'Belligerent' Crypto Miners Prompt Power Utility to Beef Up Security

|

CoinDesk, 1/1/0001 12:00 AM PST Chelan County's Public Utilities District is enacting new security measures to protect employees from bitcoin miners. |

Op Ed: Can Solar Power Drive Bitcoin Mining in Africa?

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST While many in the West often overlook Africa as an emerging blockchain innovation center, a deeper look across the continent tells a very different story. The Blockchain Africa Conference came to a close last month in Johannesburg, South Africa. Around the same time, the Kenyan government set up a task force to study the impact of the technology. There are plenty of other blockchain communities growing around Africa too, in places like Nigeria, Sudan and Algeria. Although not without difficulties, the growing connectivity and an advancing computer science field — especially at institutions like Makerere University in Uganda — show the African blockchain ecosystem is evidently building agency. And it has the potential to make a massive impact on local economies and communities alike. During a speech, the United Nations Economic Commission for Africa, Managing Director of the IMF Christine Lagarde noted, “So [blockchain] is not just about saving money, it is also about creating more transparency, promoting stronger accountability, and in the end, delivering a better life for every citizen.” For many, cryptocurrency mining is providing a big leap forward. Communities have sprouted up across the region. But with global bitcoin mining using more power than most African countries (only South Africa, Egypt and Algeria consume more), it’s hard to see how it’s going to be sustainable on the continent. On the flipside, solar power just might have the force to push bitcoin mining in Africa to the next level. Here’s how. A Snapshot of the Bitcoin Mining Community in AfricaBitcoin mining farms have begun popping up around the world to mine bitcoin in bulk. But while Egypt’s hot climate seems like an unfavorable place to do so, a community has developed to mine bitcoin in secret. According to the Bitcoin Africa article linked above, many miners keep a low profile for fear of being charged for working with black market foreign currencies. Still, bitcoin mining farms are spreading across Cairo. One of the main reasons for the boom is that electricity is cheaper compared to other economies. With lower overheads paid out in the local currency, miners get more back in bitcoin. Bitcoin mines are spread throughout other countries, too. IT Software company Ghana Dot Com (GDC) opened what it claims to be the country’s first bitcoin mine back in 2016, for example. (GDC is a descendant company of Network Computer Systems, which introduced internet in Ghana in 1993.) In South Africa, bitcoin mining hardware store Bitmart just opened in 2018. There’s also active communities in Nigeria, Gambia, Uganda, Ethiopia and Kenya. One Nairobi-based miner, Eugene Mutai, has received a fair share of press for the mining facility in his apartment. He told Bloomberg that, in the global market, bitcoin mining has leveled the playing field for him. Without a college degree, he’s been able to move into the Kenyan middle class. Solar as a Viable Mining AlternativeCertainly, parts of Africa aren’t exactly the ideal place to be mining bitcoin due to the hot climate — the average temperature in Ethiopia, for example, is 93 °F year round. Even more significantly, about 600 million people living in Sub-Saharan Africa don’t have access to electricity. And, while nearly 1 billion people in the region might gain access to electricity by 2040, an estimated 530 million people will still not have electricity access due to population growth. Each country in Africa has its own nuanced problems and solutions; however, in a good handful of African countries, solar power is emerging as a viable option for combatting these electricity woes — and there are already several solar projects on the go. In Morocco, for example, there’s the 800MW Noor Midelt solar complex. According to Reuters, the estimated $2.4 billion (€2 billion) project has been supported by the African Development Bank, the World Bank, the European Union and the European Investment Bank, among other institutions. In addition, Seychelles just announced they’re planning to install Africa’s first floating solar project, which is expected to contribute 5.8 GWh annually to the country. There are also giant solar farms in South Africa, Uganda, Kenya, Morocco and Burkina Faso. Many produce so much energy, in fact, they hope to one day export solar energy to Europe. This investment in energy infrastructure could eventually help make bitcoin mining in Africa a more sustainable endeavor which, if implemented on a large scale, might actually help push Africa’s industry forward. In an article on Greentech Media, author Tam Hunt writes: “It can make good financial sense to use solar power to mine bitcoin. Solar plants can provide power that is cheaper than grid power in areas with good insulation and low construction costs. The price of power is also known with some certainty over time because there are no fuel costs and thus no volatility.” Not only can mining with solar energy drive the bitcoin industry in many African countries forward, but it will give greater parts of the population across the continent access to the global market. Instead of being held back by highly inflated currency or local tenders impacted by government turbulence, bitcoin mining is enabling many Africans to get ahead. And if solar power is brought into the mix, it can prove to be a truly sustainable leap forward for economies and individuals alike. After all, in parts of Africa there is a huge necessity for it. The power requirements to mine bitcoin are globally unsustainable. And since access to electricity in Africa is already problematic, solar power could be the answer. This is a guest post by Nabyl Charania, Chairman and Chief Executive Officer of Rokk3r. Views expressed are his own and do not necessarily reflect those of BTC Media or Bitcoin Magazine. This article originally appeared on Bitcoin Magazine. |

