Prosecutors Set to Indict Suspect in Bitcoin Mine Stabbing

|

CoinDesk, 1/1/0001 12:00 AM PST Swedish prosecutors are set to indict an individual arrested following a deadly assault at a data center in Boden, Sweden, used by KnCMiner. |

The Fifth Amendment and Bitcoin Private Keys: The Battle is About to Begin

|

CoinDesk, 1/1/0001 12:00 AM PST Baker Marquart partner Brian Klien discusses a recent federal court case and its implications for the bitcoin and blockchain industry. |

European Central Bank is Open to Blockchain Technology

|

CryptoCoins News, 1/1/0001 12:00 AM PST The European Central Bank (ECB) has revealed that it is taking a close look at exploring the potential of blockchain technology for a multitude of services that it helps collaborate with other central banks in Europe. The European Union’s central bank has, in a report, revealed that it is looking toward new innovations such as […] The post European Central Bank is Open to Blockchain Technology appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Bitcoin Core Developer Eric Lombrozo on Misunderstandings in Block Size Debate

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Bitcoin Core contributor and Ciphrex CEO Eric Lombrozo was recently interviewed on Epicenter Bitcoin, and he used a portion of his time to explain some misconceptions and misunderstandings related to the block size limit debate. While the focus of this development controversy has mainly centered on the actual block size metric in the Bitcoin protocol, Lombrozo says this misses the main point of disagreement. In his view, a hard fork is what the Bitcoin Core development community would like to avoid over the short term. The Hard Fork Is the Issue When explaining the full picture of the block size debate, Lombrozo made the point that the non-technical Bitcoin community (likely a reference to Bitcoin subreddits) may not have had the full picture of what was going on in the development community back in May of 2015. Lombrozo described the debate that took place among developers during this period of time:

Although progress has been made on the simplicity of soft fork deployments, hard forks are still hard. At the recent Blockchain Agenda Conference in San Diego, Lombrozo detailed BIP 9, which allows for several new features to be applied to Bitcoin via simultaneous soft forks. Contentious Hard Forks Should Be Avoided Getting deeper into the problems with hard forks, Lombrozo made it clear that such changes to Bitcoin’s consensus rules are not impossible. Instead, he said contentious hard forks are the ones that should be avoided. Lombrozo noted:

Bitcoin Classic is a new implementation of the Bitcoin protocol with an increased block size limit of 2 megabytes. This change in the block size limit would require a hard fork, and it is enabled 28 days after 750 of the last 1,000 blocks have been found by miners who support the increase. Many Bitcoin Core contributors find this hard fork to be contentious and would like to see something in the 90 to 95 percent social consensus range. Although an intentional hard fork has never been attempted on the Bitcoin network (Note: One change implemented in 2010 and activated in 2012 had implications somewhat similar to a hard fork), 95 percent approval from miners has been the standard for past soft forks. We All Want Bigger Blocks Lombrozo said everyone would like to see the Bitcoin network scale via an increased block size limit. He explained:

In other words, Bitcoin Core contributors would like to see a solution to the block size limit issue that does not involve a contentious hard fork. Segregated Witness Is the Best of Both Worlds Until recently, the concept of increasing the block size limit while also avoiding a hard fork was theoretical. Bitcoin Core Developer Pieter Wuille presented Segregated Witness (SegWit) at the Scaling Bitcoin Hong Kong Workshop to near-universal acclaim. Lombrozo described how this solution provides developers with the best path forward:

Some detractors of the SegWit soft fork have noted the changes to Bitcoin wallets required by this proposal are too cumbersome, but Lombrozo said that the wallet developers he’s worked with have been able to implement the required changes in a few days. The Bitcoin Core website also lists the wallet providers who plan to support SegWit. The Soft Fork Is Almost Like a No-Brainer In Lombrozo’s view (and Bitcoin Core’s view according to their roadmap), the Segregated Witness soft fork is nearly a no-brainer. The Ciphrex CEO explained:

Lombrozo went on to say that there is general consensus among the Bitcoin Core development community that the network cannot handle blocks much bigger than 2 megabytes right now. This means a hard fork to anything over 2 megabytes would likely not gain social consensus among Bitcoin Core contributors. Segregated Witness also comes with a variety of benefits unrelated to the block size limit, which Lombrozo has discussed in the past. Kyle Torpey is a freelance journalist who has been following Bitcoin since 2011. His work has been featured on VICE Motherboard, Business Insider, RT’s Keiser Report and many other media outlets. You can follow@kyletorpeyon Twitter. The post Bitcoin Core Developer Eric Lombrozo on Misunderstandings in Block Size Debate appeared first on Bitcoin Magazine. |

