin Will Remain as BTC, Market Will Decide

|

CryptoCoins News, 1/1/0001 12:00 AM PST […] The post Bittrex on SegWit2x: Bitcoin Will Remain as BTC, Market Will Decide appeared first on CryptoCoinsNews. |

'Fibs, exaggerations, omissions, fabrications and whoppers': Forbes says Commerce Secretary Wilbur Ross inflated his net worth

|

Business Insider, 1/1/0001 12:00 AM PST

Commerce Secretary Wilbur Ross isn't a billionaire — and it's possible he never was, according to a bombshell report by Dan Alexander in Forbes Magazine. Ross has come under fire recently for leaving $2 billion he told Forbes he owned off of his financial disclosure forms when he joined President Donald Trump's administration after the election. Senate Democrats have called for an investigation into the missing billions. Forbes, which bumped Ross from its annual Forbes 400 list of wealthiest Americans last month with a far lower net worth of $700 million, conducted an investigation of its own and believes it has solved the mystery (emphasis added): "That money never existed. It seems clear that Ross lied to us, the latest in an apparent sequence of fibs, exaggerations, omissions, fabrications and whoppers that have been going on with Forbes since 2004. In addition to just padding his ego, Ross' machinations helped bolster his standing in a way that translated into business opportunities." Forbes conducted interviews with 10 former employees from Ross' private equity firm WL Ross & Co., and reported that Ross has for decades lied to not just the magazine, but also investors, colleagues, and employees. Forbes said it sent questions to Ross and the Commerce Department. This was their response, according to Forbes: "Secretary Ross has filed all required disclosures in accordance with the law and in consultation with both legal counsel and ethics officials at the Department of Commerce and Office of Government Ethics. As we have said before, any misunderstanding from your previous conversation with Secretary Ross is unfortunate." Read the full story at Forbes.Join the conversation about this story » NOW WATCH: Gary Shilling calls bitcoin a black box and says he doesn't invest in things he doesn't understand |

The Rublix Vision for Crypto Investing

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST With the exponential growth of cryptocurrency businesses, investing can be complex. This complexity has no doubt hindered mass adoption and prompted the need for trusted user-friendly tools to attract more traditional investors. Specializing in blockchain and smart contract technology, the Canadian technology company Rublix is building a network that could make - not just cryptocurrency trading - but any trading less complex. They are launching the Rublix platform so that investors across the world can access and share valuable trading information for all markets. The information will be provided to users from traders whose authenticity and credibility have been verified based on reputation and performance. This in turn will provide Rublix users with the credible analysis and strategies they need to have confidence trading. In the long term, the Rublix platform aims to help build and evolve a network of profitable traders by enhancing their skills, confidence and profitability. Currently, most small traders and investors are limited in the number of desktop and mobile investing tools at their disposal. Rublix is developing an integrated, cross-platform suite to make it easier for nontechnical investors to utilize data analytics. The company believes that these tools will allow smaller investors to “trade the way the pros do,” thereby creating a more level playing field. Currently, Rublix is navigating by an ambitious roadmap that involves the development of three signature products, as well as a foundational proprietary blockchain that will be utilized to manage the whole enterprise. The platform’s end goal is to bring scores of new traders into the crypto space by mitigating as many roadblocks as possible as well as aiding the broader trading world altogether. Building the Rublix Toolbox One of the signature solutions in the Rublix suite is the Hedge platform, which uses cutting-edge technologies to validate trading predictions. A key component of the platform are the trading “blueprints,” which use smart contracts to verify the trading predictions and penalize poor information. This will allow the larger investor community to track and replicate the work of successful traders with proven results. The platform rewards traders who have exhibited a successful track record in delivering valuable trading blueprints. Experienced traders who have a demonstrated history of sound investments will be incentivized by Rublix tokens for their strategies and knowledge. This will allow even the least experienced traders to learn from the successful patterns of top investors. Once the proprietary blockchain is developed, these rewards will be automatically distributed through smart contracts where the trader receives the token upon a successful prediction whereas the token is returned if they are incorrect. The alpha release of the platform is targeted for Q1 of 2018, with a version 1 general release scheduled for later in the year. Rublix also has plans to develop an integrated trading platform called TradersEdge. This API-centric platform will allow for in-depth analysis to investors, including interactive charting mechanisms, enhanced indicators and myriad other features. This flagship web application that Rublix is currently developing employs the programming language Java, and will feature a user-friendly, aesthetically pleasing interface to encourage traders and investors to participate in new cryptocurrency markets. Rublix is doing this by using a team of UX and creative designers to research and develop what will be a visually and functionally advanced digital trading space. Finally, Rublix is creating a proprietary wallet called Centurio. Currently in alpha stage, this wallet will be used to store Rublix native cryptocurrency (RBLX). User experience and aiding traders of all levels of sophistication are paramount for Rublix and these tools may only be the beginning for the company, as noted by CEO and co-founder David Waslen. “We’re at the stage of establishing and building a name for ourselves within the space by bringing a revolutionary product to life. We are using smart contracts and blockchain technology to build a trading ecosystem based on trust and transparency, which is completely different from current modern-day social trading platforms. Our plans are to integrate our Hedge application with ‘TradersEdge,’ allowing us to maximize efficiency between the knowledge learned on Hedge and executing efficient cryptocurrency trades via TradersEdge.” Token Sale Rublix also has an upcoming token sale event, which will be conducted through the Ethereum blockchain. Eventually, the team plans to transition to their own blockchain, likely through a token swap. The Rublix crowdsale and token distribution will establish interested parties with tokens to be used on the platform. Says co-founder and lead developer Peter Danihel: “Our intent is to disrupt the trading market by implementing a clear and concise trading tool that rewards experienced users for high-quality information. We seek to incentivize traders that have great information and reputable trading tips so that others in the market can learn from their analysis. Realizing that the feeling of not knowing where to start can be daunting for any newcomer in this industry, the ultimate goal for Rublix and Hedge is to pair experienced traders with newcomers, filling the void in the marketplace.” Looking ahead at the Rublix roadmap, Waslen said, “Our long-term vision with Rublix is to continue to add unique financial-based tools to our lineup that support our mission of merging modern-day finance with the cryptocurrency sector. We are in an exciting technological era with the emergence of blockchain technology and we envision helping newcomers enter the sector as well as using the technology to help traders prosper in any industry from anywhere in the world.” The post The Rublix Vision for Crypto Investing appeared first on Bitcoin Magazine. |