Square made $200,000 trading bitcoin (SQ)

|

Business Insider, 1/1/0001 12:00 AM PST

Square jumped on the bitcoin bandwagon back in January when it started letting Cash App customers buy and sell bitcoin. And in its first-quarter results released Wednesday, the fintech company revealed the impact of bitcoin on its business. Bitcoin brought in a $200,000 profit for Square in the quarter. The Cash App facilitated trading of the cryptocurrency without charging any fees. Price fluctuations in the cryptocurrency helped the company sell $34.1 million worth of bitcoin at a cost of $33.9 million. Square founder and CEO Jack Dorsey has been an endorser of the cryptocurrency, saying it provides an "opportunity to get more people access to the financial system." He also thinks bitcoin is a "transformational technology" and will be the world's "single currency" in 10 years. "If they actually charged a fee as some of their competitors do, that number would be much higher," Nomura Instinet analyst Dan Dolev said. "They're just basically testing out, allowing people who don't normally trade bitcoin to trade bitcoin." The company isn't depending on bitcoin for a large chunk of revenue but its popularity indicated potential, he said. Dolev's own research found 60% of Square merchants are willing to accept bitcoin as payment, so it's possible the company can monetize bitcoin use by enacting a fee once cryptocurrency is more widely used in day-to-day transactions. The launch of bitcoin on the Cash App may have spurred downloads and increased adoption of Square by new customers according to Dolev. In the first-quarter, the Cash App hosted 7 million monthly active users and continued to be a top 25 app in Apple's App store. While bitcoin comes with risks, specifically the digital currency's continued volatility in pricing, Dolev isn't worried about Square. He said even if bitcoin went to zero, Square will still be a successful company. "The cohesive ecosystem that they're building is only going to get better," he said. "They already have a great brand. With [the acquisition of] Weebly, they're going to have much better access to the online channels. " Square is up more than 22% this year.

SEE ALSO: Tesla sinks after 'odd conference call that lacked answers' (TSLA) Join the conversation about this story » NOW WATCH: Wall Street's biggest bull explains why trade war fears are way overblown |

Square made $200,000 trading bitcoin (SQ)

|

Business Insider, 1/1/0001 12:00 AM PST

Square jumped on the bitcoin bandwagon back in January when it started letting Cash App customers buy and sell bitcoin. And in its first-quarter results released Wednesday, the fintech company revealed the impact of bitcoin on its business. Bitcoin brought in a $200,000 profit for Square in the quarter. The Cash App facilitated trading of the cryptocurrency without charging any fees. Price fluctuations in the cryptocurrency helped the company sell $34.1 million worth of bitcoin at a cost of $33.9 million. Square founder and CEO Jack Dorsey has been an endorser of the cryptocurrency, saying it provides an "opportunity to get more people access to the financial system." He also thinks bitcoin is a "transformational technology" and will be the world's "single currency" in 10 years. "If they actually charged a fee as some of their competitors do, that number would be much higher," Nomura Instinet analyst Dan Dolev said. "They're just basically testing out, allowing people who don't normally trade bitcoin to trade bitcoin." The company isn't depending on bitcoin for a large chunk of revenue but its popularity indicated potential, he said. Dolev's own research found 60% of Square merchants are willing to accept bitcoin as payment, so it's possible the company can monetize bitcoin use by enacting a fee once cryptocurrency is more widely used in day-to-day transactions. The launch of bitcoin on the Cash App may have spurred downloads and increased adoption of Square by new customers according to Dolev. In the first-quarter, the Cash App hosted 7 million monthly active users and continued to be a top 25 app in Apple's App store. While bitcoin comes with risks, specifically the digital currency's continued volatility in pricing, Dolev isn't worried about Square. He said even if bitcoin went to zero, Square will still be a successful company. "The cohesive ecosystem that they're building is only going to get better," he said. "They already have a great brand. With [the acquisition of] Weebly, they're going to have much better access to the online channels. " Square is up more than 22% this year.

