There's something about this market that doesn't add up

|

Business Insider, 1/1/0001 12:00 AM PST

The recent data isn’t supporting the narrative of accelerating global growth and inflation while equities continue to experience higher volatility. What does it mean for stocks, bonds and yields? Glad you asked! Here’s my take on why all the talk on an accelerating economy and rising inflation just doesn't add up when you look at the data. Equity Markets — A Relatively Narrow RecoveryThe shortened trading week opened Tuesday with every sector except technology closing in the red. The S&P 500 fell back below its 50-day moving average after Walmart (WMT) reported disappointing results, falling over 10% on the day, having its worst trading day in over 30 years. Walmart’s online sales grew 23% in the fourth quarter, but had grown 29% in the same quarter a year prior and were up 50% in the third quarter. We saw further evidence of the deflationary power of our Connected Society investing theme as the company reported the lowest operating margin in its history. Ongoing investment to combat Amazon (AMZN) and rising freight costs — a subject our premium research subscribers have heard a lot of about lately — were the primary culprits behind Walmart's declining numbers. To really rub salt in that wound, Amazon shares hit a new record high the same day. This pushed the outperformance of the FAANG stocks versus the S&P 500 even higher. Wednesday was much of the same, with most every sector again closing in the red, driven mostly by interpretations of the Federal Reserve’s release of the January Federal Open Market Committee meeting notes. In fact, twenty-five minutes after the release of those notes, the Dow was up 303 points . . . and then proceeded to fall 470 points to close the day down 167 points. To put that swing in context, so far in 2018, the Dow has experienced that kind of a range seven times but not once in 2017. Thursday was a mixed bag. Most sectors were flat to slightly up as the S&P 500 closed up just +0.1%, while both the Russell 2000 and the Nasdaq Composite lost -0.1%. The energy sector was the strongest performer, gaining 1.3% while financials took a hit, falling 0.7%. The recovery from the lows this year has been relatively narrow. As of Thursday’s close, the S&P 500 is still below its 50-day moving average, up 1.1% year-to-date with the median S&P 500 sector down -1.0%. Amazon, Microsoft and Netflix alone are responsible for nearly half of the year’s gain in the S&P 500. The Russell 2000 is down -0.4% year-to-date and also below its 50-day moving average. The Dow is up 78 points year-to-date, but without Boeing (BA), would be down 317 points as two-thirds of Dow stocks are in the red for the year. Fixed Income and Inflation — the Coming Debt HeadwindThe 1-year Treasury yield hit 2.0%, the highest since 2008 while the 5-year Treasury yield has risen to the highest rate since 2010, these are material moves! What hasn’t been terribly material so far is the Fed’s tapering program. It isn’t exactly a fire sale with the assets of the Federal Reserve down all off 0.99% since September 27 when Quantitative Tightening began, which translates into an annualized pace of 2.4%. As for inflationary pressures, U.S. Import prices increased 3.6% year-over-year versus expectations for 3.0%, mostly reflecting the continued weakness in the greenback. The Amex Dollar Index (DXY) has been below both its 50-day and 200-day moving averages for all of 2018. The increase in import prices excluding fuel was the largest since 2012 and also beat expectations. Import prices for autos, auto parts and capital goods have accelerated but consumer good ex-autos once again moved into negative territory. Outside the U.S. we see little evidence that inflation is accelerating. Korea’s PPI fell further to 1.2% - no evidence of rising inflation there. In China the Producer Price Index fell to a 1-year low – yet another sign that we don’t have rising global inflation. On Friday the European Central Bank’s measure of Eurozone inflation for January came in at 1.3% overall and has been fairly steadily declining since reaching a peak of 1.9% last April. This morning we saw that Japan’s Consumer Price Index rose for the 13th consecutive month in January, rising 0.9% from year-ago levels. Excluding fresh food and energy, the increase was just 0.4% - again, not exactly a hair-on-fire pace.

The reality is that the U.S. economy is today the most leveraged it has been in modern history with a total debt load of around $47 trillion. On average, roughly 20% of this debt rolls over annually. Using a quick back-of-the-envelope estimate, the new blended average rate for the debt that is rolling over this year will likely be 0.5% higher. That translates to approximately $250 billion in higher debt service costs this year. Talk about a headwind to both growth and inflationary pressures. The more the economy picks up steam and pushes interest rates up, the greater the headwind with such a large debt load… something consumers are no doubt familiar with and are poised to experience yet again in the coming quarters. The Twists and Turns of CryptocurrenciesThe wild west drama of the cryptocurrency world continued this week as the South Korean official who led the government’s regulatory clampdown on cryptocurrencies was found dead Sunday, presumably having suffered a fatal heart attack, but the police have opened an investigation into the cause of his death. Tuesday, according to Yonhap News, the nation’s financial regulator said the government will support “normal transactions” of cryptocurrencies, three weeks after banning digital currency trades through anonymous bank accounts. Yonhap also reported that the South Korean government will “encourage” banks to work with the cryptocurrency exchanges. Go figure. Bitcoin has nearly doubled off its recent lows. Tuesday the crisis-ridden nation of Venezuela launched an oil-backed cryptocurrency, the “petro,” in hopes that it will help circumvent financials sanctions imposed by the U.S. and help improve the nation’s failing economy. This was the first cryptocurrency officially launched by a government. President Nicolás Maduro hosted a televised launch in the presidential palace which had been dressed up with texts moving on screens and party-like music stating, “The game took off successfully.” The government plans to sell 82.4 million petros to the public. This will be an interesting one to watch. Economy — Maintaining Context & Perspective is KeyHousing joined the ranks of U.S. economic indicators disappointing to the downside in January with the decline in existing home sales. Turnover fell 3.2%, the second consecutive decline, and is now at the lowest annual rate since last September. Sales were 4.8% below year-ago levels while the median sales price fell 2.4%, also the second consecutive decline and this marks the 6th decline in the past 7 months. U.S. mortgage applications for purchase are near a 52-week low. Again, that’s the latest data, but as we like to say here at Tematica, context and perspective are key. Looking back over the past month, around 60% of the U.S. economic data releases have come in below expectations and this has prompted the Citigroup Economic Surprise Index (CESI) to test a 4-month low. Sorry to break it to you folks, but the prevailing narrative of an accelerating economy just isn’t supported by the hard data. No wonder that even the ever-optimistic Atlanta Fed has slashed its GDPNow forecast for the current quarter down to 3.2% from 5.4% on Feb. 1. We suspect further downward revisions are likely.

Looking up north, it wasn’t just the U.S. consumer who stepped back from buying with disappointing retail sales as Canadian retail sales missed badly, falling 0.8% versus expectations for a 0.1% decline. Over in the land of bronze, silver and gold dreams, South Korean exports declined 3.9% year-over-year. Wednesday’s flash PMI’s were all pretty much a miss to the downside. Eurozone Manufacturing PMI for February declined more than was expected to 58.5 from 59.6 in January versus expectations for 59.2. Same goes for Services which dropped to 56.7 from 58 versus expectations for 57.7. France and Germany also saw both their manufacturing and services PMIs decline more than expected in February. The U.K. saw its unemployment rate rise unexpectedly to 4.4% from 4.3% The Bottom LineEconomic acceleration and rising inflation aren’t showing up to the degree that was expected, and this was a market priced for perfection. The Federal Reserve is giving indications that it will not be providing the same kind of downside protection that asset prices have enjoyed since the crisis, pushing markets to reprice risk and question the priced-to-perfection stocks. Join the conversation about this story » NOW WATCH: Why North Korea sent hundreds of cheerleaders to the Olympics |

A New Georgia Bill Could Allow Residents to Pay Taxes with Bitcoin

|

CryptoCoins News, 1/1/0001 12:00 AM PST The post A New Georgia Bill Could Allow Residents to Pay Taxes with Bitcoin appeared first on CCN Georgia has become the latest US state to consider allowing its residents to pay their taxes using Bitcoin and other cryptocurrencies. Senate Bill 464, which was introduced on Feb. 21 by Republican state senators Michael Williams and Joshua McKoon, aims to amend Georgia’s laws regarding tax payments to compel the state’s revenue commissioner to accept The post A New Georgia Bill Could Allow Residents to Pay Taxes with Bitcoin appeared first on CCN |

