Chilean Bitcoin Exchange SurBTC Raises $300k

|

CoinDesk, 1/1/0001 12:00 AM PST Chilean bitcoin exchange SurBTC has closed a $300,000 seed funding round. |

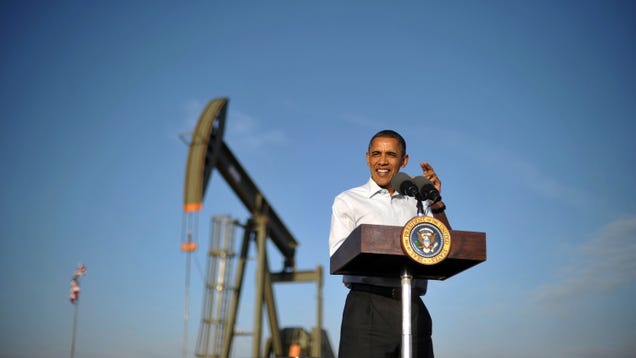

Obama Wants to Tax Oil Companies and Give the Money to Green Transportation Projects

|

Gizmodo, 1/1/0001 12:00 AM PST

Oil is at its lowest price in decades which has many people worrying about what burning that cheap oil will do to an already crippled planet. Now President Obama is proposing something pretty ambitious: Taxing oil companies to pay for cleaner transportation infrastructure. |

IBM Supports Linux Foundation's Hyperledger Blockchain as Industry Standard, Plans Deployment

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST In December Bitcoin Magazine reported that IBM and a group of top tech and finance companies are joining forces to develop a new open source blockchain separated from the Bitcoin blockchain. The group will work with the Linux Foundation to create a public network that lets blockchain applications built on top of it communicate with each other. Digital Asset Holdings, the fintech startup headed by the financial superstar Blythe Masters, is contributing its Hyperledger mark, which will be used as the project name, as well as enterprise grade code and developer resources. Digital Asset Holdings bought San Francisco-based Hyperledger in June. Now IBM is starting to reveal some details of its blockchain projects and strategy. In an interview with IT analyst David Strom published in IBM’s online magazine Security Intelligence, John Wolpert, IBM’s blockchain offering director, said that IBM will eventually have hundreds of developers working on various blockchain projects. IBM didn’t invent blockchain technology but plans to take a leading role in its development, with an approach similar to IBM’s Java developments. “[Java] wasn’t our technology, but we got behind it and put an army against it,” Wolpert said. “At its height, thousands were working on Java-related projects.” Wolpert is responsible for engineering, products and open source initiatives at IBM. Previously, he was head of products for IBM’s Watson Ecosystem – IBM’s ambitious Artificial Intelligence (AI) project – and a successful entrepreneur before joining IBM. At the forthcoming Block Chain Conference on February 10 in San Francisco, Wolpert will give a keynote presentation titled “How to Make Block Chain Real for Business.” The address will focus on IBM’s point of view in this space and its contribution to the open source community led by the Linux Foundation. The open source community is aimed at accelerating the maturity of this shared ledger technology, through a collective, open and coordinated approach. Wolpert said that Hyperledger code will become an open source industry standard, eventually available on Github just like other open-source software, and developers will be able to build applications on top of Hyperledger. “There are going to be lots of people who will compete on providing solutions,” he said. “We will try to get the best minds across the industry to work together on this code.” Developers will be able to deploy Hyperledger applications on the IBM Cloud, a collection of fully integrated services to help IBM clients use data across all digital channels to understand their customers and anticipate their needs. According to the company, IBM Cloud is the first full spectrum cloud built on open technologies, with the world’s most advanced analytics and cognitive computing toolbox. “We intend to be the best place and fastest place to get blockchain technologies running,” said Wolpert. “We are moving assets on a massive scale in ways that we never thought of before and doing so automatically and without any human intervention. It isn’t just the data, but using the transaction log of the data in new and interesting ways.” The recent U.K. Government Office for Science report ““Distributed Ledger Technology: Beyond Block Chain” noted that the strong association of blockchain technology with Bitcoin represents an important problem when it comes to communicating the potential benefits of distributed ledgers. Wolpert agrees, and adds that many banks and other traditional financial institutions were hesitant to be associated with blockchains because of Bitcoin. But IBM’s strategy is more focused on non-banking applications of blockchain technology. “Now people are talking about how they can use blockchains without endorsing any shadow currencies, and everyone is excited,” said Wolpert. “It has gone beyond being a fad.” Wolpert is persuaded that blockchain technology could have many important non-currency applications, and, in particular, that it could be a solid foundation for more efficient supply chain networks. Photo Patrick / Flickr(CC) The post IBM Supports Linux Foundation's Hyperledger Blockchain as Industry Standard, Plans Deployment appeared first on Bitcoin Magazine. |