SEE ALSO: Tesla sinks after 'odd conference call that lacked answers' (TSLA) Join the conversation about this story » NOW WATCH: Wall Street's biggest bull explains why trade war fears are way overblown |

Here’s How much Revenue Square Earned from Bitcoin Trading in Q1 2018

|

CryptoCoins News, 1/1/0001 12:00 AM PST Digital payments firm Square published its first-quarter earnings report this week, providing insight into how much revenue the company has raised from its recently-launched bitcoin trading platform. The company first rolled out bitcoin trading to a limited number of its Cash App users last year, and in January it unlocked the feature for the remainder The post Here’s How much Revenue Square Earned from Bitcoin Trading in Q1 2018 appeared first on CCN |

CRYPTO INSIDER: Goldman Sachs will soon trade bitcoin-linked products

CRYPTO INSIDER: Goldman Sachs will soon trade bitcoin-linked products

CRYPTO INSIDER: Goldman Sachs will soon trade bitcoin-linked products

CRYPTO INSIDER: Goldman Sachs will soon trade bitcoin-linked products

Introducing the 2018 Map of the Blockchain/Crypto Ecosystem

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST The 2018 edition of BTC Inc’s “Map of the Blockchain/Crypto Ecosystem” has been unveiled. The map provides a visual representation of “the space” in the form of a city skyline with buildings displaying the logos of various entities. While many of the logos were selected by BTC Inc’s editorial staff to reflect the most prominent and successful blockchain and crypto ventures, others were purchased by these projects as sponsorships. “This map is meant to provide a captivating snapshot of what has become a diverse and dynamic space,” said Peter Chawaga, editor-in-chief of yBitcoin. “It’s proven to be really popular with crypto developers and programmers as well as the larger blockchain companies and entrepreneurs in the space.” Designed by Josh Dykgraaf, who was also the creative hand behind the map’s previous two iterations, the cityscape is subdivided into 10 islands, each depicting a distinct facet of the industry: Mining, Processors, Media & Advocacy, Currencies, Wallets/Hardware, Exchanges, ICOs/Tokens, Enterprise, Blockchain Venture Capital and Blockchain Applications & Projects. With the exception of the ICOs/Tokens islands, which forms the epicenter of the city, each district sits on a separate island connected to the mainland by a series of highways. The ecosystem also includes a number of hidden gems. Upon closer inspection, one will find that the buildings in the Mining district are constructed from server towers. Various travel and recreational amenities can be found as well such as the CoinCart stadium, a Space Chain rocket lunch and a Bitcoin 747. Dykgraaf placed his favorite feature, the “Hodlrcoaster,” in the Currencies district, of course, for those thrill seekers who are brave enough to ride the ups and downs of the crypto markets. “The work is a composite of 3D and photo-manipulation,” said Dykgraaf. “The buildings that appear on the poster are all real-world buildings, mostly in New York, London, Shanghai, Dubai and Chicago. They are mostly based on high-angle, photographic material I've shot and then manipulated into isometric perspective. Some of them were constructed in 3D as sponsors requested certain buildings (e.g. the Burj Al Arab). All up, it represents about 200 hours of work.” The map is a testament to just how far the young industry has come in its development and exploration of all the available niches in the space. It will appear in print as part of the spring issue of yBitcoin, which will be officially released on May 11, 2018. It will also be available as a standalone poster. Note: yBitcoin and the ecosystem map are owned by BTC Inc, which also owns Bitcoin Magazine. This article originally appeared on Bitcoin Magazine. |

Goldman Sachs Plans to Trade Bitcoin Futures Contracts

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Goldman Sachs, one of the most well-known investment banking and financial services providers in the world, announced plans to trade bitcoin futures contracts – a Wall Street first. Goldman’s competitors like JP Morgan have so far shunned the risks and volatility associated with trading bitcoin and have yet to make public forays into the space. What Exactly Is Goldman Trading?In the next few weeks, the firm plans to deploy its own capital to buy and sell bitcoin futures contracts and non-deliverable forwards, or futures with greater flexibility, on behalf of their institutional clients. Futures contracts are legally binding agreements that allow purchasers to buy or sell assets at a fixed price at a specified time in the future. Traditionally, futures contracts are used to hedge exposure or to “go long” on an asset if a trader believes price will increase. It is important to note that bitcoin futures enable Goldman to trade on the underlying bitcoin cryptocurrency, without being directly exposed to it. Goldman will not (yet) come directly into contact with the Bitcoin blockchain. Justin Schmidt, Goldman’s first digital asset trader, will handle the firm’s bitcoin trading efforts. As reported by The New York Times, Schmidt is considering trading bitcoin itself, provided Goldman can secure regulatory approval and mitigate the risks associated with holding cryptocurrency. Why Is Goldman Trading Bitcoin?Goldman cites client interest as a catalyst for their entry into the bitcoin space. Traditional clients have indicated that they would like to hold bitcoin as a scarce commodity, similar to gold. Hedge funds and endowments have also reached out to Goldman asking for best custodial practices for storing and handling newly received bitcoin donations. Since the financial crisis, Goldman has emphasized a technology-first approach and is perhaps trying to gain a strategic advantage over its competitors on Wall Street. The firm, in the capacity of an intermediary, has already helped customers who want to buy and sell bitcoin futures on the Chicago Mercantile Exchange and the Chicago Board Options Exchange in the past. Broader Bitcoin TradingGoldman’s competitors have not shared plans to formally trade bitcoin, criticising bitcoin as a “bubble” and a “fraud.” Notably, JP Morgan CEO Jamie Dimon described bitcoin a “terrible store of value." Goldman, on the other hand, does not view bitcoin as a fraud, though it acknowledges that bitcoin does not have the traditional characteristics of a currency. It remains to be seen whether or not other firms will follow Goldman’s lead. After all, most bitcoin prices are extremely volatile and are derived on unregulated exchanges all over the globe. These factors could potentially expose clients to prices affected by market manipulation and steep losses. As a result of Goldman’s formal entry into bitcoin trading, one key question remains unanswered: What kind of information asymmetry does Goldman Sachs currently possess to confidently trade bitcoin futures contracts for their clients that other firms don’t have? This article originally appeared on Bitcoin Magazine. |