Overstock CEO and bitcoin pioneer explains his long-standing crypto play and his philosophy on life

|

Business Insider, 1/1/0001 12:00 AM PST Overstock CEO Patrick Byrne sat down with Business Insider's Sara Silverstein to discuss his longstanding belief in cryptos, a revolutionary cryptocurrency called Ravencoin, and his philosophy on life. Following is a transcript of the video. Sara Silverstein: So Overstock.com has been accepting bitcoin for as long as I can remember anyone has. Patrick Byrne: We were the first. We were the first — there was a — the largest company then accepting bitcoin was an $800,000 a year restaurant diner in western Australia. We stepped up and started taking it — we were $1.4 billion. So we often — I like to think that we saved that community about five years in their adoption cycle. Silverstein: And how much of bitcoin are you transferring to cash right now? Byrne: Now we only transfer 50% and the rest we keep in bitcoin. And then periodically, we do — we have cashed in bitcoin and made a few million dollars along the way or five million dollars somewhere like that. But generally, as we go along, we do 50% retain bitcoin 50% USD. Silverstein: And where do you think the bitcoin price should be? Byrne: No idea. No idea. Wherever millions of people through their trading say it should be. I can't read their — there's no way anyway — Silverstein: Yeah, and are you interested in everything cryptocurrency? Or are you really interested in the blockchain? Where do you separate the two? Byrne: Well I'm not really interested in cryptocurrencies per se. Although in general, I guess there's nothing wrong with me saying there is an open-source project of which I'm really letting something big out of the bag here. I'll tell you. But there's an open-source project called Ravencoin, which Overstock has put millions of dollars into teams. We have people contributing to this open-source project. We think this coin actually has quite a future. It's about — it's bitcoin, but a thousand times more energy efficient. And there's other real interesting virtues to it — so Ravencoin. But other than that, I stay out of the cryptocurrency game. I'm building the — we're focusing on applications of this technology and not just betting on coins themselves. Silverstein: And is that the primary purpose of Ravencoin is to be a more energy efficient version of some of these other cryptocurrencies? Byrne: That's — I'd say that's the first feature it brings to the world. What I hear — from the open-source community and on the message boards — I know what they are working on and it seems — it's really quite a — I think it has — it was launched January 3 and it's as this open-source project. And I think it has more — last I heard — the number of miners who are now working on it — or it has spread faster than any number of miners of any coin introduced. It's really quite a phenomenon this Ravencoin. So — and what's nice it's democratized. Yeah, it — what happens is, you know, all these coins like bitcoin and such are built on — there's a processor that's solving mathematical problems. And it's possible to build chips that specialize in just that problem. And so you really can't — with your home computer, you're not going to mine any bitcoin anymore unless you have this dedicated ASIC chip. Well, Ravencoin was designed, so you can't do that — it's ASIC resistant. And that's because the problem that you solve keeps flipping randomly among a bunch of class of problems. Anyway, you can't solve it efficiently with an ASIC’s chip, which means it redemocratizes mining. Anyone can download this software, and you don't have an advantage by having this big mining warehouse in China. Silverstein: And what's your life philosophy? I know you've ridden your bike across country five times? Byrne: Four times Byrne: Don't remind me — Silverstein: I know, just exaggerating — Silverstein: And you obviously run your company different than a lot of people run their companies. Byrne: Is it that obvious? Silverstein: Yeah, just a little bit. What would you say your philosophy is? What keeps you going? What keeps you creative? Byrne: Really? No one has ever asked me that question. Truth is it's service. That's what we're all here for — is service. You know, at some point in your life, you realize it's not about me, and it's not about gaining stuff, it's finding ways to serve other people. |

What you need to know on Wall Street today

|

Business Insider, 1/1/0001 12:00 AM PST Welcome to Finance Insider, Business Insider's summary of the top stories of the past 24 hours. Sign up here to get the best of Business Insider delivered direct to your inbox. One recommendation keeps coming up on Wall Street as a best idea: buy commodities. Strategists from Goldman Sachs to Citigroup are all making a number of key assumptions. This phase of super-low interest rates is likely behind us because the global economy is growing. And in the US, with a jolt of fiscal stimulus, inflation and demand are finally starting to pick up. Macquarie's Tom Price said in a recent note these views, which solidified over the past month, mark "a fundamental change in market psychology." You can read more about Wall Street's new favorite trade here. In other news, Kylie Jenner's tweet about dumping Snapchat made one group of investors $163 million. And Evan Spiegel wasn't the only one at Snap who got a huge bonus last year — fellow exec Imran Khan got $100 million. Hedge fund legend Jim Chanos explained the most important asset class in the world. And Goldman Sachs is telling its multimillionaire clients not to worry about valuations or inflation. In corporate news, General Mills is buying pet food maker Blue Buffalo for $8 billion. And there's a clear playbook for how Amazon could upend the healthcare business — along with an obvious victim. Lastly, Wall Street billionaire Steve Schwarzman gave a record-setting gift to his public high school — and it highlights the dire situation American schools face. Join the conversation about this story » NOW WATCH: Ken Rogoff on the next financial crisis and the future of bitcoin |

Rapper Lupe Fiasco says cryptocurrencies are like 'baseball cards,' but that blockchain can 'revolutionize' the music industry

|

Business Insider, 1/1/0001 12:00 AM PST

Rapper Lupe Fiasco has had a notable history of contention with the corporate structures of the record industry. But like a growing number of musicians, he sees blockchain technology as a form that could revolutionize the music industry by helping artists profit off their work to a greater degree. In an interview with Business Insider this week, following his participation in a technology summit with Autodesk, we asked Fiasco if he had any thoughts on the subject of cryptocurrency. While he referred to cryptocurrencies like bitcoin as "any other kind of speculative commodity" — comparing them to collector's items like "baseball cards" and vintage troll dolls that one could accumulate money through over time — Fiasco zeroed in on blockchain technologies as an application that could specifically benefit artists. "People are going to find a way to speculate and value things no matter what it is. I mean, whether it was troll kids, or flowers, or baseball cards, or it's digital currency, you're always going to have that regardless. And I think there's going to be a time to win in that and then a time to lose in that," Fiasco said of cryptocurrency. "But I think the difference between those things, the cryptocurrency, specifically bitcoin now, is that the technology and the implications and applications for the blockchain side of it is going to be so massive." He went on to describe how blockchain could "revolutionize music" in its ability to pay artists more money, and he contrasted it with the approach of Spotify, the streaming giant that has drawn criticism for its low payouts to artists. "It's a disagreement that I've always had with Spotify, which was, they're saying, you can never get rid of piracy. And that's the reason we can charge .00000 nothing for a song, and completely devalue music," he said. "But then you have blockchain technology coming around, where you say, 'Ah, now we're able to kind of reverse that process,' by implementing a blockchain strategy when it comes to licensing music." A BI Intelligence report from November describes how the company SingularDTV is working with musicians to utilize blockchain, in order to "tokenize" their intellectual property (their music) and turn it into a direct financial asset through blockchain apps. The process potentially allows musicians to bypass middle-men like record labels in raising money to fund their music. "Artists can raise money through a token launch, which is similar to an initial coin offering (ICO). Here, anyone can buy the tokens upfront," writes BI's Robert Elder. "The majority of the windfall will go the artist, and the token launch platform-provider (such as SingularDTV) will retain a service fee." The producer Grammatik signed on with Singular DTV's tokenization program in November, describing it as "something artists have been dreaming about since the beginning of time, to be free of gatekeepers, and to communicate freely." The singer-producer Imogen Heap has also written extensively on the subject of blockchain and music in an essay for the Harvard Business Review, published in June. Join the conversation about this story » NOW WATCH: Inflation is the market's biggest fear — here's how to protect yourself |

One of bitcoin's biggest problems is showing signs of getting better

|

Business Insider, 1/1/0001 12:00 AM PST

"Is bitcoin getting better?" That's a question research analysts at Deutsche Bank examined in a short note sent out to clients Wednesday. Analysts Paul Condra and Mrinalini Bhutoria examined how bitcoin's scaling problem might be improving despite a slight uptick in the coin's price. Bitcoin, which was designed as a cheap, transparent payment network to rival old guard Wall Street and its big banks, became more expensive to use as the price climbed to nearly $20,000 at the end of 2017. At that point, it cost upwards of $30 to transfer a bitcoin. Those fees, which go to miners who validate transactions on bitcoin's network, can spike when there is an imbalance between mining capacity and the number of folks looking to make bitcoin transactions. When bitcoin was surging, that imbalance grew as newbies poured into the network. In a sense, the bitcoin networks operates like Uber, which employs surge pricing during busy travel times.