Bitcoinj Maintainer Andreas Schildbach: Segregated Witness worth the Effort

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST The long-lasting block size dispute has catapulted into the center of attention again. One of the most talked-about developments is Segregated Witness, of which a public testnet iteration – SegNet – waslaunched in January. The innovation as recently proposed by Blockstream co-founder and Bitcoin Core developer Dr. Pieter Wuille is a centerpiece of a scalability “roadmap” set out by Bitcoin Core. To find out where the broader development community stands on Segregated Witness, Bitcoin Magazine reached out to library and wallet developers, those who will need to do the heavy lifting in order to utilize the innovation once rolled out. In part 7 of this series: Bitcoin Wallet developer and bitcoinj maintainer Andreas Schildbach. Segregated Witness Makes Future Extensions Easier Schildbach is the developer behind Bitcoin Wallet, the first and very popular Bitcoin wallet app for Android. He also maintains the bitcoinj Java library, which was initially created by recent R3CEV-hire Mike Hearn, and provides the basis for Bitcoin Wallet and many other wallet apps. While Segregated Witness received a lot of attention in light of the block size dispute, many developers are particularly excited about the improvements to the Bitcoin protocol that don’t concern the block size limit directly. Schildbach, too, believes Segregated Witness offers many benefits beyond just the added transaction capacity.

Segregated Witness also offers an effective block size increase to a range between 1.75 megabytes and 2 megabytes, depending on the types of transactions. Schildbach is skeptical, however, that this will be enough:

Soft Fork “Liveable” Roll-out of Segregated Witness on the Bitcoin network is currently scheduled for April. Once a super-majority of miners agrees to the solution, Segregated Witness will be activated, and can be utilized by wallet and app software. Segregated Witness is currently being integrated in bitcoinj, and Schildbach hopes that both bitcoinj and Bitcoin Wallet will be ready to utilize the benefits once the protocol change is rolled out. “I drafted a rough schedule for development,” Schildbach said. “Other developers are doing most of the work, so I can focus on code review. I’d say it can be done in a matter of weeks. Once it is done, all wallets built on bitcoinj can simply use the code with minimal effort.” The intended roll-out method of Segregated Witness through a soft fork is being contested by recent Bitcoin implementation Bitcoin Classic. While a soft fork would require only miners to upgrade, Bitcoin Classic plans to deploy a block size increase to 2-megabyte blocks through a hard fork instead, requiring all full nodes on the network to switch in unison. Schildbach shared the concerns as presented by Bitcoin Classic, and believes a hard fork to be the preferred solution.

He added, however, “That said, I can live with a soft fork, too. And I hope one day a hard fork will be used to clean up the soft-forking mess we leave behind.” For more information on Segregated Witness, see Bitcoin Magazine’s three-part series on the subject, or part 1, part 2, part 3, part 4, part 5 and part 6 of this development series. The post Bitcoinj Maintainer Andreas Schildbach: Segregated Witness worth the Effort appeared first on Bitcoin Magazine. |

Blockstream Investors See Commercial Use Cases for Bitcoin Blockchain

|

CoinDesk, 1/1/0001 12:00 AM PST Following Blockstream's $55m funding yesterday, CoinDesk speaks to investors who participated in the round. |

Deutsche Bank: Banks Must Partner with Fintech and Digital Currency Businesses or Risk Disappearing Altogether