Venezuela Offers India Discounted Oil to Boost Petro Confidence

|

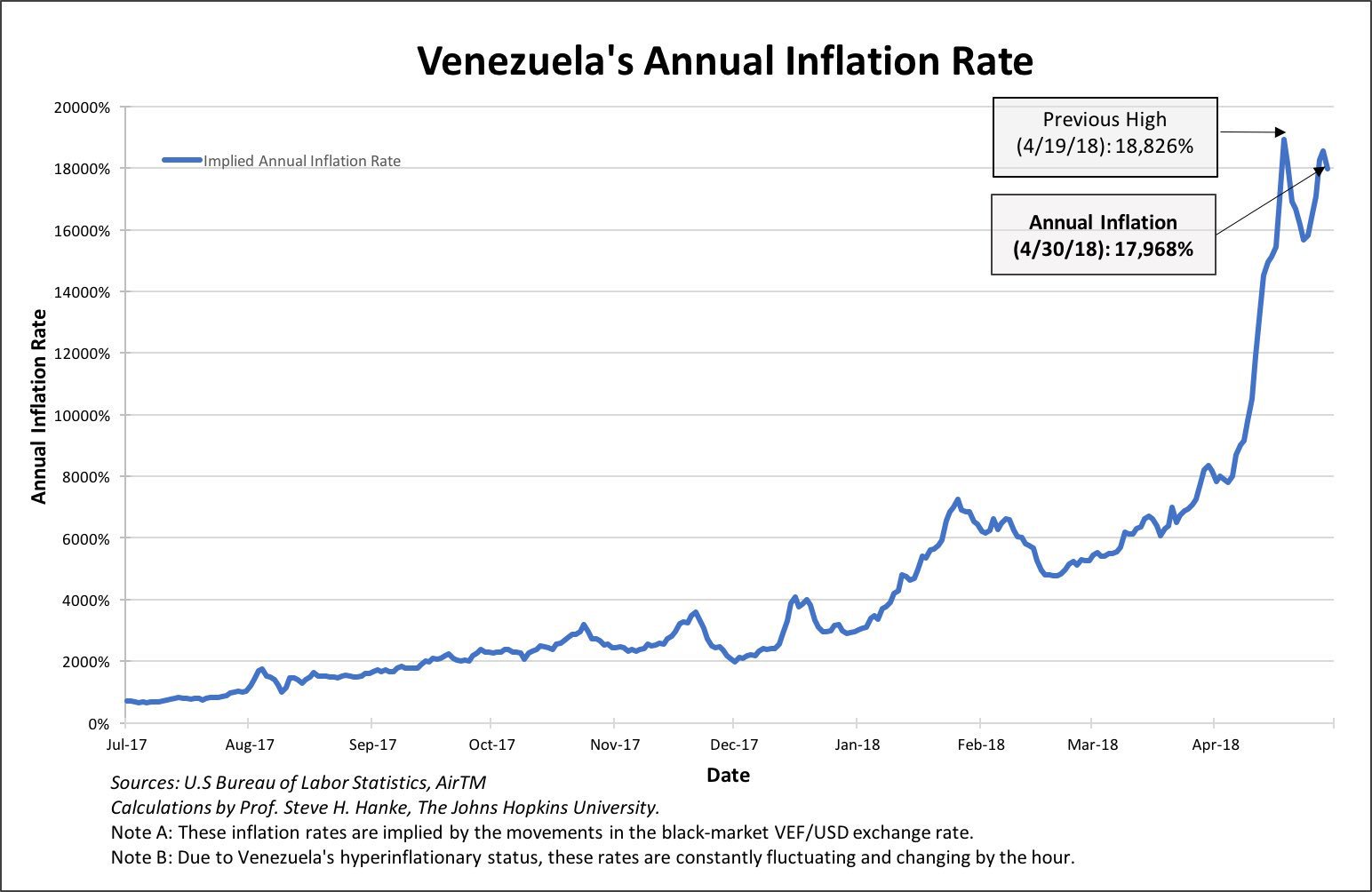

Bitcoin Magazine, 1/1/0001 12:00 AM PST Venezuela has reportedly offered the Indian government a fantastic deal: a 30 percent discount on crude oil imports. The only condition being that the oil must be purchased through the nation’s newly minted cryptocurrency, the Petro. Venezuelan CrisisThe release of the currency comes as Maduro’s government attempts to address a number of pressing financial issues that have pushed Venezuela into a crippling recession. As a nation heavily dependent on oil exports, the dramatic fall in crude oil price hit the South American country especially hard. The recent fall has been dramatic with increased production and reduced consumption plummeting the world price from above $125 per barrel in 2012 to less than $30 by January of 2016. The IMF predicts that, by the end of year, Venezuela will have experienced a GDP decline of nearly 50 percent since 2013. In response to the political controversy surrounding the election of President Maduro and substantial evidence of human rights abuse, the Trump administration in August 2017 announced additional sanctions against Venezuela and encouraged its allies to follow a similar course. This further hampering of the economy, which is expected to contract 15 percent by the end of the year, turned the situation dire. In November, the government announced that it could no longer service its foreign debt of $105 billion, “roughly ten times Venezuelan foreign exchange reserves,” and that a restructuring was imminent.

To add to the list of troubles, the country’s rampant inflation has caused a desperate shortage of paper currency. The USD gained 3,400 percent against the Bolívar in 2017 and is projected to gain another 13,000 percent by the end of this year. Banks have been forced to limit cash withdrawals to the equivalent of just a few cents a day, while small businesses have been forced to stop accepting the Bolívar as payment in favor of foreign currencies. The PetroBy the end of 2017, Venezuela found itself in an unfortunate financial position; economic ostracism as a result of U.S. sanctions had closed off access to almost all traditional means of fiscal rescue. Given the nation’s short list of friends and the nature of its economic crisis, it resorted (unsurprisingly) to leveraging its most lucrative and abundant commodity in tandem with the prevailing enthusiasm that continues to surround cryptocurrency. Petro will be an instrument for Venezuela’s economic stability and financial independence, coupled with an ambitious and global vision for the creation of a freer, more balanced and fairer international financial system. – Petro white paper In December of 2017, Venezuela President Nicolás Maduro announced that his government was planning the release of the world’s first digital currency issued by a sovereign nation. The initial presale on February 20, 2018, saw the release of 82.4 million Petros out of what is believed to be a total purse of 100 million PTR. In theory, the currency is backed by the nation’s oil reserves, the largest in the world totaling nearly 300 billion barrels, with a single coin representing a single barrel on a non-transferable basis. Venezuela has guaranteed its buyers that the Petro will carry the full weight of legal tender, acceptable as payment for fees and taxes and exchangeable for the nation’s hard currency, the Bolívar. Reports have also stated that Venezuela is looking into the possibility of integrating the currency into its compulsory state ID system, the Cédula de Identidad, which is currently used for claiming government benefits and controlling food distribution. The ReleaseThe lead up to and aftermath of the Petro’s release has been rather