The Strange Life and Death of Dave Kleiman, A Computer Genius Linked to Bitcoin's Origins

|

Gizmodo, 1/1/0001 12:00 AM PST

About two weeks before his grisly death, there was a change in Dave Kleiman. The formerly generous and lively computer forensics expert became confrontational and bitter. Around that time, Kleiman left the Veteran’s Affairs hospital where he’d been a patient, and called his close friend and business partner Patrick Paige to let him know. “They’ve decided to release you? That’s great,” Paige remembers asking. |

Craig Wright, The Man Who Claimed He Invented Bitcoin, Has Erased Himself

|

Gizmodo, 1/1/0001 12:00 AM PST

As soon as Gizmodo began its investigation |

Why It Doesn’t Matter Who Invented Bitcoin

|

Time, 1/1/0001 12:00 AM PST "Satoshi is quite irrelevant at this point" |

Sony Pictures emails 'back to business as usual' year after hack

|

CNN Money, 1/1/0001 12:00 AM PST One year after a hack crippled Sony Pictures and exposed a string of insulting emails about some of Hollywood's biggest celebrities, company CEO Michael Lynton explained what he had learned from the cyber attack. |

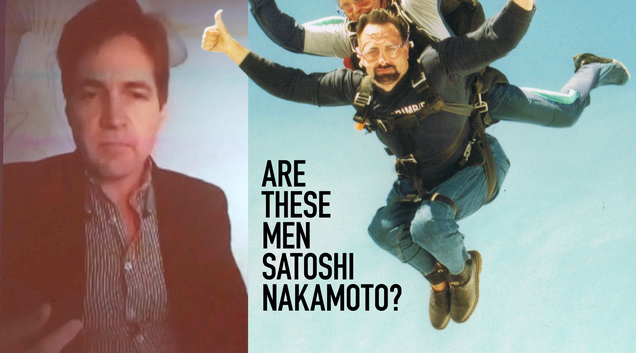

Has the True Identity of the Bitcoin Founder Finally Been Revealed?

|

Entrepreneur, 1/1/0001 12:00 AM PST The latest name to float to the surface in the hunt for Satoshi Nakamoto is Craig Steven Wright, an Australian entrepreneur and academic |

The man who disappeared after people said he was the inventor of Bitcoin has a crazy theory that the tulip bubble wasn't actually a bubble

|

Business Insider, 1/1/0001 12:00 AM PST

Currently, no one knows where he is. Wright has taken his blog, his Linkedin and his YouTube accounts offline. He told a Bitcoin conference in November that he was about to travel to London or Iceland, two locations where he has previously lived and studied. In that conference, where he appeared on a panel via Skype, he was asked about the computers he runs. Wright said he was based "in Iceland because of power. It's much, much cheaper in Iceland to run supercomputers" and that the computer he was building was "No. 15 in the top 500 supercomputers globally." (The cost of mining Bitcoin is determined largely by the amount of electricity you need to do the computer processing, and that cost is vastly reduced if you don't need to keep the machines cool — so Bitcoin miners prefer cold climates for their computers.) When asked what he was doing with Tulip, Wright replied, "we've been modeling Bitcoin scalability for a number of years now." It wasn't clear what he meant by that, but he seemed to be trying to avoid describing directly what he was actually doing. One theory about Wright is that he is in possession of a Bitcoin trove worth $60 million. The name of his Iceland computer is "Tulip," Wright said. When asked why he named the machine Tulip, he said that the name was a reference to the "tulip mania" bubble that afflicted the Netherlands in 1637. In the tulip bubble, Holland's tulip bulbs suddenly rose in price as people traded them. Bulbs briefly became more valuable than a year's income for some workers. Prices collapsed again suddenly, wiping out several fortunes. The episode is generally regarded as the first classic case of an economic bubble bursting, and is a frequent reference when people talk about what other meaningless economic assets might look like a tulip bubble. Bitcoin price rises — a tradeable currency that is not backed by any asset whatsoever, except itself — is frequently compared to the tulip bubble.