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST The number of banks experimenting with blockchain technology and looking at their own digital currencies is growing by leaps and bounds, so it’s no surprise that Deutsche Bank is well on its way to having its own blockchain technology. In a recent statement, the bank was quoted as saying: “Banks must partner with fintech and digital currency businesses or risk disappearing altogether.” Although Deutsche Bank is a member of the R3CEV consortium of 42 banks that is developing a protocol for blockchain technology for the banking sector, the bank has been quietly running its own blockchain experiments. Recently, Bank of America JPMorgan, UBS and Bank of England have also said that their respective banks are looking at ways to adapt blockchain technology for their own use. But unlike some banks, such as Japan’s Bank of Tokyo-Mitsubishi, Citibank and BNY Mellon, Deutsche Bank is not looking at developing its own digital currency. It believes customers are looking for more digitalization and convenience, not necessarily a new currency. In a forthcoming white paper called FinTech 2.0, Deutsche Bank signals to investors and clients that it is looking at partnering with new fintech startups to accelerate the transition to digital banking, including blockchain technology. Deutsche Bank’s report is a wake-up call for the banking sector, warning that unless banks learn to partner with fintechs and “digital disruptors” they will begin to disappear altogether from the financial services landscape. Coming on the heels of Deutsche Bank’s reported record loss for 2015 and a drop in Deutsche Bank’s share price, the report notes that it’s time for the bank to adopt a new business model that recognizes the importance of digital disruption in financial services. In a wide-ranging interview with Bitcoin Magazine , Deutsche Bank Managing Director Rhomaios Ram said that the bank is more than ready to adopt new payment innovations and considers the adoption of blockchain technology inevitable. “As the white paper notes, the biggest hurdles to adoption of new technologies and partnerships are regulatory and legal requirements in different jurisdictions around the world,” said Ram. “Fintechs, and huge digital ecosystems in particular, have entered the market with a bang,” he said, noting that the report calls for a “mindset” adjustment to understand the major change in the marketplace and “that digitalization can become the new differentiator for banks.” The white paper calls on the banking sector to “modernize the entire financial system infrastructure” andpartner with new digital market forces. including cryptocurrency startups, saying, “Banks must change their attitude to fintech companies in order to survive.” Fintech startups happy to partner with Deutsche Bank Ram told Bitcoin Magazine he had met with many fintech startups and was pleasantly surprised that they were more than happy to partner with the bank. “I’ve discussed the possibility of partnerships with tens of different fintech startups, and they all seem very keen to partner with us,” Ram said. “It’s great that they see the benefits that we can bring to a potential partnership, including a client base, security and regulatory certainty.” The report lists the following projects as examples of “payment innovators”: PayPal, M-Pesa, Bitcoin, Alipay, Stripe, Payoneer, Samsung Pay, Apple Pay, Square and Google Wallet. In the spirit of cooperation, JPMorgan Chase already has teamed up with Digital Asset Holdings on a trial blockchain initiative that aims to make the trading process more efficient and cost-effective. What’s in it for the new fintech company? The white paper notes: “In order to maintain their position, they must find a way to meet their regulatory, investment and risk needs in order to focus on their core competencies. They may find partnering with a global banking provider to be the most strategic approach in this regard, and many of the developments of coming years will likely evolve within such alliances. Several market leaders have realised that bank alliances are the way forwards.” Deutsche Bank experiments with three blockchain labs According to Ram, Deutsche Bank currently operates three innovation labs in Berlin, London and one soon to be launched in Silicon Valley. Calling blockchain technology “genius,” Ram said they haven’t settled on one version yet of the various technologies being developed. “We’re blockchain ‘agnostics’ – we’re interested in and studying the benefits of all the various blockchain technologies including Bitcoin, Ethereum, Stellar and others – to ensure we’re adopting the best possible version for our use,” he said. In early December 2015, Deutsche Bank announced it had successfully tested a corporate bond platform that was based on blockchain technology. Blockchain technology “smart contracts” were used to issue and redeem bonds that paid out coupons automatically. On bitcoin as a currency, Ram isn’t sure what the future holds for the digital currency, saying: “As far as bitcoin as a future currency, I’m not sure whether universal adoption is a sure thing. The public seem most interested in the digitalization and convenience of new faster payment methods more than a change in the currency itself.” Photo Epizentrum / Creative Commons The post Deutsche Bank: Banks Must Partner with Fintech and Digital Currency Businesses or Risk Disappearing Altogether appeared first on Bitcoin Magazine. |

Bitcoin Price Breaks Above Resistance

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin price followed a gold price move that broke above resistance today. The move, in both charts, comes as a surprise and we have to adjust our outlook. This analysis is provided by xbt.social with a 3-hour delay. Read the full analysis here. Not a member? Join now and receive a $29 discount using the […] The post Bitcoin Price Breaks Above Resistance appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Commonwealth Encourages Member Nations to Deem Bitcoin Legal

|

CryptoCoins News, 1/1/0001 12:00 AM PST In a new report, the Commonwealth of Nations has called for the acknowledgement and legislation of virtual currencies by its member nations. A new Commonwealth report – the result of research conducted by the Commonwealth Virtual Currencies Working Group – has broadly spoken toward the impact of virtual currencies like Bitcoin and called for […] The post Commonwealth Encourages Member Nations to Deem Bitcoin Legal appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

