Brave browser lets you tip your favorite sites in bitcoin

|

Engadget, 1/1/0001 12:00 AM PST

|

As Central Banks Sell off Record US Debt, Blockchain Offers Cost Cutting for Financial Industry

|

CryptoCoins News, 1/1/0001 12:00 AM PST Central banks are playing hot potato with America’s debt. The first six months of this year saw foreign central banks sell a net $192 billion of U.S Treasury bonds – double that of last year. The post As Central Banks Sell off Record US Debt, Blockchain Offers Cost Cutting for Financial Industry appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Brave Details Payment Process for Supporting Websites; Users Get Paid Too

|

CryptoCoins News, 1/1/0001 12:00 AM PST Brave, a web browser that blocks third-party trackers and unwanted ads from websites and allows users to reward preferred web content, has detailed how it accomplishes these things in a blog by Brendan Eich, founder, president and CEO. Brave recently introduced a beta version of its bitcoin-based payment system that automatically pays the websites that […] The post Brave Details Payment Process for Supporting Websites; Users Get Paid Too appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

What you need to know on Wall Street right now

|

Business Insider, 1/1/0001 12:00 AM PST Finance Insider is Business Insider's summary of the top stories of the past 24 hours. The US economy added 151,000 jobs in August, fewer than forecast, while the unemployment rate was unchanged at 4.9%, according to data released Friday by the Bureau of Labor Statistics. Donald Trump's campaign reacted to the disappointing August jobs report on Friday by contending it was further proof of the “stagnant Clinton-Obama economy.” Apple CEO Tim Cook has continued to rail against the European Commission for Competition's ruling that the company got a special deal from Ireland to avoid taxes, which is against EU rules. And he said something else that raised some eyebrows. "We provisioned several billion dollars for the US for payment as soon as we repatriate it, and right now I would forecast that repatriation to occur next year," Cook told RTE's Paschal Sheehy. Barclays lent $3 billion (£2.2 billion) to Qatari investors to buy the bank's shares and help it avoid a government bailout at the height of the 2008 crisis, Amanda Staveley, the dealmaker at the centre of the transaction, alleged in court documents. There's an EpiPen Tycoon computer game, and it is a gentle reminder of the monster we've made of our stock market, according to Business Insider's Linette Lopez. In other news, Uber tried to buy Lyft but negotiations fell apart over price, TPG-Axon Capital Management is shutting its office in Hong Kong, and Hillary Clinton announced plan to address 'unjustified' price hikes on lifesaving drugs. The average American is gripped by fear, according to Byron Wien, Blackstone's vice chairman and investing guru. Finally, here are 26 airport travel hacks that'll make your next flight a breeze. Here are the top Wall Street headlines at midday: See Wall Street's slow, devastating decline in one chart — It has been a rough couple of years on Wall Street. DEUTSCHE BANK: America's 'energy shock' is over — One of the biggest stories over the past few years has been the struggling American energy sector. Everyone should stop acting like the world is going to end — The headline averages of the major stock indexes appear to be riding high, sitting near all-time records set just a few weeks ago. BYRON WIEN: I spent all summer meeting with rich people and no one was excited about anything — Blackstone vice chairman Byron Wien spent the summer meeting with power players in US finance, real estate, technology, and politics. Samsung just gave a big gift to Apple — The iPhone 7 is expected to be boring. A shipping giant's bankruptcy could have terrifying ripple effects on the economy — The bankruptcy of the Hanjin shipping line has thrown ports and retailers around the world into confusion, with giant container ships stranded and merchants worrying whether tons of goods will reach their shelves. BERNANKE: The Fed shouldn't shrink its $4.5 trillion balance sheet — I attended the Fed’s recent gathering in beautiful Jackson Hole, Wyoming—the first time I had been since the end of my term as Fed chairman. I enjoyed the opportunity to catch up with many friends and former colleagues. This clothing line wants to solve the biggest problems with shopping for a work wardrobe — Ola Hixon used to hate shopping for professional workwear. SEE ALSO: This brilliant map renames each US state with a country generating the same GDP |

The Fight for On-Blockchain Bitcoin Scaling Soldiers On

|

CoinDesk, 1/1/0001 12:00 AM PST A web conference this week found a notable selection of industry thought leaders exploring lesser-publicized solutions for bitcoin scaling. |