Fees started to decrease at the tail end of last year as the price of bitcoin retreated from all-time highs. They continued to fall as bitcoin dropped to $6,000 a coin at the beginning of February. Since then, however, the coin has made a comeback with its price and transactions steadily increasing over the last two weeks. But fees are still declining. So what gives? Deutsche Bank has a multi-pronged explanation. First, less people are looking to transfer their bitcoin. "Relatively weak demand compared to 4Q17 not creating the same supply/demand imbalance," the analysts wrote. Still, the bank says two other factors, a glut in mining capacity and Segregated Witness, a recent upgrade to bitcoin's network, might also be playing a role in lower fees. Here's Deutsche Bank: "Increased mining capacity resulting in miners willing to accept lower-fee transactions; and gradual working through of the backlogged (“mempool”) transactions that likely have lower fees attached to them. While segregated witness ("SegWit") implementations could also be driving this trend, we were not able to find a reliable source of data related to this." SegWit was released by bitcoin core developers in August and has slowly gained traction with some members of the community, including Coinbase. It's optional for exchanges like Coinbase to use the update. Currently, only 14% of all bitcoin transactions run on the SegWit update. Garrick Hileman, cofounder of blockchain company Mosaic.io, told Business Insider new technological developments might be behind the lower fees, but "at the moment it appears that most of the drop off in fees is due to a corresponding drop in transaction volume." |

Goldman Sachs is telling its multimillionaire clients not to worry about valuations or inflation

|

Business Insider, 1/1/0001 12:00 AM PST Sharmin Mossavar-Rahmani is the CIO of the Investment Strategy Group at Goldman Sachs. She is responsible for the overall asset allocation and investment strategy within Private Wealth Management. In short she guides the investment strategy for clients with over $10 million in assets. Mossavar-Rahmani joined Business Insider’s Sara Silverstein to discuss Goldman Sachs’ 2018 Investment Outlook. She says she is not worried about equity valuation levels or inflation and is telling investors to stay invested. She also talks about cryptocurrencies which she says, "in their current incarnation, are in a bubble." Following is a transcript of the video. Sara Silverstein: I'm here at the Nasdaq MarketSite in Times Square with Sharmin Mossavar-Rahmani. Thank you so much for joining me. Sharmin Mossavar-Rahmani: Thanks for having me. Silverstein: Sharmin is the chief investment officer of Goldman Sachs' Investment Strategy Group. You guys came out with your 2018 outlook and one of the things that stuck out, I'm sure, to a lot of people is that you don't think valuations are particularly too high. Do you think that they're really sustainable at the levels that they've been at? Mossavar-Rahmani: When we talk about valuations with our clients, we tell them they need to think about the context. What's the overall context in which we're looking at these valuations? When we look at environments where inflation is low, and very importantly, the volatility of inflation is low, which is the environment we're in, the market has typically sustained much higher valuations. So if we look at a range of market valuation measures, whether it's Shiller CAPE, whether its price-to-book, whether it's price-to-trailing earnings, price-to-peak earnings, when we look at these measures, they look like they're in the, what we would call, the 10th decile, meaning generally, valuations are cheaper 90% of the time. And when we look at the long-term average, it looks like they are 70-plus percent overvalued. However, when we look at valuations and compare them to periods of low and stable inflation, it only looks like it's about 20% overvalued. So the level of overvaluation is not as high as people are thinking. Then we take the economic backdrop and say, "Well, we have a favorable economic backdrop." The economy is growing." In fact, the US is likely to grow faster this year than, let's say, last year. Generally, global growth will be a bit better, let's say, at 3.5%. As the IMF has reported, we have better synchronization, meaning there are the largest number of countries who are growing now than we've ever seen. So you have a better global backdrop. You look at fiscal policy. You look at monetary policy, all favorable. And so in the context of the backdrop, the global environment, these valuations at 20% more expensive is not that significant. That alone is not going to mean we have to have a bear market. Silverstein: And so if you're in a period of low and stable inflation, the valuations don't look that overvalued. But what happens when inflation rises? Mossavar-Rahmani: So the key question for us is to monitor carefully several things, one of which would be inflation. But we're actually not concerned about inflation. And inflation has been a topic now for several years. Everybody is looking for inflation to be just around the corner, and it hasn't. Some of this, in our view, is driven by major structural forces. Globalization creates many more opportunities for companies to reduce their costs. So as long as that continues and exists, and you look at companies trying to find the cheapest source of, whether it's labor, whether it's manufacturing resources, then we think inflation is going to stay subdued and within the targets that the Fed is looking for. And it's not just inflation in the US, but inflation globally, whether we're looking at Europe, or whether we're looking at, let's say, Japan. Silverstein: So what could derail the market? Mossavar-Rahmani: The title of our outlook is, sort of, steady and unsteady. We're trying to say that they're a lot of steady factors, such as the economy, monetary policy, fiscal policy. But there's a very strong, unsteady undertow, factors such as the geopolitics. What about all the geopolitical tensions with North Korea? What about risk of terrorism? What about risks of major cyber attacks? So when we look at some of these factors, we know that they can be a source of volatility, a big source of downdraft. But it's very hard to attribute a certain probability. We just can't predict these things. So our recommendation to our private wealth management clients is that they should stay invested in equities, because we can't predict what will happen with North Korea. We speak to a broad range of experts on this topic. And they will have the risk of a military engagement with North Korea, some as low as 10, some as high as 50%. So given that broad range, it's not as if one can say, "Let's underweight equities in anticipation of something that may or may not happen." Silverstein: And you still like US equities more than other global equities? Mossavar-Rahmani: Yes, we have had a general bias towards US equities, both tactically. So the thought of overweighting any particular country, or region, or sector, we have been biased in favor of US equities. And strategically, meaning long-term, irrespective of the environment, we also recommend clients have an overweight to US equities. US preeminence has been an investment theme for us from 2009, where there were all these naysayers who said, "Oh, this is the end of the American century. This is the beginning of the China century." Our view has been that, no, US is preeminent across a broad range, everything from as simple a factor as demographics, to something like innovation, to incredible corporate management. There have been lots of very interesting academic studies that show US corporations are the best managed. And within that group, multinationals are among the best managed. So if you have S&P 500 exposure, you are getting international exposure for a pretty significant portion of those earnings. But you're also getting great management. And then you can add all these other things like rule of law that are very important. Silverstein: And if you like US equities, are you worried at all about tech, 'cause they have been leading the rally? And their valuation, some think, are the most overvalued of any. Mossavar-Rahmani: In our view, this concern about the tech sector and saying that this looks like the late '90s, 2000, is a bit misplaced, this type of concern. Because when you actually look at the relationship across sectors, and you look at their valuations based on return on equity, or other measures, all sectors seem to be about fairly valued.

Silverstein: And are your clients worried or are they interested in cryptocurrencies? Are they interested in bitcoin? Are they worried that it's gonna destroy the market? What are you hearing from clients? And what's your point of view? Mossavar-Rahmani: Cryptocurrencies are the hot topic. One of our colleagues, Mary Rich, has actually spent a lot of time on it. And she's so much in demand, because everybody wants to talk to her and learn more about cryptocurrencies, learn about blockchain. Our view is that while we like the concept of blockchain, and think it will evolve into a useful tool for a company, for the financial industry, we think cryptocurrencies in their current format, meaning in the current incarnation, are in a bubble. We actually have a couple of very interesting exhibits in our report. And the report is available for any of your viewers who would like to see it on the Goldman Sachs website. And we show the returns of cryptocurrencies against other asset classes that have been in bubble territory. So for example, we compare it to the TOPIX in 1990. We compare it to the Nasdaq in 2000. And what you can see is that, basically, these other big bubbles that we've had look like a flat line, even compared to tulip bulb prices, tulip mania in the 1600s, which was a bubble. We always talk about tulip mania. The bitcoin prices are astronomical. Then we compare that to Ether, and Ether is even more astronomical. So clearly, these valuations don't make sense to us. In addition, we think that these currencies have major shortcomings. Is there room for a digital currency, maybe sponsored by one of the major central banks like the Federal Reserve? Yes. Could it be incredibly useful? Could it reduce transaction costs? Yes. But not these ones.