New App Seeks to Use Blockchain as Immutable Answering Machine

|

CoinDesk, 1/1/0001 12:00 AM PST LedgerAssets, developer of an app that timestamps users photos on bitcoin's blockchain, is to launch a similar application for phone calls. |

South Africa has a lot of problems

|

Business Insider, 1/1/0001 12:00 AM PST

South Africa's economy is not looking good. The country's latest data were worse than economists were expecting, and now analysts are raising questions about South Africa's long-term outlook. Arguably, the most worrying data point was January's Manufacturing PMI, which fell to 43.5. That makes six consecutive readings below 50, which indicates a contraction. "The dire performance of the manufacturing sector is especially disappointing given the depreciation of the rand, which has boosted external competitiveness," argues Capital Economics' Africa economist John Ashbourne.

"Unlike many African peers, the South African mining industry was struggling before commodity prices fell: gold production has halved since 2005 as a result of rising costs and the depletion of reserves at aging mines," he added.

But even that's not a great gamble for the struggling economy. "We doubt that highly indebted South African consumers can continue to ramp up spending indefinitely, and have long argued that the economy is effectively living on borrowed time," he argued. And if all of that weren't enough, Ashbourne also notes that there are a number of "potential crises" and structural issues that could be major headwinds: "The decaying electricity grid could yet collapse, spurring a prolonged power crisis. Labor relations remain fraught; another round of strikes could cripple the mining sector. And it is increasingly likely that South Africa credit rating will be downgraded to junk. Unemployment will probably remain among the highest in the world. ... Political protests are already becoming more common, and a sustained period of economic stagnation will raise tensions and cause more South Africans to question the political and economic bargain that underpins the post-Apartheid settlement." As for what all of this means growth wise, Ashbourne writes that Capital Economics analysts have downgraded their 2016 forecast for South Africa's economy to a "sclerotic" 0.5%, below consensus, and 1.3% in 2017. That would make "South Africa one of the world's worst-performing major economies. Even if the economy narrowly avoids a recession, per capita incomes will fall as the population grows," he noted grimly. "The key risk in South Africa is not an acute crisis, but a period of stagnation that could strain the country's political and economic institutions to the breaking point." In two words: not good. SEE ALSO: The famous last words of 18 famous people |

Greenbank Capital Looks to Keep the Bad Guys Away with GreenCoinX

|

CryptoCoins News, 1/1/0001 12:00 AM PST Publicly traded Canadian Greenbank Capital Inc (CSE:GBC and OTCMKTS:GRNBF) has announced that the offering of a cryptocurrency that focuses on user identification in contrast to Bitcoin’s and other altcoin’s user anonymity policies. Citing recent concerns by some figures in the public sector and financial sector about Bitcoin and other cryptocurrencies being good opportunities for illegal […] The post Greenbank Capital Looks to Keep the Bad Guys Away with GreenCoinX appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Greenbank Capital Looks to Keep the Bad Guys Away with GreenCoinX

|

CryptoCoins News, 1/1/0001 12:00 AM PST Publicly traded Canadian Greenbank Capital Inc (CSE:GBC and OTCMKTS:GRNBF) has announced that the offering of a cryptocurrency that focuses on user identification in contrast to Bitcoin’s and other altcoin’s user anonymity policies. Citing recent concerns by some figures in the public sector and financial sector about Bitcoin and other cryptocurrencies being good opportunities for illegal […] The post Greenbank Capital Looks to Keep the Bad Guys Away with GreenCoinX appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Polish Programmer Claims He Is Not Satoshi Nakamoto

|

CryptoCoins News, 1/1/0001 12:00 AM PST The latest individual, or in this case, pair of individuals suspected of being Bitcoin creator Satoshi Nakamoto, has denied accusations. Pawel Pszona, a Polish programmer was believed by username BountyHunter2012 to be Satoshi Nakamoto. Pszona published a Master’s thesis paper in 2007 as a student with the help of his professor Dr. Grzegorz Stachowiak titled […] The post Polish Programmer Claims He Is Not Satoshi Nakamoto appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Why the banks that are going crazy for blockchain technology don't care about bitcoin's problems