Most people don't actually realise that the tulip bubble wasn't really a bubble. It was actually a reallocation of contracts, it was made from a contract to a "swaption," by changing the contract to a swaption effectively, and by allowing government officials to get out of a contract they collapsed the price. Now tulips did actually have a use back then. Tulips kill grass and one of the things they would have done was plant them around castles to keep the grass down and trees down, because they're toxic. If you had a castle back then you wanted a large area to see things. There was actually quite a value in tulips because, they sold billions of them around Europe. ... The volumes were huge. The audience was huge, it was bigger than coffee is now. Needless to say, most people understand the tulip bubble as a period in which prices rose because they became unlinked from the underlying value of tulips. It is true, however, that the bubble ended in part when the Dutch government converted futures contracts on tulip contracts into options on tulip futures, which gave buyers an easy way to get out of an agreement to buy and vastly reduced the value of any contract. But the bottom line for observers is, arguably, this: The guy who invented Bitcoin doesn't think the tulip bubble was a bubble. Join the conversation about this story » NOW WATCH: 5 hard-to-find iPhone tricks only power users know about |

Financial and Tech Executives Team up for BankersLab® Angel Round

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin Press Release: San Francisco – BankersLab® is pleased to announce that it has closed its Angel Round comprised of financial and tech sector executives from the US, Germany and Singapore. The US-based FinTech is utilizing the funds to accelerate development of it’s spin-off product PortfolioQuest, a self guided, SaaS based simulation training product for the retail banking and Fintech industries. After boot strapping BankersLab, the company took B2B bank customer feedback to heart and is accelerating development of PortfolioQuest. Whether in a bank or FinTech, financial services employees find they need to be better equipped to tackle the complexities […] The post Financial and Tech Executives Team up for BankersLab® Angel Round appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

What you need to know on Wall Street today

|

Business Insider, 1/1/0001 12:00 AM PST

To sign up, scroll to the bottom of this page and click 'Get updates in your inbox.' It is a day of dealmaking and deals breaking on Wall Street. Yahoo decided to kill its plan to spin out Alibaba shares into their own standalone publicly traded company. That puts Yahoo back to square zero. It emerged late Tuesday meanwhile that Dow Chemical and DuPont are in merger talks, with a deal announcement potentially just days away. Some of the biggest names in the alternatives investment industry are excited about the energy crash. David Rubenstein at Carlyle thinks "the greatest energy investing opportunities we've ever seen" lie ahead. Howard Marks at Oaktree Capital says his firm is ready to "catch falling knives." Oil trading "god" Andrew J. Hall, who heads energy and commodities hedge fund Astenbeck Capital, has told clients that now is not the time to exit the market, meanwhile. At Business Insider's IGNITION event, RBC Capital Markets analyst Mark Mahaney gave an in-depth presentation on Facebook's biggest opportunities, while well-respected Apple analyst Gene Munster of Piper Jaffray gave a presentation on the company's future. On a related note, here is GE CEO Jeff Immelt on whether we are in a tech bubble, and former Disney CEO Michael Eisner on why this is the 'golden age of television'. Here are the top Wall Street headlines at midday - A big Wall Street business is in danger of drying up - In the past two years, American companies have spent nearly $4 trillion on takeovers, fueled in large part by the unprecedented opportunity to borrow at extremely low interest rates. GUNDLACH: 'It's a different world when the Fed is raising interest rates' - Jeffrey Gundlach, CEO and CIO of DoubleLine Funds, has a simple warning for the young money managers who haven't yet been through a rate-hike cycle from the Federal Reserve: It's a new world. CHANOS: Short Obamacare - Billionaire hedge fund manager Jim Chanos is skeptical about healthcare stocks once again. Etihad CEO to US rivals: 'I don't know what the problem is' - Etihad Airways has grown from tiny upstart to one of the world's most respected international airlines — all in a little more than a decade. Steve Wynn just sent out a ‘forceful’ message and his company's stock is going bonkers - Wynn Entertainment stock is up 15% in early trading Wednesday on the news that the CEO Steve Wynn bought 1 million shares of the company. CHEVRON CEO: 'Hundreds of billions of dollars are being taken out of the business right now' - It is tough out there in the oil business. The most popular search this year on 'Investopedia' tells you just how anxious people really are right now - "Smart beta" was the most searched-for term on investing dictionary website Investopedia.com in 2015. Hated pharma CEO Martin Shkreli is the villain we need - Pharma CEO Martin Shkreli is easy to hate, but that doesn't mean he's wrong. BAML: These are the 3 'disruptive catalysts' that will shake up markets in 2016 - We're getting closer to the end of 2015, and investors are starting to look ahead to what is in store for the markets next year. Elsewhere on the web - Bitcoin’s Creator Satoshi Nakamoto Is Probably This Unknown Australian Genius - Wired Friends turn to foes as activists challenge private equity - Reuters Dow-DuPont Merger: Better Living Through Layoffs - The Wall Street Journal |