chaotic, with poor communication and conflicting reports creating mass confusion regarding the details of the new asset. The Petro’s initial white paper, which seemed to be edited on an almost rolling basis even after the ICO, had the currency pinned as an ERC20 token that would utilize the Ethereum payment rail. The buyer’s manual, however, stated that the coin would be a PTR token that would operate on the NEM blockchain. The discrepancy between the two documents was not clarified until the February 20 pre-sale date when both Maduro and the NEM Foundation confirmed via Twitter that the Petro did indeed operate as a NEM application. In March, Time Magazine confirmed the rumor that Russia had secretly worked with Venezuela to design the Petro as a means of circumventing U.S. sanctions. It was suspected that this was the intended purpose, but confirmation that the coin was indeed a Russian collusion greatly injured its international reputation as well as its legitimacy as a financial investment. How the price of the Petro was to be determined also gained criticism. The government set the Petro initial offer against the mid-January price of a barrel of Venezuelan crude oil, around $60 USD, with the price, thereafter, being determined by the barrel price from the day before. The following equation is provided by the white paper: The most glaring issue with this rationale is that, since oil production is a nationalized industry, the price of a barrel of Venezuelan oil is determined by the Venezuelan government. Though this would in practice follow the world market price, no framework exists to ensure that the Venezuelan government will abide by these guidelines. How current prices are calculated as well as those of the 17.7 million coins that have yet to be released has drawn concern. The response from the crypto space has been less than raving. Despite the underlying technology, most have found it difficult to classify the Petro as anything other than a digital oil security that bears a much closer resemblance to a fiat currency than it does to Bitcoin. In practice, how the PTR differs from the bonds issued by PDVSA, the state-owned oil company, is difficult to understand. The sloppiness with which the Petro was brought to market was best displayed when President Maduro announced that the Petro had raised $735 million in its first day of sale without providing a single means of verification. Many in the press balked at this statistic, dismissing it as “farcical” and a direct attempt to mislead investors. In his article “Venezuela’s cryptocurrency is one of the worst investments ever,” Matt O’Brien from the Washington Post voiced the apprehension and skepticism held by many toward the future prospect of this new coin. What Does the Sale Mean?In 2017, 8 percent of India’s total petroleum imports came from Venezuela at a cumulative cost of $5.5 billion. Though the regulatory status has yet to be clarified, the past several months have shown that the Indian government is far from comfortable with digital currencies, remaining deeply suspicious of its illicit utility. But this is oil: It’s safe to say that, in the past, countries have done much worse than overlook their objections to cryptocurrencies for the chance to get their hands on a few million barrels of discounted oil. Though the India deal may be the only one to come to public knowledge, it surely is not the only offer of its kind. Venezuela has other oil guzzling partners, particularly China, who might be convinced to overlook the program’s shortcomings by the lure of cheap petroleum. With the amount of skepticism surrounding the Petro, it seems natural that Venezuela would try to bolster confidence and entice involvement using whatever means necessary. This article originally appeared on Bitcoin Magazine. |