This fintech startup's biggest business is looking after $116 million in a speculative, non-tradable, virtual cryptocurrency

|

Business Insider, 1/1/0001 12:00 AM PST

The CEO of fintech startup Uphold told Business Insider it is doing everything "by the book" after a Reddit post drew attention to the fact that it is holding over $100 million (£69.7 million) of a speculative virtual cryptocurrency issued by a separate company set up by Uphold's cofounder. Uphold is a startup that lets people store regular currency, digital currency, and precious metals in digital wallets. Clients can easily switch between assets for low fees. It was the subject of a thread published on Reddit on Sunday that gathered more than 140 comments. The post drew attention to the fact that Uphold currently holds $116 million (£80 million) of a digital currency named "Voxel" in accounts on behalf of clients. Voxel is an as-yet untradable currency built for a virtual reality marketplace that hasn't launched yet. Total client deposits in Voxel are $124 million (£86.4 million). Only $5.8 million (£4 million) are deposits in non-Voxel currencies. Uphold keeps all clients funds in accounts rather than investing or lending some out. But it doesn't hold all the value deposited with it in the same asset class as it was deposited in — so you could make a deposit in Chinese yuan but Uphold may hold the equivalent value in US dollars. That lead some Reddit posters to worry that people who had deposited other currencies and assets with Uphold would be exposed to the volatility of Voxel, a highly speculative currency.

Uphold CEO Anthony Watson says this is not the case. He says illiquid assets like Voxel are segregated from general funds. He told Business Insider: "When you net out the Voxelus [deposits], we're still over-reserved." "The reason why we have a large amount of Voxel on our platform is because we are the only company, so far, that allows you to hold Voxel in your digital wallet. At the end of March, early April, 7 exchanges will start openly trading Voxel and then it will be driven by the marketplace." He added: "Let's say Voxel goes to zero tomorrow — no one's interested in it, no one wants to buy it. That makes zero difference to us. We're simply holding it in wallets. We're not actively trading it and we're not actively backing the asset either." Uphold's founder and chairman, Halsey Minor, is also the cofounder and chairman of Voxelus, the company that issued Voxel. Voxelus is building a platform a little like a virtual reality Minecraft, which lets you build VR stuff. Voxel will be the digital currency used to buy and sell assets on the platform, like in-game add-ons. Uphold announced in a blog post last October that it was partnering with Voxelus to "create, distribute & support their proprietary currency."

But Uphold CEO Anthony Watson insists "there is no conflict of interest" with the two companies working so closely together. Watson, a former Barclays, Citi, and Nike executive, told Business Insider: "Voxelus is a separate company not related to Uphold, nor has Uphold invested in it in any way shape or form. Uphold is simply partnering with Voxelus. "We've done this by the book and I'm very comfortable as the CEO of the company that there is no conflict of interest. Nor are the companies even engaged with each other at a management level. Halsey, as chairman of Uphold, only has one vote out of a board of seven people." Voxelus raised 1,200 bitcoins — around $507,500 or £352,700 at today's exchange rate — by selling its cryptocurrency Voxel in a crowdfunding last year. Uphold's transparency register shows it is currently holding $116 million worth of Voxel in its digital wallets, with Voxel currently marked at $0.64. It's not clear who owns the vast majority on the platform but Watson confirmed Minor and other Voxelus executives are major holders. Watson admitted: "We could have done a better job explaining what it was overall, but in terms of Halsey's role, in terms of Voxelus vs. Uphold, there is no conflict of interest, there is no deviation of duties, we've completely segregated them." Uphold also hedges clients' non-Voxel deposits so their accounts don't lose value. But Voxel isn't involved in that hedging activity, it's completely separate, Watson says. "If you look at the broader hedging strategy, we do have quite complex algorithms that we use on a 24/7 basis, depending on what currencies people are focused on and how people are focused on them." |

FTC Settles Charges Against Bitcoin Mining Firm Butterfly Labs

|

CoinDesk, 1/1/0001 12:00 AM PST The US Federal Trade Commission says it has reached a settlement with bitcoin mining firm Butterfly Labs after it sued the company in 2014. |