Here's All the Evidence That Craig Wright Invented Bitcoin

|

Gizmodo, 1/1/0001 12:00 AM PST

Parallel Gizmodo |

Babbage: A bit of peace, round the corner

|

The Economist, 1/1/0001 12:00 AM PST UK Only Article: standard article Fly Title: Babbage Rubric: The end of bitcoin’s civil war and a look at new technology that can be used to see round corners Byline: The Economist Main image: Babbage Published: 20151209 Source: Online extra Enabled |

The One Big Reason Why It Matters Who Invented Bitcoin

|

Time, 1/1/0001 12:00 AM PST It's about more than mere curiosity |

Bitcoin World Sceptical About Claims That Wright Is Satoshi

|

CoinDesk, 1/1/0001 12:00 AM PST The bitcoin world appeared unconvinced that Wright is indeed the man behind the world's most popular cryptocurrency. |

Australia Police Raid Home of Man Said To Be Bitcoin Founder

|

Inc, 1/1/0001 12:00 AM PST The identity of currency's creator has remained a mystery since its birth in 2009. But several technology publications published reports this week claiming an Australian businessman is the likely inventor. |

'Probable' Bitcoin Creator Is A Garrulous Government Security Contractor And A Convicted Criminal

|

Forbes, 1/1/0001 12:00 AM PST Craig White is nothing like the Satoshi Nakamoto many had imagined. He loves Bitcoin, but he's also been training government on cybersecurity, according to his large online footprint. |

Australian Police Raid Home & Office of Reported Bitcoin Creator Craig Wright

|

CryptoCoins News, 1/1/0001 12:00 AM PST Australian police have raided the Sydney home and office of Craig Steven Wright, the man alleged to be bitcoin’s inventor as the anonymous Satoshi Nakamoto. Australian Federal police in Sydney have raided the home and office of Craig Wright who is identified as the creator of bitcoin. According to The Guardian, more than 10 police personnel arrived in Gordon, a Sydney suburb to raid a home belonging to Craig Wright. The raid was conducted not long after WIRED and Gizmodo revealed investigations leading the publications to believe they may have discovered bitcoin’s creator. The Guardian reports two police staff among […] The post Australian Police Raid Home & Office of Reported Bitcoin Creator Craig Wright appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

10 things you need to know before the opening bell (spy, spx, qqq, dia, lulu, swhc, dow, dd)