8 in 10 financial service executives fear losing market share to fintechs

|

Business Insider, 1/1/0001 12:00 AM PST

Although many financial services firms are implementing strategies aimed at staving off disruption — including partnering with fintechs, launching incubators, and building solutions to help them better compete — new data suggests that most executives think these initiatives are not enough to protect their businesses. Eighty-three percent of UK financial services executives believe that the expansion of fintechs will negatively impact their ability to maintain or grow market share over the next 12 months, according to data from Robert Half. Here are the study’s other key findings:

We think that these executives' fears are largely unfounded, and that in the future, we will see more partnerships between incumbents and fintechs. Eventually, we expect to witness the acquisition of these fintechs by incumbents, once it's been ensured that the new technology and business models work. This will reduce potential competitors, while bolstering activity for financial services firms by enabling them to operate more efficiently and offer more services. In turn, they will likely become more competitive with any remaining stand-alone fintechs. Regardless of the executives' feelings, it's clear that we’ve entered the most profound era of change for financial services companies since the 1970s brought us index mutual funds, discount brokers and ATMs. No firm is immune from the coming disruption and every company must have a strategy to harness the powerful advantages of the new fintech revolution. The battle already underway will create surprising winners and stunned losers among some of the most powerful names in the financial world: The most contentious conflicts (and partnerships) will be between startups that are completely reengineering decades-old practices, traditional power players who are furiously trying to adapt with their own innovations, and total disruption of established technology & processes:

As you can see, this very fluid environment is creating winners and losers before your eyes…and it’s also creating the potential for new cost savings or growth opportunities for both you and your company. After months of researching and reporting this important trend, Evan Bakker, senior research analyst for BI Intelligence, Business Insider's premium research service, has put together an essential report on the fintech ecosystem that explains the new landscape, identifies the ripest areas for disruption, and highlights the some of the most exciting new companies. These new players have the potential to become the next Visa, Paypal or Charles Schwab because they have the potential to transform important areas of the financial services industry like:

If you work in any of these sectors, it’s important for you to understand how the fintech revolution will change your business and possibly even your career. And if you’re employed in any part of the digital economy, you’ll want to know how you can exploit these new technologies to make your employer more efficient, flexible and profitable. Among the big picture insights you'll get from The Fintech Ecosystem Report: Measuring the effects of technology on the entire financial services industry:

This exclusive report also:

The Fintech Ecosystem Report: Measuring the effects of technology on the entire financial services industry is how you get the full story on the fintech revolution. To get your copy of this invaluable guide to the fintech revolution, choose one of these options:

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of the fast-moving world of financial technology. |

A Chinese Online-Only Bank Will Present at the Global Blockchain Summit

|

CryptoCoins News, 1/1/0001 12:00 AM PST WeBank, launched last year by China’s internet giant Tencent whose instant messaging service Wechat and QQ is used by around 650 million people, is to present at Shanghai’s Global Blockchain Summit on the 23rd of September. As China’s first online-only bank, WeBank has extended $4.5 billion in loans, but faces stiff competition from Ant Financial’s […] The post A Chinese Online-Only Bank Will Present at the Global Blockchain Summit appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Brave to Integrate Bitcoin Micropayments: For "Users Who Will Take a Stand and Fight Back"

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST In March, Bitcoin Magazine covered the launch of the Brave browser, which offers faster browsing by replacing ads with clean and light ads.... The post Brave to Integrate Bitcoin Micropayments: For "Users Who Will Take a Stand and Fight Back" appeared first on Bitcoin Magazine. |