Accenture Partners with Digital Asset Holdings, Launches Blockchain Consulting Practice

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Accenture has launched a specialized practice within its financial services group to help institutions implement blockchain technology in order to improve operational efficiency, security and client service, as well as to capture new revenue opportunities. Accenture will provide a range of consulting and technology services, from feasibility studies, business case assessments and operating model design, to advisory services on systems architecture, cybersecurity and cloud consulting, through to full-scale systems integration. Accenture, a Fortune Global 500 company, is the world's largest consulting firm as measured by revenues. The company employs approximately 373,000 people serving clients in more than 120 countries. In December 2015, Accenture’s clients included 94 of the Fortune Global 100 and more than 80 percent of the Fortune Global 500. The prestige of Accenture and its leadership in the top corporate consulting space is likely to significantly boost blockchain-based fintech. “Blockchain and distributed-ledger technologies enable the financial industry to move away from reconciliation-based processes that are expensive and inefficient,” said David Treat, managing director and global head of Accenture’s capital markets blockchain practice. “Our new practice, which builds on the strong growth of our global capital markets business, can help clients move from concept to production in the shortest possible time, improving efficiency and unlocking new revenue streams.” The Accenture press release notes that, according to the firm Aite Group, investment in new blockchain-enabled financial technologies will more than quintuple over the next four years, from an estimated $75 million in 2015 to $400 million by 2019. In June 2015 Santander InnoVentures, the $100 million fintech venture capital fund of Santander Group, Oliver Wyman and Anthemis Group, published a paper titled The Fintech 2.0 Paper: rebooting financial services. The paper noted that international payments remain slow and expensive, and significant savings can be made by banks and end-users bypassing existing international payment networks, and suggested that distributed ledger technology could reduce banks’ infrastructure costs attributable to cross-border payments, securities trading and regulatory compliance by between $15 billion and $20 billion per annum by 2022. Accenture has also formed an alliance with Digital Asset Holdings to help institutions assess and implement block chain-related solutions. The two companies will collaborate on innovative solutions for banks, brokerages and infrastructure providers that Accenture will implement as a preferred systems integrator. A Digital Asset Holdings press release notes that, besides Accenture, the company is forming partnerships with Broadridge and PricewaterhouseCoopers (PwC). “Accenture is a renowned leader in large-scale systems transformation and the development of complex technology infrastructure,” said Blythe Masters, CEO of Digital Asset Holdings. “Working together, we can dramatically accelerate the adoption of blockchain technology globally. Our products and software combined with Accenture’s expertise at integrating new technologies with existing systems will help institutions reduce settlement latency, risk, operating costs and capital requirements.” Accenture and Digital Asset Holdings are key members of the Hyperledger Project, a high profile initiative spearheaded by the Linux Foundation, which wants to develop develop a new open source blockchain separated from the Bitcoin blockchain. “The development of blockchain technology has the potential to redefine the operations and economics of the financial services industry,” said Richard Lumb, chief executive of Accenture’s Financial Services. Accenture and Digital Asset Holdings support closed, “permissioned” blockchains that would offer the advantages of digital currencies – fast and cheap transactions permanently recorded in a shared distributed ledger – without the troublesome openness of the Bitcoin network where anyone can be a node on the network anonymously. Instead of anonymous miners, only banks and vetted financial operators would be allowed to validate transactions in permissioned blockchains. “To be used by financial institutions, including capital markets firms and insurers, blockchains must supplant the costly methods introduced by Bitcoin with a mechanism that guarantees security, privacy and speed without paying for anonymous consensus,” said two Accenture executives in July. “With private chains, you can have a completely known universe of transaction processors,” Digital Asset Holdings CEO Blythe Masters said in September. “That appeals to financial institutions that are wary of the bitcoin blockchain.” Other experts, including legendary cryptographer Nick Szabo, strongly argued that financial operators should, instead, embrace the crowd-sourced power and resiliency of permissionless blockchains like Bitcoin. Bitcoin Magazine reached out to Treat to find out more about Accenture’s position in the permissionless vs. permissioned blockchain debate. "Permissionless blockchain solutions were driven by the desire to transfer value – whether cryptocurrency or other digital assets – without the need for a trusted third-party,” Treat told Bitcoin Magazine. “That has tremendous power, but also distinct limits in terms of use cases and scalability. Permissioned blockchain solutions tip the dynamic towards groups of known actors who can message, transfer, and validate transactions in a number of ways with the necessary controls (e.g. AML/KYC). They are less constrained by latency and scalability challenges, which opens a multitude of opportunities for financial institutions to remove inefficiencies." “Permissioned-based solutions enable faster and more scalable consensus mechanisms because the nodes are controlled by known chosen actors,” added Treat. “In a permissioned environment, the ledger can be engineered along a much wider array of consensus mechanisms, including multi-signature, Practical Byzantine Fault Tolerant, Proof of Stake, Zero Knowledge Proof, etc.” Photo Michael Gray / Flickr The post Accenture Partners with Digital Asset Holdings, Launches Blockchain Consulting Practice appeared first on Bitcoin Magazine. |