Mossavar-Rahmani: That's an excellent question. And clients ask us if the dot-com bubble bursts or when subprime mortgages led the downdraft and eventually the global financial crisis, could we see something similar from the impact of cryptocurrencies coming down? But cryptocurrencies are a much smaller part of the global economy, whether you compare it to US GDP or global GDP, it's less than one percent of global GDP. And so in terms of the impact, it'll have some impact. There are a lot of people who have set up various exchanges, infrastructure, hedge funds in that space, so obviously, they will get hurt. But it's a very, very small part of global GDP. |

Bringing Renewable Energy to the World Using Blockchain Technology

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Modern energy services are vital to human well-being and to a country’s economic development, yet according to the International Energy Agency (IEA), globally 1.2 billion people lack access to electricity. It’s thought that around 95 percent of these people are in either sub-Saharan Africa or developing Asia, with 80 percent in rural areas. Ethereum-based platform ImpactPPA is attempting to turn on the lights using the power of the blockchain. Selected as one of the top three most promising ICOs at this year’s North American Bitcoin Conference, ImpactPPA aims to disrupt renewable energy to finance and accelerate global clean energy production by decentralizing and tokenizing energy generation through power purchase agreements (PPAs). To achieve this, the platform is using blockchain technology, smart contracts and its energy protocol, the SmartPPA. The project white paper describes how, right now, energy financing and distribution is bottlenecked by large, centralized NGOs and government agencies that have established an unwieldy financing system that can take years from proposal to product implementation. The SmartPPA is the lynchpin of the new system and permits anyone, anywhere, to create a proposal for a project of any size. Even though ImpactPPA will allow users worldwide to access clean energy on a mobile device, the platform is primarily focusing on the emerging economies in the world. Speaking to Bitcoin Magazine, ImpactPPA CEO Dan Bates explained that the current funding process with centralized NGOs is “too cumbersome and costly for many developing nations,” leaving many countries and their populations with limited access to power. “ImpactPPA’s use of the blockchain and the crowd dramatically changes this paradigm, tapping into the vast potential of the socially minded impact investor and concerned citizen, looking to benefit the well-being of others while mitigating climate change,” he said. As a company that has already been working in the traditional renewable energy (wind and solar) space for over 10 years, with projects on the ground in 35 countries, ImpactPPA’s platform is now ready to deploy with the blockchain component. According to Bates, the team has more than 200 megawatts in discussion for PPAs around the world that they expect to begin executing within the next six months. Through its pay-as-you-go model for power, ImpactPPA is providing the most remote and underserved populations the chance to rapidly fund and deploy clean energy solutions that improve their quality of life, giving users the chance to purchase and consume energy on an as-needed basis. “There is great need for our solutions in rural Africa as well as island nations like Puerto Rico and Haiti, which have been affected by hurricanes, just to name a few examples,” said Bates. “But as a company, we are interested in working everywhere and anywhere there is a need for power.” ImpactPPA is currently working with the Haitian government and local partners to provide power to 42 of their coastal communities that have been left without power since Hurricane Matthew in 2016. The platform is planning on working with NGOs in the future too. Delivering this energy to smart meters that are connected to the blockchain allows for government, utility companies, businesses or individuals to decentralize the flow of power while using the best of the blockchain to ensure trust and security of the power generated and transmitted, Bates explained. Built on the Ethereum platform, ImpactPPA will sell its asset-based MPAQ token to enable projects, typically microgrids, to be quickly deployed. “MPAQ token holders will be able to review and vote on proposed projects for funding by the company, giving the token-holding community a voice in the conversation about which projects should be funded,” Bates said. ImpactPPA expects to begin its MPAQ token sale on April 22, 2018, coinciding with Earth Day, for funding projects currently in the pipeline. It will also sell a GEN Credit to be used by consumers of the electricity generated by the renewable energy systems. It is priced in kWh and is determined by the PPA that it is attached to. Bates added that 30 percent of all net profits from implemented PPAs will be credited toward the platform’s GEN Pool. On a quarterly basis, and as long as the GEN Pool has a value of at least $100,000, ImpactPPA will use the accumulated GEN Pool to repurchase MPAQ tokens. “It is this GEN Credit that will be exchanged by end users, buyers or proxies for the energy created by the renewable energy systems delivered to fulfill the SmartPPAs,” said Bates. “It is used to insure delivery of energy, manage storage devices, create interconnected data networks, and enable new economic models for the millions upon millions of people who will be positively impacted by the access to power.” For Bates, the platform will deliver positive social impact in any form. Energy begets an improved quality of life, education and self-empowerment, but energy is just the beginning for ImpactPPA. This article originally appeared on Bitcoin Magazine. |

There's a simple phrase you can use when asking for a flight upgrade that could help you land a first-class seat — but there’s a catch

|

Business Insider, 1/1/0001 12:00 AM PST

But there's a simple way to increase your chances of being able to upgrade to first-class with miles, New York Times best-selling author Tilly Bagshawe told Bloomberg. The secret is to call the airline's reservations line and use the words "revenue management." That's because an airline's revenue management department tells reservation agents what they're allowed to offer to customers, so having a reservation agent check with revenue management or transfer you to them allows you to appeal to the real decision-makers. If you're transferred to revenue management, Bagshaw says you should ask how many first-class seats haven't been sold yet, then "politely" ask when they'll be released for passengers who want to upgrade. According to Bagshaw, the strategy has "a pretty much 100 percent success rate." That strategy probably won't work for everyoneHowever, there's a catch. Not only do you need enough miles to make an upgrade a possibility, you probably have to be one of the airline's top customers (Bagshawe told Bloomberg she flies over 100,000 miles each year), aviation analyst Henry Harteveldt told Business Insider. "Asking a reservations agent to check with the airline’s Revenue Management department will probably result in the agent muting her line while she laughs at the request," he said. "Very few airlines allow their reservations agents to either contact Revenue Management or queue a reservation to that department for upgrades." Even if you are enough of a high-profile customer to warrant special treatment, "strong demand" for business and first-class seats on long flights means airlines often don't have many open seats that can be used for upgrades, according to Harteveldt. "When premium cabin seats are available, airlines often attempt to sell them, and are generally successful at this," he said. So next time you're looking for an upgrade, ask for revenue management — if you're feeling lucky.

SEE ALSO: This is the site you need to look at for super cheap flights before you book your next trip Join the conversation about this story » NOW WATCH: Ken Rogoff on the next financial crisis and the future of bitcoin |

Gartman Loses Big On Biotech-Turned-Blockchain Stock

|

CryptoCoins News, 1/1/0001 12:00 AM PST The post Gartman Loses Big On Biotech-Turned-Blockchain Stock appeared first on CCN Dennis Gartman, the longtime publisher of an investment newsletter and television commentator known as the “commodities king” famous for touting blockchain technology while dissing bitcoin, might be having second thoughts about placing retirement funds in Riot Blockchain Inc. Riot Blockchain lost a third of its value on Feb. 16 following a CNBC report about the The post Gartman Loses Big On Biotech-Turned-Blockchain Stock appeared first on CCN |

Nokia Launches Blockchain-Powered IoT Sensing as a Service for Smart Cities

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Nokia is launching a set of services, based on Internet of Things (IoT), data analytics, and blockchain technologies, for economically and environmentally sustainable “smart cities.” In the emerging IoT, billions of connected devices and sensors will generate vast amounts of data. Smart cities will need to retrieve, process, interpret and act upon real-time environmental data in a timely manner to ensure they remain sustainable environments for their citizens. To enable efficient IoT ecosystems for smart cities, it’s important to create new data monetization opportunities for IoT sensor network operators able to provide smart city authorities with real-time processed and analyzed environmental data. "Cities need to become digital in order to efficiently deliver services to their habitants,” said Asad Rizvi, head of Global Services business development at Nokia. “Smart infrastructure, which is shared, secure, and scalable, is needed to ensure urban assets and data are efficiently used. We can help cities with that. In addition, we can help operators generate new revenue utilizing their existing network by providing solutions for smart city players, such as city, transport, travel and public safety authorities." Nokia’s Sensing as a Service (S2aaS) provides intelligent analytics on environmental data gathered from IoT-connected sensors, which operators can sell to cities and other authorities. Nokia envisions IoT-based, real-time monitoring systems able to provide timely environmental information for smart city management. For example, S2aaS will detect unusual environmental behavior like illegal construction, trash burning or unusual particles in the air. NetworkWorld notes that the idea behind the product is to provide a way for mobile network operators (MNOs), many of which use Nokia cell site equipment, to monetize existing infrastructure, such as towers, by selling live environmental sensor data to cities and others. Nokia’s S2aaS is powered by a blockchain with a built-in micropayment platform, which supports smart contracts for “anonymized, private and secure micro-transactions that allow operators to monetize analyzed data and generate new revenue streams.” “Our complete micropayment platform can help you quickly generate new revenue from your data,” reads a Nokia solution paper. “Based on blockchain, the distributed ledger technology that is taking finance, healthcare, and a range of other industries by storm, our platform allows you to easily integrate third parties into your data market — expanding your customer base and service offerings. And as every transaction is verified against other peers in the blockchain network, you can be sure that your platform is secure.” Independent operators will have the option of a traditional CapEx (Capital Expenditure) business model, or a revenue sharing service model. Nokia stated that it will work with clients to identify optimal business models for their specific use cases. Nokia will manage all hardware installation, equipping existing network sites with new environmental sensors and edge gateways. S2aaS will include a complete platform for collecting and processing sensor data hosted in Microsoft Azure, AWS, or Nokia’s private cloud, using a choice of Amazon IoT, and Microsoft IoT, or Nokia’s own AVA cognitive services platform. According to the company, AVA “integrates cloud-based delivery, intelligent analytics and extreme automation to deliver instant and flawless personalized services.” Nokia will present S2aaS and related services at the Mobile World Congress in Barcelona, Spain, held from February 26 to March 1, 2018. This article originally appeared on Bitcoin Magazine. |

