How Blockchain Technology Is Reinventing Global Trade Efficiency

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST This article orginally appeared in The Distributed Ledger. The business of moving commercial goods around the planet represents billions of... The post How Blockchain Technology Is Reinventing Global Trade Efficiency appeared first on Bitcoin Magazine. |

Marketplace lending is facing a troublesome scenario

|

Business Insider, 1/1/0001 12:00 AM PST

This story was delivered to BI Intelligence "Fintech Briefing" subscribers. To learn more and subscribe, please click here. U.K. marketplace lenders might only originate $0.7 billion in 2025, according to a new Deloitte forecast. That would be a marked decrease from $4 billion in 2015 and would represent less than 1% of marketplace lenders' addressable market of personal loans, business loans, and buy-to-let property loans, according to Deloitte's math. This is a worst-case scenario, but it demonstrates two features of marketplace lending that are mostly outside the control of these startups. For starters, marketplace lenders must provide investors with a greater return than other investments in order to give them a reason to buy loans. If interest rates in the U.K. rise, then the rate lenders must pay investors would also likely rise along with them. This would place more pressure on margins and make it harder to acquire capital. Marketplace lenders use technology to expedite borrowers' decisions on loan applications and provide faster access to funds than legacy lenders. This tech also helps them service markets that are not profitable for banks, which increases the appeal to borrowers. But banks could simply acquire or partner with startups to get this technology, or even build it themselves. For example, JPMorgan Chase has teamed with OnDeck and now lends to borrowers through a platform with the Chase brand that OnDeck built and runs. Economic conditions have been rocky, so it's unlikely that interest rates will rise significantly in the U.K. anytime soon. This gives marketplace lenders some cushion. They will, however, struggle to make sure that their platforms are still the most attractive options on the market. There is little preventing banks from replicating lenders' technology, and big banks could even introduce inferior platforms to place more pressure on lenders. Regardless of the struggle these lenders face, their continued prevalence demonstrates that we’ve entered the most profound era of change for financial services companies since the 1970s brought us index mutual funds, discount brokers and ATMs. No firm is immune from the coming disruption and every company must have a strategy to harness the powerful advantages of the new fintech revolution. The battle already underway will create surprising winners and stunned losers among some of the most powerful names in the financial world: The most contentious conflicts (and partnerships) will be between startups that are completely reengineering decades-old practices, traditional power players who are furiously trying to adapt with their own innovations, and total disruption of established technology & processes:

As you can see, this very fluid environment is creating winners and losers before your eyes…and it’s also creating the potential for new cost savings or growth opportunities for both you and your company. After months of researching and reporting this important trend, Evan Bakker, research analyst for BI Intelligence, Business Insider's premium research service, has put together an essential report on the fintech ecosystem that explains the new landscape, identifies the ripest areas for disruption, and highlights the some of the most exciting new companies. These new players have the potential to become the next Visa, Paypal or Charles Schwab because they have the potential to transform important areas of the financial services industry like:

If you work in any of these sectors, it’s important for you to understand how the fintech revolution will change your business and possibly even your career. And if you’re employed in any part of the digital economy, you’ll want to know how you can exploit these new technologies to make your employer more efficient, flexible and profitable. Among the big picture insights you'll get from The Fintech Ecosystem Report: Measuring the effects of technology on the entire financial services industry:

This exclusive report also:

The Fintech Ecosystem Report: Measuring the effects of technology on the entire financial services industry is how you get the full story on the fintech revolution. To get your copy of this invaluable guide to the fintech revolution, choose one of these options:

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of the fast-moving world of financial technology.

|

Dollar stores' results may shelter battered retail shareholders

|

Business Insider, 1/1/0001 12:00 AM PST

By Noel Randewich SAN FRANCISCO (Reuters) - Investors shell-shocked by dismal quarterly reports from department stores will look for new signs of hope for brick-and-mortar retailers on Thursday as discount sellers Dollar General Corp Macy's But strip mall retailers like Dollar Tree and rival Dollar General that sell ramen noodles, dish soap and toothpaste have been doing relatively well as a sluggish U.S. economy keeps many consumers living paycheck to paycheck. While their products may sell at discounts, their stocks do not. Shares of Dollar General and Dollar Tree both recently traded at just under 20 times expected earnings, above their five-year averages, according to Thomson Reuters data. On Wednesday, Dollar Tree's stock rose 1.3 percent while Dollar General added 0.9 percent. Options on each traded faster than normal and appeared to lean toward bets the stocks would rise, according to options analytics firm Trade Alert data. Both companies have likely lost less business than department stores to Amazon than because their customers tend to make small, day-to-day purchases of staples and often cannot afford Amazon's $99-a-year Prime delivery membership, analysts say. "They're in a very different place relative to the Macy's, Kohl's and Nordstroms of the world," BB&T analyst Anthony Chukumba said of the discount sellers. "While Macy's is closing stores, these guys are still opening stores." Helped by the addition of around 8,000 shops last year through the acquisition of Family Dollar Stores, Dollar Tree is expected by analysts to post a 134 percent surge in revenue when it reports first-quarter results early on Thursday. Dollar General's revenue is seen increasing by 7.4 percent, according to Thomson Reuters data. Following its Family Dollar acquisition, Dollar Tree aims to better compete against one-time leader Dollar General. Dollar General's stock is up 17 percent in 2016, while Dollar Tree is up 2 percent. By comparison, Macy's has dropped 9 percent year-to-date and Nordstrom is 24 percent lower. Dollar Tree's earnings-per-share have exceeded expectations in all of the last four quarters, while Dollar General's EPS has missed estimates in three of the four last quarters. Underscoring the relative health of retailers catering to lower-income customers, a better-than-expected quarterly report by Wal-Mart Stores (Additional reporting by Saqib Ahmed in New York; Editing by Nick Zieminski) |