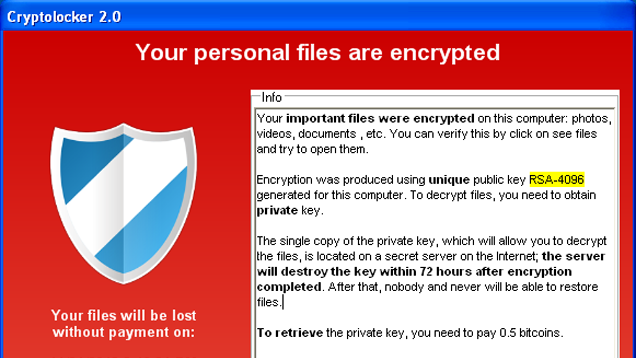

Ransomware Extortionists Land $17,000 in Bitcoin

|

CryptoCoins News, 1/1/0001 12:00 AM PST A cyberattack targeting a Hollywood hospital laced with ransomware malware has been making rounds in mainstream news circles recently. In a separate incident, the Horry County school system in North Carolina was also struck by a ransomware cyberattack. The cyberattack on Hollywood Presbyterian Medical Center lasted nearly a fortnight after beginning on 5 Feb, with […] The post Ransomware Extortionists Land $17,000 in Bitcoin appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Meet Boost VC's Newest Bitcoin and Blockchain Startups

|

CoinDesk, 1/1/0001 12:00 AM PST Incubator Boost VC has announced its 2016 group of early-stage startups, four of which offer bitcoin and blockchain services. |

Los Angeles Hospital Paid Hackers $17,000 Ransom in Bitcoins

|

Entrepreneur, 1/1/0001 12:00 AM PST Paying the ransom was the "quickest and most efficient way" of regaining access to the affected systems, hospital president said |

Bitcoin Price Analysis: Groundhog Day

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin price pushed above $420 today and continues higher in a narrow channel of advance. This analysis is provided by xbt.social with a 3-hour delay. Read the full analysis here. Not a member? Join now and receive a $29 discount using the code CCN29. Bitcoin Price Analysis Time of analysis: 13h00 UTC Bitstamp 1-Hour Chart […] The post Bitcoin Price Analysis: Groundhog Day appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

HashFast's $1 Million Question: Is Bitcoin a Currency or Commodity?

|

CoinDesk, 1/1/0001 12:00 AM PST Berger Singerman LLP counsel Andrew Hinkes discusses what's at stake in an upcoming court hearing in the HashFast bitcoin miner bankruptcy case. |

Dutch Burger King Accepts Bitcoin

|

CryptoCoins News, 1/1/0001 12:00 AM PST In an effort to promote itself as the world’s most Bitcoin-friendly city, Arnhem in Netherlands has added Burger King to the list of businesses both big and small that accept Bitcoin payments within city limits. Currently listing over 100 businesses that accept Bitcoin, Arnhem is hosting its next meetup at the Bitcoin-friendly Burger King on September 19th […] The post Dutch Burger King Accepts Bitcoin appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

How mounting job cuts could threaten UK's economic recovery

|

The Guardian, 1/1/0001 12:00 AM PST Tens of thousands of workers are being laid off in key sectors, prompting fears of ‘trickle-down effect’ on British economy Major UK-based companies have announced tens of thousands of job losses that are expected to have a ripple effect on the economy in the coming months, casting a shadow over Britain’s recovery. Affecting vast areas of the UK economy – from factories to the high street, banking, media and energy – the job losses coincided with another wave of panic selling on stock markets and fears of a further global recession. Continue reading... |