|

Business Insider, 1/1/0001 12:00 AM PST

Here is what you need to know. Dow Chemical and DuPont are discussing a merger. A combination of the two chemical giants would create a $120 billion behemoth, people close to the talks told Reuters. The combined company would then possibly split up into material sciences, specialty products and agrochemicals businesses, according to the sources. A combination could produce as much as $3 billion in synergies, according to CNBC. Yahoo won't spin-off Alibaba. Yahoo won't spin-0ff Alibaba, but is considering a spin-off or sale of its core internet business. This is a major shift in strategy for Yahoo as the company had been planning to spin-off its 15% stake in Alibaba for several months. The decision comes amid pressure from activist investor Starboard Value, who has called for the company to abandon its Alibaba spin-off and instead sell its core internet business. Kinder Morgan slashed its dividend. The pipeline operator cut its quarterly divided by 74% to $0.125 per share. The announce comes as Kinder Morgan continues its efforts to deal with the fallout from the oil bust and "enables the company to use a significant portion of its large cash flow to fund the equity portion of its expansion capital requirements, eliminate any need to access the equity market for the foreseeable future and maintain a solid investment grade credit rating." The stock is down about 8% in pre-market trade. Smith & Wesson had another great quarter. The gunmaker announced earnings of $0.22 per share, outpacing the Bloomberg consensus by four cents. Revenue surged 32.1% to $143.2 million, which was ahead of the $139 million Wall Street consensus. The company said gun sales rose 15.2% to $124.9 million. "Higher revenue in our firearms division was driven by increased orders for our Smith & Wesson SDVE polymer pistols, M&P Shield and M&P BODYGUARD polymer pistols, and our long guns, especially our Thompson/Center Venture bolt-action rifles," CEO James Debney said in the earnings release. Lululemon posted a mixed quarter. The athletic apparel maker announced earnings of $0.38 per share, topping the Bloomberg consensus estimate by a penny. Revenue rose 14.4% to $479.7 million, which was shy of the $481.9 million that Wall Street was expecting. Comparable same store sales rose 6% for the third quarter on a constant dollar basis. "We had a solid quarter in line with our expectations underscored by the combination of our product, guest and community initiatives along with tremendous guest reception to major store openings around the world," CEO Laurent Potdevin said in the press release. The creator of bitcoin may have been unmasked. A report from Wired suggests Craig Steven Wright, an Australian finance geek, and possibly his close friend, Dave Kleinman, who is now deceased, could be the creator(s) of bitcoin. Evidence pointing to Wright, and maybe Kleinman, as the creator(s) of the digital currency includes his blogging about writing papers about a cryptocurrency, his ownership of two supercomputers and the fact Kleinman had a trust holding exactly the same number of bitcoins the rumored creator owned. Meredith Whitney is back. Meredith Whitney left the hedge fund world in June, at the time saying the managing money chapter of her life was "over." However, Bloomberg reports Whitney will resurface at Bermuda-based insurer Arch Capital Group in September, where she will manage an $800 million portfolio. Consumer prices in China ticked higher. Chinese consumer prices grew at a 1.5% year-over-year clip in November, up from the 1.3% reading in October. Meanwhile, producer prices fell 5.9% YoY, matching the pace of decline from the two months prior. China's yuan slipped 0.2% to 6.4272 per dollar, ending at its weakest level in over four years. Stock markets around the world are mostly lower. Spain's IBEX (-0.9%) paces the decline in Europe after Japan's Nikkei (-1%) led the way lower in Asia. China's Shanghai Composite (+0.1%) eked out a gain. S&P 500 futures are up 1.25 points at 2060.00. US economic data remains light. Wholesale inventories will be released at 10 a.m. ET and crude oil inventories are due out at 10:30 a.m. ET. Treasury will hold a $21 billion 10-year reopening at 1 p.m. ET. The US 10-year yield is up 2 basis points at 2.24%. Join the conversation about this story » NOW WATCH: Why Korean parents are having their kids get plastic surgery before college |