ADP is slipping after winning its proxy battle against Bill Ackman (ADP)

|

Business Insider, 1/1/0001 12:00 AM PST

ADP has been battling Bill Ackman to fend off the addition of three Ackman-friendly directors to the company's board. On Tuesday, the final vote came in and ADP's shareholders decided to deny Ackman his seats. Shares of ADP are down 1.24% to $109.95 after the vote. Ackman disclosed an 8% stake in the HR software giant when he started his proxy fight in August and had said he didn't plan on selling his shares if the vote didn't go his way. The investor said he would continue calling for changes at the company to increase margins and profitability. Under the tenure of CEO Carlos Rodriguez, shares have almost doubled, but Ackman started his proxy fight by saying that shares could double again if the company focused on increasing shareholder value. Shares have moved 7.57% higher over the last year. Read more about Ackman's fight with ADP here.

SEE ALSO: Bill Ackman suffers a big blow in his effort to shake up ADP Join the conversation about this story » NOW WATCH: THE BOTTOM LINE: A market warning, the big bitcoin debate and a deep dive on tech heavyweights |

Will SegWit2x Lead to Major Bitcoin Price Decline by End of November?

|

CryptoCoins News, 1/1/0001 12:00 AM PST […] The post Will SegWit2x Lead to Major Bitcoin Price Decline by End of November? appeared first on CryptoCoinsNews. |

The US dollar is nearing a 4-month high

|

Business Insider, 1/1/0001 12:00 AM PST

The dollar is higher, nearing its best level in four months. The US dollar index was up by 0.4% at 95.11 at 8:41 a.m. ET. Later on Tuesday, we will hear from two Federal Reserve policy makers: outgoing chair Janet Yellen and Randal Quarles, who recently joined the board of governors. Yellen's speech comes less than one week after President Donald Trump's announcement that he will replace her with Jerome Powell at the end of her term in February 2018. As for Quarles, he will be taking part in a discussion on financial regulation in what will be his first extensive comments since taking up the job. "Typically it would be Yellen’s comments that would be of most interest but under the circumstances, it may be Quarles that most are interested in hearing from," Craig Erlam, senior market analyst at OANDA, said in emailed comments. "Yellen’s term will end in February and a rate hike in December is almost entirely priced in, leaving us with little to potentially take from her message, especially given the number of positions still to be filled on the board." As for the rest of the world, here was the scoreboard at 8:47 a.m. ET:

SEE ALSO: Millions of American adults are not allowed to vote — and they could change history Join the conversation about this story » NOW WATCH: THE BOTTOM LINE: A market warning, the big bitcoin debate and a deep dive on tech heavyweights |