On Scaling Decentralized Blockchains

|

CryptoCoins News, 1/1/0001 12:00 AM PST This article summarizes a technical paper on scaling blockchains. I do not disaggregate the entire work, but I definitely get under the hood. So if you do not have the time, spoiler alert! “Here is the takeaway. Blockchains must be massively more scalable than the current tech that supports Bitcoin. We start scaling slowly or […] The post On Scaling Decentralized Blockchains appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Dubai Museum of the Future Foundation Launches Global Blockchain Council

|

CryptoCoins News, 1/1/0001 12:00 AM PST The Dubai Museum of the Future Foundation has established the Global Blockchain Council to explore transactions through the blockchain platform. The Council will examine the blockchain’s impact on future business and finance, and its role in facilitating transactions within both the financial and non-financial sectors as ways to improve efficiency and reliability levels, according […] The post Dubai Museum of the Future Foundation Launches Global Blockchain Council appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

As Ransomware Crisis Explodes, Hollywood Hospital Coughs Up $17,000 In Bitcoin

|

Forbes, 1/1/0001 12:00 AM PST Russia's biggest cybercriminal gang said to be spreading Locky ransomware at an astonishing rate of 90,000 infections a day, as a Hollywood hospital pays out to unknown hackers using the same techniques. |

Hospital pays nearly $17G in bitcoins to hackers who disabled computer network

|

Fox News, 1/1/0001 12:00 AM PST A Los Angeles hospital paid a ransom of nearly $17,000 in bitcoins to hackers who infiltrated and disabled its computer network because paying was in the best interest of the hospital and most efficient way to solve the problem, the medical center’s chief executive said Wednesday. |

Steps from Wall Street, Bitcoin Still in Style With Fashion Designers

|

CoinDesk, 1/1/0001 12:00 AM PST The message that bitcoin can be a force of social good and individual empowerment is resonating in surprising places. |

Hospital pays bitcoin ransom after malware attack

|

CNN Money, 1/1/0001 12:00 AM PST A Los Angeles hospital just paid a ransom equivalent to around $17,000 in bitcoins to get its computer systems back up and running. |

Hospital Pays $17,000 Ransom to Reclaim Its Files

|

Gizmodo, 1/1/0001 12:00 AM PST

Ransomware is one of the nastiest forms of malware around: once it’s downloaded onto a computer network, it runs around encrypting all your files, before charging a Bitcoin ransom to give up the encryption key: bad if it’s your holiday photos at stake, disastrous for hospitals and patient data. |

Celebrate Gravitational Waves With This Spiral-Patterned Soup Bowl

|

Gizmodo, 1/1/0001 12:00 AM PST

Last week physicists finally succeeded |

Hospital paid hackers 40 bitcoins to get its network back

|

Engadget, 1/1/0001 12:00 AM PST

|

LA hospital paid $17K ransom to hackers of its computer network

|

Fox News, 1/1/0001 12:00 AM PST A Los Angeles hospital paid a ransom in bitcoins equivalent to about $17,000 to hackers who infiltrated and disabled its computer network, the medical center's chief executive said Wednesday. |

Kraken & Tokyo Trustee Announce ‘Significant Progress’ in MtGox Claims Investigation

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin exchange Kraken and the Tokyo District Court-assigned Trustee assigned to the MtGox creditors’ claims investigation have revealed that there is “significant progress” being made, in an update today. In an email communicated to CCN today, an update from Kraken and Tokyo District Court-assigned Trustee Nobuaki Kobayashi confirms that “significant progress” has been made into […] The post Kraken & Tokyo Trustee Announce ‘Significant Progress’ in MtGox Claims Investigation appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Minor's involvement in the Voxelus venture wasn't disclosed in

Minor's involvement in the Voxelus venture wasn't disclosed in

After more than a week of computer problems for Hollywood Presbyterian Memorial Medical Center, President & CEO Allen Stefanek announced (PDF) that it has decided to pay 40 bitcoins, or about $17,000 to fix the issue. The hospital's network was s...

After more than a week of computer problems for Hollywood Presbyterian Memorial Medical Center, President & CEO Allen Stefanek announced (PDF) that it has decided to pay 40 bitcoins, or about $17,000 to fix the issue. The hospital's network was s...