Square Books Small Profit for First Quarter of Bitcoin Sales

|

CoinDesk, 1/1/0001 12:00 AM PST Square made $34.1 million in Q1 revenue through bitcoin sales, according to an SEC filing. |

Ripple took some criticism during the UK Parliament hearing

|

Business Insider, 1/1/0001 12:00 AM PST This story was delivered to Business Insider Intelligence "Fintech Briefing" subscribers. To learn more and subscribe, please click here. The UK Parliament's Treasury Select Committee held a cryptocurrency and blockchain panel this week, during which it discussed the benefits and shortcomings of those technologies. Ripple and related cryptocurrency XRP were especially a subject of criticism.

Two main issues came up during the hearing. First, Ripple’s ability to solve real financial issues was questioned. Martin Walker, director of nonprofit Center for Evidence Based Management and former product developer at blockchain consortium R3, claimed that Ripple's technology is unlikely to solve inefficiencies in the financial sector, and said it doesn’t offer much more than the conventional SWIFT system. In response, Ryan Zagone, Ripple’s director of regulatory relations, cited the technology's ability to track money transfers as one of its most valuable benefits. Countering this, Walker argued that the difficulty does not lie in tracking payments but in getting people to share the status of payments — an issue he claimed using blockchain does not solve. Second, XRP’s relationship to Ripple came under scrutiny. Ministers at the hearing said there is confusion about XRP’s relationship with Ripple. Specifically, MP Stewart Hosie noted that buying XRP doesn't actually entitle anyone to an ownership stake. Zagone clarified that there isn’t a direct connection between Ripple and XRP, and that the company simply owns a considerable amount of XRP, gifted to it by the cryptocurrency's creators. A direct relationship between the two is a "common misperception," he said. Meanwhile, Ripple is still welcoming new members to its global network. Earlier this week, BankDhofar, an Oman-based financial investment management company, joined the Ripple network, in order to use Ripple’s blockchain technology for cross-border payments. Additionally, Santander announced that it will extend its use of Ripple for cross-border payments to more countries in the next year. This suggests that, while there is considerable criticism of Ripple’s operations, this does not seem to be dissuading companies looking to use its technology. While Ripple would be wise to take the concerns voiced during the hearing to heart — in particular, those related to being misleading to investors — it doesn’t seem like interest in its technology is going anywhere for the time being. Of the many technologies reshaping the world economy, distributed ledger technologies (DLTs) are among the most hyped. DLTs are most often associated with cryptocurrencies like Bitcoin, but such coverage sidelines the broader use cases of DLTs, even though they stand to make a far bigger impact on the broader the financial services (FS) industry. DLT's value lies in its ability to centralize record-keeping, while cutting out the need for authorization by an overseeing party, instead allowing a record to be confirmed by multiple parties with access to the database. This means DLTs have the potential to streamline financial institutions' (FIs) operations, boost data security, improve customer relationships, and drastically cut costs. But many FIs have struggled to implement DLTs and reap the rewards, because of organizational obstacles, but also because of issues rooted in the technology itself. There are a few players working to make the technology more usable for FIs, and progress is now being made. In a new report, Business Insider Intelligence takes a look at what DLTs are and why they hold so much promise for FS, the sectors in which DLTs are gaining the most traction and why, and the efforts underway to remove the obstacles preventing wider DLT adoption in finance. It also examines the few FIs close to unleashing their DLT projects, and how DLTs might transform the nature of FS if adoption truly takes off. Here are some of the key takeaways from the report:

In full, the report:

Subscribe to an All-Access pass to Business Insider Intelligence and gain immediate access to:

|

Ripple took some criticism during the UK Parliament hearing

|

Business Insider, 1/1/0001 12:00 AM PST This story was delivered to Business Insider Intelligence "Fintech Briefing" subscribers. To learn more and subscribe, please click here. The UK Parliament's Treasury Select Committee held a cryptocurrency and blockchain panel this week, during which it discussed the benefits and shortcomings of those technologies. Ripple and related cryptocurrency XRP were especially a subject of criticism.

Two main issues came up during the hearing. First, Ripple’s ability to solve real financial issues was questioned. Martin Walker, director of nonprofit Center for Evidence Based Management and former product developer at blockchain consortium R3, claimed that Ripple's technology is unlikely to solve inefficiencies in the financial sector, and said it doesn’t offer much more than the conventional SWIFT system. In response, Ryan Zagone, Ripple’s director of regulatory relations, cited the technology's ability to track money transfers as one of its most valuable benefits. Countering this, Walker argued that the difficulty does not lie in tracking payments but in getting people to share the status of payments — an issue he claimed using blockchain does not solve. Second, XRP’s relationship to Ripple came under scrutiny. Ministers at the hearing said there is confusion about XRP’s relationship with Ripple. Specifically, MP Stewart Hosie noted that buying XRP doesn't actually entitle anyone to an ownership stake. Zagone clarified that there isn’t a direct connection between Ripple and XRP, and that the company simply owns a considerable amount of XRP, gifted to it by the cryptocurrency's creators. A direct relationship between the two is a "common misperception," he said. Meanwhile, Ripple is still welcoming new members to its global network. Earlier this week, BankDhofar, an Oman-based financial investment management company, joined the Ripple network, in order to use Ripple’s blockchain technology for cross-border payments. Additionally, Santander announced that it will extend its use of Ripple for cross-border payments to more countries in the next year. This suggests that, while there is considerable criticism of Ripple’s operations, this does not seem to be dissuading companies looking to use its technology. While Ripple would be wise to take the concerns voiced during the hearing to heart — in particular, those related to being misleading to investors — it doesn’t seem like interest in its technology is going anywhere for the time being. Of the many technologies reshaping the world economy, distributed ledger technologies (DLTs) are among the most hyped. DLTs are most often associated with cryptocurrencies like Bitcoin, but such coverage sidelines the broader use cases of DLTs, even though they stand to make a far bigger impact on the broader the financial services (FS) industry. DLT's value lies in its ability to centralize record-keeping, while cutting out the need for authorization by an overseeing party, instead allowing a record to be confirmed by multiple parties with access to the database. This means DLTs have the potential to streamline financial institutions' (FIs) operations, boost data security, improve customer relationships, and drastically cut costs. But many FIs have struggled to implement DLTs and reap the rewards, because of organizational obstacles, but also because of issues rooted in the technology itself. There are a few players working to make the technology more usable for FIs, and progress is now being made. In a new report, Business Insider Intelligence takes a look at what DLTs are and why they hold so much promise for FS, the sectors in which DLTs are gaining the most traction and why, and the efforts underway to remove the obstacles preventing wider DLT adoption in finance. It also examines the few FIs close to unleashing their DLT projects, and how DLTs might transform the nature of FS if adoption truly takes off. Here are some of the key takeaways from the report:

In full, the report:

Subscribe to an All-Access pass to Business Insider Intelligence and gain immediate access to:

|

Daily Volatility Decline? Bitcoin Has Seen $1K Range 43 Times In 2018

|

CoinDesk, 1/1/0001 12:00 AM PST Bitcoin's price may be quiet at the moment, but data through April shows it's certainly been one volatile start to 2018. |

Reports of institutional crypto desks have been greatly exaggerated

|

TechCrunch, 1/1/0001 12:00 AM PST Todays news that Goldman Sachs is opening a Bitcoin trading desk is good news for the crypto economy as a whole. But is it a real shift in perception for crypto at big institutions? Not likely, said David Gerard, author of Attack of the 50 Foot Blockchain. “If you look closely at the reports, they […] |

Bitcoin is ‘Bulls–t,’ Says ‘Dr Doom’ Nouriel Roubini in Latest Crypto Rant

|

CryptoCoins News, 1/1/0001 12:00 AM PST Nouriel Roubini has doubled down on his longstanding hatred for bitcoin, ranting this week that the flagship cryptocurrency is “bulls–t” and that blockchain technology is not much more valuable. Roubini, who participated in a panel discussion on cryptocurrencies at the annual Milken Institute Global conference in Los Angeles, unleashed a verbal assault on bitcoin that The post Bitcoin is ‘Bulls–t,’ Says ‘Dr Doom’ Nouriel Roubini in Latest Crypto Rant appeared first on CCN |

Sell In May and Go Away? Not for Bitcoin Bulls

|

CoinDesk, 1/1/0001 12:00 AM PST While equity bulls fear drops in May, it should not be a cause of worry for the bitcoin market, according to historical data. |

Reddit Aims to Relaunch Bitcoin Payments with ETH and LTC Too

|

CoinDesk, 1/1/0001 12:00 AM PST Reddit is looking to bring back cryptocurrencies as a payment option – and this time bitcoin won't be the only option. |

Reddit Aims to Relaunch Bitcoin Payments with ETH and LTC Too

|

CoinDesk, 1/1/0001 12:00 AM PST Reddit is looking to bring back cryptocurrencies as a payment option – and this time bitcoin won't be the only option. |

Reddit to Re-Enable Bitcoin Payments, Ethereum and Litecoin Support Coming

|

CryptoCoins News, 1/1/0001 12:00 AM PST Cryptocurrencies are set to make a comeback on Reddit. It is the largest community where cryptocurrency enthusiasts meet and discuss the technology. The Bitcoin subreddit has 816K subscribers, and Cryptocurrency subreddit has over 663K subscribers. But back in March, the platform disabled Bitcoin as a payment method for Reddit Gold after enabling it in February The post Reddit to Re-Enable Bitcoin Payments, Ethereum and Litecoin Support Coming appeared first on CCN |

Reddit to Re-Enable Bitcoin Payments, Ethereum and Litecoin Support Coming

|

CryptoCoins News, 1/1/0001 12:00 AM PST Cryptocurrencies are set to make a comeback on Reddit. It is the largest community where cryptocurrency enthusiasts meet and discuss the technology. The Bitcoin subreddit has 816K subscribers, and Cryptocurrency subreddit has over 663K subscribers. But back in March, the platform disabled Bitcoin as a payment method for Reddit Gold after enabling it in February The post Reddit to Re-Enable Bitcoin Payments, Ethereum and Litecoin Support Coming appeared first on CCN |

China National Radio Questions Legality of OKEx Bitcoin Futures Trading

|

CoinDesk, 1/1/0001 12:00 AM PST China National Radio, a high-level mouthpiece of the government, has claimed OKEx illegally offered bitcoin futures and OTC trading. |

The Blockchain Data Problem Is Bigger Than You Think

|

CoinDesk, 1/1/0001 12:00 AM PST Some bitcoin data points seem easy enough to measure, but beware, there's more nuance to those numbers than you might think. |

Major Cryptocurrencies Record Strong Gains, Ethereum Price up 7%, Bitcoin at $9,300

|

CryptoCoins News, 1/1/0001 12:00 AM PST The cryptocurrency market has recorded strong gains once again over the past 24 hours, as the valuation of the market broke the $440 billion, moving one step closer to the $0.5 trillion region. Bitcoin, Ethereum, Cardano, Bitcoin Cash, and other major cryptocurrencies demonstrated large short-term gains. Ethereum Leads Market The price of Ether, the native … Continued The post Major Cryptocurrencies Record Strong Gains, Ethereum Price up 7%, Bitcoin at $9,300 appeared first on CCN |

Goldman Sachs to Begin Bitcoin Futures Trading Within Weeks

|

CoinDesk, 1/1/0001 12:00 AM PST Goldman Sachs is launching a new operation that will use the firm's own money to trade bitcoin related contracts on behalf of its clients. |

‘A New Phenomenon’: Eurasian Economic Union Discusses Cryptocurrencies and Blockchain

|

CryptoCoins News, 1/1/0001 12:00 AM PST The five-member nations of the Eurasian Economic Union (known officially as EAEU) are trying to figure out how they should leverage cryptocurrencies and blockchain, the technology behind bitcoin, to improve their economies. Eurasian bankers and scientists discussed these topics in Moscow last week at a conference jointly hosted by the Eurasian Economic Commission, the Interstate The post ‘A New Phenomenon’: Eurasian Economic Union Discusses Cryptocurrencies and Blockchain appeared first on CCN |

Goldman Sachs Will Launch a Bitcoin Trading Desk

|

CryptoCoins News, 1/1/0001 12:00 AM PST Goldman Sachs will launch a bitcoin trading desk, the investment banking giant confirmed on Wednesday. The New York Times reports that the firm, one of the largest financial institutions in the United States, is preparing to begin using its own funds to sponsor a variety of investment contracts tied to the bitcoin price and hopes The post Goldman Sachs Will Launch a Bitcoin Trading Desk appeared first on CCN |