Bill Ackman reportedly suffers a big blow in his effort to shake up ADP (ADP)

|

Business Insider, 1/1/0001 12:00 AM PST

ADP shareholders voted against adding three directors to its board including Bill Ackman, handing a loss to the activist investor after a three-month long campaign, The Wall Street Journal and Bloomberg reported on Tuesday. The billionaire founder of the hedge fund Pershing Square has engaged in a bitter proxy battle with the HR-software provider, calling for sweeping changes including the replacement of CEO Carlos Rodriguez. Ackman, whose hedge fund disclosed an 8% stake in the $49 billion company in August, said the company's margins were "vastly below" what they could be. He said ADP's stock price could double in five years without the company needing to change its dividend or capital structure. ADP shares were down by less than 1% in premarket trading on Tuesday. SEE ALSO: Disney has reportedly been in talks to buy most of 21st Century Fox Join the conversation about this story » NOW WATCH: THE BOTTOM LINE: A market warning, the big bitcoin debate and a deep dive on tech heavyweights |

Short-Lived Rebound? Bitcoin Struggles to Retake $7,200

|

CoinDesk, 1/1/0001 12:00 AM PST Bitcoin prices dropped to a four-day low below $6,950 yesterday before regaining some poise. So has the pullback run out of steam? |

Here's a super-quick guide to what traders are talking about right now

|

Business Insider, 1/1/0001 12:00 AM PST

Dave Lutz, head of ETFs at JonesTrading, has an overview of today's markets.

Here's Lutz:

Read about the 10 things you need to know today...SEE ALSO: 10 things you need to know before the opening bell Join the conversation about this story » NOW WATCH: THE BOTTOM LINE: A market warning, the big bitcoin debate and a deep dive on tech heavyweights |

“A Very Important Step in Bitcoin’s History”: CME Pioneer Heralds New Asset Class

|

CryptoCoins News, 1/1/0001 12:00 AM PST The founder of financial futures and former chairman of the CME Group is bullish on bitcoin. The post “A Very Important Step in Bitcoin’s History”: CME Pioneer Heralds New Asset Class appeared first on CryptoCoinsNews. |

Bitcoin2X is Just Around the Corner: What You Should Know

|

CryptoCoins News, 1/1/0001 12:00 AM PST […] The post Bitcoin2X is Just Around the Corner: What You Should Know appeared first on CryptoCoinsNews. |

10 things you need to know before the opening bell (SPY, SPX, QQQ, DIA, DIS, FOXA, QCOM, BRCM)

|

Business Insider, 1/1/0001 12:00 AM PST

Here is what you need to know. The US dollar nears a 4-month high. The US Dollar Index trades up 0.36% at 95.09 and is threatening its best level since the middle of July. The Reserve Bank of Australia is worried about household debt. The central bank held its benchmark interest rate at 1.50% and warned, "Household incomes are growing slowly and debt levels are high." Oil hits its best level in 2.5 years. Brent crude oil hit $64.65 early Tuesday as political tensions in Saudi Arabia remain elevated. Goldman Sachs says Bitcoin could get close to $8,000. "It exceeded an equality target from the July low at 6,044," Goldman Sachs technical head Sheba Jafari wrote. "This break indicated potential for an impulsive advance, one that could reach at least 7,941." Disney has reportedly been in talks to buy most of 21st Century Fox. A deal would exclude Fox broadcast network and Fox's sports channels, according to CNBC's David Faber. Broadcom offers to buy Qualcomm in the largest tech deal ever. The offer of $60 in cash and $10 a share in Broadcom shares values Qualcomm at about $130 billion on a pro forma basis, including $25 billion of net debt. Salesforce reveals its 2019 guidance. A press release issued at Salesforce's 170,000-person tech conference said the company expects to finish its next fiscal year with revenue of between $12.45 billion and $12.5 billion, making for about 20% growth versus the current year. Stock markets around the world are mixed. Japan's Nikkei (+1.73%) led the advance in Asia and Britain's FTSE (-0.17%) lags in Europe. The S&P 500 is set to open little changed near 2,591. Earnings reporting remains heavy. Mallinckrodt and Valeant report ahead of the opening bell while Snap releases its quarterly results after markets close. US economic trickles out. JOLTS Job Openings will be released at 10 a.m. ET. The US 10-year yield is up 1 basis point at 2.33%. |