This new web browser wants to solve ad blocking problems with Bitcoin

|

Business Insider, 1/1/0001 12:00 AM PST

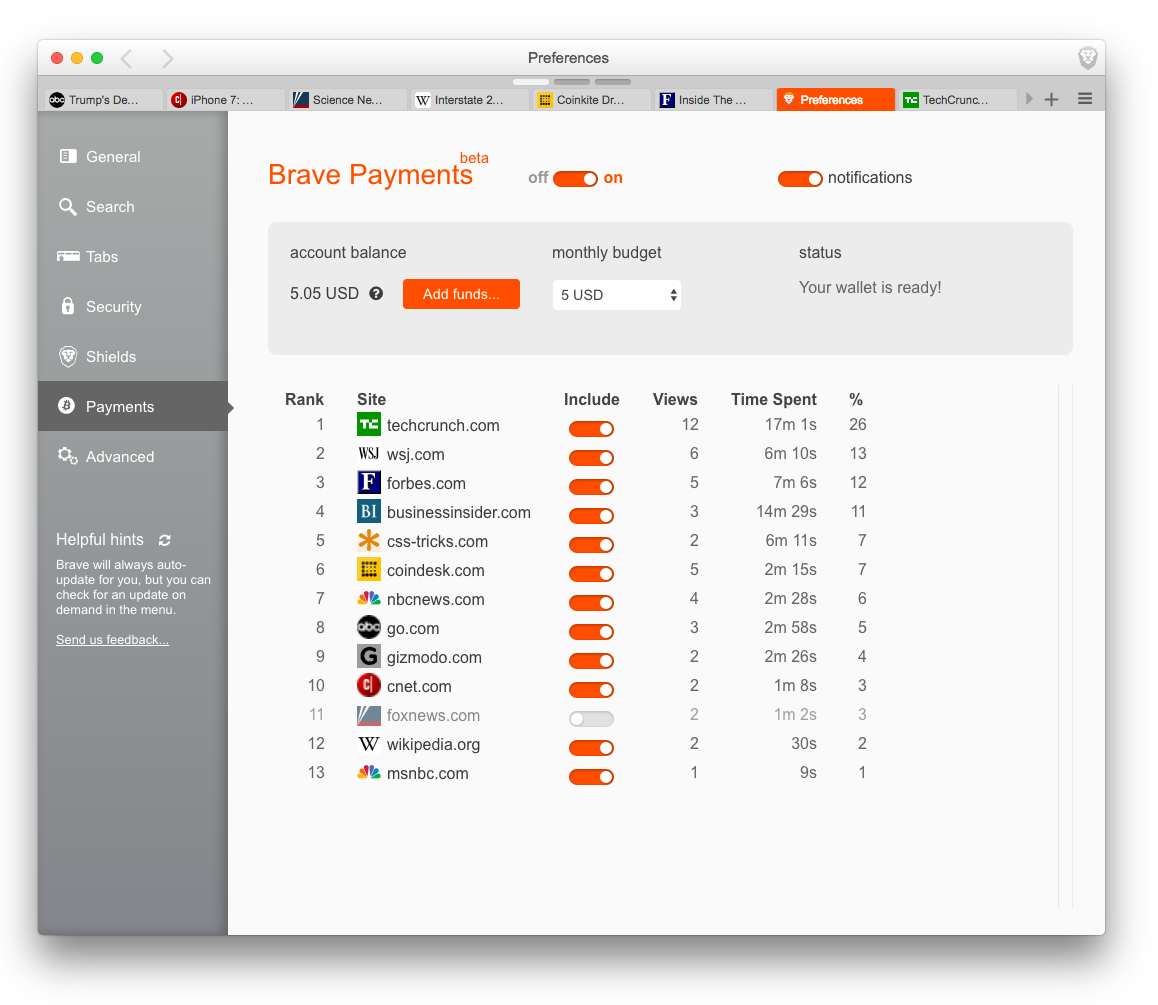

Brave — a web browser co-created by ex-Mozilla CEO Brendan Eich —launched Brave Payments in beta yesterday. The Brave browser blocks ads, but it also offers a novel solution that allows publishers to keep generating revenue. Brave Payments allows users to top up an account with bitcoin, select a monthly budget, and select sites that they would like to pay when they make a visit. Brave automatically pays these publishers based on the amount of time users of the browser spend on the publishers' web properties and how much the user is willing to give. BitGo is providing bitcoin wallets for Brave users and Coinbase is providing the marketplace for bitcoins to be purchased. Brave faces three hurdles before it can be a successful micropayments browser:

Brave technology is a solution to one of the big hurdles to a fee model based on time spent on content. Even if people begin paying for website visits, they are unlikely to pay much and these online transactions are typically made with credit and debit cards. These small-value card payments are a big problem for publishers because they carry fixed per-transaction fee in a addition to a variable fee based on the amount spent. That means that low value transactions tend to be less profitable and can even create losses. But fees for Bitcoin transactions are next to nothing, which makes low-value payments viable online. BitGo's pricing for outgoing transactions is 0.1% of volume. Blockchain technology, which is best known for powering Bitcoin and other cryptocurrencies, is gaining steam among finance firms because of its potential to streamline processes and increase efficiency. The technology could cut costs by up to $20 billion annually by 2022, according to Santander. That's because blockchain, which operates as a distributed ledger, has the ability to allow multiple parties to transfer and store sensitive information in a space that’s secure, permanent, anonymous, and easily accessible. That could simplify paper-heavy, expensive, or logistically complicated financial systems, like remittances and cross-border transfer, shareholder management and ownership exchange, and securities trading, to name a few. And outside of finance, governments and the music industry are investigating the technology’s potential to simplify record-keeping. As a result, venture capital firms and financial institutions alike are pouring investment into finding, developing, and testing blockchain use cases. Over 50 major financial institutions are involved with collaborative blockchain startups, have begun researching the technology in-house, or have helped fund startups with products rooted in blockchain. Jaime Toplin, research associate for BI Intelligence, Business Insider's premium research service, has compiled a detailed report on blockchain technology that explains how blockchain works, why it has the potential to provide a watershed moment for the financial industry, and the different ways it could be put into practice in the coming years. Here are some key takeaways from the report:

In full, the report:

To get your copy of this invaluable guide, choose one of these options:

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of blockchain technology. |

Darknet Marketplace Issues Complete Ban Against a Drug

|

CryptoCoins News, 1/1/0001 12:00 AM PST A popular darknet marketplace has announced that it has prohibited the sale of fentanyl after a dramatic rise in the number of deaths related to fentanyl overdose in the last two years. According to NBC, in Philadelphia, there has been a 636 percent increase in overdoses from the medical-grade opioid fentanyl. What is Fentanyl? Fentanyl […] The post Darknet Marketplace Issues Complete Ban Against a Drug appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

7 Recent Roger Ver Quotes on Block Size Debate and Bitcoin

|

CryptoCoins News, 1/1/0001 12:00 AM PST “Let’s Raise the Bitcoin Block Size!” That’s Roger Ver’s take on the block size debate. But the Bitcoin leader has been such a staunch proponent of increasing the block size, we at CCN, thought we’d take some of Roger’s most recent quotes on increasing the block size so that Bitcoin can take on more transactions […] The post 7 Recent Roger Ver Quotes on Block Size Debate and Bitcoin appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Bitfinex Reimburses First Bitcoin Exchange Hack Victims

|

CoinDesk, 1/1/0001 12:00 AM PST Analysts reacted positively to news that exchange Bitfinex had redeemed roughly 1% of its outstanding debt tokens on 1st September. |

R3 Blockchain Consortium Includes Second Chinese Member

|

CryptoCoins News, 1/1/0001 12:00 AM PST The private blockchain consortium led by blockchain technology startup R3 has added its newest member in China Merchants Bank, a Chinese banking giant. Guangdong-based China Merchants Bank (CMB), the first commercial bank wholly owned by corporate legal entities in China is now the second Chinese member to join the R3-led banking blockchain consortium. As of […] The post R3 Blockchain Consortium Includes Second Chinese Member appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Bitcoin Exchange BTC-E and BitcoinTalk Forum Breaches’ Details Revealed

|

CryptoCoins News, 1/1/0001 12:00 AM PST The details of cyberattacks resulting in breaches of user data from two prominent bitcoin websites – bitcoin exchange BTC-e and Bitcointalk.or, the largest bitcoin forum around – have been revealed. Data breach indexing and monitoring resource LeakedSource has revealed details surrounding data breaches suffered by bitcoin exchange Btc-e in 2014 and bitcoin discussion forum Bitcointalk.org in […] The post Bitcoin Exchange BTC-E and BitcoinTalk Forum Breaches’ Details Revealed appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Brave Browser Launches Bitcoin Micropayments For Rewarding User-Preferred Websites

|

CryptoCoins News, 1/1/0001 12:00 AM PST Brave, a web browser that blocks third-party trackers and ads, has introduced a beta version of its bitcoin-based payment system that automatically pays the websites that users want to support. Brave Payments allows users to reward sites for content they like without being tracked, including by Brave. The beta was announced in a blog by […] The post Brave Browser Launches Bitcoin Micropayments For Rewarding User-Preferred Websites appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Brave, the browser meant to block ads and trackers by design, has launched what might be a fairly controversial service: the ability to tip websites via bitcoin.

Brave, the browser meant to block ads and trackers by design, has launched what might be a fairly controversial service: the ability to tip websites via bitcoin.

This story was delivered to BI Intelligence "

This story was delivered to BI Intelligence " This story was delivered to BI Intelligence "

This story was delivered to BI Intelligence "