'Banks really have to fear smarter banks' — this CEO nails the dirty secret about fintech startups

|

Business Insider, 1/1/0001 12:00 AM PST

Fintech — or financial technology — is one of the hottest areas of technology right now, with money pouring into the sector, startups springing up all over the place, and plenty of column inches devoted to the phenomenon. Investors and founders hope that technology can help them revolutionise everything from lending and payments to bond trading, letting them do things faster, better, and cheaper than big banks have traditionally. Even Barclays' former CEO Antony Jenkins is on board, saying recently that disruption to traditional financial services from fintech startups could lead to an "Uber moment" for banks. But at the Fintech Connect Live conference in London on Tuesday, Currency Cloud CEO Mike Laven voiced an uncomfortable truth about the sector — it's still a relatively niche concern. Asked about how well fintech is doing right now, Laven, whose business is a cloud-based payments platform, told the crowd: You have to differentiate between mind share and market share. You can add up a lot of the market share of these guys and it would be pretty small. But we've got a lot of mind share with all the press coverage and conferences. Laven's point is that the fintech sector is still a minnow swimming in the ocean of financial services, it just appears bigger because of all the hype. Laven joked that if you can't eat out at least once a week at some sort of fintech conference or event, your company isn't doing well. The 'Level39 bubble'On another panel Julian Cork, COO of peer-to-peer buy-to-let mortgage platform Landbay, called the problem the "Level39 bubble" — referring to the fintech hub set up in Canary Wharf. Within this bubble, the narrative is that plucky startups are on course to beat the banks by offering consumers a better deal. There's a lot of back slapping and navel gazing. But the truth is most people in Britain still rely on traditional banks and established financial service players. Laven said: "I am not one who believes that if we close our eyes and wish really hard, the banks will go away. They'll still be here 20 years from now. "The only question is how well institutions will respond — can they get there? Banks really have to fear smarter banks, because some will get it and some won't." Banks have to fear banks — not fintech startups. Not only is this bruising to the fintech's ego, it also presents a serious problem for the legion of startups springing up. Consumer-facing businesses like payments, peer-to-peer lending, and crowdfunding — three of the hottest areas for fintech startups in the UK — depend on ordinary people using them for growth. Awareness and uptake of fintech and alternative finance is crucial. A great slide deck on the online lending industry from Cormac Leech, an analyst with investment bank Liberum, highlights the problem many fintech startups have. Leech focuses on peer-to-peer lenders but there's plenty of read across to any other consumer facing business. Less than 45% of people in the UK have heard about peer-to-peer and only around 15% would consider lending using it, according to Liberum — far from mainstream. Those figures are also pretty flat, Leech says, suggesting that most of the explosive growth in peer-to-peer lending in the UK has come from early adopters increasing the amount they lend over these platforms, not more people signing up.

In payments, meanwhile, TransferWise has around 2% of the UK international money transfer market, sending £500 million a month over its platform. That's no mean feat for a four-year-old business. But Nick Day, CEO of money transfer business SmallWorldFS, made the point to me back in June that it's still nowhere near the size of a Western Union or MoneyGram. He told me: "They put out PR about how they grew 200% last year, but it’s from peanuts to 3x peanuts." 'Mindshare changes consumer demand'So why do journalists like me wastes so much oxygen on fintech? The main reason is the money going into the sector. $50 billion has been pumped into fintech startups around the world over the last 5 years, with the amount growing every year. In the UK alone $5.4 billion has been invested between 2010 and 2015. These VC backers are betting that fintech will be a game changer, either revolutionising systems within banks or heralding a huge shift in consumer behaviour. They may not be a Facebook or Google today, but one day they might be. The worry for fintech startups though is that banks and existing financial service providers also see this changing wind and adopt their own in-house solutions to head off the challenge from plucky fintech startups.

Laven said: "What you'll see is that mind share changes consumer demand and prices will go down and transparency will increase." So where does that leave all the startups? The Funding Circles and TransferWises of the world are likely to be big successes — they've got everything going for them right now. But there's a huge number of fintech companies lower down the food chain who will struggle to make it work and may not really understand just what they're getting into. There are over 70 fintech startups exhibiting at Fintech Connect Live this week. It will be interesting to see how many make it to next year. Join the conversation about this story » NOW WATCH: Jeff Sachs: Here's why the Middle East is going to get a lot worse |