An emotional support dog bit a six-year-old girl on a Southwest Airlines flight — and some people are blaming the child (LUV)

|

Business Insider, 1/1/0001 12:00 AM PST

"@SouthwestAir flight 1904 allows a support dog on the plane, bites kid, paramedics now on plane. Why are dogs on the plane?! Never again will I fly SWA," Rice reportedly wrote. Southwest told Business Insider in a statement that after the child approached the emotional support dog while boarding the flight, the dog's teeth "scraped" the child's forehead. The contact resulted in a "minor injury" that was evaluated by emergency medical personnel before the flight departed. The dog and its owner left the aircraft and took a later flight to Portland. The incident has provoked a surprising reaction on Twitter, where some users are blaming the child and her parents for failing to act responsibly. "She was specifically told to stay away, clearly she nor her parents listened," one user wrote. "She's already six, teach her personal responsibility. The pet owner has every right to be angry, it's not the dog's fault the kid wasn't supervised."

Southwest's "assistance animal" policy says that passengers who wish to fly with an emotional support animal must provide documentation from a mental health professional. The policy also states that, "Service and emotional support animals must be trained to behave in a public setting. If an animal behaves poorly, it may be denied boarding." Since airlines can leave the question of what qualifies as an emotional support animal to medical professionals, the real trouble lies in ensuring that emotional support animals, which often don't receive the same training as service animals, are fit to behave on their flights. Delta and United Airlines have attempted to address this problem by updating their policies to require that passengers flying with emotional support animals sign paperwork that states the animal is fit to behave in public. Southwest told Business Insider that it's continuing to evaluate its policies around emotional support and service animals. Here's how people reacted to the Southwest incident on Twitter:

SEE ALSO: Here's how airlines decide if a pet qualifies as an emotional support animal Join the conversation about this story » NOW WATCH: Ken Rogoff on the next financial crisis and the future of bitcoin |

Wall Street billionaire Steve Schwarzman gave a record-setting gift to his public high school — and it highlights the dire situation American schools face

|

Business Insider, 1/1/0001 12:00 AM PST

"The world keeps moving faster and faster and the US is falling behind," Schwarzman told Business Insider, calling out the country's deficits in arming students with computer literacy, coding, and other skills that have grown increasingly important in the modern job economy. Money, naturally, is a hurdle in remedying this, as Schwarzman readily acknowledges. Funding for K-12 education, which is provided mostly by state and local governments, plummeted after the recession in 2008 and in many locations still hasn't bounced back to pre-recession levels. In 2015, the most recent year data are available, 29 states were providing less school funding per student than they were in 2008, according to analysis of US Census data by the think tank the Center on Budget Policy and Priorities. Schwarzman, who is worth nearly $13 billion according to Forbes, doesn't expect government funding to solve the issue anytime soon, citing growing income inequality and an erosion of the tax base in America. "The middle class economically has shrunk. The monies aren't there in the same way," Schwarzman said. "I think we have to recognize that and figure out what to do about it." One solution, as Schwarzman told some 3,000 school superintendents in his speech, is to start wooing successful alumni like himself to donate. It's a commonplace practice in higher education and in private K-12 schools, but it's rare in public school systems, as Schwarzman learned in the process of providing his own high school in Abington, Pennsylvania, a $25 million check to help modernize their campus and ramp up digital and STEM learning. It's a record donation for the school, and among the largest ever individual donations to a single public school. After recounting the story of his donation to the audience of superintendents, and providing practical advice for fundraising, Schwarzman called for a paradigm shift. Rather than accepting the fate of inadequate financial resources, Schwarzman says, schools should take matters into their own hands and start raising money from alumni the way a private school would. Private sources of funding account for just 2% of all public elementary and secondary school revenue in the US, according to the National Center for Education Statistics. "I think the roadblocks are basically just tradition," Schwarzman told Business Insider. "What I'm talking about is just typically not done." He continued: "Sometimes in life you just have to adapt." The crowd's response to the speech was ebullient. "People stood up and clapped and gave him a standing ovation," Amy Sichel, the superintendent of the Abington School District, told Business Insider. "It was fabulous." "You have to be psychologically prepared to just keep asking"Many schools would likely benefit from the low-hanging fruit of this largely untapped resource, and it's not all that complicated to get started, Schwarzman and Sichel pointed out. In his speech, Schwarzman gave the school administrators a practical tutorial, laying out the steps: set up a 501(c)(3) charitable organization to receive gifts, start reviewing your lists of alumni and identifying people likely to have resources to help out, and then, perhaps most difficult, start making the ask — and prepare to hear "no" a lot. "Part of it is, if you've never done this type of work in terms of raising money, it's preparing people psychologically for the difficulty of asking," Schwarzman said. "You have to be psychologically prepared to just keep asking." Sichel did just that with Schwarzman, who worked with her on crafting a proposal and added some conditions to his gift — including commitments to computer science and coding in the curriculum as well as professional development and training for school counselors to better prepare students for college and their careers. While Schwarzman's gift, which will fill the shortfall in Abington's ambitious $100 million high school renovation project, will have a tremendous impact on the roughly 8,100-student school district, is it a realistic model for solving funding gaps on a broader scale? Not every school has a billionaire alumnusRegardless of fortitude and determination, some districts will have more potential funds to mine than others. Not every school has an alumnus like Schwarzman, who has deep pockets and an enduring commitment to education — he has donated hundreds of millions to a variety of education causes. Such a model has the potential to exacerbate school inequality, according to Sean Corcoran, who studies education financing issues as an associate professor of economics and education policy at NYU Steinhardt. "School districts' reliance on private funding is slim-to-none," Corcoran said, "but where it does exist it tends to be in wealthier communities." Corcoran said he had mixed feelings hearing about Schwarzman's gift and "paradigm shift," because on one hand, he's always excited to "hear cases when those of means give back to public schools," but on the other hand, "it's been a long, uphill battle to improve equity in school funding across the US." A slew of lawsuits across US states since the 1970s have resulted in some redistribution in school funding within states to address inequality. But significant gaps still persist in part because local funding provided by cities — and typically raised by property taxes — accounts for a large proportion of budgets. Wealthy cities with sky-high property values can raise more money than low-income locales. One such lawsuit seeking a remedy to school district inequality was rejected just this January by the Connecticut Supreme Court, ending a litigation effort in the state that began in 2005. Corcoran worries that a broader movement of communities tapping private donors to fund public education could roll back what strides have been made on education equality, ultimately not providing much help to the schools and students who need it most. It's worth noting as persistent achievement gaps between black and Hispanic students and their white peers exist, private funding has the potential to deepen racial divides as well. Abington School District is 64% white, according to enrollment data from the Pennsylvania Department of Education, roughly in keeping with overall US demographics. Still, private funding is a drop in the bucket at this point, and many schools are facing real budget shortfalls. Corcoran isn't angling to cut schools off from a potential source of revenue. "I wouldn't want to deny any superintendents from using those opportunities," Corcoran said. Not a panaceaBut he doesn't believe the notion represents a realistic cure for public school funding ills, and he says it would become a problem if people started treating private donations as a substitute for local tax dollars and state aid. Sichel, despite her district's recent good fortune, isn't convinced private donations are a magic elixir or a replacement for public funding, either. She points out that Schwarzman's gift is not a substitute for a district operating budget, which in Abington currently stands at $159 million, 28% of which comes from local funds. "In Abington, this is not replacing an operating budget at all. This is $25 million for a targeted gift for building and renovating a high school. It's a very targeted gift," she said. But, she says, to stay competitive and offer students the best programs and opportunities, public schools have to give it a try. "This may not be a panacea, but it sure is another avenue to pursue," she said. Join the conversation about this story » NOW WATCH: Ken Rogoff on the next financial crisis and the future of bitcoin |