|

Business Insider, 1/1/0001 12:00 AM PST

Here's a paradox. Financial institutions like top banks and stock exchanges are hugely excited about blockchain technology, the databasing protocol that underpins bitcoin. But as the blockchain hype in mainstream finance has grown, bitcoin itself has faced more and more problems. The decentralized network is facing issues with capacity because of a technical limit on how many transactions the blockchain can process per second. As all this is going on, 42 investment banks have signed up to a consortium experimenting with blockchain technology, banks like JPMorgan and pouring cash into startups experimenting with the stuff, and Goldman Sachs has declared the technology can change "well, everything." So how can they all be so excited if the original blockchain is showing cracks? The answer is because banks are planning to use private replicas of the technology, rather than the original blockchain that underpins bitcoin (or an analogous public blockchain). Chad Cascarilla, CEO of New York-based blockchain and bitcoin company itBit, told Business Insider: "In a public blockchain, you’re trying to get everyone all over the world to agree to changes at the same time. In a private one, you’re not. You’re really just saying you trust everybody that’s on that network because you’ve all agreed to join it. You don’t have these same computational issues that you do when it’s public." If bitcoin's blockchain is the internet, then the private blockchains are the intranet. Only a limited number of people are given access to it, but you still have the benefit of decentralization — identical records are shared across each organisation and updated simultaneously — and the security of cryptography, which means transactions can't be amended once signed off on. You can cut cost, gain speed, and get security benefits without the processing power burden.

The bitcoin system awards bitcoins to people who crunch through the transactions that are waiting to be verified and added to the blockchain — at which point they are official and cannot be changed. By using this economic incentive, bitcoin has been able to transform the concept of "trust" in a transaction from something centralized, where a Central Banks or clearing house would verify all transactions, into something decentralized — anyone can come along and verify it and they get a reward for doing so. "When it’s public, that makes sense, what else are you going to do?" says Cascarilla. "You’ve got to limit access to this thing and as you said, there are real costs to maintaining it. Those are the trade-offs." But there's a problem with the way the system is set up — the more people join the network, the harder it becomes to add transactions to bitcoin blockchain. As a result, more and more computational power is needed (and the rewards get smaller too). On top of this, the system is facing issues with transaction processing because of the sheer volume of them. In the private blockchains that banks are looking at, that's not a problem because the incentive for signing off on transactions isn't a monetary reward, it's cost saving in the form of reducing middle men and speeding up processing times. Cascarilla says: "You’re appealing to the enlightened self-interest. Everyone wants to have a similar database to the other. It doesn’t cost you that much to run a database if you permission people to join. In a private distributed database, like a private blockchain, you don’t need to restrict access [in the same way bitcoin's blockchain does]." You’re appealing to the enlightened self-interest. Some in the blockchain space have criticised this private approach. The former head of Barclay's technology division in Europe, the Middle East, and Africa Anthony Watson told BI he believes the approach is "cynical," with the banks' customers unlikely to see any benefits. Watson now runs Uphold, a cloud money platform aiming to bring the benefits of blockchain technology to everyday consumers. itBit, founded in 2012, runs a bitcoin exchange but has also developed Bankchain, an off-the-shelf blockchain solution for banks and other financial institutions that can be adapted for everything from gold trading to clearing securities. Cascarilla says his company, one of the first bitcoin companies to be regulated by the New York State Department of Financial Services, is in conversation with multiple banks who are interested in running proof of concepts. So how is it to replicate bitcoin's blockchain or build a different type of private blockchain? "About as easy as it is to build any other kind of database, which means it can be very hard or it can be just hard," says Cascarilla. "The difficulty is coming up with a way to have consensus between different people on the database, so everyone agrees what’s on it. That’s the real innovation that was created. That’s where the science is still new. Even today, common databases are complex to manage." Join the conversation about this story » NOW WATCH: Disgraced pharma CEO Martin Shkreli dissed a Wu-Tang Clan member in a hostile video |

Bitcoin Group Raises 5.9 Million AUD, Falling Far Short Of Its Goal As It Seeks ASX Listing

|

CryptoCoins News, 1/1/0001 12:00 AM PST The Bitcoin Group, a Melbourne, Australia-based bitcoin miner, raised 5,927,168.40 AUD in an initial public offering for its long-anticipated listing on the Australian Stock Exchange (ASX), significantly missing its 20 million AUD target. The company announced it is working with ASX on the listing application process as it seeks to become the world’s first publicly-listed bitcoin […] The post Bitcoin Group Raises 5.9 Million AUD, Falling Far Short Of Its Goal As It Seeks ASX Listing appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