Six Bitcoin Mines Related to Criminal Ring Seized by Spanish Police

|

CryptoCoins News, 1/1/0001 12:00 AM PST Spanish police have seized six bitcoin mines that were allegedly in use by a criminal network involved in the illegal distribution of pay-TV channels in Spain. A joint investigation by the Spanish National Police and Tax Authorities with the support of Europol and local German police saw the crackdown of a criminal network making proceeds […] The post Six Bitcoin Mines Related to Criminal Ring Seized by Spanish Police appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Russia’s National Settlement Depository Successfully Tests Blockchain-Based E-Voting System

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST The National Settlement Depository (NSD), Russia’s central securities depository, has developed and successfully tested an e-proxy voting... The post Russia’s National Settlement Depository Successfully Tests Blockchain-Based E-Voting System appeared first on Bitcoin Magazine. |

Mt. Gox’s trustee has finished examining claims for missing bitcoins

|

TechCrunch, 1/1/0001 12:00 AM PST

|

Bitcoin Price Bulls Try Again

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin price is trending higher and the bulls may have found their nads. It’s a speculative certainty that they will eventually break through resistance and strike out for $500, but will it be this time? This analysis is provided by xbt.social with a 3-hour delay. Read the full analysis here. Not a member? Join now […] The post Bitcoin Price Bulls Try Again appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Bit Hash Limited Handholds the Investors to Reap the Maximum Gain From Bitcoin Investment

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin Press Release: Bit Hash Limited is a Bitcoin investment service provider offering various schemes to the potential investors using Bitcoins legally and securely. London (May 23, 2016): Bit Hash Limited brings the unique chance for the investors interested in real online investments to diversify their portfolio with the addition of Bitcoin, which is assumed […] The post Bit Hash Limited Handholds the Investors to Reap the Maximum Gain From Bitcoin Investment appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Spanish Police Seize 6 Bitcoin Mines in Crackdown on Stolen TV Content

|

CoinDesk, 1/1/0001 12:00 AM PST Spanish police have seized and destroyed six bitcoin mines as part of an investigation into the illegal distribution of television content. |

New Spanish Payment Platform Bitnovo Allows Customers to Access Funds Directly from Their Bitcoin Wallet Using Debit Card

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin Press Release: Spanish Bitcoin payment platform Bitnovo is now offering multiple payment options including Bitcoin charged debit cards that can be used at all retailers and ATMs that accepts MasterCard.May 24, 2016 Valencia, Spain – The Spanish Bitcoin payment platform Bitnovo continues to exhibit impressive growth since the launch 6 months ago. The startup […] The post New Spanish Payment Platform Bitnovo Allows Customers to Access Funds Directly from Their Bitcoin Wallet Using Debit Card appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

The Initial Coin Offering OpenLedger ‘ICOO’ Extends Support to Future ICOs in Order to Empower the Community

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin Press Release: Danish CCEDK supports OpenLedger’s crowdsale ‘Initial Coin Offering OpenLedger’ (ICOO). The project aims to gather ICOs on the OpenLedger platform in order to benefit both startups and investors. May 24 2016, Blokhus, Denmark – As a part of the new offering, the Danish cryptocurrency platform, CCEDK, and OpenLedger have announced the crowdsale […] The post The Initial Coin Offering OpenLedger ‘ICOO’ Extends Support to Future ICOs in Order to Empower the Community appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Lisk Releases First Modular Cryptocurrency with Sidechains

|

CryptoCoins News, 1/1/0001 12:00 AM PST Bitcoin Press Release: Following $6.5 million crowdsale, Lisk deploys first truly scalable cryptocurrency, with JavaScript compatibility and infinite ability to add new features via sidechains. May 24, 2016, Aachen, Germany – Lisk (www.lisk.io), the first modular cryptocurrency utilizing sidechains, has released its eagerly awaited first public release, Lisk v0.3.0, which is the first cryptocurrency to put […] The post Lisk Releases First Modular Cryptocurrency with Sidechains appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

ISO May Propose Certified Standards for Blockchains and Distributed Ledgers

|

Bitcoin Magazine, 1/1/0001 12:00 AM PST In April when the Bitcoin community began preparing for Australian Craig Wright’s “Satoshi Nakamoto reveal,” there was another announcement... The post ISO May Propose Certified Standards for Blockchains and Distributed Ledgers appeared first on Bitcoin Magazine. |