An ETF veteran who ditched Wall Street for crypto explains how bitcoin can fit into a portfolio

|

Business Insider, 1/1/0001 12:00 AM PST

The former chief executive of the think tank Inside ETFs joined California-based Bitwise Asset Management as VP of research and development. He's got a lot on his to-do list. But his main task is simple: Making cryptocurrency investing less of a Wild West. "There is a general approach to the index market, but there is no general approach to indexing in the crypto market," he said. "That's what I'll be working on." We caught up with Hougan to talk about some of the questions he's grappling with and what he thinks is keeping Wall Street from diving into crypto. The following interview has been lightly edited for length and clarity: Frank Chaparro: What are some of the questions you are grappling with in your new position? Matt Hougan: When I joined the ETF world 15 years ago, there was a lack of understanding about how they worked, and I see a similar situation in crypto. There's a lack of understanding about how to classify different assets in the space, how to fit it into a portfolio, et cetera. It is super engaging to wrestle with those questions in a new space. And I am still figuring out the answers to these questions since I am only one week in. Chaparro: In a note to clients, JPMorgan said bitcoin could serve as an addition to a portfolio for an investor looking for a non-correlative asset. Where do you see it fitting in a portfolio? Hougan: I think it shares a lot of similarities with early-stage venture investments, inasmuch as both fit into that high-risk, high-return bucket. These are both investments for people investing long-term. It also fits into the alternative bucket. Cryptocurrency provides investors with returns that aren't correlated. In fact, the long-term correlation is close to zero. That's because the long-term driver of the crypto market revolves around the speed of the technology and its ability to displace existing networks, which is fundamentally different from the elements that drive the broader market. So a big global funk wouldn't have that big of an impact on the crypto space, since it wouldn't derail the importance of distributed ledger technology. Chaparro: Typically, only the most savvy investors can get in on venture capital deals. Is it dangerous that crypto is open to any mom-and-pop investor with a Coinbase account?

We want folks to focus on the long-term role of crypto in a portfolio. It's something I am very passionate about. And we think a diversified index investment is a step forward. Chaparro: You come from an area of Wall Street most would deem "traditional." Are folks from that world coming to you asking about this space? How about asset managers and banks? Are they getting closer to offering their clients access to this space? Hougan: Yes. My email, LinkedIn, and Twitter are all blowing up with these guys because they want to understand it. But Wall Street is a risk-minimizing machine. When they see things they don't fully understand, they see risk as a four letter word. The reflexive response is to just cut it off. For end clients, however, this pushes them out of the regulated institutional environment and leaves them alone to navigate this risk through venues that might be less secure. But it's hard for larger institutions to be on the cutting edge. Still, we are working with advisers, trusts, and family offices to help them understand this space. SEE ALSO: The top cryptocurrency traders are asking for a big shake-up to bitcoin futures Join the conversation about this story » NOW WATCH: Ken Rogoff on the next financial crisis and the future of bitcoin |

Austria Plans to Regulate Bitcoin Like Gold, Derivatives

|

CryptoCoins News, 1/1/0001 12:00 AM PST The post Austria Plans to Regulate Bitcoin Like Gold, Derivatives appeared first on CCN Austria’s finance ministry said that it intends to regulate Bitcoin and other cryptocurrencies similarly to how it currently governs gold and derivatives trading, and it hopes the European Union will do the same. Regulators across the world have grown increasingly concerned about the immutability and decentralized nature of blockchain transactions, which they say makes them The post Austria Plans to Regulate Bitcoin Like Gold, Derivatives appeared first on CCN |

Georgia Becomes Latest State to Consider Bitcoin for Tax Payments

|

CoinDesk, 1/1/0001 12:00 AM PST Two state senators in Georgia have proposed a new bill that would allow citizens to pay their tax obligations in bitcoin. |

CRYPTO INSIDER: Litecoin is on a tear

CRYPTO INSIDER: Litecoin is on a tear

CRYPTO INSIDER: Litecoin is on a tear

CRYPTO INSIDER: Litecoin is on a tear

CRYPTO INSIDER: Litecoin is on a tear

CRYPTO INSIDER: Litecoin is on a tear

Bitcoin Price Recovers Past $10,000 as Market Halts Mid-Week Slide

|

CryptoCoins News, 1/1/0001 12:00 AM PST The post Bitcoin Price Recovers Past $10,000 as Market Halts Mid-Week Slide appeared first on CCN The cryptocurrency markets halted their mid-week slide on Friday, with most coins achieving minor advances after enduring significant retraces over the previous two days. The Bitcoin price headlined the advance with a march back above $10,000, while Ethereum outperformed the index by a considerable margin. Altogether, the cryptocurrency market cap rose about 1.3 percent for The post Bitcoin Price Recovers Past $10,000 as Market Halts Mid-Week Slide appeared first on CCN |

‘Turkcoin’: Turkish Politician Endorses Launching a National Cryptocurrency

|

CryptoCoins News, 1/1/0001 12:00 AM PST The post ‘Turkcoin’: Turkish Politician Endorses Launching a National Cryptocurrency appeared first on CCN A Turkish lawmaker affiliated with the political party partnering the country’s ruling party has proposed a national cryptocurrency. On bitcoin, the politician suggested the government open its own bitcoin exchange(!). Turkey’s former industry minister and deputy chair of the Nationalist Movement Party (MHP), Ahmet Kenan Tanrikulu, has reportedly drafted a ‘detailed report’ calling for the The post ‘Turkcoin’: Turkish Politician Endorses Launching a National Cryptocurrency appeared first on CCN |

Bitcoin is Back Over $10K, But Rally Looks Weak

|

CoinDesk, 1/1/0001 12:00 AM PST Bitcoin is witnessing a minor corrective rally today, but longer-term gains may be elusive, according to price chart analysis. |

London property is worth more than Bristol, Birmingham, Glasgow, Manchester, and Edinburgh combined

|

Business Insider, 1/1/0001 12:00 AM PST

Zoopla's figures suggest that the value of London property is 13 times higher than that of its nearest rival, Bristol, which has a property market worth £115.2 billion. London represents just over 18% of the entire UK property market by value. However, London property prices grew the slowest out of any of the top 10 hotspots last year, according to Zoopla's figures. House prices in the capital rose by just 1.54% over the last 12 months. Zoopla's rival Rightmove said last week that London house prices have now moved out of their "boom" phase after nearly two decades of rapid price rises. Lawrence Hall, a spokesperson for Zoopla, said in a statement: "It comes as no surprise that London is significantly more valuable as a residential property market than any other British city. "However, the data does show that, in comparison to cities further north and across the Scottish border, the rate of growth in London has slowed. The capital may be worth almost 10 times more than Sheffield, but Britain’s Steel City wins in the growth rate stakes." House prices in Sheffield grew by 5.63% last year according to Zoopla. Here's Zoopla's full table of the top 10 cities by property market worth:

Join the conversation about this story » NOW WATCH: Ken Rogoff on the next financial crisis and the future of bitcoin |

RBS made its first annual profit since the financial crisis — but it is not out of the woods yet

|

Business Insider, 1/1/0001 12:00 AM PST

The bank announced on Friday morning that it had an attributable profit of £752 million in the 2017 financial year, compared to a loss of just less than £7 billion in 2016. RBS, which is 73% owned by the UK government, recorded an operating profit of around £2.23 billion, up from a loss of around £4.08 billion last year. Beyond the headline profit, here are some of the key figures from the bank's annual report:

Ross McEwan, the bank's CEO, said: "This is a symbolic moment for this bank and a clear indication of the progress we continue to make in putting the past behind us, while at the same time investing to build a bank which delivers for both customers and shareholders. "With many of our legacy issues behind us, the investment case for this bank is much clearer and the prospect of returning any excess capital to shareholders is getting closer.” Despite a return to full-year profitability, the bank still faces challenging times, with the expectation that it will be hit with a substantial fine by the US Department of Justice over the historical sale of mortgage-backed securities. "The number of legacy issues the bank faces has reduced," RBS said in its results statement. "However, we have one major legacy issue that we have yet to resolve which is with the US Department of Justice. The timing of the resolution of this issue is not in our control." Shares crashed over 4% at the open in London, with investors wary of just how large the fine could be. RBS made a £764 million provision for litigation and conduct costs in the fourth quarter, with £442 million set aside for the US DoJ case, and a further £175 put back for PPI claims. Here's the share price chart after a few minutes of morning trade:

"To those customers who did not receive the experience they should have done while in GRG we have apologised. We accept that we got a lot wrong in how we treated customers in GRG during the crisis," RBS said. Join the conversation about this story » NOW WATCH: Ken Rogoff on the next financial crisis and the future of bitcoin |

10 things you need to know in markets today

|

Business Insider, 1/1/0001 12:00 AM PST

Good morning! Here's what you need to know in markets on Friday. 1. European Union leaders will lay down the first markers on Friday on the size and aims of the bloc's next long-term budget, as a large hole in its finances begins to take shape with next year's departure of one of its main net contributors. All EU states except Britain are to say in a summit debate whether they agree to increase the 2021-2027 budget to pay for new common policies on security, defense and migration, at a time when Brexit will slash revenues to the common pot by 10-12 billion euros ($12.3-14.8 billion) a year. 2. Bonuses for female investment bankers at Barclays are 78.7% smaller on average compared to those paid to male bankers, the lender said in a filing on Thursday. In total, pay packets for women are around half that of men at the bank's international division, which houses the investment bank at Barclays. Barclays is the first major UK bank to make a gender pay gap disclosure under new rules that require any organisation with 250 or more employees to publish the data. 3. The US will implement new sanctions on North Korea on Friday. New reports this week indicate existing sanctions are working on surprising industries like media and air travel. 4. Labour wants the UK to strike a deal with the European Union that is "pretty much like the current customs union," shadow foreign secretary Emily Thornberry has said. Speaking to LBC Radio on Thursday, the Islington South and Finsbury MP shed significant light on what kind of relationship Labour wants Britain to have with the EU after Brexit — setting the opposition party up for a showdown with the Conservatives over the issue. 5. China has seized control of Anbang Insurance. The group owns the Waldorf Astoria and was reportedly in previous talks with Jared Kushner, the son-in-law and senior adviser to US President Donald Trump, to invest in one of his properties. 6. Asian shares rebounded on Friday as comments from a Federal Reserve official eased worries that the central bank might raise rates more aggressively this year, while the safe-haven yen held on to its gains amid heightened volatility across markets. MSCI's broadest index of Asia-Pacific shares outside Japan climbed 0.4 percent, but was still on track to end the week barely changed. 7. Snap gave CEO Evan Spiegel a gargantuan stock award last year. Snap on Thursday published its annual report, which detailed the compensation it paid executives last year. The report also revealed the value of the massive stock grant Snap gave CEO Evan Spiegel at the time of its IPO; it was worth $637 million. 8. U.S. businesses and diplomats are pressing India to cut tariffs, industry and government sources say, after New Delhi's move to increase customs duties on dozens of products to help its flagship Make-in-India drive aggravated differences over trade. Ford, which has two plants in India, has sought a reversal of the new tariffs on auto components, while Apple Inc is concerned its iPhones have become even more expensive in the price-conscious $10 billion smartphone market. 9. HP reported a more than three-fold rise in first-quarter profit on Thursday as the company, formed out of the 2015 split of Hewlett-Packard Co, benefited from changes in the U.S. tax law and sold more personal computers and printers. Net earnings rose to $1.94 billion, or $ 1.16 per share, in the quarter ended Jan. 31, from $611 million, or 36 cents per share, a year earlier. 10. The founder of a defunct cryptocurrency exchange has been arrested for allegedly lying to financial watchdogs to cover up a heist of 6,000 bitcoin. Federal prosecutors in New York charged Jon Montroll, the 37-year-old founder of BitFunder, on Wednesday with obstruction of justice and two counts of perjury. Join the conversation about this story » NOW WATCH: These are the watches worn by the smartest and most powerful men in the world |

Taiwanese Police Tackle Country’s First Bitcoin Robbery

|

CryptoCoins News, 1/1/0001 12:00 AM PST The post Taiwanese Police Tackle Country’s First Bitcoin Robbery appeared first on CCN Four men have been arrested in Taiwan following a bitcoin robbery. Police were called to the street in the city Taichung by neighbors who reported a dispute. They found bloodstains at the scene, and it was discovered that a cryptocurrency trader named Tai had been lured by men pretending to wish to buy Bitcoin and The post Taiwanese Police Tackle Country’s First Bitcoin Robbery appeared first on CCN |

One of the world's largest rental-car companies is ending a key partnership with the NRA

|

Business Insider, 1/1/0001 12:00 AM PST

A company spokesperson told Business Insider in an email on Thursday: "We ended the discount program, effective March 26." The spokesperson did not immediately respond to follow-up questions about why Enterprise ended the program. Avis Budget Group and Hertz — two rivals of Enterprise — still offered NRA discounts as of Thursday night, and did not immediately respond to Business Insider's request for an interview. The move by Enterprise comes more than a week after a deadly mass shooting ended the lives of 17 people at a high school in Parkland, Florida. The February 14 shooting at Marjory Stoneman Douglas High School has prompted demands for increased accountability from US lawmakers and businesses, in what so far has been an unprecedented push for gun-law reform. Earlier on Thursday, First National Bank said it would not renew a contract with the NRA in which it issued an NRA-branded Visa card, Reuters reported. "Customer feedback has caused us to review our relationship with the NRA," said Kevin Langin, a spokesman for the Omaha-based bank. The left-leaning news site, ThinkProgress, said it rounded up a list of 22 corporations it said was "making membership to America's premier gun-lobbying group more enticing" by offering such discounts and promotions. NRA spokeswoman Dana Loesch and Wayne LaPierre, the CEO of the gun-advocacy group, doubled down on their defense of the lobby on Thursday, hours after Loesch argued the NRA's case at a CNN town hall event, during which she was confronted by student survivors and parents of those killed in the Parkland shooting. SEE ALSO: An NRA spokeswoman and a Florida sheriff clashed during a raucous discussion on gun violence Join the conversation about this story » NOW WATCH: Ken Rogoff on the next financial crisis and the future of bitcoin |

Bitcoin Fees Are Down Big: Why It's Happening and What It Means

|

CoinDesk, 1/1/0001 12:00 AM PST It wasn't long ago that bitcoin's transaction fees were over $20. But now they're down again. CoinDesk explores why. |