10 things you need to know before the opening bell (SPY, SPX, QQQ, DIA, DIS, FOXA, QCOM, BRCM)

|

Business Insider, 1/1/0001 12:00 AM PST

Here is what you need to know. The US dollar nears a 4-month high. The US Dollar Index trades up 0.36% at 95.09 and is threatening its best level since the middle of July. The Reserve Bank of Australia is worried about household debt. The central bank held its benchmark interest rate at 1.50% and warned, "Household incomes are growing slowly and debt levels are high." Oil hits its best level in 2 1/2 years. Brent crude oil hit $64.65 early Tuesday as political tensions in Saudi Arabia remain elevated. Goldman Sachs says bitcoin could close in on $8,000. "It exceeded an equality target from the July low at 6,044," Goldman Sachs technical head Sheba Jafari wrote. "This break indicated potential for an impulsive advance, one that could reach at least 7,941." Disney has reportedly been in talks to buy most of 21st Century Fox. A deal would exclude the Fox broadcast network and Fox's sports channels, according to CNBC's David Faber. Broadcom offers to buy Qualcomm in the largest tech deal ever. The offer of $60 in cash and $10 a share in Broadcom shares values Qualcomm at about $130 billion on a pro forma basis, including $25 billion of net debt. Salesforce reveals its 2019 guidance. A press release issued at Salesforce's 170,000-person tech conference said the company expected to finish its next fiscal year with revenue of $12.45 billion to $12.5 billion, making for about 20% growth versus the current year. Stock markets around the world are mixed. Japan's Nikkei (+1.73%) led the advance in Asia, and Britain's FTSE (-0.17%) lags in Europe. The S&P 500 is set to open little changed near 2,591. Earnings reporting remains heavy. Mallinckrodt and Valeant report ahead of the opening bell, while Snap releases its quarterly results after markets close. US economic trickles out. Jolts Job Openings will be released at 10 a.m. ET. The US 10-year yield is up 1 basis point at 2.33%. |

20 banks applied for new EU banking licences as they prepare for Brexit, a senior ECB official says

|

Business Insider, 1/1/0001 12:00 AM PST

As many as 20 lenders have applied for new EU banking licences as they make preparations for a shift in Europe's financial services landscape after Brexit, one of the European Central Bank's most senior figures has said. Speaking on Tuesday, Daniele Nouy said that nearly two dozen applications for licences are "already being assessed," following the UK's decision last year to leave the EU. "It's about 20 that have something that is already being assessed," Nouy, who is Chair of the ECB's Supervisory Board said, according to a report in the Financial Times. "Maybe they have not signed it, but they have made a pretty comprehensive application that can be formalised very fast." Under current rules, Britain is under the jurisdiction of the so-called financial passport — a set of rules and regulations that allow UK based financial firms to access customers and carry out activities across Europe. Many non-EU lenders use the passport to operate a hub in the UK and then sell services across the 28-nation bloc. Once Britain leaves the EU, however, it is almost certain to lose passporting rights, which are tied strongly to membership of the European Single Market, a marketplace the UK intends to leave as part of Brexit. As a result, major lenders — especially those from the USA and Japan — are making preparations to set up new hubs in continental Europe so that they can continue serving their customers in Europe without any disruption. Banks need at least a year to set up fully functioning branches and subsidiaries in Europe to maintain activities, so are starting the process now. Nouy is the head of the Single Supervisory Mechanism, which has final oversight of granting banking licences for all eurozone member states, and as a result is the body with the biggest say in the new licences banks need after Brexit. Major lenders are all expected to shift staff out of the UK as a result of Brexit, with Japanese banks the fastest on the draw. Four big Japanese banks, MUFG, Nomura, Daiwa, and Sumitomo Mitsui have all announced new EU HQs, with three choosing Frankfurt, and one, MUFG, opting for the Dutch capital Amsterdam. American giant Citigroup also confirmed that it will send some staff to Frankfurt, while Goldman Sachs CEO Lloyd Blankfein recently tweeted that he'd be "spending a lot more time" in the city. Join the conversation about this story » NOW WATCH: I spent a day trying to pay for things with bitcoin and a bar of gold |

One of the world's hottest investment strategies is slowing — and that could shift the whole landscape

|

Business Insider, 1/1/0001 12:00 AM PST

Known as "smart beta," it takes the passive approach of mirroring an index and combines it with the more analytical practice of stock picking. And that fundamental overlay usually adheres to a predetermined investment style, such as low-volatility or high-growth. The ability to straddle that line has translated into an area of serious growth for exchange-traded fund providers looking to capture the massive flow of capital into passive strategies while also proving their bona fides as active managers. But unfortunately for those providers looking to break into smart beta, the window to get involved appears to be closing. Only 36 new smart-beta funds have been launched this year, on pace for the lowest annual number since 2014, according to data compiled by Goldman Sachs.

'Smart beta ETFs are facing increasing pressure'"The economics in smart beta ETFs are facing increasing pressure," a group of analysts led by Alexander Blostein wrote in a client note. "Market share is ultimately consolidating among top players, fees are migrating lower and the limited success of several recent launches could discourage others from entering the space." Goldman offers three clear-cut reasons that fund managers may be discouraged from entering the smart-beta space: