OIL CRASHES: Here's what you need to know (DIA, SPX, SPY, QQQ, IWM, TLT, OIL, USO)

|

Business Insider, 1/1/0001 12:00 AM PST

Another day, more new lows for crude oil. On Monday stocks finished higher while West Texas Intermediate crude oil, the US benchmark, fell over 6% and cracked $31 a barrel at one point for the first time since December 2003. Technology stocks were hit particularly hard on Monday while the Dow and S&P 500 managed to eke out gains. First, the scoreboard:

And now, the top stories on Monday:

SEE ALSO: Loads of Americans are moving out of these 18 states Join the conversation about this story » NOW WATCH: Why Chinese executives keep disappearing |

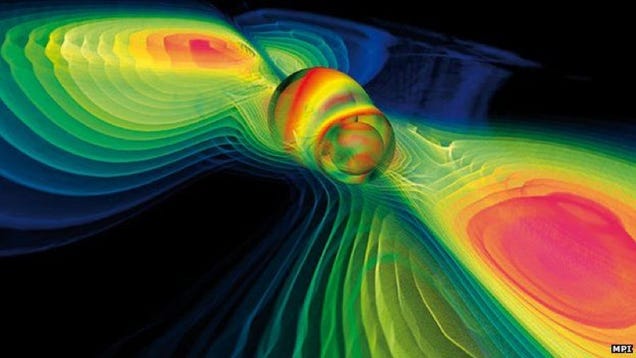

Why Finding Gravitational Waves Would Be Such a Big Deal

|

Gizmodo, 1/1/0001 12:00 AM PST

This morning, the Internet erupted with rumors that physicists have finally observed gravitational waves; ripples in the fabric of spacetime predicted by Albert Einstein a century ago. While it isn’t the first time we’ve heard excited whispers about the elusive phenomena, the gossip feels more promising, in light of the recently upgraded detector at the Laser Interferometer Gravitational Wave Observatory (LIGO) that’s behind all the hubbub. |

Breadwallet CEO Aaron Voisine: We Support Core's Scalability Road Map, but Bitcoin Does Need a Hard Fork

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Breadwallet , according to CEO and co-founder Aaron Voisine, is one of the most popular mobile bitcoin wallets that signed the scaling “ road map ” proposed by Bitcoin Core developer Gregory Maxwell. Speaking to Bitcoin Magazine, Voisine did emphasize, however, that Bitcoin’s block-size limit will need to be increased through a hard fork as well – and sooner rather than later. “I’m concerned that it will become increasingly difficult to make hard forks. We should find a durable solution for scalability as soon as possible,” Voisine said. The block-size dispute, which made headlines throughout 2015, represents a trade-off between the number of transactions the Bitcoin network can handle and its decentralization . To increase the possible number of transactions, Maxwell’s road map – which found much support among developers – effectively combines a limited block-size increase with additional optimizations. Importantly, this plan heavily relies on Bitcoin Core developer Dr. Pieter Wuille’s Segregated Witness proposal , and, as such, does not require a hard fork any time soon. “I’m quite excited about Segregated Witness. Breadwallet will support it as soon as it’s rolled out,” Voisine told Bitcoin Magazine. ”I am, however, a little concerned that it might delay the hard fork increase, which will still be necessary. It’s important to increase the maximum block size soon for bitcoin to become a major currency, and to maintain an acceptable user experience.” As such, Voisine agrees with a recent opinion piece by Jeff Garzik and Gavin Andresen, in which the two prominent Bitcoin Core developers call for a block-size limit increase in order to maintain Bitcoin’s current low-fee policy. Allowing blocks to fill up, Garzik and Andresen contend, would constitute a radical change to Bitcoin’s economics which, in turn, could harm Bitcoin companies and drive users away. “The risk of not increasing the max block size is far greater than the suggested centralization risk,” Voisine said. “Some developers have a strong status-quo bias when it comes to the network rules, but are failing to consider that the network behavior will change radically as use increases and the rules don’t change with it. With billions of dollars worth of value at stake, it is imperative that we take the conservative route and maintain the existing network behavior in the face of growing network use.” To solve Bitcoin’s scalability issue, Maxwell’s road map envisions a future where most transactions are not recorded on the blockchain at all. Rather, they are conducted on layers built on top of Bitcoin’s blockchain, which some developers predict will have most of the benefits offered by “on-chain” transactions – plus some extra. This vision is not shared by Breadwallet, however. “These additional layers are interesting research projects, but the Bitcoin network needs to stand on it’s own,” Voisine said. “It’s ill-advised to let Bitcoin’s future rely on other networks, who’s decentralization, security and stability haven’t been fully researched and tested, and haven’t even been implemented yet.” Instead, Voisine believes Bitcoin’s decentralization should be safeguarded through some of the added benefits of Segregated Witness, and other protocol optimizations. In particular, the Breadwallet CEO is excited about Fraud Proofs, a method enabled by Segregated Witness which would vastly increase the security of SPV clients (or “light wallets”) such as Breadwallet. And while SPV clients would still not be quite as secure as full nodes, Voisine believes fee policy by miners and individual nodes would ensure the Bitcoin network can’t be abused by attackers. “There is still the tried-and-true method of inducing users to pay transaction fees, through default network relay rules, and miner transaction selection rules,” Voisine explained. “Fees can be raised using these tools if needed, which will cause users to voluntarily economize on blockchain use at the cost of centralizing small value transactions by pushing them off chain.” The post Breadwallet CEO Aaron Voisine: We Support Core's Scalability Road Map, but Bitcoin Does Need a Hard Fork appeared first on Bitcoin Magazine. |

Netflix CFO: ‘Sure Would Be Nice to Have Bitcoin’ Payments

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin – a decentralized, truly global currency. Netflix – a streaming platform that just went global. Do both stand to gain by coming together? One of the biggest stories of the 2016, so far, is Netflix’s global expansion that saw the streaming service reach a 130 new countries. The new rollout now sees Netflix beaming […] The post Netflix CFO: ‘Sure Would Be Nice to Have Bitcoin’ Payments appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Netflix Exec Suggests Streaming Video Giant Open to Bitcoin

|

CoinDesk, 1/1/0001 12:00 AM PST The CFO of streaming video giant Netflix issued new comments on digital currency in a recent public Q&A. |

Rumors Are Flying That We Finally Found Gravitational Waves

|

Gizmodo, 1/1/0001 12:00 AM PST

Excited rumors began circulating on Twitter this morning that a major experiment designed to hunt for gravitational waves—ripples in the fabric of spacetime first predicted by Albert Einstein—has observed them directly for the very first time. If confirmed, this would be one of the most significant physics discoveries of the last century. |

BitPesa Board Member Departs Following Kenyan Government Appointment

|

CoinDesk, 1/1/0001 12:00 AM PST Bitcoin remittance startup BitPesa has lost one of its board members following an appointment to a top government position related to technology. |

DRM And Blockchains: An Interview with Bryce Weiner

|

CryptoCoins News, 1/1/0001 12:00 AM PST For my first interview as a journalist, I have chosen a controversial figure that people either love or hate. In an interview with CCN, Bryce sits with me and we discuss his past and future with surprising revelations including his plans for future blockchains. Bryce Weiner is 41 years old and a Bitcoin and fintech […] The post DRM And Blockchains: An Interview with Bryce Weiner appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Scalability Debate Continues As Bitcoin XT Proposal Stalls

|

CoinDesk, 1/1/0001 12:00 AM PST The industry has failed to reach consensus over the bitcoin block size issue so far, so what is the solution? |

Indian Banks & Big Industry Targeted in Ransomware Racket Demanding Bitcoin

|

CryptoCoins News, 1/1/0001 12:00 AM PST Three banks and a pharmaceutical company in India have been revealed as targets of a ransomware scheme that saw a ransom demand in bitcoin. In what is now the first known instance of an online extortionist demanding ransom in bitcoins from Indian targets, the Economic Times has revealed that hackers disrupted operations by crippling computers […] The post Indian Banks & Big Industry Targeted in Ransomware Racket Demanding Bitcoin appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

CES 2016 Roundup: Artificial Intelligence And Custom Maps Will Take Over Your Driving Soon

|

Forbes, 1/1/0001 12:00 AM PST After another glamorous, glitzy and automotive-heavy Consumer Electronics Show, it's clearly the show is setting out to be the best one on automated driving. CES featured showcases on the automated driving hand-off scenarios, and what technology options and ripple effects automated driving can bring on board; that’s where deep learning and artificial intelligence comes in. The other major showcase area continues to be Human to Machine Interface (HMI)-related innovations, especially the relevance of digital clusters and head-up displays, and the overall concept of networked displays in the age of automated driving and connected living. Here are some of the top trends my team observed during the show. |

Snapcard CEO: Developing Countries Care About Bitcoin, Not Blockchain

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST While Wall Street seems more interested in the idea of permissioned or private blockchains these days, the point of Bitcoin in developing countries has nothing to do with the technology underpinning the decentralized payment network. According to Snapcard Co-Founder and CEO Michael Dunworth, people in developing nations are more interested in bitcoin as a currency than those in more developed countries. While there are some niche use cases for Bitcoin in places like the United States, it seems clear that owners of credit cards with cashback programs are not going to switch to the digital currency at any point in the near future. Michael Dunworth recently sat down with Bitcoin Magazine to discuss some of his thoughts on the Bitcoin versus blockchain debate, and he explained why Wall Street is focused on blockchain technology, while the developing world has its eyes set on bitcoin. Some Countries Would Still Like a Decent Currency Dunworth understands the current trend is a move away from bitcoin and toward the blockchain, but he does not see the same phenomenon in the developing world. During his conversation with Bitcoin Magazine, the Snapcard CEO said that some parts of the world still have interest in bitcoin as a currency: “Right now, everyone is talking about the blockchain. It’s not bitcoin, it’s the blockchain. That’s very USA bubble. If you go to Brazil, Nairobi in Kenya or Argentina, they still need a decent currency. They don’t have a Chase Rewards card that gives them one-and-a-half percent back on everything they spend.” In accordance with Dunworth’s vision, Snapcard has made Brazil one of its main areas of focus. Dunworth gave a presentation to a variety of government officials and central bankers at the Central Bank of Brazil in November, and the company has also partnered with PagPop , which is a payment processor with more than 12,000 merchants in Brazil. Americans Won’t Choose Bitcoin Over Credit Cards When discussing the consumer adoption of bitcoin in the United States (or lack thereof), Dunworth made the point that Americans already have options that are comparatively better than the cryptocurrency — at least when it comes to making payments. Plenty of Americans are interested in holding bitcoin as a speculative asset, but the idea of spending bitcoin is less attractive. Dunworth explained: “You’re going to be very hard pressed to find a decent incentive to get someone in the USA to get someone to use bitcoin and say, ‘Hey. Go spend this over your local currency. Go spend this over your Chase Rewards card.’ [And that’s] the majority of people. Over 78 percent of Americans have credit cards or something ridiculous like that — of which are tied to a loyalty program of sorts.” Dunworth did agree that discounts could be used as an incentive to get some Americans on board with spending their bitcoin, and he pointed to Fold and Purse as two perfect examples of the types of apps that could get more people in the United States interested in the digital currency. One of the main points Dunworth attempted to get across during his conversation with Bitcoin Magazine is that there needs to be a compelling use case for someone to switch to bitcoin. So why isn’t Wall Street interested in Bitcoin? In Dunworth’s view, it has to do with the difficulties involved with selling Americans on the idea of using the digital payment system. “In general, the reason why they don’t talk about Bitcoin as much on Wall Street and they’re talking blockchain instead of Bitcoin — why would they talk about something that doesn’t have a use case? It’s like, ‘Oh. I can use bitcoin as a currency.’ And [consumers would say], ‘Why do I need to?’” he said. Many Countries Don’t Need to Be Sold on Bitcoin Dunworth said you don’t need to sell people on bitcoin in certain parts of the world. Once you explain how it works, the idea intrinsically makes sense to them because it is much better than their other currently available options for money, payments or both. Dunworth used a hypothetical story of a Zimbabwean farmer to explain the contrast between the developed and the developing worlds when it comes to Bitcoin: “I’ve got to sell you on [bitcoin in the United States]. You’re like, ‘Why would I use it?’ If I’m in Nairobi and the dude is wheelbarrowing Zimbabwean dollars across the border to pay for a bag of rice, I don’t have to sell him on anything. That’s the contrast. So the emerging markets are going to see bitcoin as a currency, but I don’t know if that’s going to happen in the U.S. or more developed countries.” The post Snapcard CEO: Developing Countries Care About Bitcoin, Not Blockchain appeared first on Bitcoin Magazine. |

Bitcoin Price Finds Intermediate Support

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin price is holding to a previous chart structure after finding support near 2900 CNY and $440. This analysis is provided by xbt.social with a 3-hour delay. Read the full analysis here. Not a member? Join now and receive a $29 discount using the code CCN29. Bitcoin Price Analysis Time of analysis: 14h30 UTC BTCC […] The post Bitcoin Price Finds Intermediate Support appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Why Bitcoin Needs 21 Inc to Deliver in 2016

|

CoinDesk, 1/1/0001 12:00 AM PST You may not have heard the name Balaji Srinivasan, but in 2016 the 21 Inc CEO could become synonymous with another more infamous ‘b’ word: 'bitcoin'. |

The RAND Corporation Report: National Security Implications of Virtual Currency

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST The RAND Corporation, an influential global policy think tank with strong defense and homeland security ties, has released a report titled “National Security Implications of Virtual Currency .” The report, freely available online , examines the feasibility for non-state actors, including terrorist and insurgent groups, to increase their political and/or economic power by deploying a virtual currency (VC) for use in regular economic transactions. The report was sponsored by the U.S. government through the Office of the Secretary of Defense, and the research work was conducted within the International Security and National Security Implications of Virtual Currency Defense Policy Center of the RAND National Defense Research Institute, a federally funded research and development center sponsored by the Office of the Secretary of Defense, the Joint Chiefs of Staff, the Unified Combatant Commands, the Navy, the Marine Corps, the defense agencies and the defense intelligence community. After the recent wave of terrorist attacks in Paris and San Bernardino, it was easy to predict that virtual currencies would be denounced as tools that can be used by terrorists for their criminal intent. Immediately after the Paris attacks, there have been calls to increase state control of digital currency transactions to prevent terrorists from using digital currencies to work around state regulation and control of fiat currency transactions – or to ban digital currencies entirely. The RAND report goes one step further and suggests that governments should use advanced technical means to actively disrupt virtual currencies. That includes terrorist groups, but also peaceful deployments of digital currencies by other non-state actors, and a general war on privacy and encryption. According to the RAND analysts, virtual currencies demonstrate a resilient means of storing data in a highly distributed fashion that is very hard to corrupt and could permit, for instance, information dissemination (blogs, social media, forums, news websites) that is resilient to nation-state interference. “[Virtual currencies] represent the latest step toward decentralized cyber services,” notes the report. “In particular, the historical trend suggests the development of a resilient public cyber key terrain, which this report defines as the ability of unsophisticated cyber actors to have persistent, assured access to cyber services regardless of whether a highly sophisticated state actor opposes their use.” The report suggests that the U.S. Department of Defense should disrupt decentralized digital currencies to prevent “unprecedented global access to information and communication services that, at its core, is agnostic to the national security interests of the United States.” The RAND researchers analyze key features of decentralized blockchain-based systems, including but not limited to virtual currencies, of which bitcoin is the best-known example. But non-currency applications of blockchain technology, such as sophisticated systems for encrypted storage and emerging forms of decentralized web and communication services, are seen as equally threatening. In fact, one of the effects of the growing popularity of Bitcoin is an increase in the cryptography awareness and sophistication of the population at large. “Increased awareness of block-chain technologies has, as a result, increased awareness of sophisticated cryptographic techniques for distributed consensus and computation,” note the analysts. “Venture capitalists now talk about computer-science concepts [that] would never have been the subject of discussion beyond rarefied academic circles.” A key consideration is that digital currencies are still relatively unknown and untrusted by the population. But this will change as more people begin to see the advantages of decentralized, P2P blockchain-based systems for all sorts of value storage and transactions. In fact, digital currencies are becoming more and more popular, not only in the developed world, but also in the developing world where unfavorable economic conditions and inefficient financial systems could push people to accept a non-state digital currency as a viable alternative. Therefore, the RAND report seems to suggest pre-emptive strikes and notes that “perhaps the best strategy for the United States and its allies to thwart a VC deployment would be to target those properties of a VC that would most increase its acceptance, most notably transaction anonymity, security, and availability.” Examples of promising cyber attacks against digital currencies and blockchain-based systems for other applications are given. In related news, presidential candidate Hillary Clinton has recently called for a “Manhattan-like project” to help law enforcement break into encrypted communications. Calls for a war on encryption have also been issued by other top politicians worldwide, such as U.K. Prime Minister David Cameron, whose plan to ban strong encryption in Britain has been ridiculed by high-profile Internet activists. A difference is that Clinton and RAND suggest relying more on technical means other than regulations and bans. The post The RAND Corporation Report: National Security Implications of Virtual Currency appeared first on Bitcoin Magazine. |

Bitcoin Price Achieves Stability: Why It Will Continue

|

CryptoCoins News, 1/1/0001 12:00 AM PST The current rise in bitcoin’s price is more stable than its previous price changes, according to Martin Tillier, a financial advisor writing in Nasdaq, a provider of exchange technology, trading, information and public company services across six continents. Tillier says bitcoin’s previous price hikes were mysterious, but the current one is due to the devaluation […] The post Bitcoin Price Achieves Stability: Why It Will Continue appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Executives from the most notorious hedge fund blow-up of the 1990s are back — and they want a piece of China

|

Business Insider, 1/1/0001 12:00 AM PST

Welcome back, Long-Term Capital Management. Sort of. According to a report from Bloomberg, Jeff Li, a former strategist at Long-Term Capital Management will serve as CEO of Sycamore Investment Services, a new firm designed to connect Chinese investors with global hedge funds. Among Sycamore's early investors is John Meriwether, the former CEO of LTCM. Long-Term Capital Management is the notorious hedge fund that blew up in 1998 and had to be bailed out by the Federal Reserve after Russia defaulted on its debt in 1998. The fund's rise and fall was chronicled in Roger Lowenstein's classic book "When Genius Failed." Among LTCM's early partners were Robert Merton and Myron Scholes, who won the Nobel Prize together in 1997 for their work on derivatives pricing just a year before the fund fell apart. As Bloomberg's Bei Hu notes, Sycamore joins other firms that are seeking to give Chinese investors access to more international developments as the ability for capital to flow in and out of China — both from Chinese and international investors – has slowly eased. SEE ALSO: Yes, China matters to the US Join the conversation about this story » NOW WATCH: Why Chinese executives keep disappearing |

The Emercoin Group Forms a Partnership With the Microsoft Corp.

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin Press Release: The Emercoin group is proud to announce they have formed a partnership with the Microsoft Corp. (NASDAQ:MSFT) to deliver their blockchain services to the Azure cloud’s Blockchain-as-a-Service marketplace. Emercoin, a leading digital currency and blockchain platform has just partnered with Microsoft to become a member of the Azure marketplace. With demand growing […] The post The Emercoin Group Forms a Partnership With the Microsoft Corp. appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

San Diego’s First 2-Way Bitcoin ATM Opens

|

CryptoCoins News, 1/1/0001 12:00 AM PST The San Diego County in South California is now home to its very first 2-way Bitcoin ATM machine. A new 2-way Bitcoin ATM – the first of its kind in San Diego County – was announced today by CoinStructive Inc., a Bitcoin marketplace consultant in partnership with CoinOutlet Inc., a U.S.-based hardware startup-centric to Bitcoin […] The post San Diego’s First 2-Way Bitcoin ATM Opens appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Bill Seeking Bitcoin Ban Reaches Russian Legislature

|

CoinDesk, 1/1/0001 12:00 AM PST Russian lawmakers recently submitted a draft bill to Russia's Parliament that would effectively ban the use of digital currencies in the country. |

Stock Market Sees Worst First Week Ever; Bitcoin Surges

|

CryptoCoins News, 1/1/0001 12:00 AM PST Do Wall Street’s woes have anything to do with bitcoin’s bounce? Bitcoin was one of the few winning investments in the worst first week of the year for U.S. stocks, according to The Wall Street Journal. The Dow Jones Industrial Average (DJIA) and the S&P 500 had their worst first weeks in history. Bitcoin, gold, […] The post Stock Market Sees Worst First Week Ever; Bitcoin Surges appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

World’s Largest Bitcoin Poker Freeroll to Accompany BetCoin™ Casino Poker Launch

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin Press Release: Bitcoin gaming platform BetCoin™ is pleased to announce the world’s largest online Bitcoin poker freeroll launching today. International gaming giant BetCoin™ Bitcoin Casino has once again sent a shockwave throughout the Bitcoin Casino market by announcing the largest ever Bitcoin Freeroll Campaign, following up on its introduction of the world’s only Bitcoin […] The post World’s Largest Bitcoin Poker Freeroll to Accompany BetCoin™ Casino Poker Launch appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Banks Still Closing Accounts Over Bitcoin Activity

|

CryptoCoins News, 1/1/0001 12:00 AM PST Finding a bank that makes it easy to buy and sell bitcoin continues to be a challenge. The problem doesn’t come as a surprise to CCN readers, given that some major banks have questioned the need for bitcoin. (Some of these same institutions have touted the benefits of blockchain technology, which strikes many observers as paradoxical.) […] The post Banks Still Closing Accounts Over Bitcoin Activity appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Chrysler's new minivan of the future

|

CNN Money, 1/1/0001 12:00 AM PST Say goodbye to the Chrysler Town & Country and the Doge Grand Caravan minivans. Both will soon be history. |