Reports: An Australian Entrepreneur Might Be Satoshi Nakamoto

|

CryptoCoins News, 1/1/0001 12:00 AM PST If newly revealing reports from online publications Wired and Gizmodo are to be believed, a 44-year old Australian entrepreneur called Craig Wright may be Satoshi Nakamoto, the pseudonymous inventor of the cryptocurrency Bitcoin. Following an investigation, WIRED claims that that it has “obtained the strongest evidence yet of Satoshi Nakamoto’s true identity.” Unsurprisingly, the report that Craig Steven Wright, a 44-year old Australian entrepreneur may be Satoshi Nakamoto has garnered plenty of interest soon after publishing. WIRED, for its part, notes with a disclaimer about the report’s outcome with two possibilities. One, Wright really did invent bitcoin and is Satoshi Nakamoto or alternatively […] The post Reports: An Australian Entrepreneur Might Be Satoshi Nakamoto appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Police target the man identified as Bitcoin's creator

|

Engadget, 1/1/0001 12:00 AM PST

|

Bitcoin Soars past $400; the Satoshi Search Effect?

|

CryptoCoins News, 1/1/0001 12:00 AM PST The price of Bitcoin saw plenty of upward activity late last night UTC, with a surge that saw a $20 leap in the minutes leading up to midnight. The Bitstamp Price Index scaled a new high since $500 figure struck on November 4th to ring in a figure of $422.88. At the time of publishing, Bitcoin price stood at $421.50. The price swell started with Bitcoin trading at $395.15 at 11:08 PM UTC before seeing a spike of over $21 to scale $416.23 at 11: 57 PM UTC. The most comprehensive movement came between 11: 15 PM UTC and 11: 34 […] The post Bitcoin Soars past $400; the Satoshi Search Effect? appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Internet Pioneer Pindar Wong: Bitcoin’s Creator Should Not Be Penalized

|

CoinDesk, 1/1/0001 12:00 AM PST Internet pioneer Pindar Wong has issued an impassioned plea to authorities amidst speculation bitcoin’s creator may have finally been identified. |

Alleged Bitcoin Creator Craig Wright May Have Lost Bitcoin in Mt Gox Collapse

|

CoinDesk, 1/1/0001 12:00 AM PST Craig S Wright, the Australian entrepreneur who may be the creator of bitcoin, may have lost money in the collapse of Mt Gox. |

Sydney police raid 'Bitcoin founder'

|

BBC, 1/1/0001 12:00 AM PST Australian police raid the Sydney home and office of a man named by technology websites as the creator of the virtual currency Bitcoin. |

Police Raid Home of Alleged Bitcoin Creator Craig Wright

|

CoinDesk, 1/1/0001 12:00 AM PST Police in Australia have raided the home of Craig Wright, the tech entrepreneur who reports suggest may be behind creation of the bitcoin protocol. |

Satoshi Nakamoto Unmasking Might Be Driving Bitcoin's Price Rally

|

CoinDesk, 1/1/0001 12:00 AM PST The price of bitcoin spiked abruptly across major exchanges on the CoinDesk USD Bitcoin Price Index over a 15-minute period yesterday. |

Reports: Police Raid Home of Possible Bitcoin Creator Craig Wright

|

Gizmodo, 1/1/0001 12:00 AM PST

The Guardian and Reuters are reporting that police have raided the home of Craig Wright, an Australian CEO who was identified today in investigations by Gizmodo and Wired as a likely candidate for the secret identity of Satoshi Nakamoto, the elusive creator of Bitcoin. |

Reports Claim Satoshi Nakamoto Might Be 44-Year Old Australian

|

CoinDesk, 1/1/0001 12:00 AM PST New reports by Wired and Gizmodo may have identified the pseudonymous creator of bitcoin, Satoshi Nakamoto, as Australian entrepreneur Craig S Wright. |