10 things you need to know in markets today

|

Business Insider, 1/1/0001 12:00 AM PST

Good morning! Here's what you need to know in markets on Thursday. Credit Suisse swung to a loss in the fourth quarter as it wrote off billions of dollars in goodwill, set aside provisions for litigation and booked a multi-billion-dollar loss in its main trading unit. Bloomberg reports that the bank gave up 5.83 billion Swiss francs (£3.9 billion, $5.8 billion) during the final, rocky months of 2015, including a 3.8 billion-franc impairment that exacerbated its quarterly loss. It was a wild day on Wall Street on Wednesday with stocks opening higher, nose-diving in the morning, and then spiking higher as the Dow gained triple-digits. The tech-heavy Nasdaq closed in the red. But the Dow closed up 183 points overnight in the US. Oil's rally continues, albeit at a slower pace. After jumping 8% on Wednesday, UK Brent is up 0.94% to $35.37 (£24.28) at the time of writing (6.30 a.m. GMT/1.30 a.m. ET) and US crude is up 0.98% to $32.87 (£22.56). Asian stock markets are mixed. Japan's Nikkei closed down 0.81%, Hong Kong's Hang Seng is up 1.42% at the time of writing (6.30 a.m. GMT/1.30 a.m. ET) and China's benchmark Shanghai Composite is up 1.34%. It's interest rate day at the Bank of England. The bank is expected to hold the headline rate unchanged at 0.5% when it delivers its latest decision at 12.00 p.m. GMT (7.00 a.m. ET). The Bank will release minutes and a Monetary Policy Statement at the same time, followed by a speech from Bank of England Governor Mark Carney at 12.45 p.m. GMT (7.45 a.m. ET). Lloyds is cutting another 1,755 jobs and closing 29 branches as it looks to increasingly automate its operations. It is being widely reported that staff at the bank were told on Wednesday afternoon that Lloyds will lower its employee numbers as part of a broader restructuring, announced last year, that will see 9,000 staff cut by the end of 2017. Deutsche Bank must face a US lawsuit seeking to hold it liable for causing $3.1 billion (£2.1 billion) of investor losses by failing to properly monitor 10 trusts backed by toxic residential mortgages, a federal judge ruled on Wednesday. US District Judge Alison Nathan in Manhattan said Belgium's Royal Park Investments SA/NV may pursue claims that the trustee Deutsche Bank ignored "widespread" deficiencies in how the underlying loans were underwritten and serviced, and failed to require that bad loans be repurchased. The CEO of South Africa's main power supplier, Eskom, told a group of reporters that Glencore — the massive international commodities trader — threatened to cripple the country's power supply over the summer, Bloomberg reports. Glencore wanted Eskom to renegotiate its coal contract in July and pay a higher rate — 530 rand per metric ton instead of 150 rands per metric ton. Cisco said on Wednesday it was buying Jasper Technologies, a startup that connects devices like cars and medical devices to the Internet, for $1.4 billion (£960 million) in cash and equity awards, its largest acquisition since 2013. The so called Internet of Things, the area Jasper specializes in, offers Cisco a chance to offer cutting-edge technology to its current customers such as telecommunications companies. GoPro reported really ugly fourth-quarter results on Wednesday. The digital-camera maker posted an unexpected earnings loss as its growth slowed and new products failed to catch on with consumers as expected. Join the conversation about this story » NOW WATCH: These are the watches worn by the smartest and most powerful men in the world |

India: Moving a Billion People into Digital Finance

|

CryptoCoins News, 1/1/0001 12:00 AM PST Digital finance has great potential to improve life for consumers and merchants in India. But the lack of familiarity has impeded digital money’s growth in the country. This lack of awareness exists despite India Prime Minister Narendra Modi’s national mission for financial inclusion. To help improve India’s digital future, the United States Agency for International […] The post India: Moving a Billion People into Digital Finance appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Moreover, "this soft patch for the manufacturing sector comes at a time when South Africa's crucial mining sector seems locked in structural decline," he continues.

Moreover, "this soft patch for the manufacturing sector comes at a time when South Africa's crucial mining sector seems locked in structural decline," he continues. Notably, all of this bad news from the manufacturing and mining sectors have led South Africa to be "unhealthily dependent" on its service sector.

Notably, all of this bad news from the manufacturing and mining sectors have led South Africa to be "unhealthily dependent" on its service sector. .jpg)

Cascarilla continues: "Bitcoin is a public database. In order to ration access, you basically have to buy a bitcoin — you’re price rationing access to a database."

Cascarilla continues: "Bitcoin is a public database. In order to ration access, you basically have to buy a bitcoin — you’re price rationing access to a database."