Robinhood's commission-free cryptocurrency trading is live

|

Engadget, 1/1/0001 12:00 AM PST

|

Bitcoin Core 0.16.0 Is Released: Here’s What’s New

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST Today marks the official release of Bitcoin Core 0.16.0, the 16th generation of Bitcoin’s original software client launched by Satoshi Nakamoto a little over nine years ago. Overseen by Bitcoin Core lead maintainer Wladimir van der Laan, this latest major release was developed by some 100 contributors over a span of five months. As is usual for new releases, Bitcoin Core 0.16.0 includes performance improvements, bug fixes and other optimizations. This release in particular includes several added features in the wallet interface. Most notably, Bitcoin Core 0.16.0 makes Segregated Witness (SegWit) fully available for wallet users, which is what most of the effort was focused on, and it is also why this release is sometimes referred to as a “SegWit special.” Here’s an overview of some of the most notable changes. Segregated Witness in the Wallet InterfaceSegregated Witness was, of course, the main Bitcoin protocol upgrade of 2017, if not the biggest protocol upgrade ever. It introduced a whole new block data structure for upgraded nodes — while non-upgraded nodes could continue to function as normal. Among other benefits, SegWit replaced Bitcoin’s block size limit with a block “weight” limit, allowing for blocks with up to 4 megabytes of transaction data and, therefore, increased transaction capacity on the network. Segregated Witness itself was first introduced in Bitcoin Core 0.13.1, released in October 2016. The upgrade activated in August of 2017. However, Bitcoin Core 0.16.0 is the first Bitcoin Core version to let wallet users generate SegWit addresses for receiving payments. This means that when the funds received on these addresses are spent in a payment later, Bitcoin Core wallet users utilize the added block space offered by SegWit. All else being equal, these users should be able to pay lower fees compared to non-SegWit transactions. Bitcoin Core is not the first wallet to enable Segregated Witness for users; several other wallets had already introduced this feature over the past six months. Since the Bitcoin Core development team wrote and proposed the upgrade, it was notable that the feature had not been available for Bitcoin Core wallet users — until now. Bech32: Bitcoin’s New Address FormatAccompanying the introduction of SegWit in the Bitcoin Core wallet is a new address format known as “bech32.” This address format, developed by former Blockstream CTO Gregory Maxwell and Blockstream developer Dr. Pieter Wuille, is recognizable as it starts with “bc1” instead of the 1 or 3 that Bitcoin addresses usually start with. More importantly, bech32 addresses use fewer characters than the current address format, and there’s no longer a distinction between lowercase and capital letters. This reduces the potential for human mistakes (for example, when an address is read out loud). Bech32 addresses are also designed to limit other types of mistakes such as these caused by typos. Additionally, bech32 offers benefits in the context of SegWit wallet support. So far, most wallets that offer SegWit do so by “wrapping” it into P2SH outputs (with addresses starting with a 3). To spend coins from such an address, users must reveal a piece of code — the “redeem script” — to show that the coins were really locked up in a SegWit output. With the new bech32 addresses, this step can be skipped, which means that spending from a SegWit address will require a little less data in order to be transmitted over the Bitcoin network and included in the blockchain. Since not all Bitcoin wallets support bech32 addresses yet, Bitcoin Core 0.16.0 users will be able to choose whether they want to generate a bech32 receiving address for payments or a P2SH address, with P2SH still being the default for now. The Bitcoin Core wallet of course supports sending transactions to any type of Bitcoin address. Replace-by-Fee as the Default Sending OptionAs Bitcoin blocks have been filling up over the past couple of years, not all transactions on the network fit in the first available block that is mined. Instead, miners typically prioritize the transactions that include the most fees. If users want to have their transactions confirmed quickly, they should include a high enough fee. For less urgent transactions, a lower fee should suffice. Many wallets include fee-estimation algorithms to calculate what fee level will have a transaction confirmed within varying timeframes. However, the Bitcoin network deals with inherent unpredictability in terms of the speed at which blocks are found, and the number of transactions that is being transmitted at any time. This can make it difficult to include the right transaction fee, meaning that users may have to wait longer for a confirmation than they’d intended. Since Bitcoin Core 0.15.0, wallet users have been able to add a “replace-by-fee” tag to their transactions. With such a tag, nodes and miners on the network know that the sender may want to replace that transaction with a newer transaction that includes a higher fee. This effectively lets Bitcoin Core wallet users easily bump their transactions up in line to have it confirmed faster. Bitcoin Core 0.16.0 makes replace-by-fee the default sending option for the first time. Users can still opt out of adding a replace-by-fee tag to their transactions by unticking a box, but their transactions will be replaceable if they don’t untick it. This should prevent users from unwittingly depriving themselves of their options and noticing only when it’s too late that they could have easily bumped up their transactions. For more details on what’s new in Bitcoin Core 0.16.0, see the release notes. You can download Bitcoin Core 0.16.0 from bitcoincore.org. This article originally appeared on Bitcoin Magazine. |

If you looked at 2000, information technology was substantially overvalued relative to other sectors in the equity market. For example, if you looked at the return on equity and what you paid for that, you were paying two and a half times more for the technology sector's return on equity relative to other sectors. So that was a big dislocation. You don't see that anymore.

If you looked at 2000, information technology was substantially overvalued relative to other sectors in the equity market. For example, if you looked at the return on equity and what you paid for that, you were paying two and a half times more for the technology sector's return on equity relative to other sectors. So that was a big dislocation. You don't see that anymore. In fact, there have been a lot of articles and commentary about the impact of the

In fact, there have been a lot of articles and commentary about the impact of the  Silverstein:

Silverstein:

Hougan: The difference between crypto and venture capital is that crypto is publicly traded. It's basically publicly traded venture capital investments. And, yes, that encourages bad behavior. More people lose money from panicking at the wrong time.

Hougan: The difference between crypto and venture capital is that crypto is publicly traded. It's basically publicly traded venture capital investments. And, yes, that encourages bad behavior. More people lose money from panicking at the wrong time.

RBS also responded to continuing scrutiny — particularly by the House of Commons' Treasury Select Committee — over the treatment of its small business customers

RBS also responded to continuing scrutiny — particularly by the House of Commons' Treasury Select Committee — over the treatment of its small business customers

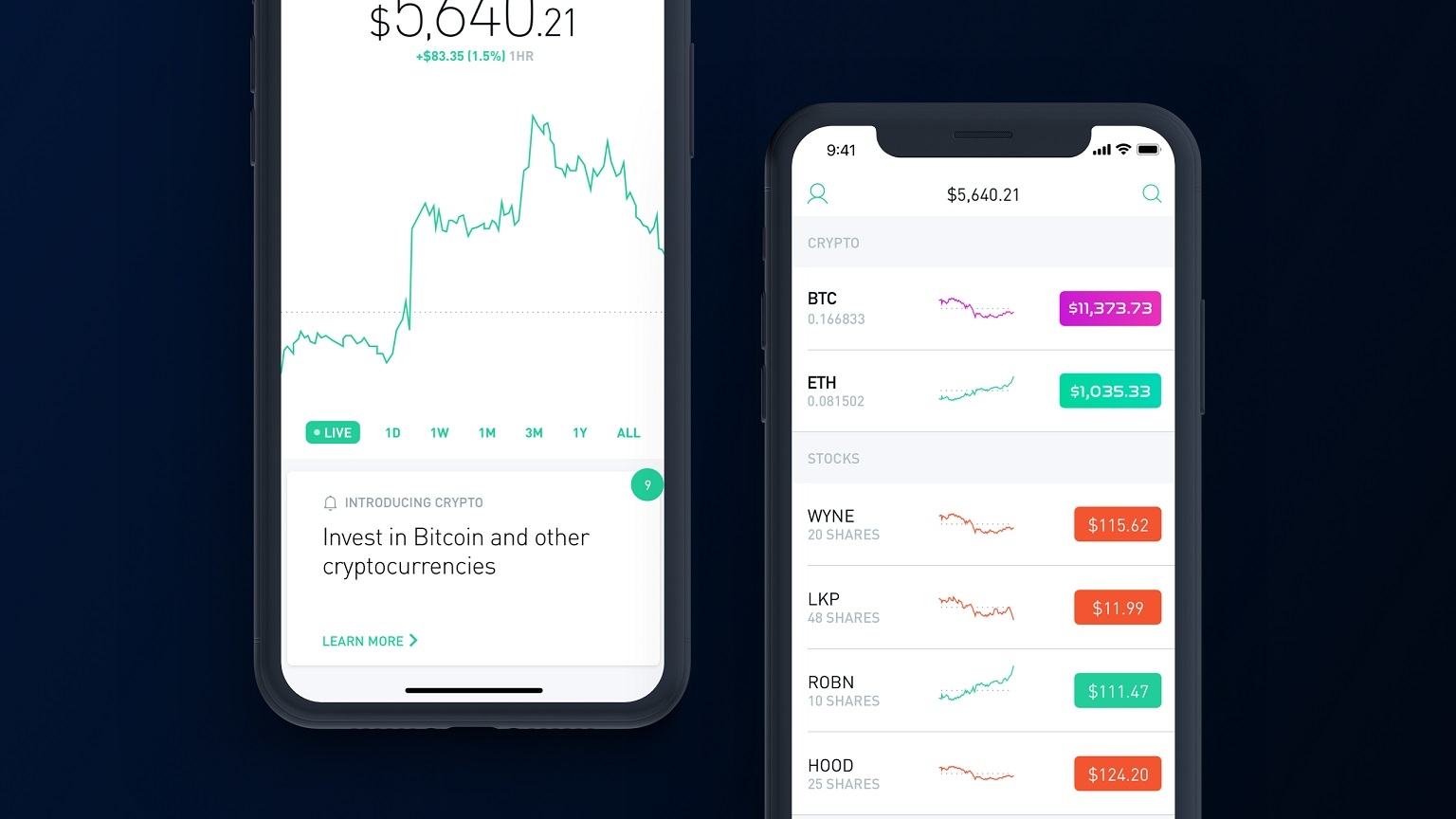

The zero-fee stock trading app, Robinhood, announced its plan to enable users to buy and sell Bitcoin and Ethereum last month. Now the company is making good on its promises. Starting today, Robinhood is rolling out access to trade the two cryptocurr...

The zero-fee stock trading app, Robinhood, announced its plan to enable users to buy and sell Bitcoin and Ethereum last month. Now the company is making good on its promises. Starting today, Robinhood is rolling out access to trade the two cryptocurr...