KeepKey Prepares for Bitcoin Scaling With Wallet Startup Acquisition

|

CoinDesk, 1/1/0001 12:00 AM PST Hardware wallet firm KeepKey announced today that it has acquired MultiBit, a desktop-based bitcoin wallet program. |

Breaking: Tokyo Trustee Completes Review of All Mt. Gox Claims

|

CryptoCoins News, 1/1/0001 12:00 AM PST In a major announcement at a scheduled Mt. Gox creditors meeting today in Tokyo, the court-appointed Trustee in the defunct bitcoin exchange Mt. Gox’s bankruptcy investigation has revealed that all claims to date have been reviewed. Notably, the status of all the claims has also been determined. A press release communicated to CCN by digital currency […] The post Breaking: Tokyo Trustee Completes Review of All Mt. Gox Claims appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Coinbase Co-Founder: “Ethereum Is Ahead of Bitcoin in Many Ways”

|

CryptoCoins News, 1/1/0001 12:00 AM PST The scripting language in bitcoin is restricting application development, which is something that Ethereum can change, according to Fred Ehrsam, co-founder of Coinbase, which recently added Ethereum trading. Ehrsam, writing in Medium, noted that in its first nine months, Ethereum’s level of app development already outpaces bitcoin’s. Ethereum has finally delivered rapid app layer iteration. Hence, […] The post Coinbase Co-Founder: “Ethereum Is Ahead of Bitcoin in Many Ways” appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

Japan Passes Bill to Regulate Bitcoin Exchanges

|

CryptoCoins News, 1/1/0001 12:00 AM PST The Diet in Japan (the legislature consisting of the Lower and the Upper Houses) has passed a bill today that mandates the regulation of bitcoin and virtual currency exchanges by the Financial Services Agency (FSA) in Japan. Japan has enacted a bill today that will see the regulation of operators of virtual currency exchanges, a […] The post Japan Passes Bill to Regulate Bitcoin Exchanges appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

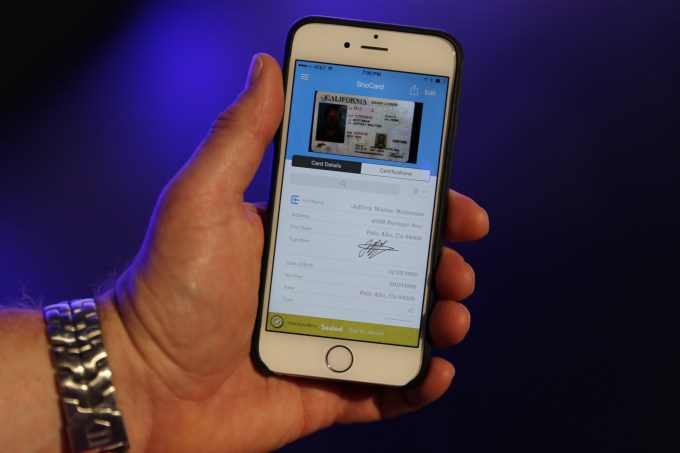

ShoCard and SITA want to store your ID details on the blockchain to authenticate travelers

|

TechCrunch, 1/1/0001 12:00 AM PST

|

Bitcoin Enabled as an Investment Option for Retirement Accounts

|

CryptoCoins News, 1/1/0001 12:00 AM PST If BitcoinIRA.com has its way, bitcoin will become ingrained as another retirement savings tool for generations to come. Edmund Moy, former Director of the U.S. Mint, serves as the group’s Chief Strategist…and possibly Chief Marketing Ploy. Many aspects of BitcoinIRA.com’s website lean heavily on Mr. Moy’s deep experience within the retirement savings space. The space and […] The post Bitcoin Enabled as an Investment Option for Retirement Accounts appeared first on CCN: Financial Bitcoin & Cryptocurrency News. |

A couple of years after bitcoin exchange Mt. Gox imploded, some former Mt. Gox users might finally get their bitcoins back. Tokyo’s court-appointed trustee in the Mt. Gox investigation has finally finished examining all the claims for missing bitcoins. Kraken is also partnering with the trustee on this investigation.

A couple of years after bitcoin exchange Mt. Gox imploded, some former Mt. Gox users might finally get their bitcoins back. Tokyo’s court-appointed trustee in the Mt. Gox investigation has finally finished examining all the claims for missing bitcoins. Kraken is also partnering with the trustee on this investigation.  ShoCard and SITA, the IT company for the air transport industry, have been working together on an interesting project. They’ve been looking at ways to store your ID details on the blockchain to manage traveler identification. More generally, ShoCard has been working on a seamless service that lets you store your identity onto the bitcoin blockchain. This way, anyone can retrieve and…

ShoCard and SITA, the IT company for the air transport industry, have been working together on an interesting project. They’ve been looking at ways to store your ID details on the blockchain to manage traveler identification. More generally, ShoCard has been working on a seamless service that lets you store your identity onto the bitcoin blockchain. This way, anyone can retrieve and…