REPORTS: The secret creator of bitcoin has been unmasked, again

|

Business Insider, 1/1/0001 12:00 AM PST

The creator of bitcoin may be an Australian finance geek named Craig Steven Wright, according to a new report by Wired's Andy Greenberg. Or, it could be Wright and his close friend Dave Kleinman, who died two years ago, according to Gizmodo. Or Wright could be a man who really wants to take credit for it. Or the hunt to identify bitcoin's creator is wrong again. In 2009, someone (or some people) named Satoshi Nakamoto invented bitcoin, a type of digital currency that uses cryptography to move money and records it in a ledger without the need of a bank. The cryptocurrency was once an obsession among finance geeks, but emerged into more of a mainstream economic obsession. A bitcoin startup even sponsored the Bitcoin Bowl, a college football bowl game, last year. Finding the creator of it has been obsession among bitcoin enthusiasts and journalists alike. In March 2014, Newsweek published a cover story alleging that Dorian Satoshi Nakamoto, a man living in southern California who denies having heard of the cryptocurrency, was its mysterious creator. But Wired's Andy Greenberg may have the most compelling evidence that points to the Australian genius so far:

Gizmodo has posted many of the emails in its own report, and read Wired's full story on the unknown Australian genius here. SEE ALSO: Yahoo will not move forward with Alibaba spinoff Join the conversation about this story » NOW WATCH: Google's self-driving car has a huge problem |

Wired thinks it knows who founded Bitcoin

|

Engadget, 1/1/0001 12:00 AM PST

|

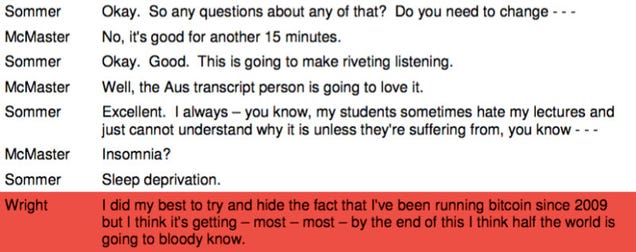

This Australian Says He and His Dead Friend Invented Bitcoin

|

Gizmodo, 1/1/0001 12:00 AM PST

A monthlong Gizmodo investigation has uncovered compelling and perplexing new evidence in the search for Satoshi Nakamoto, the pseudonymous creator of Bitcoin. According to a cache of documents provided to Gizmodo which were corroborated interviews, Craig Steven Wright, an Australian businessman based in Sydney, and Dave Kleiman, an American computer forensics expert who died in 2013, were involved in the development of the digital currency. |

Craig Steven Wright is the most-wanted Australian on the planet right

Craig Steven Wright is the most-wanted Australian on the planet right  Wright told this story:

Wright told this story: Prime Finance is Business Insider's midday summary of the top stories of the past 24 hours.

Prime Finance is Business Insider's midday summary of the top stories of the past 24 hours.

.jpg)

Many big platforms are now turning to institutional investors to get cash to fuel their growth, a subtle change to their original proposition. And at the smaller end of the market,

Many big platforms are now turning to institutional investors to get cash to fuel their growth, a subtle change to their original proposition. And at the smaller end of the market,  There are already plenty of examples of this:

There are already plenty of examples of this:  Australian Federal Police raided the home and offices of Craig Steven Wright, the man named in Gizmodo and Wired reports as the possible mind behind Bitcoin. A dozen officials entered a home he was renting and offices registered to him, telling a Reu...

Australian Federal Police raided the home and offices of Craig Steven Wright, the man named in Gizmodo and Wired reports as the possible mind behind Bitcoin. A dozen officials entered a home he was renting and offices registered to him, telling a Reu...

The person responsible for creating Bitcoin remains a mystery, though Wired is convinced it's a 44-year-old Australian man named Craig Steven Wright. The founder is commonly referred to as Satoshi Nakamoto, though that name appears to be a pseudonym....

The person responsible for creating Bitcoin remains a mystery, though Wired is convinced it's a 44-year-old Australian man named Craig Steven Wright. The founder is commonly referred to as Satoshi Nakamoto, though that name appears to be a pseudonym....